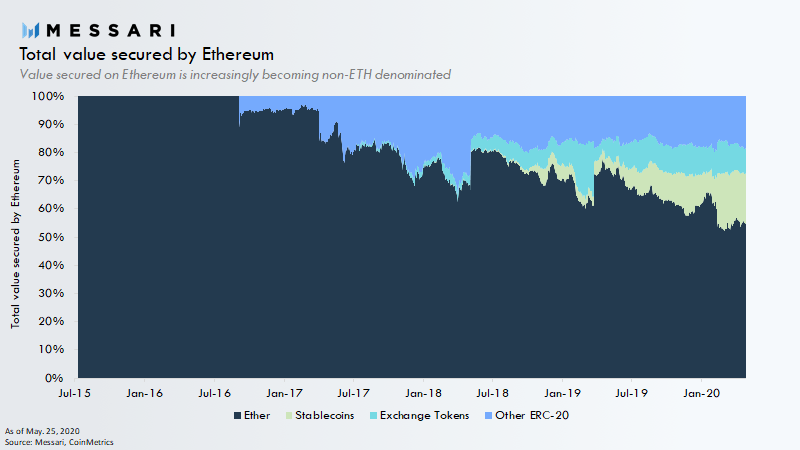

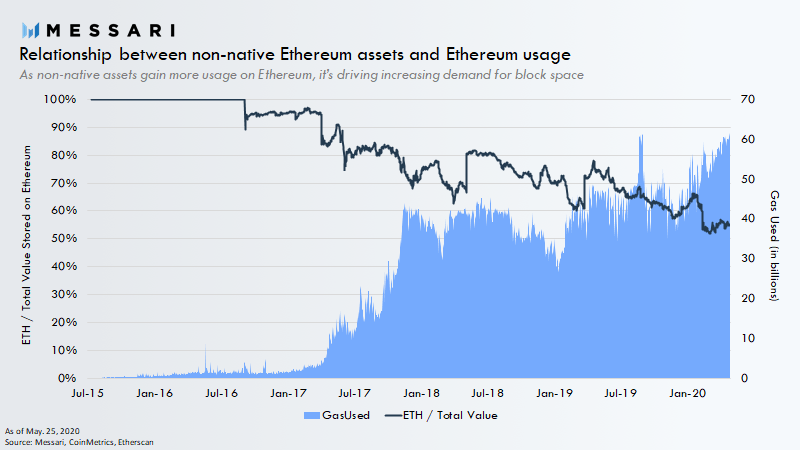

ERC-20 tokens are approaching 50% of the total value stored on Ethereum.

Over the past two years there has been a complete transformation in how value is stored and transferred on the Ethereum blockchain.

1/

Over the past two years there has been a complete transformation in how value is stored and transferred on the Ethereum blockchain.

1/

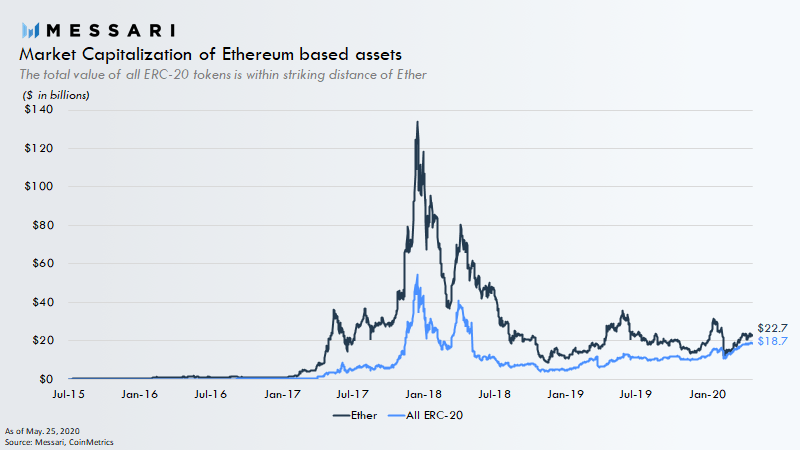

ETH is increasingly close to being flipped on its own blockchain.

Whether or not it does will likely depend on the growth of stablecoins vs growth in the value of ETH.

Whether or not it does will likely depend on the growth of stablecoins vs growth in the value of ETH.

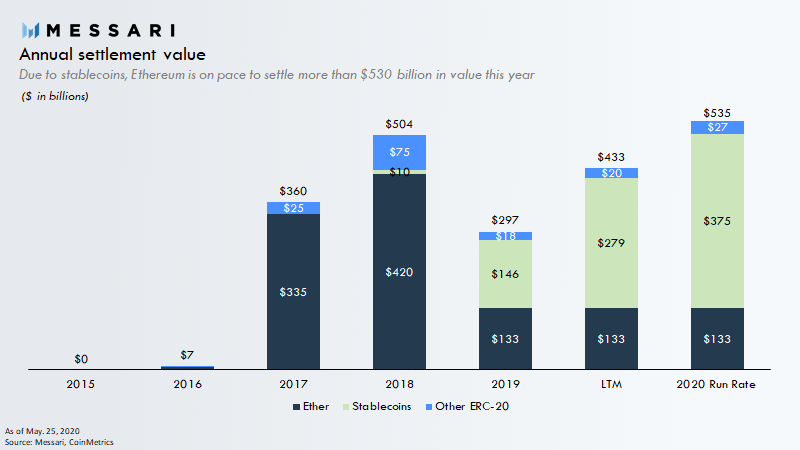

Nevertheless, this transformation in value on Ethereum is not just about assets being stored.

They’re also being used to move significant amounts of value.

Driven by the growth of stablecoins, Ethereum is on pace to settle more than $530 billion this year.

They’re also being used to move significant amounts of value.

Driven by the growth of stablecoins, Ethereum is on pace to settle more than $530 billion this year.

As covered previously, ETH& #39;s decreasing role as a MoE may not be positive for ETH, at least in the long-term.

However, the Ethereum community well understands the need to maintain ETH’s privileged position on the Ethereum blockchain. https://messari.io/article/usdt-is-invading-ethereum-is-it-good-for-eth">https://messari.io/article/u...

However, the Ethereum community well understands the need to maintain ETH’s privileged position on the Ethereum blockchain. https://messari.io/article/usdt-is-invading-ethereum-is-it-good-for-eth">https://messari.io/article/u...

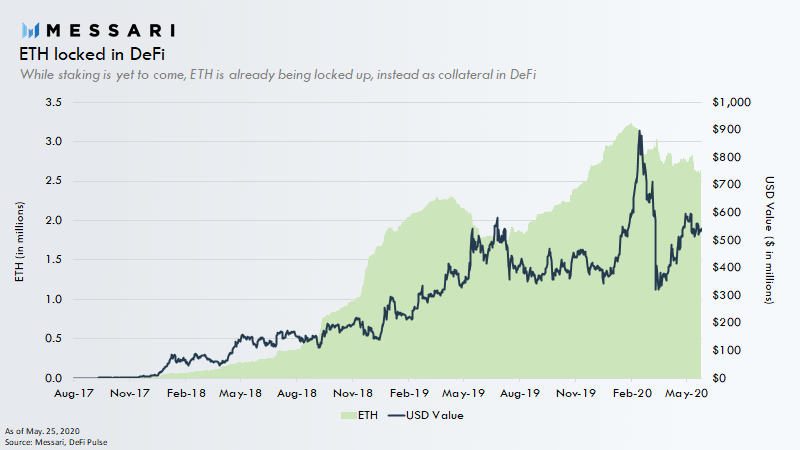

Furthermore, ETH& #39;s use in DeFi helps to solidify its position as Ethereum’s primary store of value.

ETH is and will always be the most trust-minimized asset available on Ethereum, and it is for this reason that ETH is the reserve asset for Ethereum financial system (DeFi).

ETH is and will always be the most trust-minimized asset available on Ethereum, and it is for this reason that ETH is the reserve asset for Ethereum financial system (DeFi).

Still Ethereum’s increased non-ETH usage is worthy of deeper discussion in its own right, regardless of its long-term implications on ETH’s monetary premium.

In this respect, it is safe to say that Ethereum’s increased usage is a positive for the foreseeable future.

In this respect, it is safe to say that Ethereum’s increased usage is a positive for the foreseeable future.

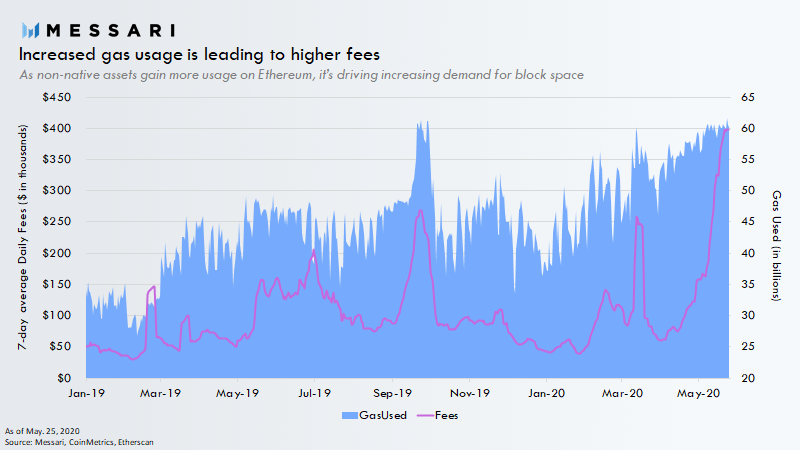

The great part about Ethereum’s programmability is that it allows Ethereum to quickly adapt and find product-market fit.

The successes of these experiments have directly translated into increased usage of the Ethereum blockchain, which has also put upward pressure on fees.

The successes of these experiments have directly translated into increased usage of the Ethereum blockchain, which has also put upward pressure on fees.

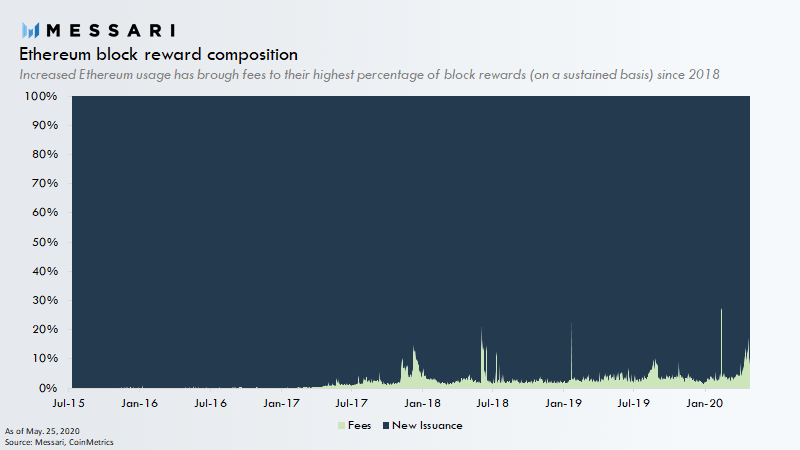

Fees are important for a handful of reasons.

For one, higher fees point towards more sustainability, allowing a blockchain to rely less on new coin issuance for security over time.

For one, higher fees point towards more sustainability, allowing a blockchain to rely less on new coin issuance for security over time.

Furthermore, the decreased inflation rate is critical in solidifying ETH’s perception as a scarce asset - an issue that has drawn criticism from the Bitcoin community.

In fact, with EIP 1559 and PoS, higher fees could lead to ETH& #39;s net issuance potentially going negative.

In fact, with EIP 1559 and PoS, higher fees could lead to ETH& #39;s net issuance potentially going negative.

In short, Ethereum is being used more than ever, and in just two years, Ethereum has evolved from a blank canvas to an agglomeration of novel forms of value and use cases.

The question for investors is whether this development will eventually be rewarded or if the market will continue to shrug it off.

One thing is certain. You can& #39;t ignore what& #39;s going on on Ethereum. https://messari.io/article/the-evolution-of-value-on-ethereum">https://messari.io/article/t...

Read on Twitter

Read on Twitter