Washington state is headed into a budget challenge of unknown proportions because of the #coronavirus. State leaders say legal and constitutional protections will spare more than 90% of money for schools from cuts. We interrogated that assumption:

https://www.seattletimes.com/education-lab/washingtons-constitution-protects-k-12-funding-the-coronavirus-will-test-that-promise/">https://www.seattletimes.com/education... #waedu

https://www.seattletimes.com/education-lab/washingtons-constitution-protects-k-12-funding-the-coronavirus-will-test-that-promise/">https://www.seattletimes.com/education... #waedu

True: Our state has some of the strongest legal and constitutional protections of K-12 funding nationwide. The state& #39;s highest court has shown willingness to enforce this. After the McCleary v. Washington case, it fined the Legislature 100k/day for insufficient school funding

But: we also top the country in reliance on sales tax. And consumer spending typically takes a nosedive during recessionary periods.

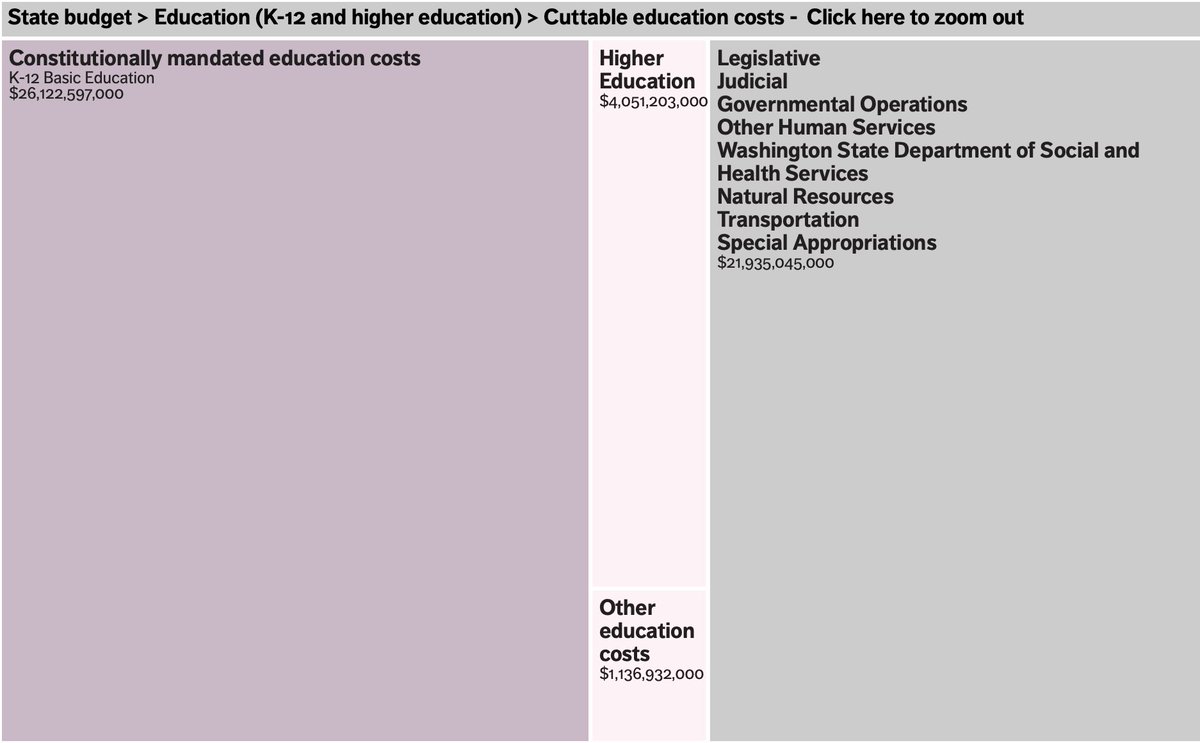

The current 2-year budget is 59% education funding, more than $26 billion. Officials say ~$1.1 billion is cuttable.

(graphic by @LaurenFlannery)

The current 2-year budget is 59% education funding, more than $26 billion. Officials say ~$1.1 billion is cuttable.

(graphic by @LaurenFlannery)

Revenue loss is projected right now at $7 billion over three years.

“This is potentially bigger than the last recession, which we all thought was the biggest thing we would ever see in our lifetimes,” said the state’s budget director, David Schumacher. https://www.seattletimes.com/seattle-news/politics/unofficial-numbers-show-7-billion-hit-to-washington-state-revenue-through-2023-from-coronavirus-downturn/">https://www.seattletimes.com/seattle-n...

“This is potentially bigger than the last recession, which we all thought was the biggest thing we would ever see in our lifetimes,” said the state’s budget director, David Schumacher. https://www.seattletimes.com/seattle-news/politics/unofficial-numbers-show-7-billion-hit-to-washington-state-revenue-through-2023-from-coronavirus-downturn/">https://www.seattletimes.com/seattle-n...

So even if it is Washington& #39;s "paramount duty" to fund schools, lawmakers still have other important priorities to balance going forward, such as mental health and transportation.

As one expert told us:

“That is a legal argument, not a math argument."

As one expert told us:

“That is a legal argument, not a math argument."

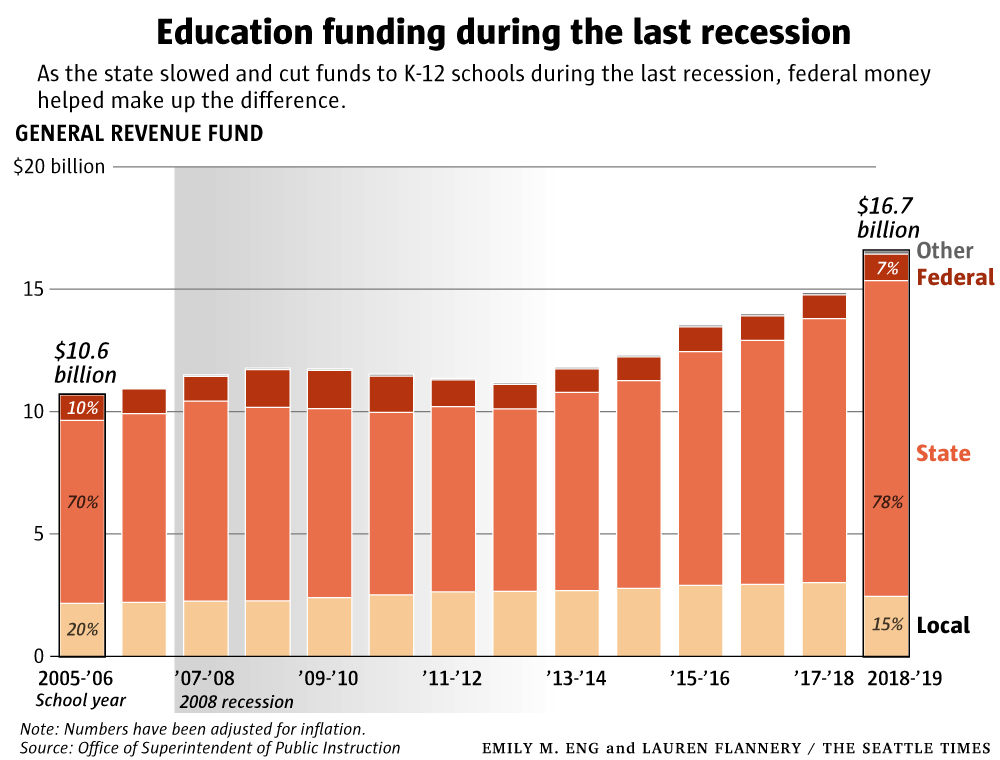

Rather than slashing money, state leaders said a more realistic version of events would be static funding, with small cuts. That& #39;s what happened during the 2008 recession. (graphic by @Emily_M_Eng)

But in that era, federal stimulus dollars were a lifeline to prevent significant disruption.

We still don& #39;t know how much more money is coming from the feds. So far, districts are slated to get just $273 million, <1% of what the state gives yearly. https://www.seattletimes.com/education-lab/as-they-brace-for-budget-strain-washington-state-school-districts-will-receive-some-coronavirus-aid/">https://www.seattletimes.com/education...

We still don& #39;t know how much more money is coming from the feds. So far, districts are slated to get just $273 million, <1% of what the state gives yearly. https://www.seattletimes.com/education-lab/as-they-brace-for-budget-strain-washington-state-school-districts-will-receive-some-coronavirus-aid/">https://www.seattletimes.com/education...

What will this look like on the ground? It& #39;s important to remember that no matter what lawmakers decide to cut, *districts* are the ones who ultimately determine local impact.

In 2008, districts statewide issued 2,000 layoff notices to teachers. Most were rehired.

In 2008, districts statewide issued 2,000 layoff notices to teachers. Most were rehired.

But pressure could be higher this time, especially in large districts. Stay w/ me. It& #39;s about to get nerdier.

In 2018, lawmakers released a lot of money for teacher salaries to satisfy the McCleary ruling. Remember those teacher strikes? It was over what to do with that money

In 2018, lawmakers released a lot of money for teacher salaries to satisfy the McCleary ruling. Remember those teacher strikes? It was over what to do with that money

Several districts like Seattle are in the process of paying out large raises to teachers from that money. Some, like Seattle, spent over the amount they receive from the state on their contracts. They used *local property tax dollars* (levies) and savings to split the difference.

But the Legislature recently capped the amount districts can collect locally, because of McCleary. (The point was to make the *state*the primary funder.)

Now they are facing extra costs related to COVID, such as technology for distance learning. (We don& #39;t know how much yet.)

Now they are facing extra costs related to COVID, such as technology for distance learning. (We don& #39;t know how much yet.)

Here& #39;s what may emerge: if federal funds don& #39;t meet the need for extra spending, state money remains static, and districts are already tapping local levies for salary costs, there could be immense political pressure on state lawmakers to raise local levy lids again for more $

Not saying they will, but if lawmakers continue bending on their levy restrictions, we could end up where we were in 2012, when the McCleary ruling was first issued.

Schools in high income areas able to lean heavily on taxes from expensive homes, and vice versa in poor areas.

Schools in high income areas able to lean heavily on taxes from expensive homes, and vice versa in poor areas.

Those restrictions were already eased last year. What& #39;s more: Seattle, with one of the hottest real estate markets in the country, was able to lobby for a custom levy lid that was higher than everyone else& #39;s. https://www.seattletimes.com/education-lab/washington-lawmakers-made-11th-hour-changes-to-school-levy-policy-but-who-benefits/">https://www.seattletimes.com/education...

I spoke to two architects of the McCleary fix about this possibility. Democrat Christine Rolfes, the Senate& #39;s budget writer, said she& #39;d be open to the idea of easing levy lids, but that it wouldn& #39;t be her first impulse. Senator John Braun, a Republican, said he would fight it.

Read on Twitter

Read on Twitter