Today, I had the honor to give a presentation on the Lebanese sovereign debt restructuring to members of the @Harvard Club of Lebanon.

My presentation can be found here: https://drive.google.com/file/d/19cexHpmikeAn_7E8n-wlUsrqkSquRzhW/view?usp=sharing

The">https://drive.google.com/file/d/19... recording here: https://zoom.us/rec/share/6MspI4uv3zxOGoWR10_cZqN6PobUaaa8hidMrvQLyxr-EDBGMlUfV5fNwGB2FzwN?startTime=1590591763000">https://zoom.us/rec/share... (Password: 6M*7.Y2p)

THREAD 1/x https://twitter.com/dan_azzi/status/1265690621911728128">https://twitter.com/dan_azzi/...

My presentation can be found here: https://drive.google.com/file/d/19cexHpmikeAn_7E8n-wlUsrqkSquRzhW/view?usp=sharing

The">https://drive.google.com/file/d/19... recording here: https://zoom.us/rec/share/6MspI4uv3zxOGoWR10_cZqN6PobUaaa8hidMrvQLyxr-EDBGMlUfV5fNwGB2FzwN?startTime=1590591763000">https://zoom.us/rec/share... (Password: 6M*7.Y2p)

THREAD 1/x https://twitter.com/dan_azzi/status/1265690621911728128">https://twitter.com/dan_azzi/...

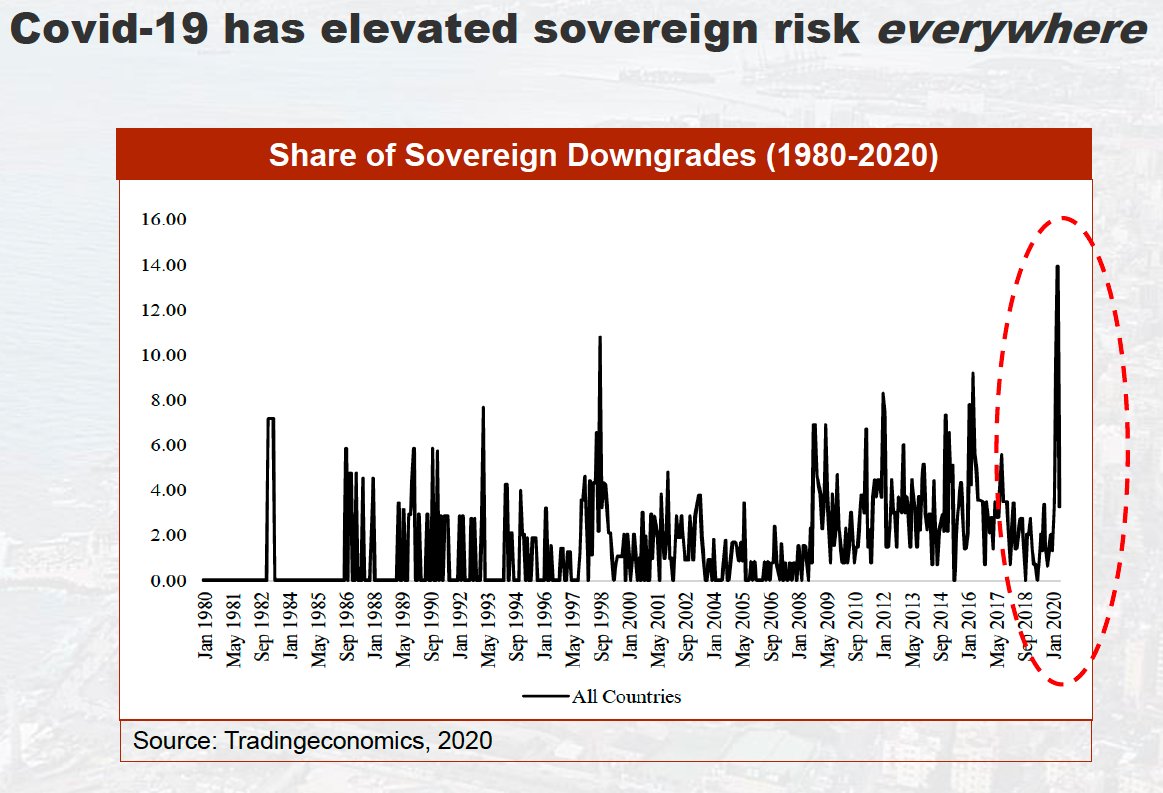

First,  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> - like Argentina - has already been in a difficult financial situation when the #Covid pandemic hit. Yet, the context within which

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> - like Argentina - has already been in a difficult financial situation when the #Covid pandemic hit. Yet, the context within which  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> will restructure its debt should not be forgotten and the pandemic could give

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> will restructure its debt should not be forgotten and the pandemic could give  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> a stronger hand in negotiations. 2/x

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> a stronger hand in negotiations. 2/x

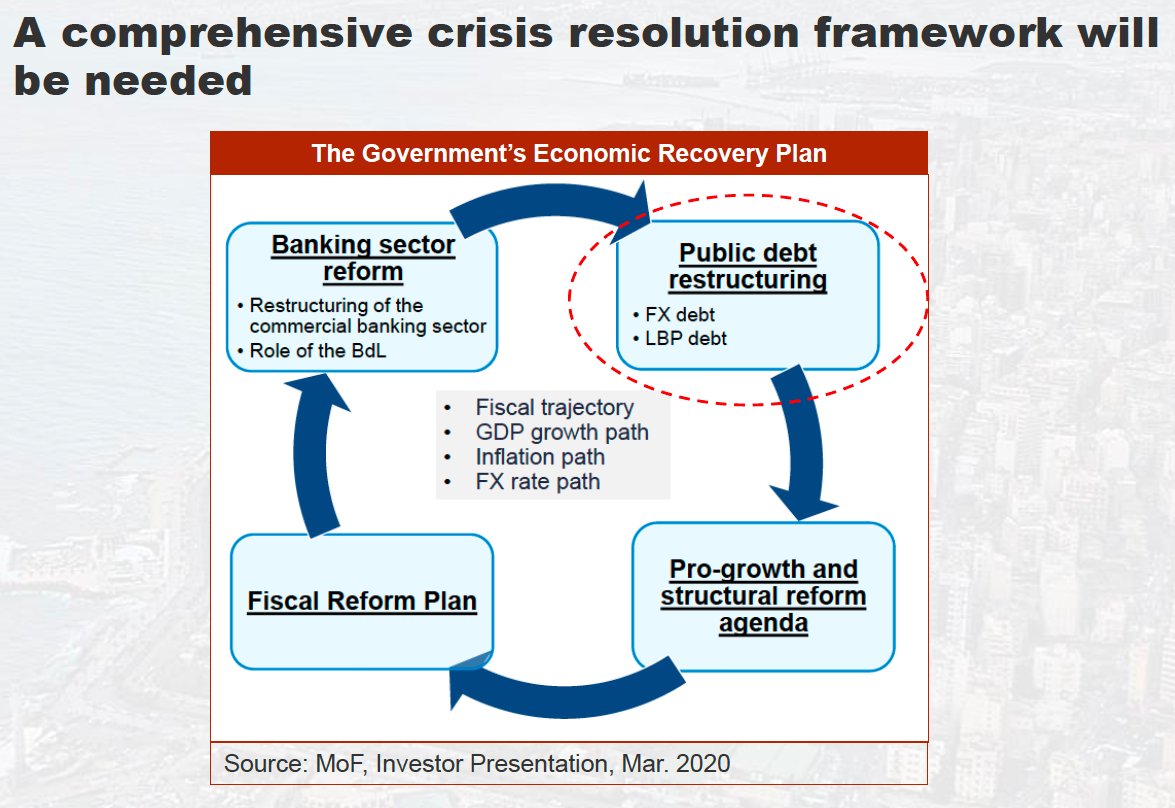

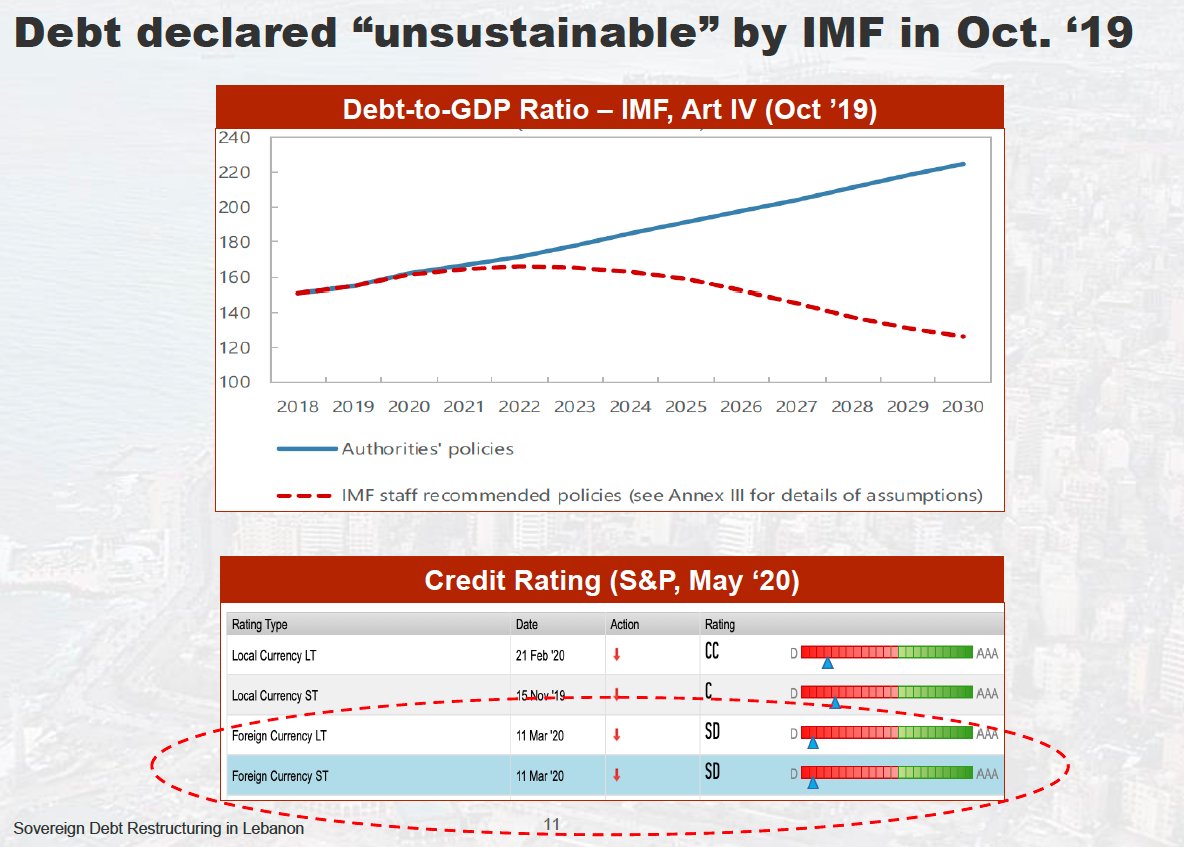

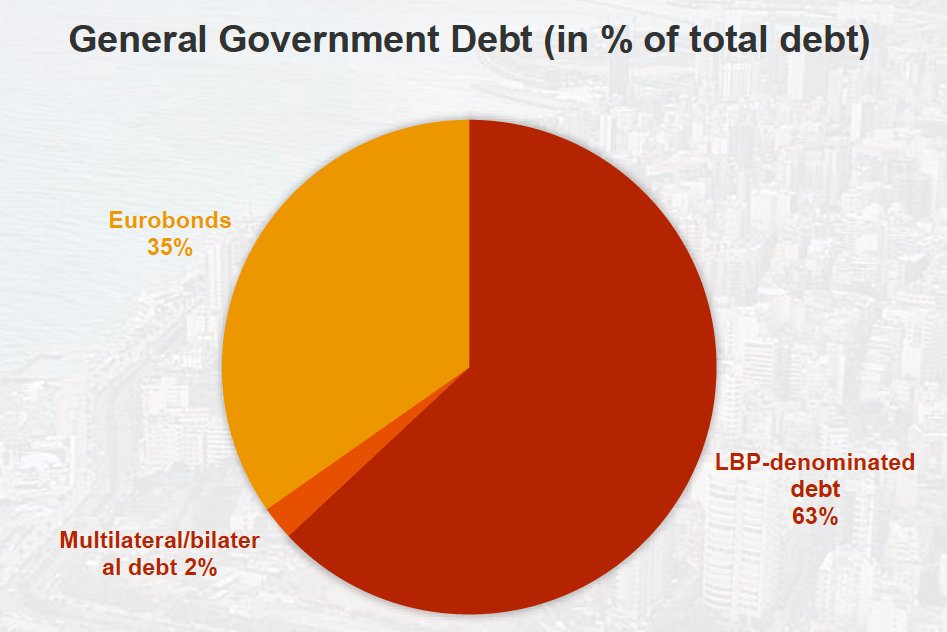

Given the lack of debt sustainability, the  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> government has already announced that a comprehensive debt restructuring will be part of the Economic Recovery Plan and will include both foreign currency (Eurobonds) and local currency (mainly LBP T-bills). 3/x

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> government has already announced that a comprehensive debt restructuring will be part of the Economic Recovery Plan and will include both foreign currency (Eurobonds) and local currency (mainly LBP T-bills). 3/x

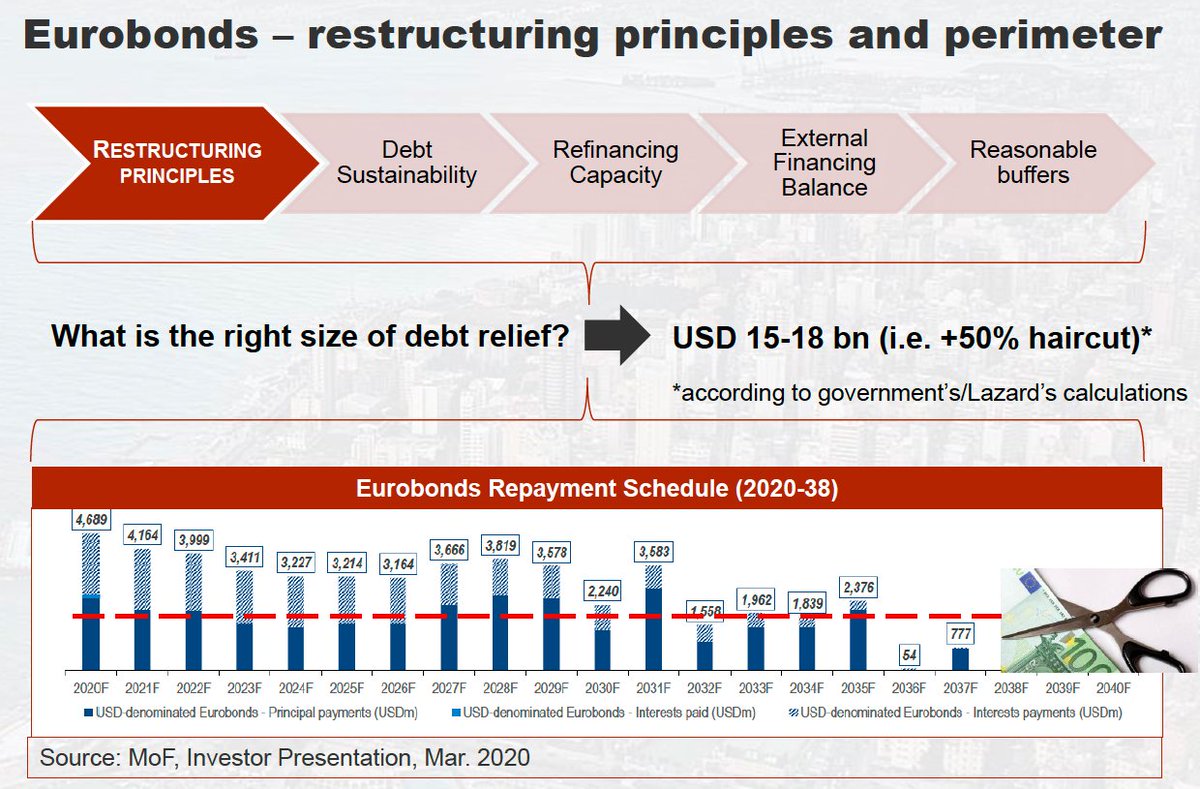

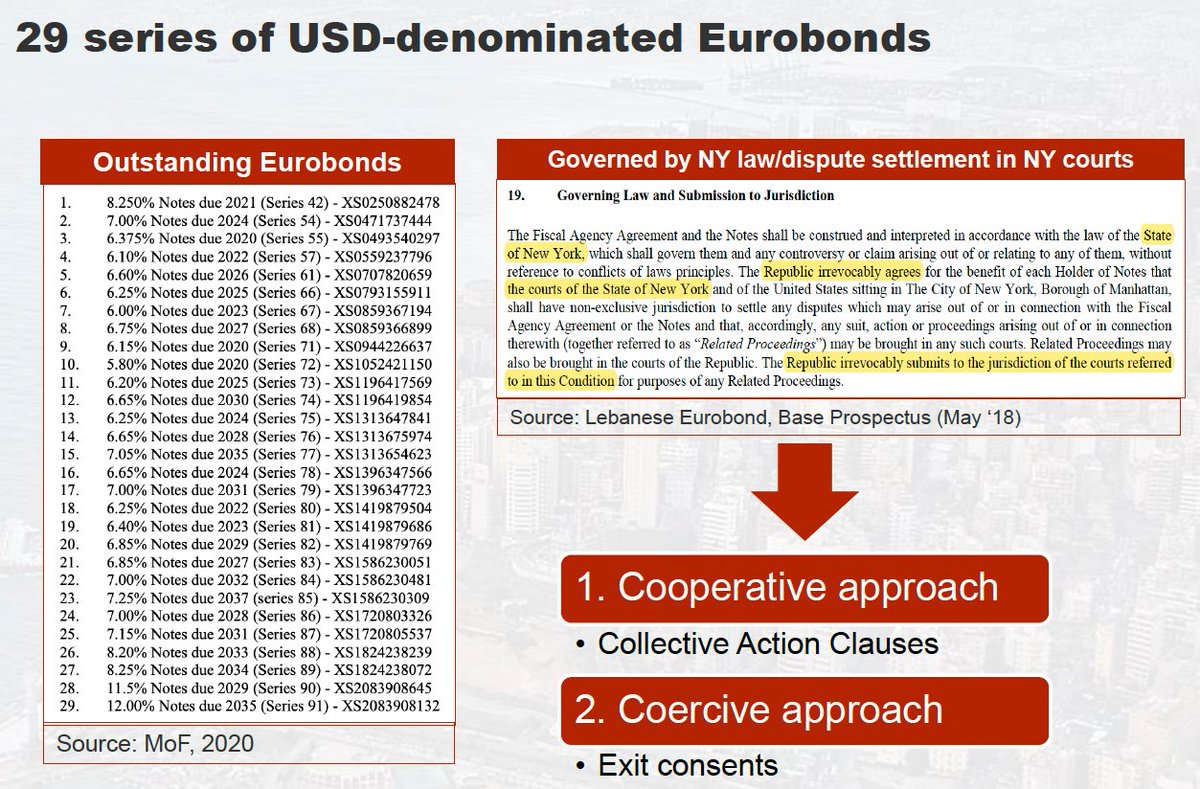

1. Eurobonds:

While the size of the haircut will be heavily disputed, the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> government& #39;s plan aims at a principal & coupon reduction of $15-18bn of the outstanding Eurobonds (USD-denominated) [a +50% haircut, given $31bn in outstanding Eurobonds] 4/x

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> government& #39;s plan aims at a principal & coupon reduction of $15-18bn of the outstanding Eurobonds (USD-denominated) [a +50% haircut, given $31bn in outstanding Eurobonds] 4/x

While the size of the haircut will be heavily disputed, the

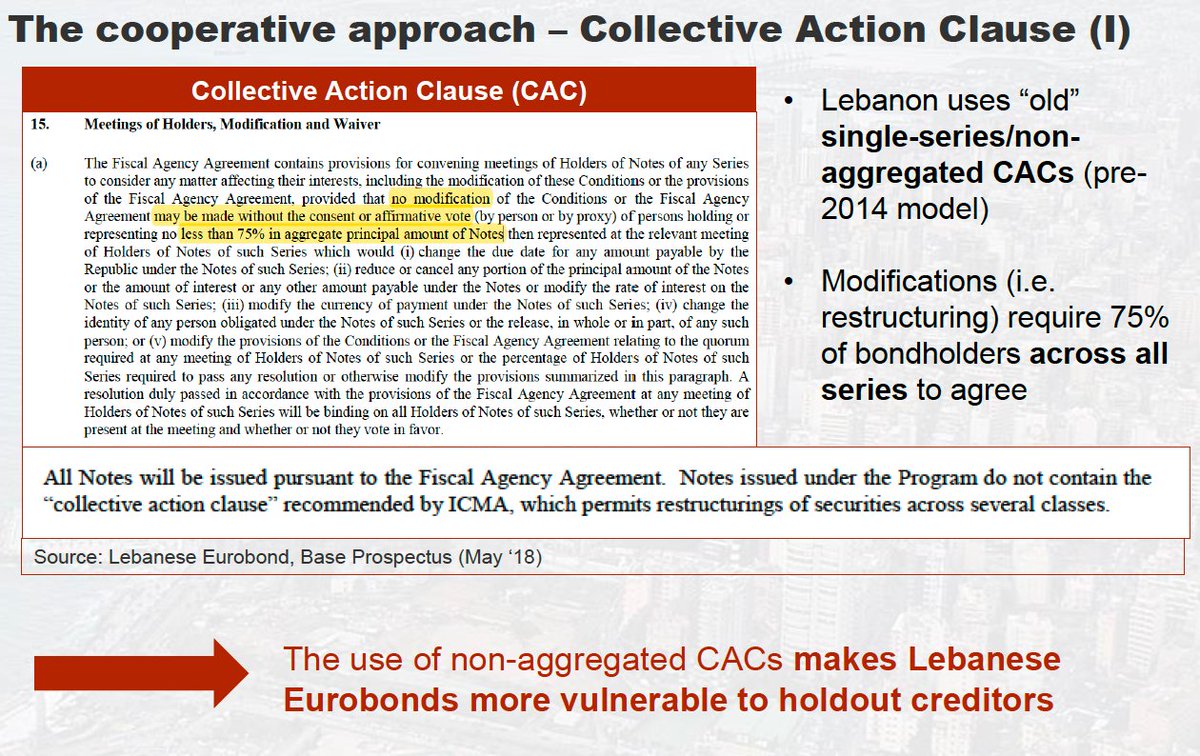

The restructuring of the 29 NY-law governed Eurobonds series could either be done cooperatively (by relying CACs) or coercively (essentially through exit consents or unilateral default). 5/x

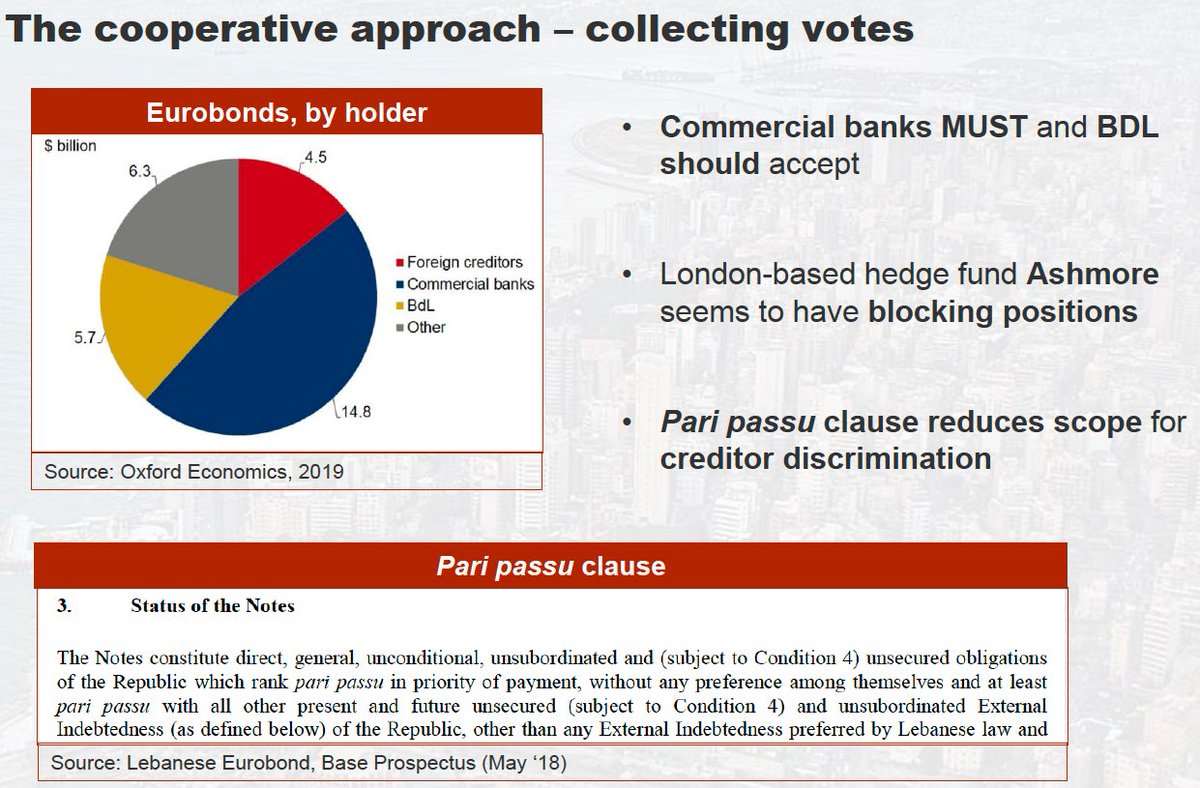

The cooperative approach seems difficult, given that  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon">& #39;s Eurobonds do not allow for cross-series modifications (latest ICMA standard) but require a majority of 75% of bondholders to accept a restructuring. According to reports, some funds have built blocking positions. 6/x

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon">& #39;s Eurobonds do not allow for cross-series modifications (latest ICMA standard) but require a majority of 75% of bondholders to accept a restructuring. According to reports, some funds have built blocking positions. 6/x

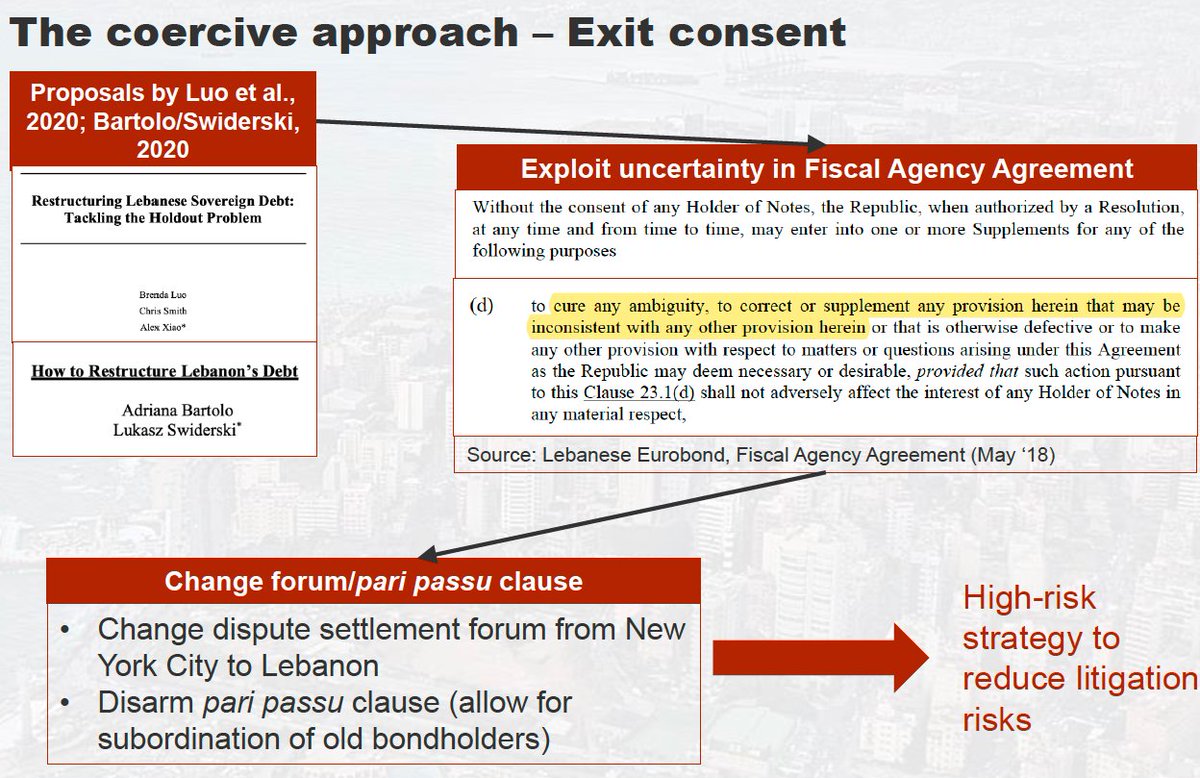

The coercive approach would involve the use of exit consents and essentially exploit ambiguities in the Fiscal Agency Agreement. Details are technical but it& #39;s a risky approach. See for a discussion of the issue by Mitu Gulati here: https://www.creditslips.org/creditslips/2020/03/subordinating-holdouts-in-a-lebanese-restructuring.html.">https://www.creditslips.org/creditsli... 7/x

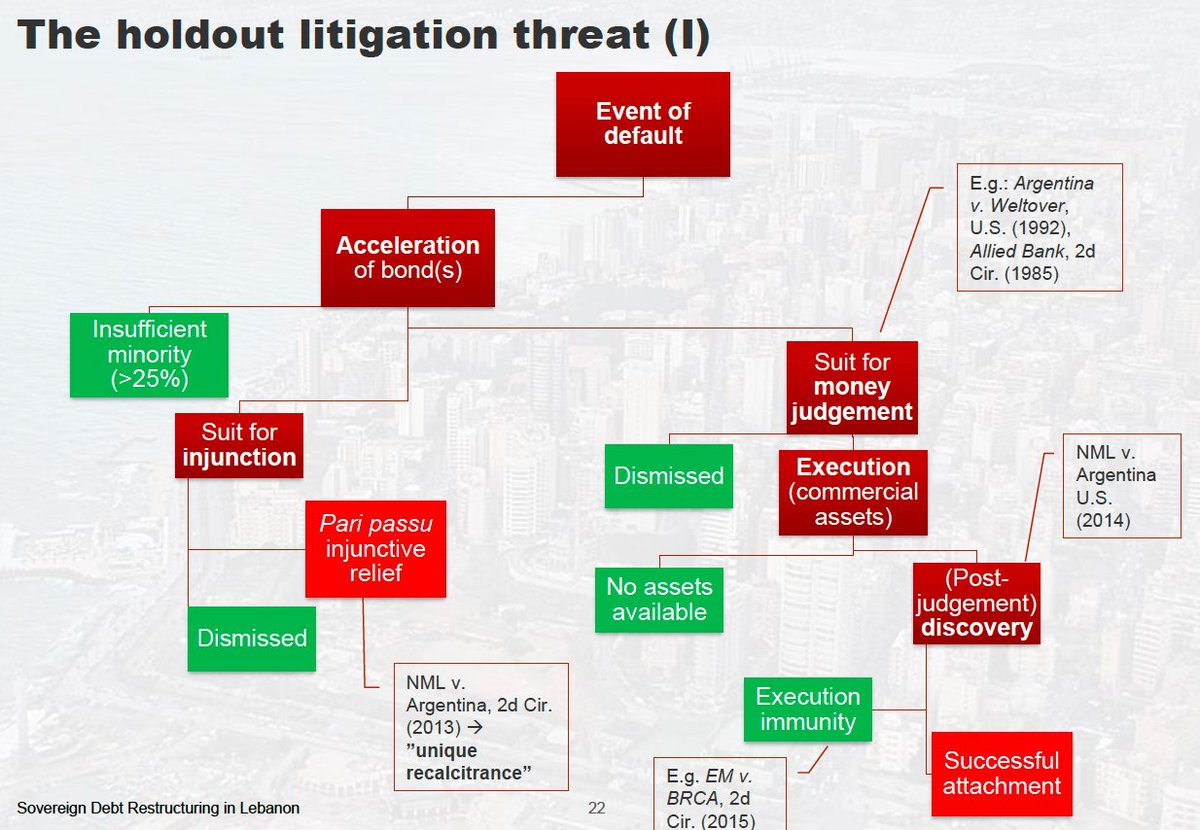

The litigation threat is real, not least since some creditors acquired blocking positions. Against this backdrop, the 25% approval threshold to accelerate Eurobonds should not be an issue. Still, the route is littered with obstacles and the holdout business is expensive. 8/x

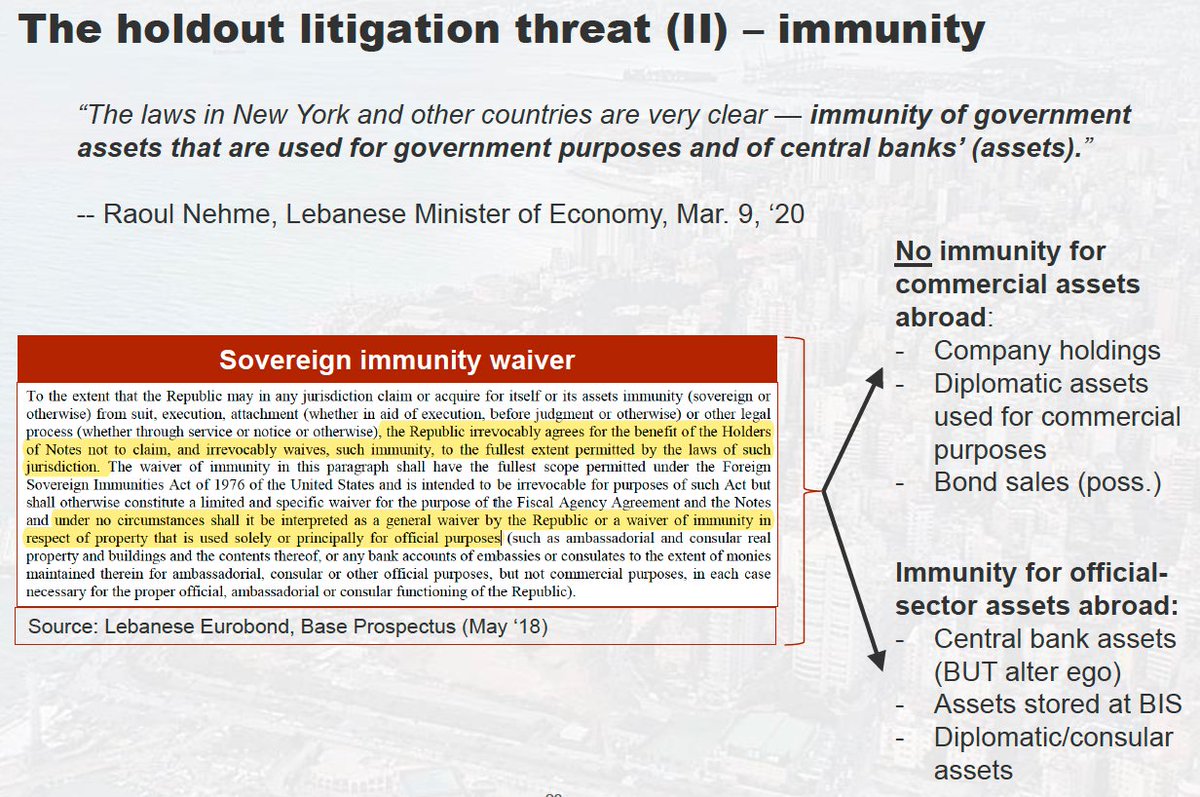

As a sovereign,  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> enjoys certain immunity wrt the attachment of public-sector assets - only "commercial" assets (such that are used for commercial purposes by the government) can be attached by creditors abroad. Shares in companies could be an attractive target. 9/x

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> enjoys certain immunity wrt the attachment of public-sector assets - only "commercial" assets (such that are used for commercial purposes by the government) can be attached by creditors abroad. Shares in companies could be an attractive target. 9/x

2. Domestic debt:

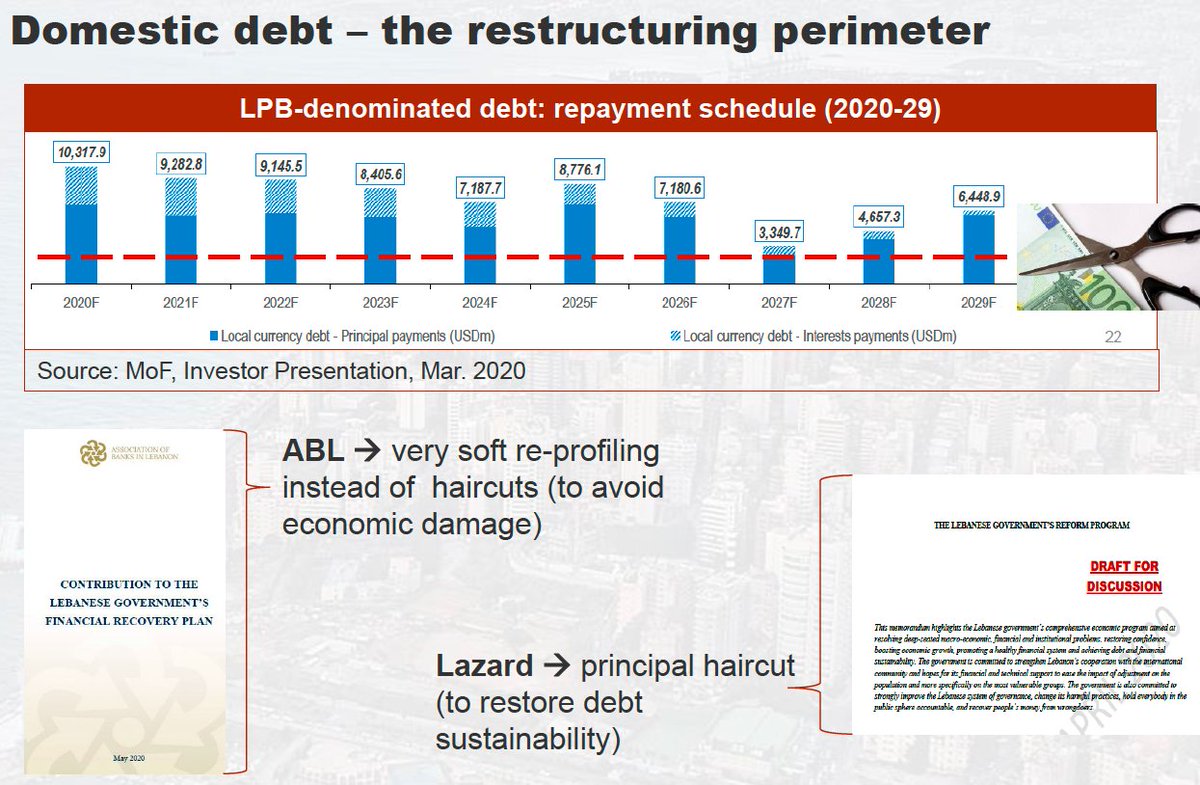

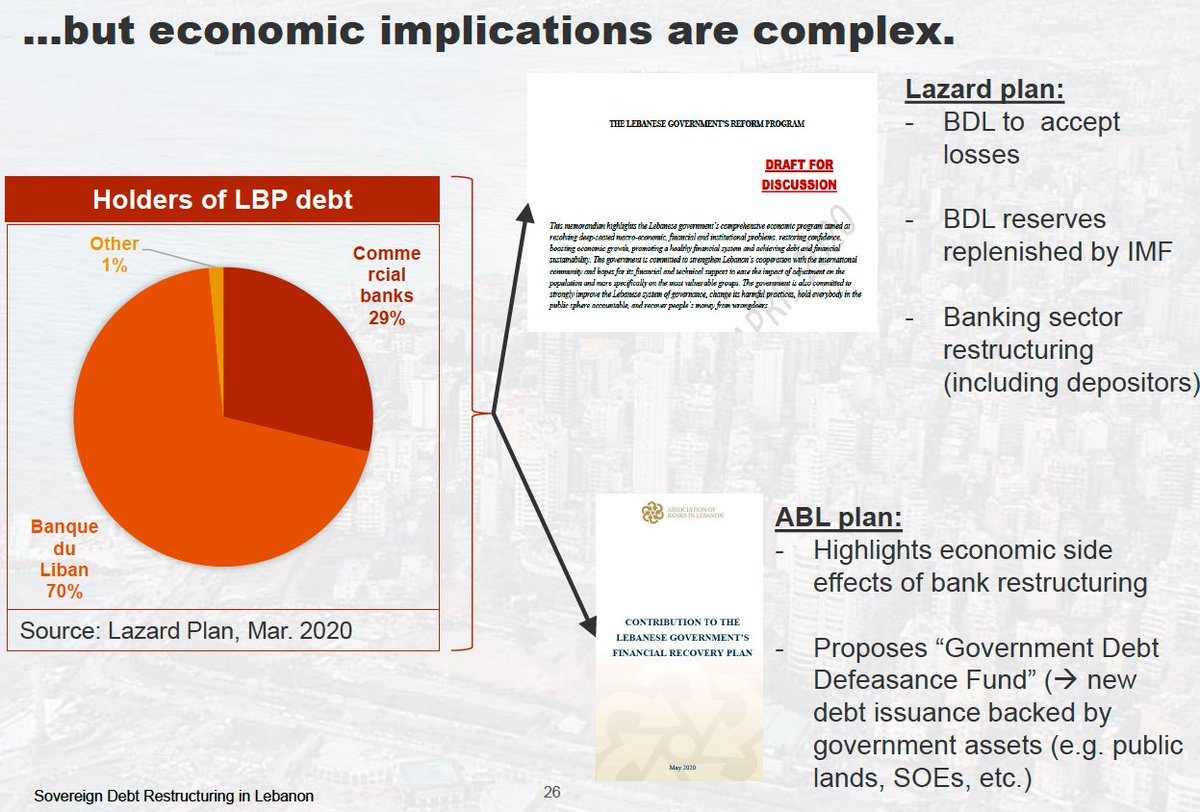

There are different visions in https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> wrt to the domestic debt (63% of total debt). While the

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> wrt to the domestic debt (63% of total debt). While the  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> commercial banks ask for a soft reprofiling, the government has announced its intention to impose a (big) haircut on domestic

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> commercial banks ask for a soft reprofiling, the government has announced its intention to impose a (big) haircut on domestic  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> debt (also hitting depositors). 10/x

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> debt (also hitting depositors). 10/x

There are different visions in

The legal risks of restructuring domestic debt are more manageable, since the instruments are governed by  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> law. (see, e.g., Greek debt restructuring of 2012). The ultimate safeguard for investors is the

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> law. (see, e.g., Greek debt restructuring of 2012). The ultimate safeguard for investors is the  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> Constitution (and limits to expropriatory measures). 11/x

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> Constitution (and limits to expropriatory measures). 11/x

Certainly, the domestic debt restructuring is more a political than a legal issue. The  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> government and the commercial banks have different visions wrt to the distribution of losses - the negotiations will show which side will have the upper hand. 12/x

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> government and the commercial banks have different visions wrt to the distribution of losses - the negotiations will show which side will have the upper hand. 12/x

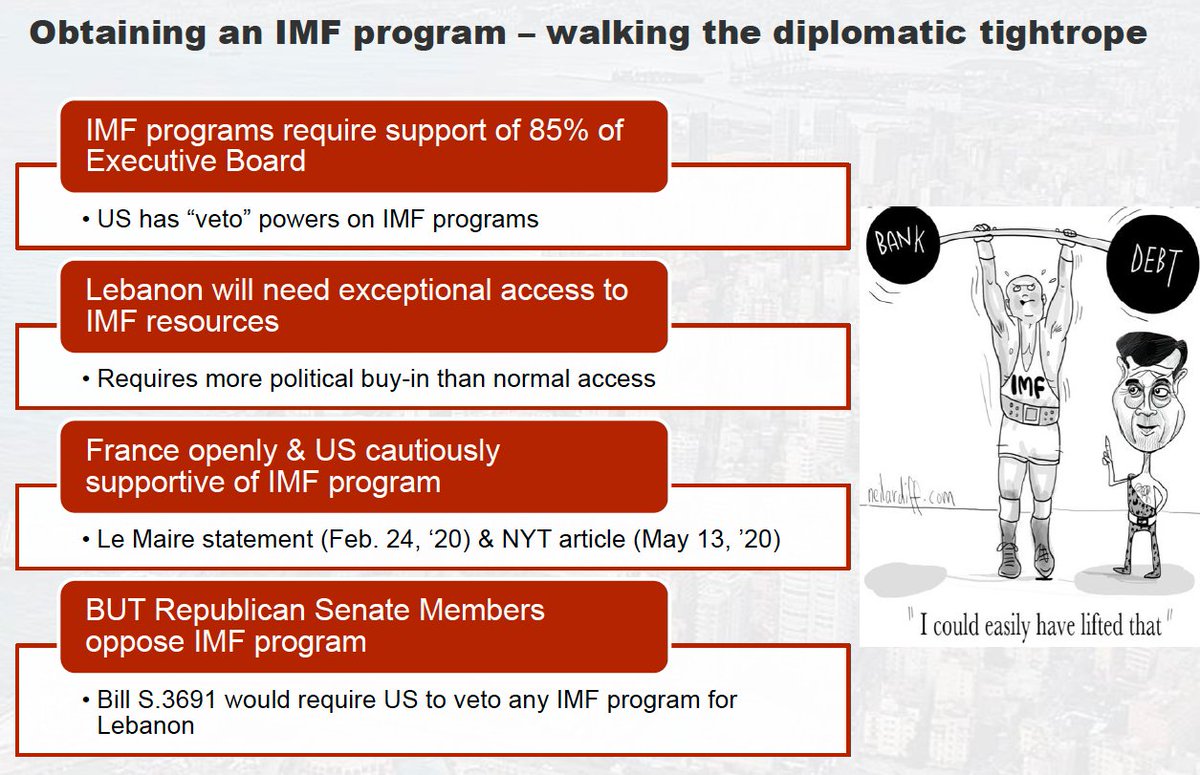

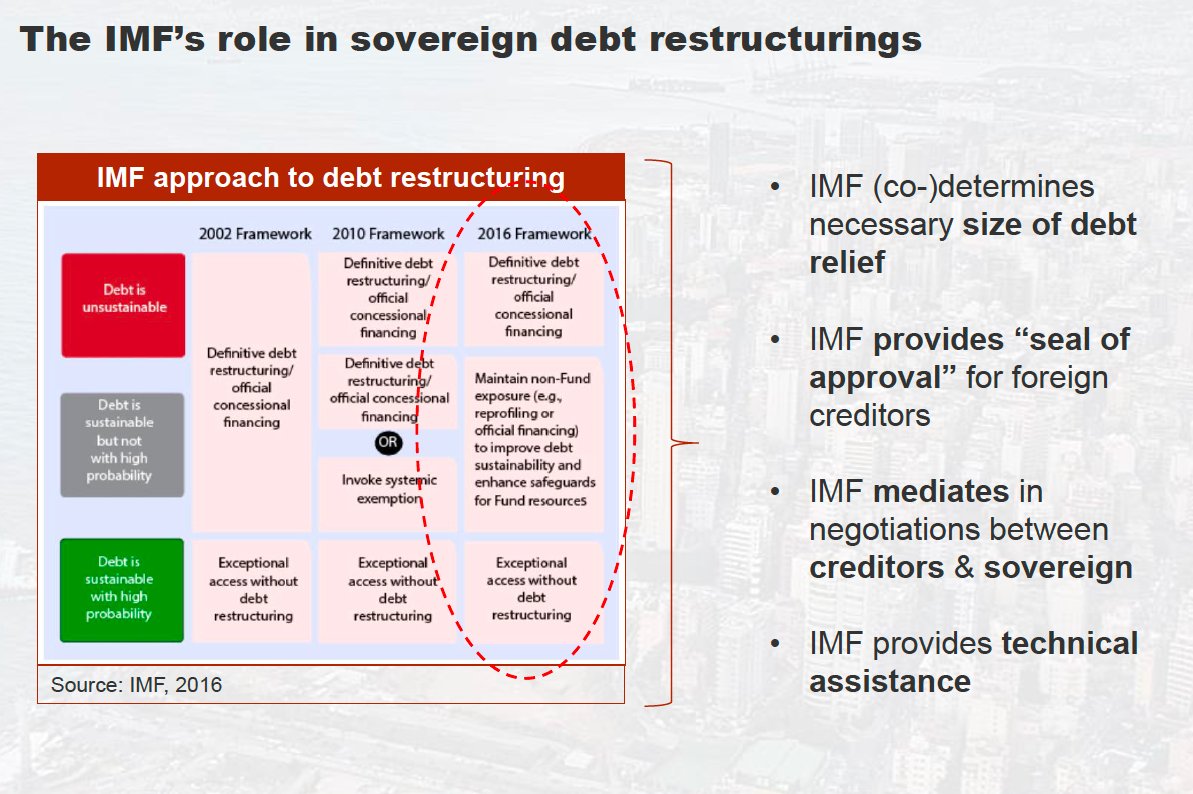

Another important issue is the @IMFNews& #39;s involvement. The pros of obtaining an IMF program seem to outweigh the cons, but the  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> government will have to lobby hard (esp. with the

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> government will have to lobby hard (esp. with the  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇪🇺" title="Flag of European Union" aria-label="Emoji: Flag of European Union"> & the

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇪🇺" title="Flag of European Union" aria-label="Emoji: Flag of European Union"> & the  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇺🇸" title="Flag of United States" aria-label="Emoji: Flag of United States">) to ensure approval in the @IMFNews Executive Board to obtain exceptional access. 13/x

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇺🇸" title="Flag of United States" aria-label="Emoji: Flag of United States">) to ensure approval in the @IMFNews Executive Board to obtain exceptional access. 13/x

The @IMFNews will likely require an upfront debt restructuring. The Fund will not only be critical to provide the necessary external financing (we are talking about +$10bn) but also to mediate between creditors with a view at providing the necessary level of credibility. 14/x

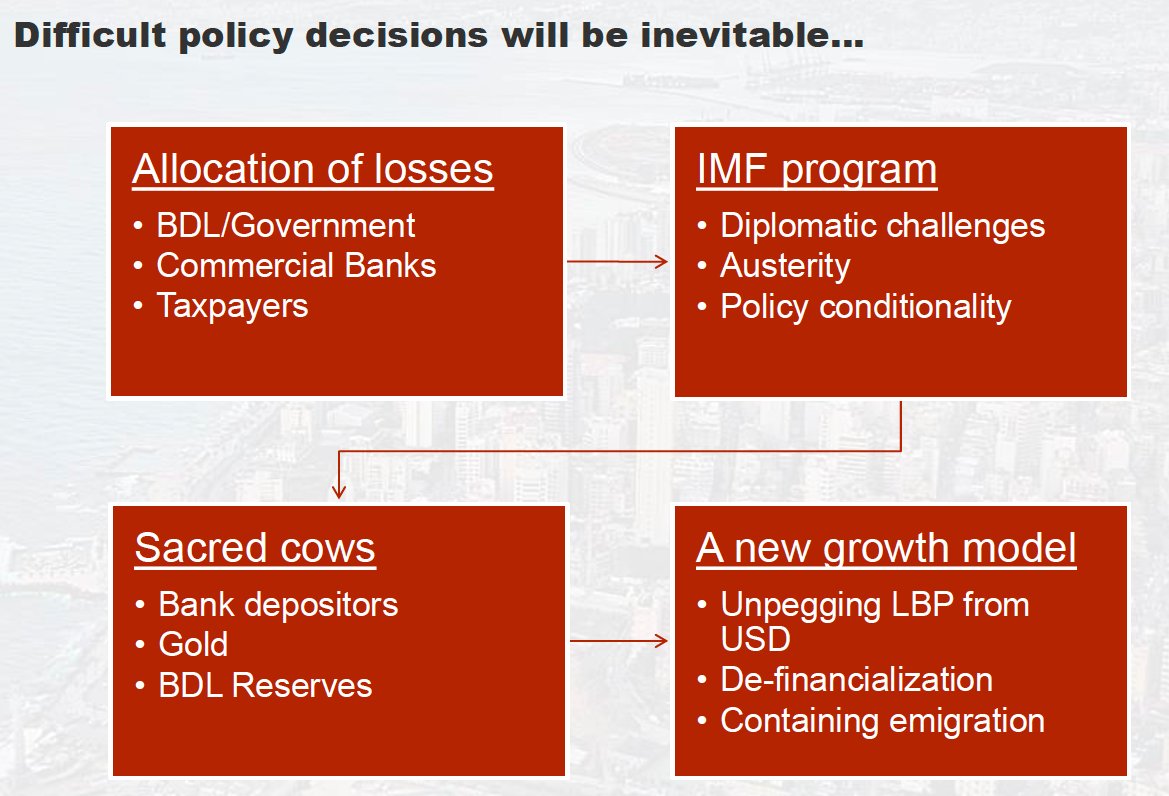

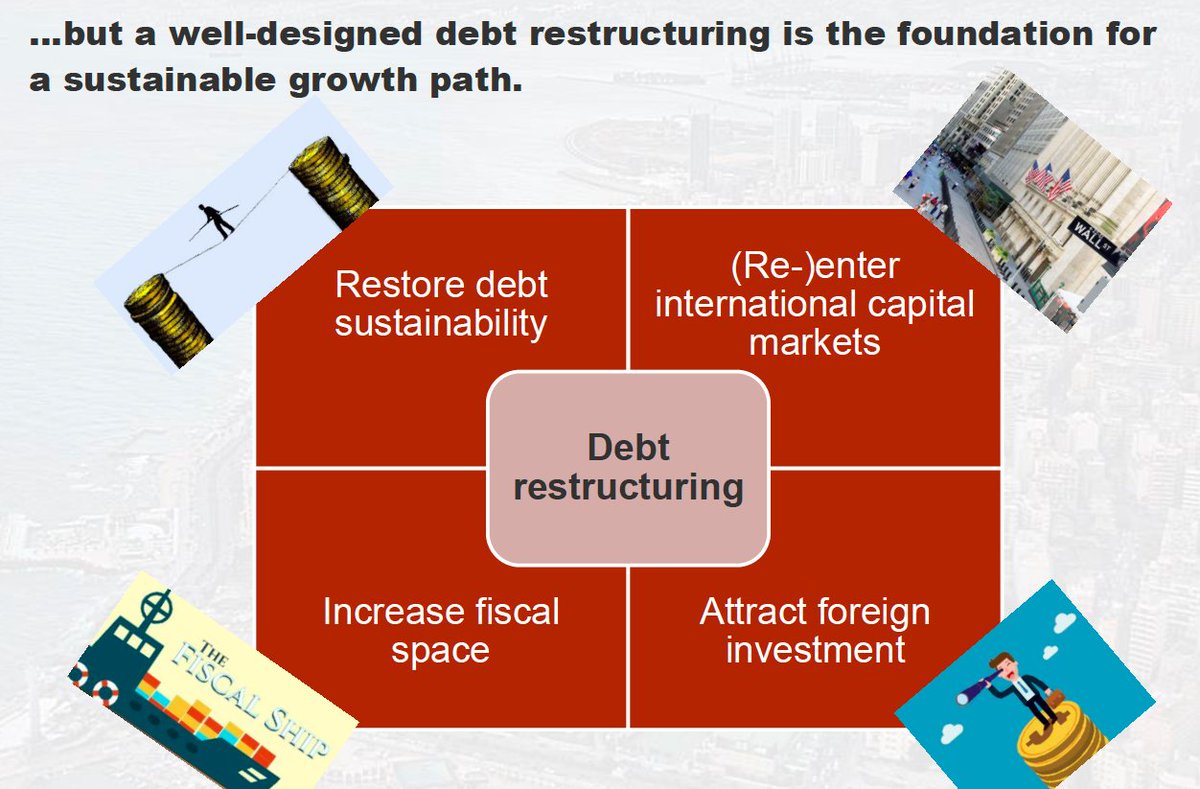

To conclude, difficult policy decisions in  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> are both inevitable and necessary. A restructuring of both the Eurobonds and the domestic debt is a necessary yet insufficient condition to bring

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> are both inevitable and necessary. A restructuring of both the Eurobonds and the domestic debt is a necessary yet insufficient condition to bring  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> back to a sustainable growth path. 15/x

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> back to a sustainable growth path. 15/x

There are several issues I did not address in this presentation, most notably the role of USD certificates of deposits, the BDL reserves, the discussion on the use of the  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> gold, etc. 16/end

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> gold, etc. 16/end

Read on Twitter

Read on Twitter - like Argentina - has already been in a difficult financial situation when the #Covid pandemic hit. Yet, the context within which https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> will restructure its debt should not be forgotten and the pandemic could give https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> a stronger hand in negotiations. 2/x" title="First, https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> - like Argentina - has already been in a difficult financial situation when the #Covid pandemic hit. Yet, the context within which https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> will restructure its debt should not be forgotten and the pandemic could give https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> a stronger hand in negotiations. 2/x" class="img-responsive" style="max-width:100%;"/>

- like Argentina - has already been in a difficult financial situation when the #Covid pandemic hit. Yet, the context within which https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> will restructure its debt should not be forgotten and the pandemic could give https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> a stronger hand in negotiations. 2/x" title="First, https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> - like Argentina - has already been in a difficult financial situation when the #Covid pandemic hit. Yet, the context within which https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> will restructure its debt should not be forgotten and the pandemic could give https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> a stronger hand in negotiations. 2/x" class="img-responsive" style="max-width:100%;"/>

government has already announced that a comprehensive debt restructuring will be part of the Economic Recovery Plan and will include both foreign currency (Eurobonds) and local currency (mainly LBP T-bills). 3/x" title="Given the lack of debt sustainability, the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> government has already announced that a comprehensive debt restructuring will be part of the Economic Recovery Plan and will include both foreign currency (Eurobonds) and local currency (mainly LBP T-bills). 3/x">

government has already announced that a comprehensive debt restructuring will be part of the Economic Recovery Plan and will include both foreign currency (Eurobonds) and local currency (mainly LBP T-bills). 3/x" title="Given the lack of debt sustainability, the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> government has already announced that a comprehensive debt restructuring will be part of the Economic Recovery Plan and will include both foreign currency (Eurobonds) and local currency (mainly LBP T-bills). 3/x">

government has already announced that a comprehensive debt restructuring will be part of the Economic Recovery Plan and will include both foreign currency (Eurobonds) and local currency (mainly LBP T-bills). 3/x" title="Given the lack of debt sustainability, the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> government has already announced that a comprehensive debt restructuring will be part of the Economic Recovery Plan and will include both foreign currency (Eurobonds) and local currency (mainly LBP T-bills). 3/x">

government has already announced that a comprehensive debt restructuring will be part of the Economic Recovery Plan and will include both foreign currency (Eurobonds) and local currency (mainly LBP T-bills). 3/x" title="Given the lack of debt sustainability, the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> government has already announced that a comprehensive debt restructuring will be part of the Economic Recovery Plan and will include both foreign currency (Eurobonds) and local currency (mainly LBP T-bills). 3/x">

government& #39;s plan aims at a principal & coupon reduction of $15-18bn of the outstanding Eurobonds (USD-denominated) [a +50% haircut, given $31bn in outstanding Eurobonds] 4/x" title="1. Eurobonds:While the size of the haircut will be heavily disputed, the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> government& #39;s plan aims at a principal & coupon reduction of $15-18bn of the outstanding Eurobonds (USD-denominated) [a +50% haircut, given $31bn in outstanding Eurobonds] 4/x">

government& #39;s plan aims at a principal & coupon reduction of $15-18bn of the outstanding Eurobonds (USD-denominated) [a +50% haircut, given $31bn in outstanding Eurobonds] 4/x" title="1. Eurobonds:While the size of the haircut will be heavily disputed, the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> government& #39;s plan aims at a principal & coupon reduction of $15-18bn of the outstanding Eurobonds (USD-denominated) [a +50% haircut, given $31bn in outstanding Eurobonds] 4/x">

government& #39;s plan aims at a principal & coupon reduction of $15-18bn of the outstanding Eurobonds (USD-denominated) [a +50% haircut, given $31bn in outstanding Eurobonds] 4/x" title="1. Eurobonds:While the size of the haircut will be heavily disputed, the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> government& #39;s plan aims at a principal & coupon reduction of $15-18bn of the outstanding Eurobonds (USD-denominated) [a +50% haircut, given $31bn in outstanding Eurobonds] 4/x">

government& #39;s plan aims at a principal & coupon reduction of $15-18bn of the outstanding Eurobonds (USD-denominated) [a +50% haircut, given $31bn in outstanding Eurobonds] 4/x" title="1. Eurobonds:While the size of the haircut will be heavily disputed, the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> government& #39;s plan aims at a principal & coupon reduction of $15-18bn of the outstanding Eurobonds (USD-denominated) [a +50% haircut, given $31bn in outstanding Eurobonds] 4/x">

& #39;s Eurobonds do not allow for cross-series modifications (latest ICMA standard) but require a majority of 75% of bondholders to accept a restructuring. According to reports, some funds have built blocking positions. 6/x" title="The cooperative approach seems difficult, given that https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon">& #39;s Eurobonds do not allow for cross-series modifications (latest ICMA standard) but require a majority of 75% of bondholders to accept a restructuring. According to reports, some funds have built blocking positions. 6/x">

& #39;s Eurobonds do not allow for cross-series modifications (latest ICMA standard) but require a majority of 75% of bondholders to accept a restructuring. According to reports, some funds have built blocking positions. 6/x" title="The cooperative approach seems difficult, given that https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon">& #39;s Eurobonds do not allow for cross-series modifications (latest ICMA standard) but require a majority of 75% of bondholders to accept a restructuring. According to reports, some funds have built blocking positions. 6/x">

& #39;s Eurobonds do not allow for cross-series modifications (latest ICMA standard) but require a majority of 75% of bondholders to accept a restructuring. According to reports, some funds have built blocking positions. 6/x" title="The cooperative approach seems difficult, given that https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon">& #39;s Eurobonds do not allow for cross-series modifications (latest ICMA standard) but require a majority of 75% of bondholders to accept a restructuring. According to reports, some funds have built blocking positions. 6/x">

& #39;s Eurobonds do not allow for cross-series modifications (latest ICMA standard) but require a majority of 75% of bondholders to accept a restructuring. According to reports, some funds have built blocking positions. 6/x" title="The cooperative approach seems difficult, given that https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon">& #39;s Eurobonds do not allow for cross-series modifications (latest ICMA standard) but require a majority of 75% of bondholders to accept a restructuring. According to reports, some funds have built blocking positions. 6/x">

enjoys certain immunity wrt the attachment of public-sector assets - only "commercial" assets (such that are used for commercial purposes by the government) can be attached by creditors abroad. Shares in companies could be an attractive target. 9/x" title="As a sovereign, https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> enjoys certain immunity wrt the attachment of public-sector assets - only "commercial" assets (such that are used for commercial purposes by the government) can be attached by creditors abroad. Shares in companies could be an attractive target. 9/x" class="img-responsive" style="max-width:100%;"/>

enjoys certain immunity wrt the attachment of public-sector assets - only "commercial" assets (such that are used for commercial purposes by the government) can be attached by creditors abroad. Shares in companies could be an attractive target. 9/x" title="As a sovereign, https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> enjoys certain immunity wrt the attachment of public-sector assets - only "commercial" assets (such that are used for commercial purposes by the government) can be attached by creditors abroad. Shares in companies could be an attractive target. 9/x" class="img-responsive" style="max-width:100%;"/>

wrt to the domestic debt (63% of total debt). While the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> commercial banks ask for a soft reprofiling, the government has announced its intention to impose a (big) haircut on domestic https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> debt (also hitting depositors). 10/x" title="2. Domestic debt:There are different visions in https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> wrt to the domestic debt (63% of total debt). While the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> commercial banks ask for a soft reprofiling, the government has announced its intention to impose a (big) haircut on domestic https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> debt (also hitting depositors). 10/x" class="img-responsive" style="max-width:100%;"/>

wrt to the domestic debt (63% of total debt). While the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> commercial banks ask for a soft reprofiling, the government has announced its intention to impose a (big) haircut on domestic https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> debt (also hitting depositors). 10/x" title="2. Domestic debt:There are different visions in https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> wrt to the domestic debt (63% of total debt). While the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> commercial banks ask for a soft reprofiling, the government has announced its intention to impose a (big) haircut on domestic https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> debt (also hitting depositors). 10/x" class="img-responsive" style="max-width:100%;"/>

law. (see, e.g., Greek debt restructuring of 2012). The ultimate safeguard for investors is the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> Constitution (and limits to expropriatory measures). 11/x" title="The legal risks of restructuring domestic debt are more manageable, since the instruments are governed by https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> law. (see, e.g., Greek debt restructuring of 2012). The ultimate safeguard for investors is the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> Constitution (and limits to expropriatory measures). 11/x" class="img-responsive" style="max-width:100%;"/>

law. (see, e.g., Greek debt restructuring of 2012). The ultimate safeguard for investors is the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> Constitution (and limits to expropriatory measures). 11/x" title="The legal risks of restructuring domestic debt are more manageable, since the instruments are governed by https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> law. (see, e.g., Greek debt restructuring of 2012). The ultimate safeguard for investors is the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> Constitution (and limits to expropriatory measures). 11/x" class="img-responsive" style="max-width:100%;"/>

government and the commercial banks have different visions wrt to the distribution of losses - the negotiations will show which side will have the upper hand. 12/x" title="Certainly, the domestic debt restructuring is more a political than a legal issue. The https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> government and the commercial banks have different visions wrt to the distribution of losses - the negotiations will show which side will have the upper hand. 12/x" class="img-responsive" style="max-width:100%;"/>

government and the commercial banks have different visions wrt to the distribution of losses - the negotiations will show which side will have the upper hand. 12/x" title="Certainly, the domestic debt restructuring is more a political than a legal issue. The https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> government and the commercial banks have different visions wrt to the distribution of losses - the negotiations will show which side will have the upper hand. 12/x" class="img-responsive" style="max-width:100%;"/>

government will have to lobby hard (esp. with the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇪🇺" title="Flag of European Union" aria-label="Emoji: Flag of European Union"> & the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇺🇸" title="Flag of United States" aria-label="Emoji: Flag of United States">) to ensure approval in the @IMFNews Executive Board to obtain exceptional access. 13/x" title="Another important issue is the @IMFNews& #39;s involvement. The pros of obtaining an IMF program seem to outweigh the cons, but the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> government will have to lobby hard (esp. with the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇪🇺" title="Flag of European Union" aria-label="Emoji: Flag of European Union"> & the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇺🇸" title="Flag of United States" aria-label="Emoji: Flag of United States">) to ensure approval in the @IMFNews Executive Board to obtain exceptional access. 13/x">

government will have to lobby hard (esp. with the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇪🇺" title="Flag of European Union" aria-label="Emoji: Flag of European Union"> & the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇺🇸" title="Flag of United States" aria-label="Emoji: Flag of United States">) to ensure approval in the @IMFNews Executive Board to obtain exceptional access. 13/x" title="Another important issue is the @IMFNews& #39;s involvement. The pros of obtaining an IMF program seem to outweigh the cons, but the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> government will have to lobby hard (esp. with the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇪🇺" title="Flag of European Union" aria-label="Emoji: Flag of European Union"> & the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇺🇸" title="Flag of United States" aria-label="Emoji: Flag of United States">) to ensure approval in the @IMFNews Executive Board to obtain exceptional access. 13/x">

government will have to lobby hard (esp. with the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇪🇺" title="Flag of European Union" aria-label="Emoji: Flag of European Union"> & the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇺🇸" title="Flag of United States" aria-label="Emoji: Flag of United States">) to ensure approval in the @IMFNews Executive Board to obtain exceptional access. 13/x" title="Another important issue is the @IMFNews& #39;s involvement. The pros of obtaining an IMF program seem to outweigh the cons, but the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> government will have to lobby hard (esp. with the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇪🇺" title="Flag of European Union" aria-label="Emoji: Flag of European Union"> & the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇺🇸" title="Flag of United States" aria-label="Emoji: Flag of United States">) to ensure approval in the @IMFNews Executive Board to obtain exceptional access. 13/x">

government will have to lobby hard (esp. with the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇪🇺" title="Flag of European Union" aria-label="Emoji: Flag of European Union"> & the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇺🇸" title="Flag of United States" aria-label="Emoji: Flag of United States">) to ensure approval in the @IMFNews Executive Board to obtain exceptional access. 13/x" title="Another important issue is the @IMFNews& #39;s involvement. The pros of obtaining an IMF program seem to outweigh the cons, but the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> government will have to lobby hard (esp. with the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇪🇺" title="Flag of European Union" aria-label="Emoji: Flag of European Union"> & the https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇺🇸" title="Flag of United States" aria-label="Emoji: Flag of United States">) to ensure approval in the @IMFNews Executive Board to obtain exceptional access. 13/x">

are both inevitable and necessary. A restructuring of both the Eurobonds and the domestic debt is a necessary yet insufficient condition to bring https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> back to a sustainable growth path. 15/x" title="To conclude, difficult policy decisions in https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> are both inevitable and necessary. A restructuring of both the Eurobonds and the domestic debt is a necessary yet insufficient condition to bring https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> back to a sustainable growth path. 15/x">

are both inevitable and necessary. A restructuring of both the Eurobonds and the domestic debt is a necessary yet insufficient condition to bring https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> back to a sustainable growth path. 15/x" title="To conclude, difficult policy decisions in https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> are both inevitable and necessary. A restructuring of both the Eurobonds and the domestic debt is a necessary yet insufficient condition to bring https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> back to a sustainable growth path. 15/x">

are both inevitable and necessary. A restructuring of both the Eurobonds and the domestic debt is a necessary yet insufficient condition to bring https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> back to a sustainable growth path. 15/x" title="To conclude, difficult policy decisions in https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> are both inevitable and necessary. A restructuring of both the Eurobonds and the domestic debt is a necessary yet insufficient condition to bring https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> back to a sustainable growth path. 15/x">

are both inevitable and necessary. A restructuring of both the Eurobonds and the domestic debt is a necessary yet insufficient condition to bring https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> back to a sustainable growth path. 15/x" title="To conclude, difficult policy decisions in https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> are both inevitable and necessary. A restructuring of both the Eurobonds and the domestic debt is a necessary yet insufficient condition to bring https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇱🇧" title="Flag of Lebanon" aria-label="Emoji: Flag of Lebanon"> back to a sustainable growth path. 15/x">