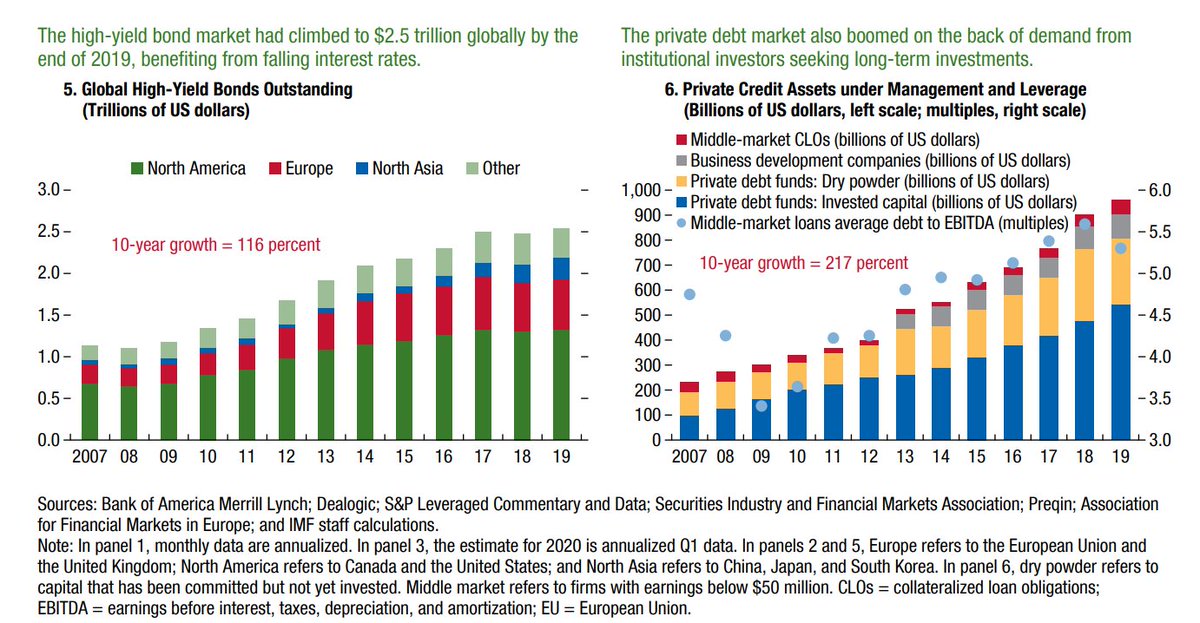

The Fed& #39;s unprecedented move to buy junk debt highlights how much the financial system has changed since 2008, with risk moving away from banks & into the shadow banking system. This IMF report has great stats on the extent of the transformation: (1/3) #ExeSum">https://www.imf.org/en/Publications/GFSR/Issues/2020/04/14/global-financial-stability-report-april-2020 #ExeSum">https://www.imf.org/en/Public...

Essentially, the measures the Fed took were akin to a shadow-banking bail-out, since the prospect of allowing investors to suffer the losses (& the resulting corporate bankruptcies) was untenable to central bankers. The biggest private debt investors, for example, are pensions:

This report actually recommends the Fed go further in buying riskier assets if markets continue to deteriorate. But it also recommends that regulators treat non-bank lenders with more scrutiny post-Covid, more in line with how they look at the largest financial firms. (end)

Read on Twitter

Read on Twitter