Australia& #39;s Carmichael coal mine is unlikely ever to make money, according to its own published accounts -- so why is Adani Group still pursuing it? Quick thread: https://www.bloomberg.com/opinion/articles/2020-05-27/australia-s-carmichael-mine-may-never-make-a-profit">https://www.bloomberg.com/opinion/a...

I& #39;ve been mystified by Adani& #39;s commitment to the Carmichael coal mine for years, and the emperor& #39;s-new-clothes insistence of Australia& #39;s political classes that it& #39;s a viable project: https://twitter.com/davidfickling/status/1131702378288181249?s=19">https://twitter.com/davidfick...

On the numbers it simply makes no sense. It& #39;s low-grade coal in a remote new basin, that would have to be extracted at Australian labour and capital costs for export to markets with access to cheaper comparable Indian or Indonesian product. https://twitter.com/davidfickling/status/1131165015124242432?s=19">https://twitter.com/davidfick...

Adani have always said the numbers stack up economically, but look at their latest accounts for the year through March and it& #39;s hard to see how this works.

For instance, there& #39;s this:

For instance, there& #39;s this:

If I was trying to get government approvals for my controversial mine, I would shy away from saying it& #39;s unlikely ever to pay taxes. And indeed this is the first year that Adani have included the line. It& #39;s what I& #39;ve been arguing for years now: https://www.bloomberg.com/opinion/articles/2017-04-02/coal-s-dirty-australian-secret-it-s-not-coming-back">https://www.bloomberg.com/opinion/a...

As it happens I& #39;m inclined to downplay that admission, though. It comes in a discussion of Adani& #39;s A$386m potential tax benefit from the losses it& #39;s racked up. One former tax office person I talked to said that such language can be boilerplate to justify the accounting treatment.

The more damning thing, to my mind, is the estimate of the project& #39;s accounting value.

Mining companies have two valuations for their assets: a balance sheet value based on how much money they& #39;ve spent on it, and a "fair value" -- how much cash they think it will generate.

Mining companies have two valuations for their assets: a balance sheet value based on how much money they& #39;ve spent on it, and a "fair value" -- how much cash they think it will generate.

If your fair value falls below your balance sheet value you write down the difference and record a loss on the income statement. Generally, fair value should be substantially higher than balance sheet value.

Rather conveniently, Adani& #39;s external advisors reckoned that the fair value based on expected cashflows over the coming decades was *the same* as the amount of money invested so far, net of previous impairments. What are the odds?

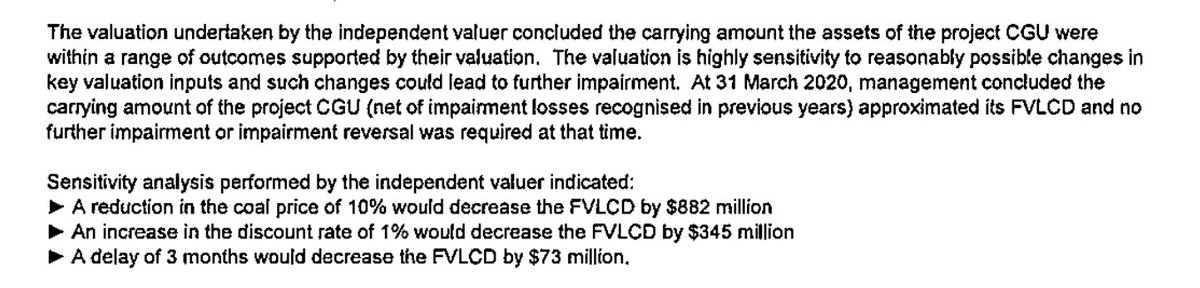

Have a look at that sensitivity analysis, too. If the coal price falls 10%, the mine& #39;s value falls more than 80%. If the discount rate rises 1 percentage point, you need to write off another A$345 million.

So essentially those two moves alone would give it a negative NPV, and mean no sane company would pursue it.

To me, having a valuation whose assumptions are so finely balanced between a billion-dollar asset and one that& #39;s not economically viable suggests the assumptions have been massaged to suit the desired outcome.

Take that coal price. Benchmark Newcastle coal has fallen by 9% or more in 3 out of 10 quarters over the past decade.

At current spot prices, Carmichael isn& #39;t viable, according to Viktor Tanevski of @WoodMackenzie -- although he expects those prices to rise in the medium term.

At current spot prices, Carmichael isn& #39;t viable, according to Viktor Tanevski of @WoodMackenzie -- although he expects those prices to rise in the medium term.

Although Newcastle coal futures are traded on ICE with pricing out to the late 2020s, Carmichael gives no detail of what their price assumptions are or what sort of discount to expect to the benchmark. Wood Mackenzie expects 32%-35% which means they& #39;d have to sell at $45/ton.

That& #39;s extremely difficult. Making money at those prices would require Carmichael to be well down the cost curve of Australian mines, most of which are closer to port, with costs already sunk, and with better geology than Carmichael, whose best grades are well below ground level.

Likewise that discount rate. Adani actually reduced it this year, from 14% to 13.5%. That& #39;s not totally unreasonable: Mining discount rates should go down as a project gets closer to operation.

But the risk premium to comparable mines looks thin.

But the risk premium to comparable mines looks thin.

Yancoal Australia uses a discount rate of 10.5% across all their assets. Whitehaven Coal used 11% up to 2017, though no longer reports that number.

These are fully operational and derisked mining companies, with only a handful of development projects.

These are fully operational and derisked mining companies, with only a handful of development projects.

It& #39;s a judgement call, but IMO a project in early construction, without a rail link or royalty agreement, with suppliers backing out, with banks refusing to finance it, dependent on funding from a rupee-denominated overseas group ... needs a higher risk premium.

Read on Twitter

Read on Twitter