Dollars investment $$$

Have you been looking for a place where you can invest in dollars to benefit from the falling naira?

Have you been looking for a platform where you can buy and sell shares in US companies like Apple, Amazon, Zoom etc?

Well then, this thread is for you

Have you been looking for a place where you can invest in dollars to benefit from the falling naira?

Have you been looking for a platform where you can buy and sell shares in US companies like Apple, Amazon, Zoom etc?

Well then, this thread is for you

The 2 platforms in question are @investbamboo and @Risevest. You can invest in dollars and receive your returns in dollars on both platforms. The difference between them is the kind of investment they offer.

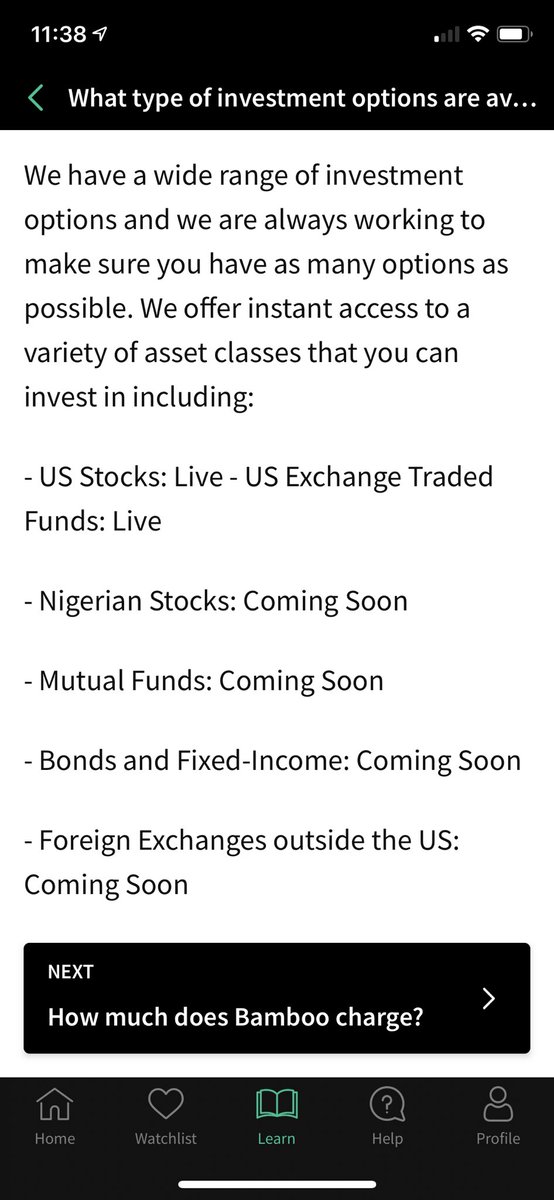

Currently on Bamboo, you can buy stocks traded in the US like Apple,

Currently on Bamboo, you can buy stocks traded in the US like Apple,

Shell, Twitter etc. They have a few other options coming soon that you can also look out for. But for now, you can only buy US-traded shares. When you buy shares on Bamboo, you see how your shares are performing in real-time. You can see if your money has increased or decreased.

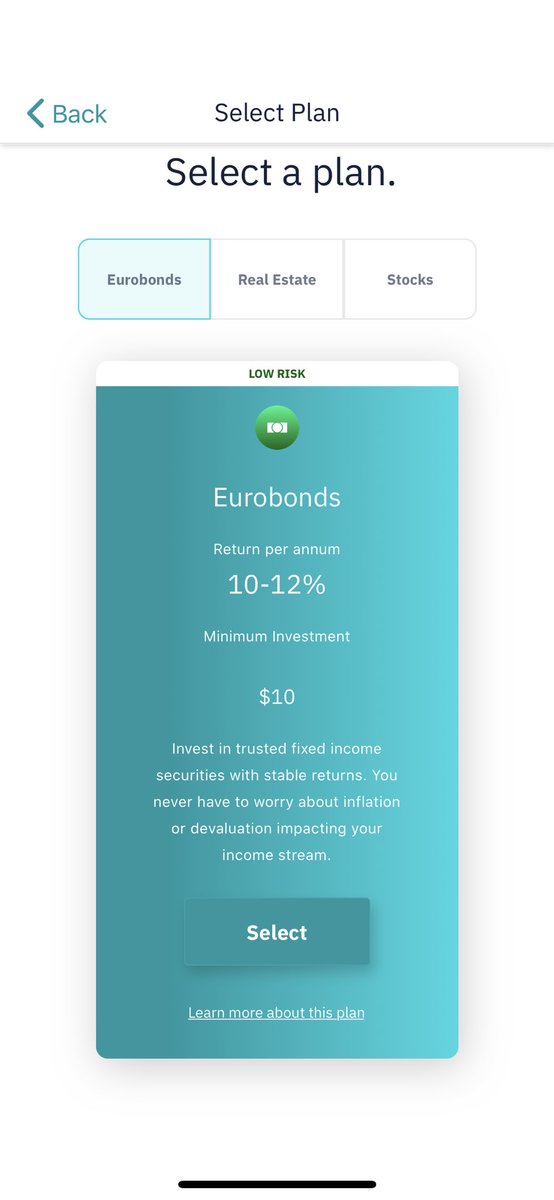

On Risevest, you can invest in 3 different asset classes: Eurobonds, Real Estate and Stocks. The difference here is that on Risevest, you don’t directly buy or pick any share or bond or real estate. You invest your money in the particular asset class you like & they would invest

your money in the best investment option in that asset class while on Bamboo you pick the shares you want to buy.

The asset classes on Risevest have 3 different risk levels.

The Eurobonds are considered low risk on the platform which means your returns there are almost

The asset classes on Risevest have 3 different risk levels.

The Eurobonds are considered low risk on the platform which means your returns there are almost

guaranteed by Risevest. I say almost guaranteed because, with every investment and really anything in life, there really is no 100% guarantee. Even disinfectants only kill 99.99% of germs. With this investment, you’d most likely get the returns that are promised and if anything

changes, the Risevest team would tell you beforehand.

It is also important to note that Eurobonds with lower risk worldwide, like those with the US, UK typically offer less than 5% so while these investments are considered to be less risky, given the kind of returns the Eurobond

It is also important to note that Eurobonds with lower risk worldwide, like those with the US, UK typically offer less than 5% so while these investments are considered to be less risky, given the kind of returns the Eurobond

investment is offering, the investment managers are probably buying Eurobonds in emerging markets which generally are more risky than the Eurobonds offered by developed countries like the US.

Government debt like Eurobonds are considered to be low risk investments but some govt

Government debt like Eurobonds are considered to be low risk investments but some govt

debt are more risky than others.

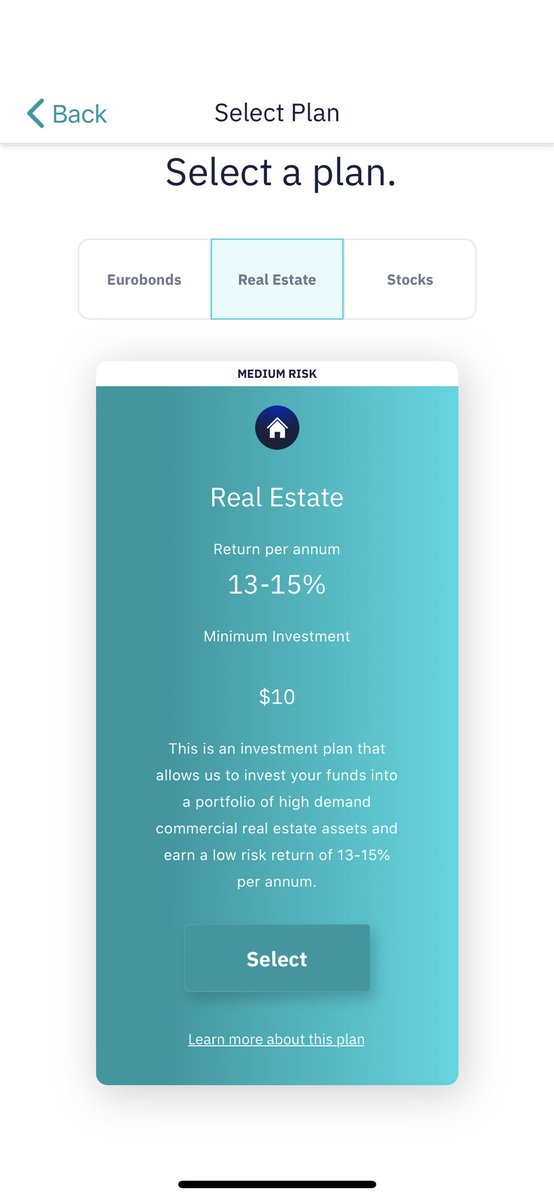

The real estate investment Risevest is offering is classified as a medium risk investment which means that the returns could likely be higher or lower than the 13-15% returns promised. Last year the investment reported 17% returns.

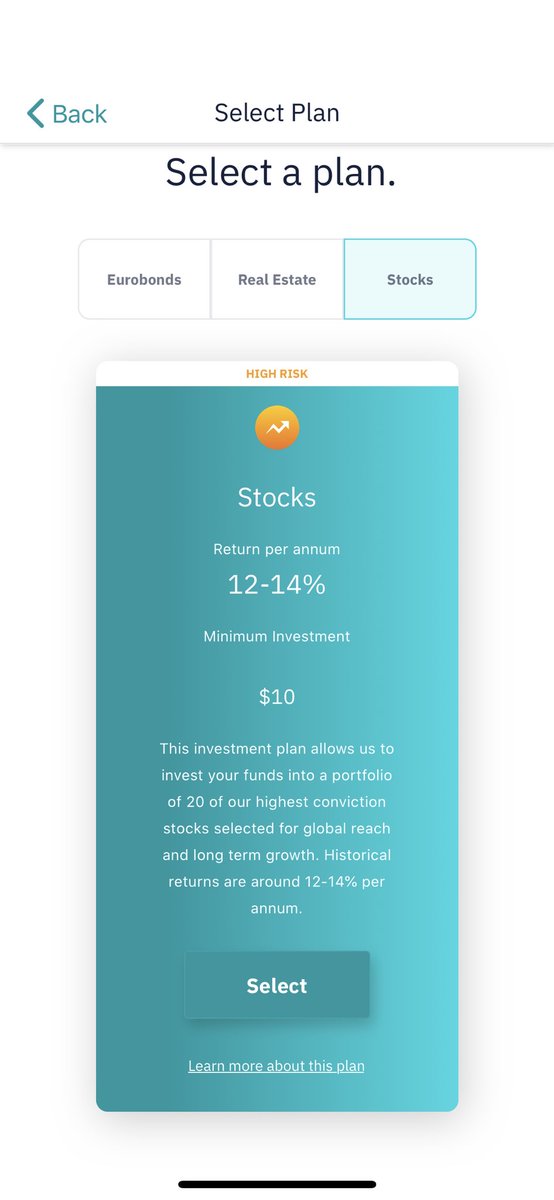

The stock

The real estate investment Risevest is offering is classified as a medium risk investment which means that the returns could likely be higher or lower than the 13-15% returns promised. Last year the investment reported 17% returns.

The stock

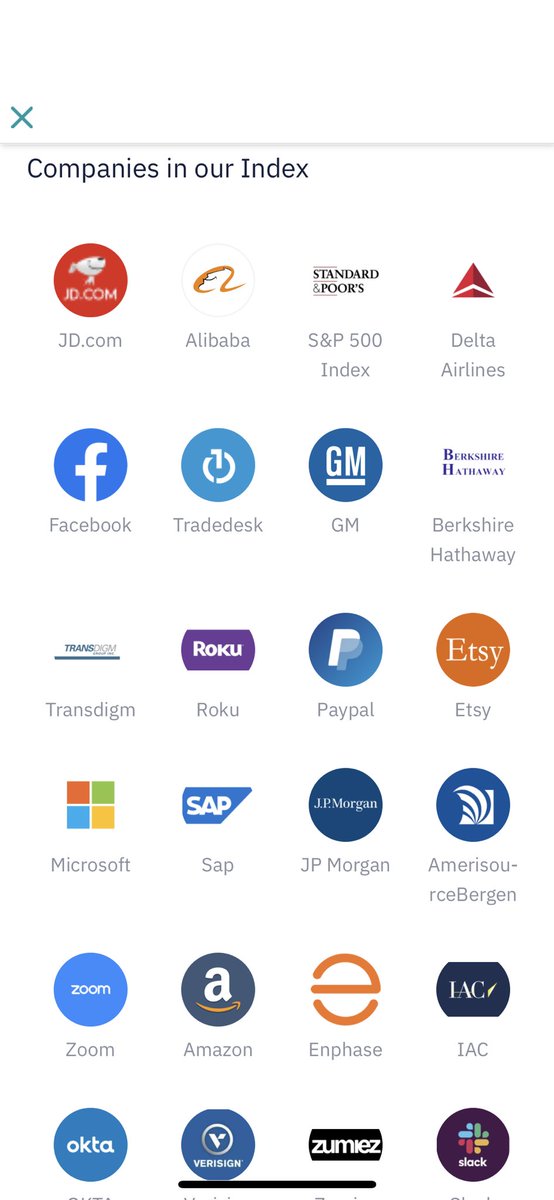

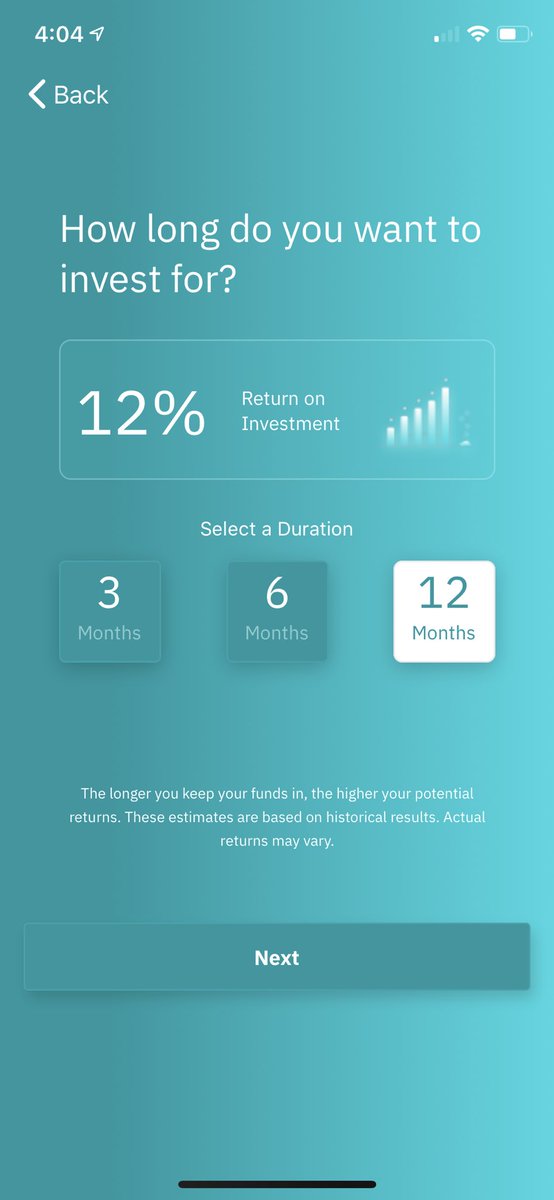

investment is classified as high risk which means that the returns are even more likely to offer more or less returns than the 12-14% offered. The stocks portfolio includes companies like Facebook, Amazon, Shopify etc.

If you invest in the stock option, you can withdraw at any

If you invest in the stock option, you can withdraw at any

time but on real estate and Eurobond options, you can select if you want to invest for 3, 6 or 12 months and you are only able to get your money after that time passes. You can see how your money is growing daily if you invest in stocks or Eurobonds and monthly for real estate.

You can also set the app to invest automatically so immediately your salary comes in, you invest some of it in dollars.

Is your money safe with these platforms?

On Bamboo, all your investments are insured by the Securities Investor Protection Corporation up to $500,000. If

Is your money safe with these platforms?

On Bamboo, all your investments are insured by the Securities Investor Protection Corporation up to $500,000. If

anything happens to Bamboo, you would be able to recover your investment.

@Risevest investments are held by a US regulated entity. If anything happens to the company, their assets will be liquidated and users will be refunded. They also have around $100,000 in VC funding to keep

@Risevest investments are held by a US regulated entity. If anything happens to the company, their assets will be liquidated and users will be refunded. They also have around $100,000 in VC funding to keep

them operational if such happens. You can sign up to Bamboo with this link https://app.investbamboo.com/invite/oghenerukevwe188343">https://app.investbamboo.com/invite/og...

You can sign up to Risevest and get a sign up bonus when you invest with this link

https://m.rise.capital/uWmaLjknRMRwA9QC9

Side">https://m.rise.capital/uWmaLjknR... note: Don’t be scared when you see share prices of like $1,000+.

You can sign up to Risevest and get a sign up bonus when you invest with this link

https://m.rise.capital/uWmaLjknRMRwA9QC9

Side">https://m.rise.capital/uWmaLjknR... note: Don’t be scared when you see share prices of like $1,000+.

On Bamboo, you can invest as low as $20. You do not need to buy 1 full unit of a share. You could buy 0.000274831 units of a share.

The most important consideration you need to make if you must choose between one of them is, how much do you know about stock investment? Are you

The most important consideration you need to make if you must choose between one of them is, how much do you know about stock investment? Are you

patient enough to run your own investment? Would you be scared in the future when the stock market crashes?

Would you sell your shares out of fear of losing your money? Or are you patient enough to weather the storms that come with share investment?

If you are patient enough

Would you sell your shares out of fear of losing your money? Or are you patient enough to weather the storms that come with share investment?

If you are patient enough

and you believe you can take that risk or you want to invest in shares and get that experience and knowledge, then Bamboo is the platform for you. All you need is your BVN and $20 to get started.

If you are not that person, if you would rather have someone else monitor your

If you are not that person, if you would rather have someone else monitor your

investment and give you decent returns, then Risevest is for you.

The thing with investment is, you should always look to diversify your portfolio for either 1 of 3 reasons:

1. to get higher returns or

2. invest at lower risk or

3. to get higher returns at lower risk.

The thing with investment is, you should always look to diversify your portfolio for either 1 of 3 reasons:

1. to get higher returns or

2. invest at lower risk or

3. to get higher returns at lower risk.

If you can, use both platforms. You might want to consider that to diversify your risk.

Do you want a thread on how you can pick shares to invest in & other share investment strategies for beginners? https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Thinking face" aria-label="Emoji: Thinking face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Thinking face" aria-label="Emoji: Thinking face">

I’ve already written it and it’s sitting in my drafts. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👐🏾" title="Open hands (medium dark skin tone)" aria-label="Emoji: Open hands (medium dark skin tone)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👐🏾" title="Open hands (medium dark skin tone)" aria-label="Emoji: Open hands (medium dark skin tone)">

Do you want a thread on how you can pick shares to invest in & other share investment strategies for beginners?

I’ve already written it and it’s sitting in my drafts.

To get your cash reward from Risevest for signing up, you can use this code when you sign up:

PFAVA0I8

It’s the last 3 characters are zero, capital letter i and 8

PFAVA0I8

It’s the last 3 characters are zero, capital letter i and 8

Read on Twitter

Read on Twitter