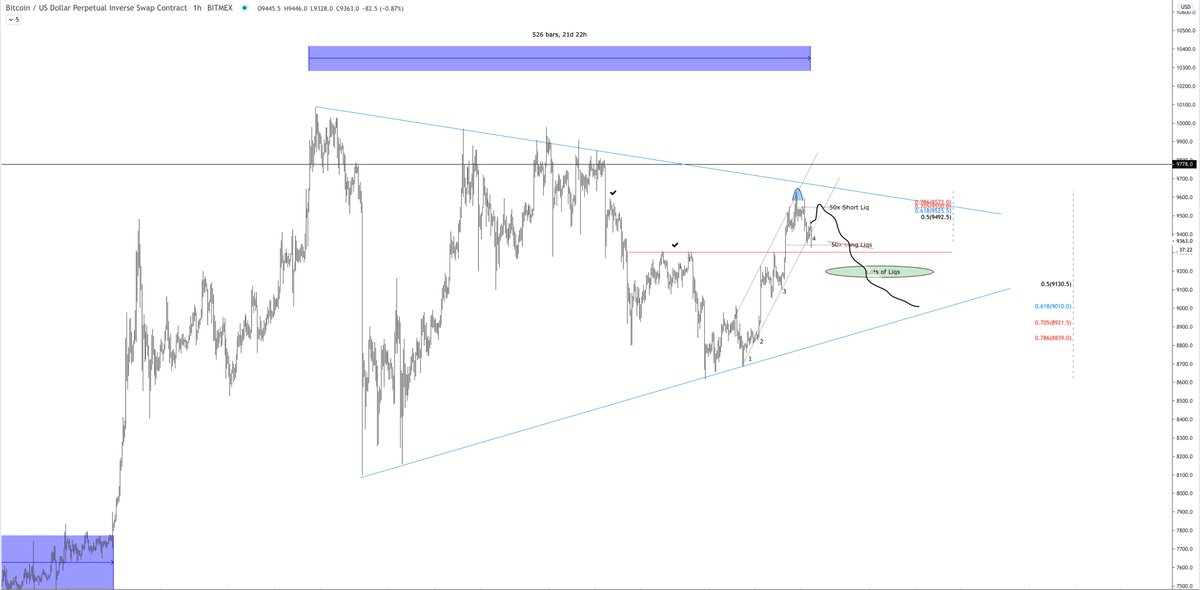

I& #39;m in 9472 but this can easily go to the upper trend line.

Ran the last liq 9477 with an overshoot.

Took the highs at 9300& #39;s

Fib retrace to the 70.5 and POB.

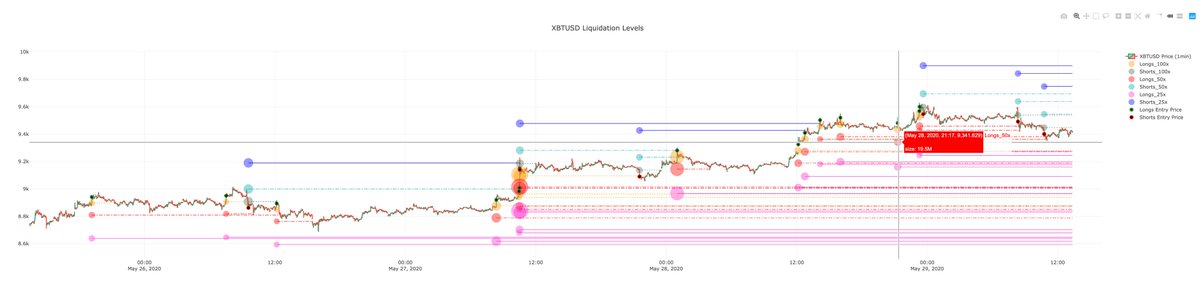

There are still some liqs 9557 and those stops.

Will cut it quickly if it looks perky.

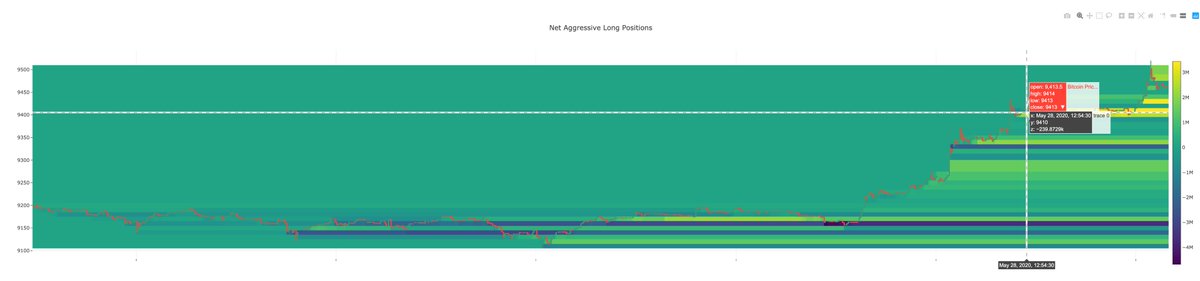

Longs hopped in 9410-20& #39;s.

Ran the last liq 9477 with an overshoot.

Took the highs at 9300& #39;s

Fib retrace to the 70.5 and POB.

There are still some liqs 9557 and those stops.

Will cut it quickly if it looks perky.

Longs hopped in 9410-20& #39;s.

There are liqs up there and that trend line is too crisp.

Could have already topped too and that is the fake out through the channel.

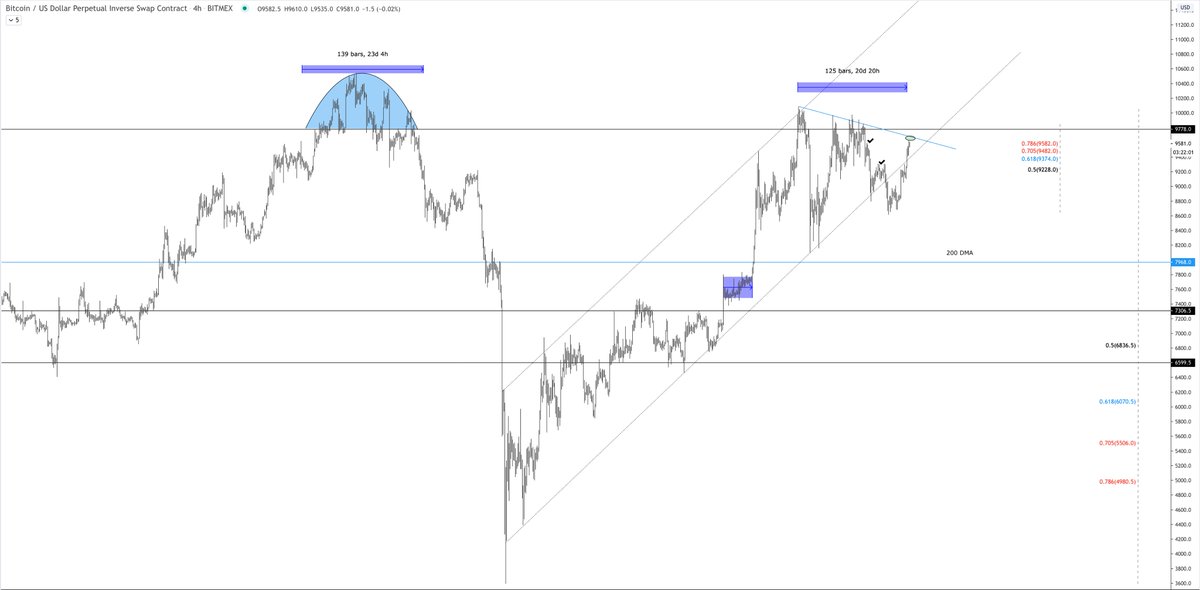

Last distribution period was about 23 days.

If this is distribution we are 20 days in.

CME expiry tomorrow so should get interesting.

Could have already topped too and that is the fake out through the channel.

Last distribution period was about 23 days.

If this is distribution we are 20 days in.

CME expiry tomorrow so should get interesting.

Possible scenario of how price gets there.

If the range is broken with volume down it was distribution.

If price holds this area it& #39;s consolidation before expansion.

If the range is broken with volume down it was distribution.

If price holds this area it& #39;s consolidation before expansion.

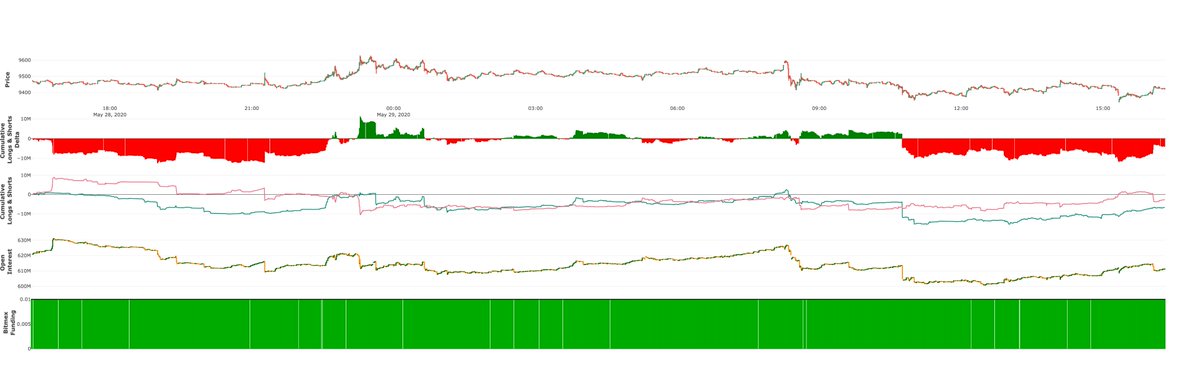

This is either a runway wick or an incoming darth maul annihilator.

Leaning towards a runway wick given the 10m spoof sitting up there at 9470.

A lot of shenanigans today with the corn.

Leaning towards a runway wick given the 10m spoof sitting up there at 9470.

A lot of shenanigans today with the corn.

Now you guys know what a runway wick is and what to look for.

Not bad.

9625 was a 50x short liq.

Stops taken.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Heavy check mark" aria-label="Emoji: Heavy check mark">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Heavy check mark" aria-label="Emoji: Heavy check mark">

9625 was a 50x short liq.

Stops taken.

Drop it command worked.

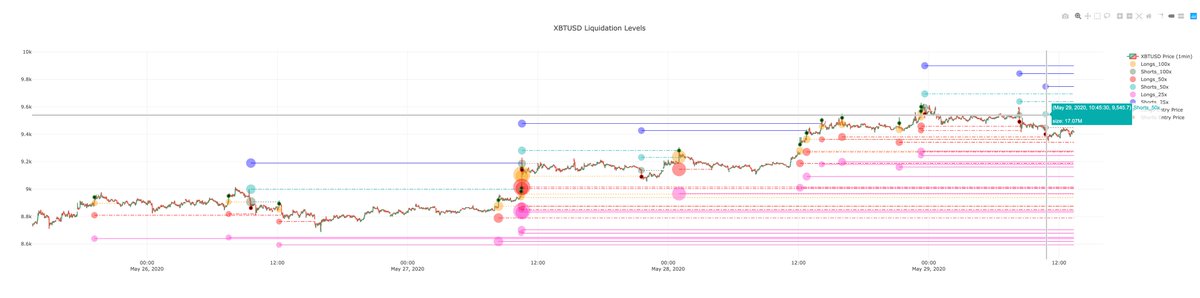

9340 is another 50x liq and there are a lot of high lev longs still sitting untouched.

A move up to 9545-50 wouldn& #39;t shock me.

Still think lower levels will be tested first given that was a critical s/r level/fib.

6hr TD9 too.

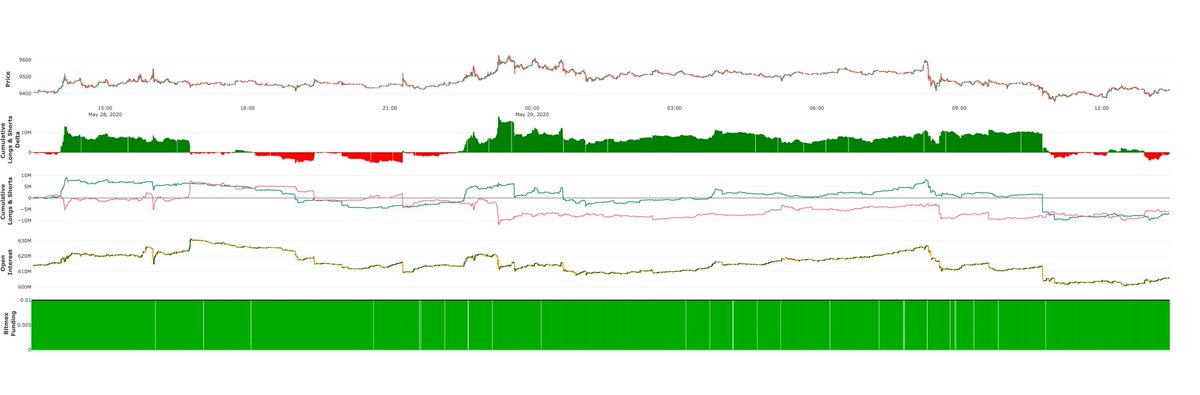

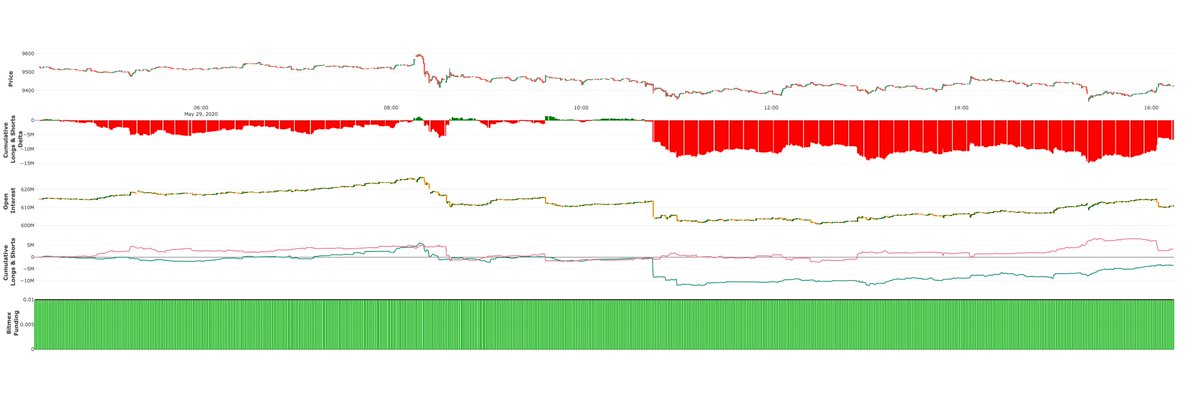

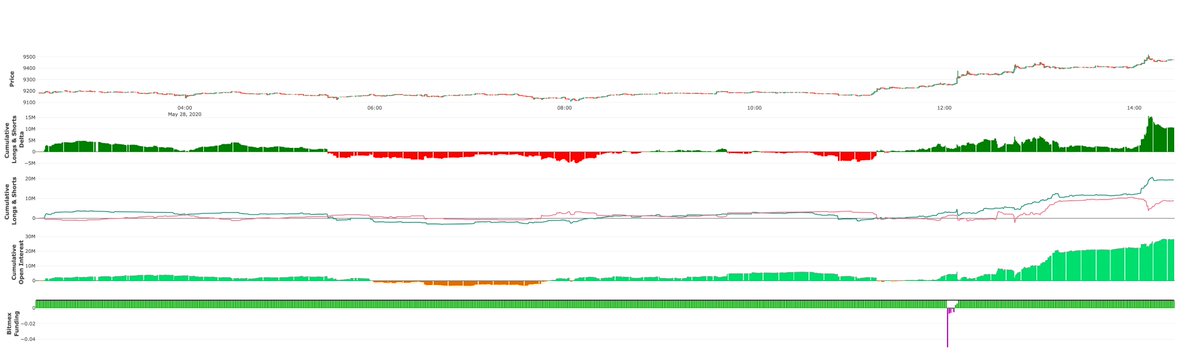

Red delta = long liqs.

9340 is another 50x liq and there are a lot of high lev longs still sitting untouched.

A move up to 9545-50 wouldn& #39;t shock me.

Still think lower levels will be tested first given that was a critical s/r level/fib.

6hr TD9 too.

Red delta = long liqs.

This reminds me of those longs that are the first round.

Aim to be the second if you want to bid it.

Aim to be the second if you want to bid it.

Longs got liq& #39;d.

Delta is red.

Squeeze.

Short green deltas.

Buy red deltas.

Not ruling out another dip but environment seems ripe for move up off that liq grab.

Delta is red.

Squeeze.

Short green deltas.

Buy red deltas.

Not ruling out another dip but environment seems ripe for move up off that liq grab.

Closed this long 9420.

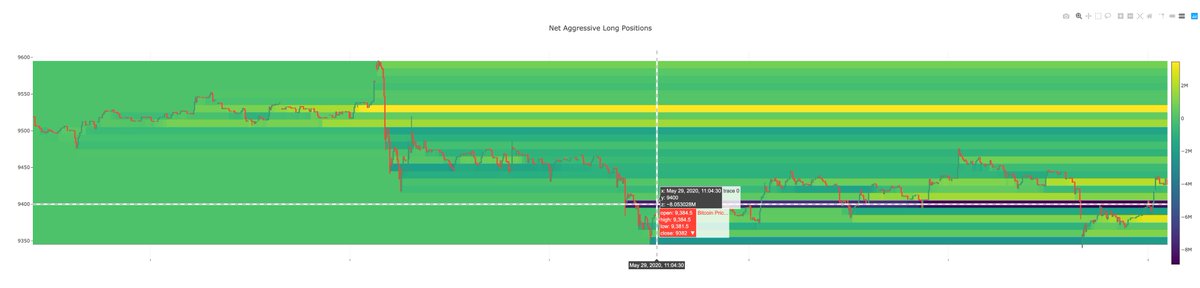

I think this sweeps the liquidity lower.

If it rips up I know where I& #39;ll short it.

Channel resistance is still holding price back.

9380 has a block of longs.

Heatmaps are telegraphing 9300.

Small wins add up.

I think this sweeps the liquidity lower.

If it rips up I know where I& #39;ll short it.

Channel resistance is still holding price back.

9380 has a block of longs.

Heatmaps are telegraphing 9300.

Small wins add up.

Read on Twitter

Read on Twitter

" title="Not bad.9625 was a 50x short liq.Stops taken.https://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Heavy check mark" aria-label="Emoji: Heavy check mark">" class="img-responsive" style="max-width:100%;"/>

" title="Not bad.9625 was a 50x short liq.Stops taken.https://abs.twimg.com/emoji/v2/... draggable="false" alt="✔️" title="Heavy check mark" aria-label="Emoji: Heavy check mark">" class="img-responsive" style="max-width:100%;"/>