1/ No upset this week, $SBUX gets the win followed by $CMG.

I totally get $SBUX getting the most votes: It& #39;s by far the most established of these restaurants and sells coffee at premium prices. Hard to beat that combo!

Now let& #39;s take a look at these companies using @ycharts. https://twitter.com/Matt_Cochrane7/status/1265699589564268547">https://twitter.com/Matt_Coch...

I totally get $SBUX getting the most votes: It& #39;s by far the most established of these restaurants and sells coffee at premium prices. Hard to beat that combo!

Now let& #39;s take a look at these companies using @ycharts. https://twitter.com/Matt_Cochrane7/status/1265699589564268547">https://twitter.com/Matt_Coch...

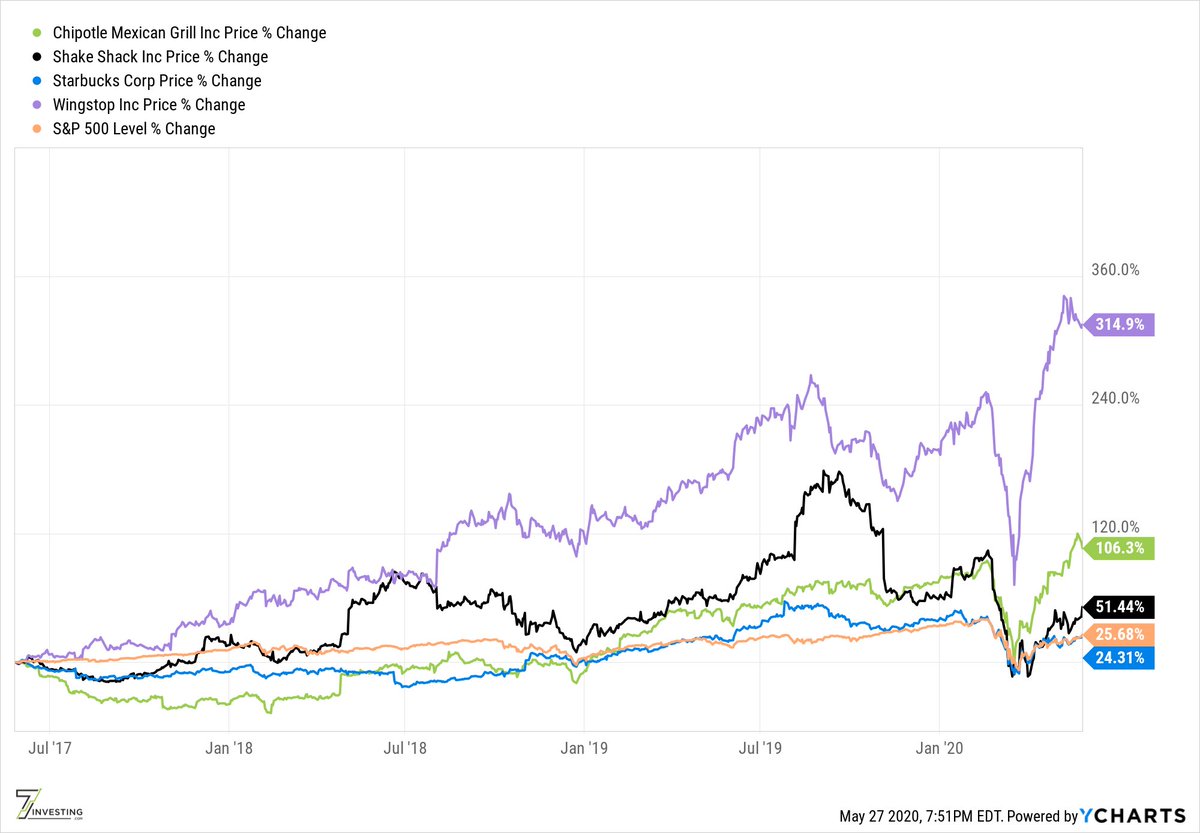

2/ As already mentioned, the only one of these choices that didn& #39;t beat the market over the trailing 3 yrs is $SBUX, while $CMG and especially $WING have smoked the S&P 500 $SPX index.

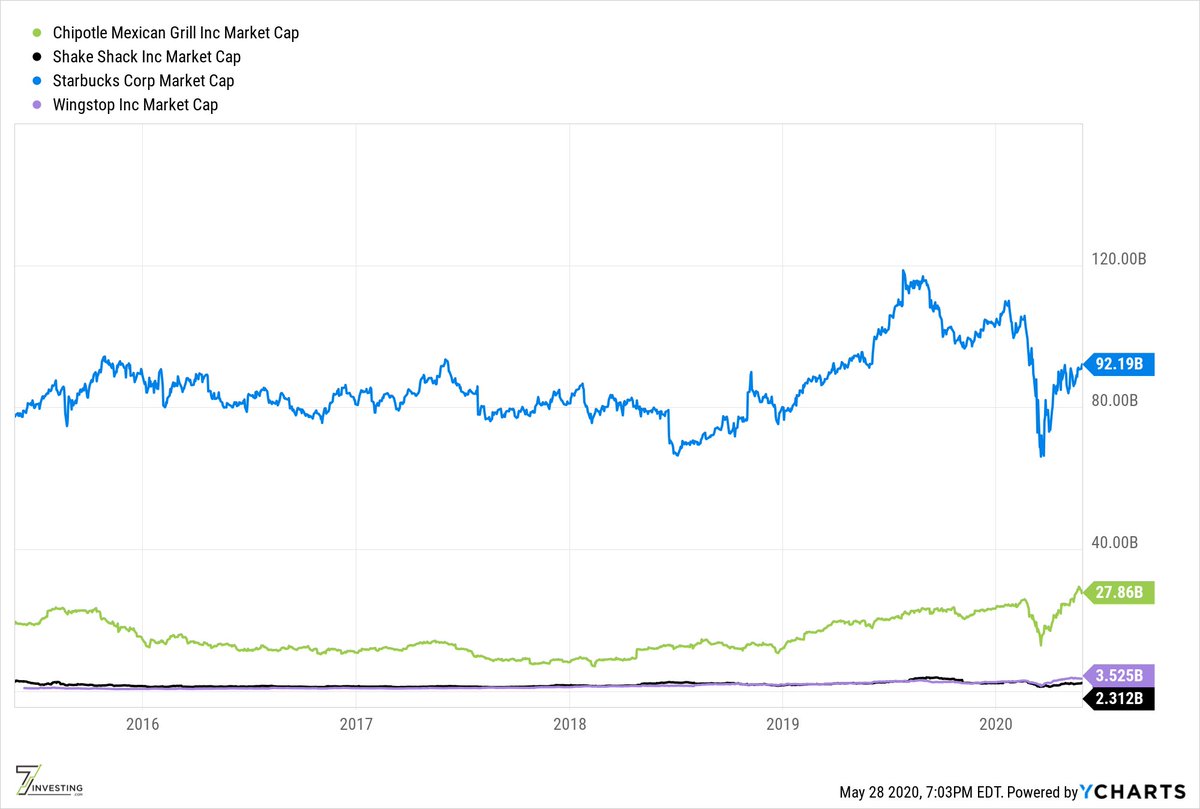

3/ One metric we& #39;ve overlooked that& #39;s important is market cap. But this is what gives us a sense of how much bigger $SBUX than $CMG, while Chipotle also dwarfs $WING and $SHAK.

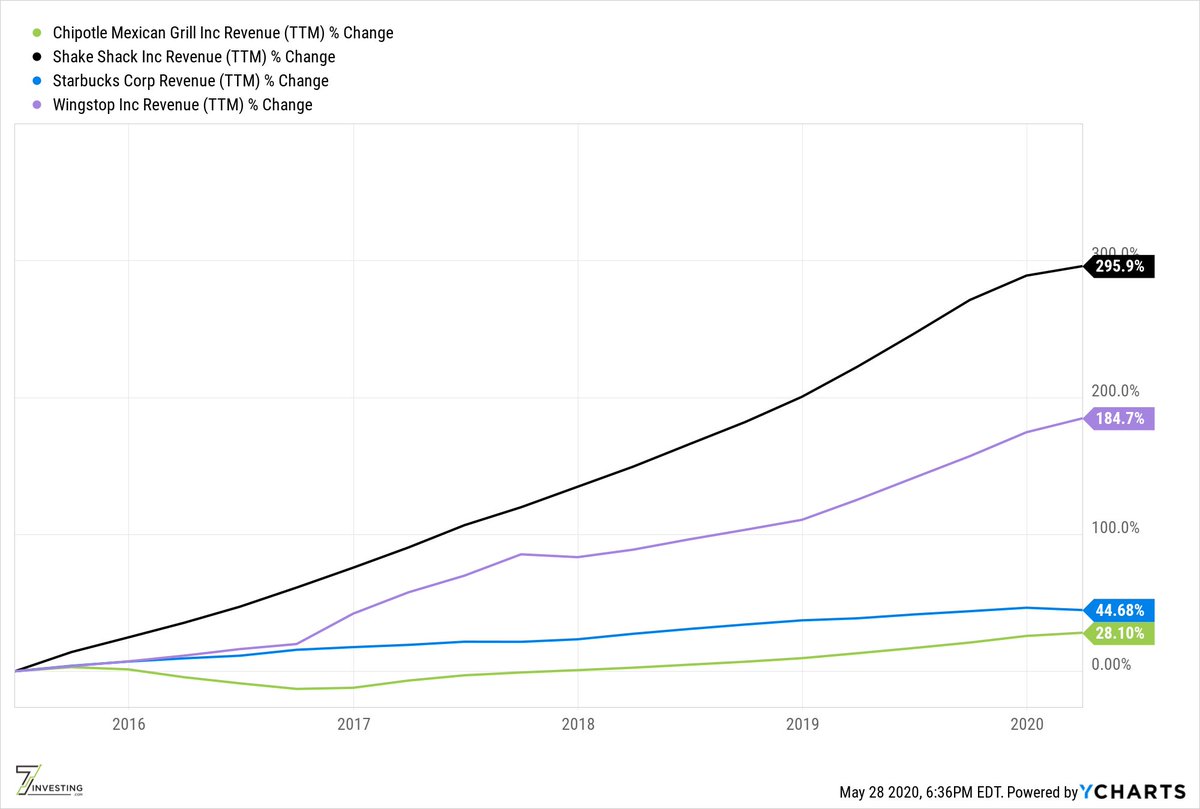

4/ The first thing I look at is revenue growth. By this metric, both $SHAK and $WING& #39;s performance are truly impressive, the power of starting from a much smaller revenue base (and far less locations).

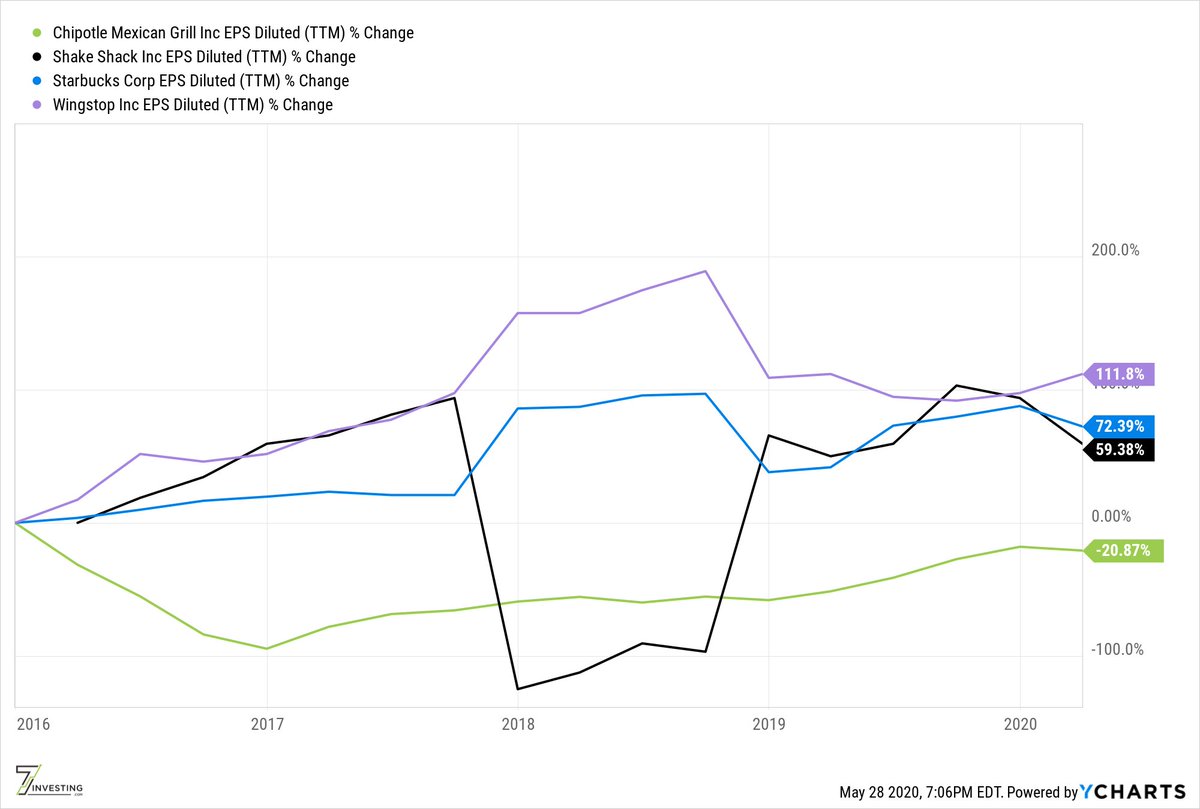

5/ But we can& #39;t just look at top-line growth, we also need to look at earnings growth. Interesting to note that w/ all its problems, $CMG& #39;s EPS < than it was 5 yrs ago. Also that $SHAK& #39;s impressive revenue growth didn& #39;t translate as much to the bottom-line as $WING& #39;s growth did.

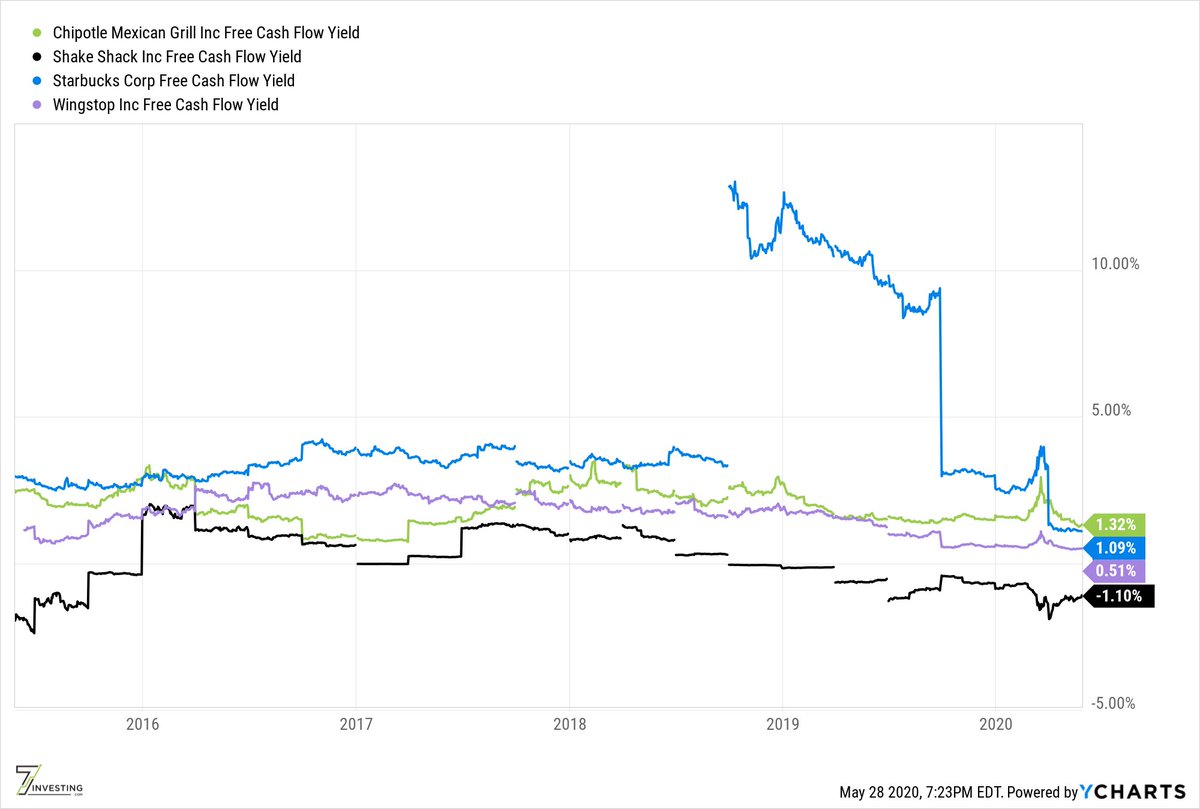

6/ What about valuation? By free cash flow yield, all appear fairly expensive, though there& #39;s no doubt COVID-19 has played a role in that.

Even going back to the beginning of this Feb, $SBUX& #39;s FCF yield was almost 200 basis points higher.

Even going back to the beginning of this Feb, $SBUX& #39;s FCF yield was almost 200 basis points higher.

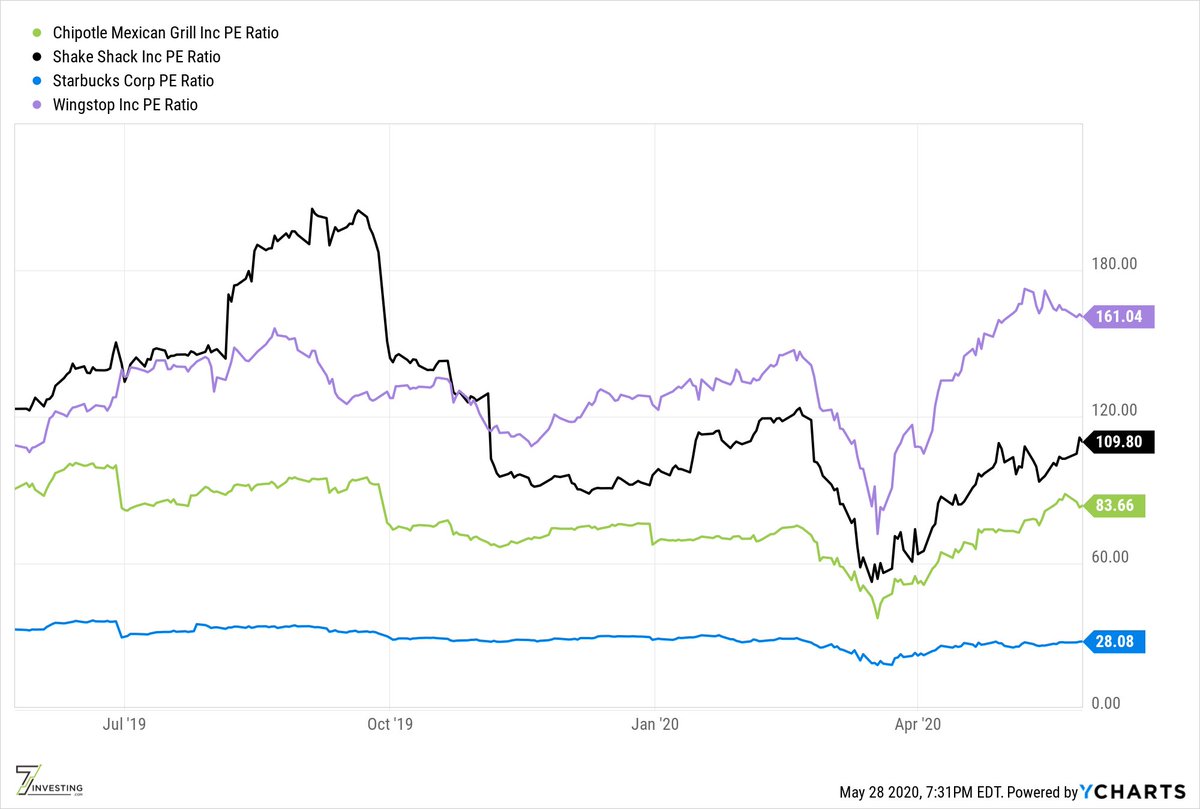

7/ By P/E ratio, $SBUX looks downright cheap compared to the rest of this group. B/c of their small market cap& #39;s, you could almost excuse $SHAK and $WING, but why does $CMG deserve this multiple?

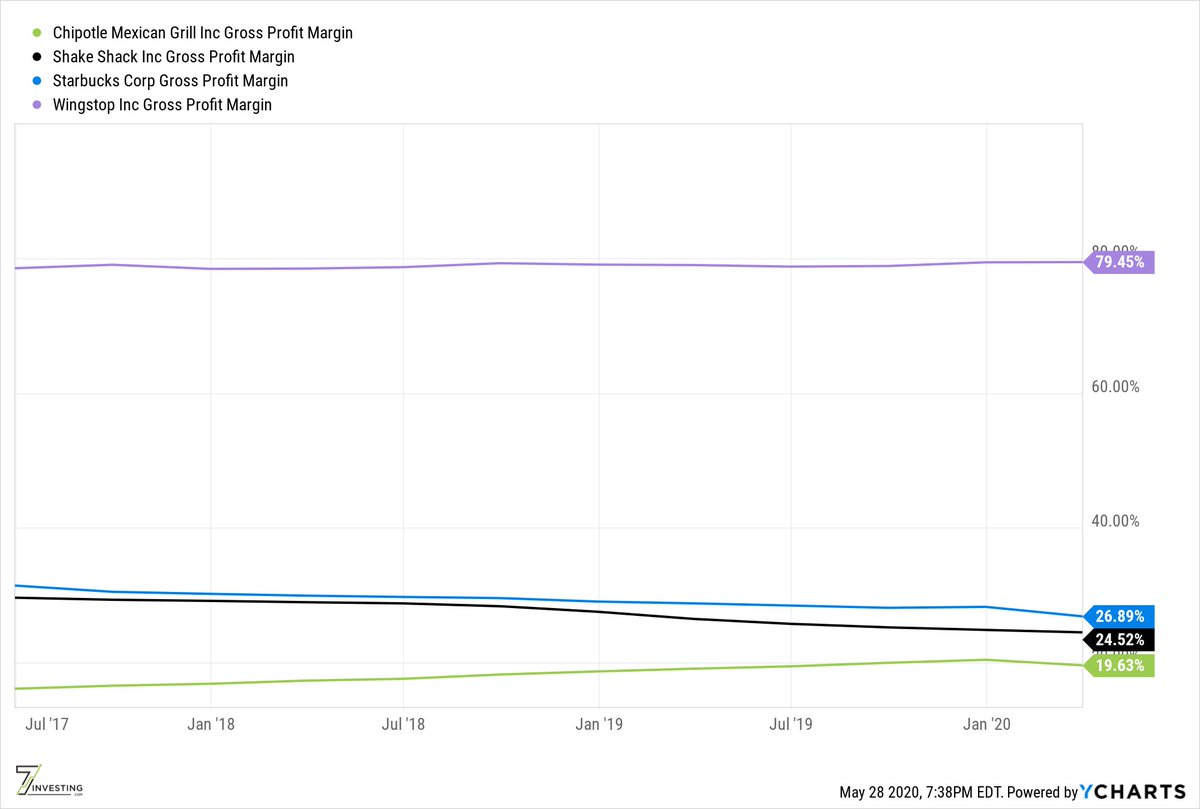

8/ Let& #39;s turn our attention to margins, starting w/ gross margin.

I have to admit, I was first shocked when I saw how much higher $WING& #39;s gross margin was compared to the others! Then I remembered - franchises vs owning restaurants are different business models!

I have to admit, I was first shocked when I saw how much higher $WING& #39;s gross margin was compared to the others! Then I remembered - franchises vs owning restaurants are different business models!

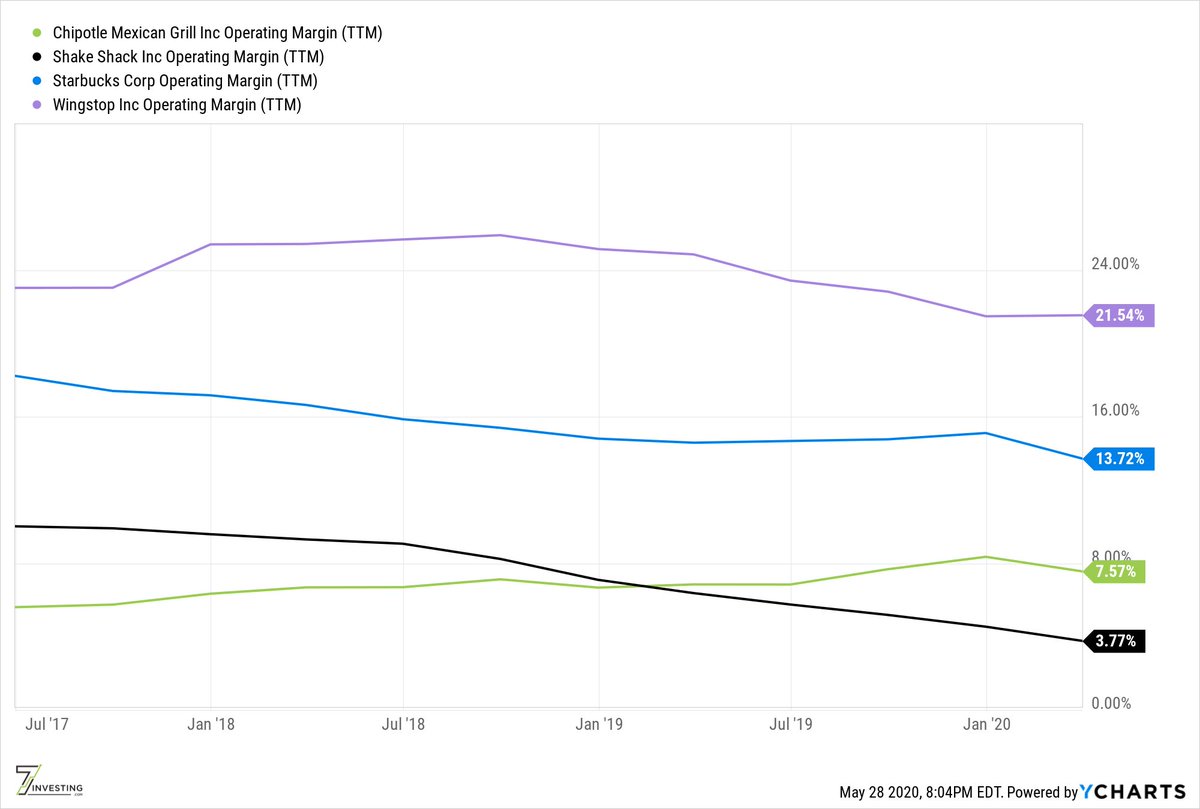

9/ By operating margin, $WING and $SBUX stand above the rest. What stood out the most though was $SHAK& #39;s really low margin? Without knowing the company better, not sure if that& #39;s a red flag or an opportunity.

10/ $SBUX might be the best-run food service company in the world. I& #39;m familiar w/ this one more than the others, and it& #39;s hard to bet against it, but at its current size it& #39;s right to wonder how much more it can grow.

11/ $WING appears to be a great business model that& #39;s taking off -- and priced for it.

$SHAK might be a decent opportunity now if -- and this is a crucial IF - it can turn its operating margin around.

$CMG is just too expensive for my taste, though it& #39;s a well-run business

$SHAK might be a decent opportunity now if -- and this is a crucial IF - it can turn its operating margin around.

$CMG is just too expensive for my taste, though it& #39;s a well-run business

12/ These metrics are a good start to researching companies, but investors& #39; jobs are from finished. A lot more about these business models would need to be learned before making an investment.

Read on Twitter

Read on Twitter