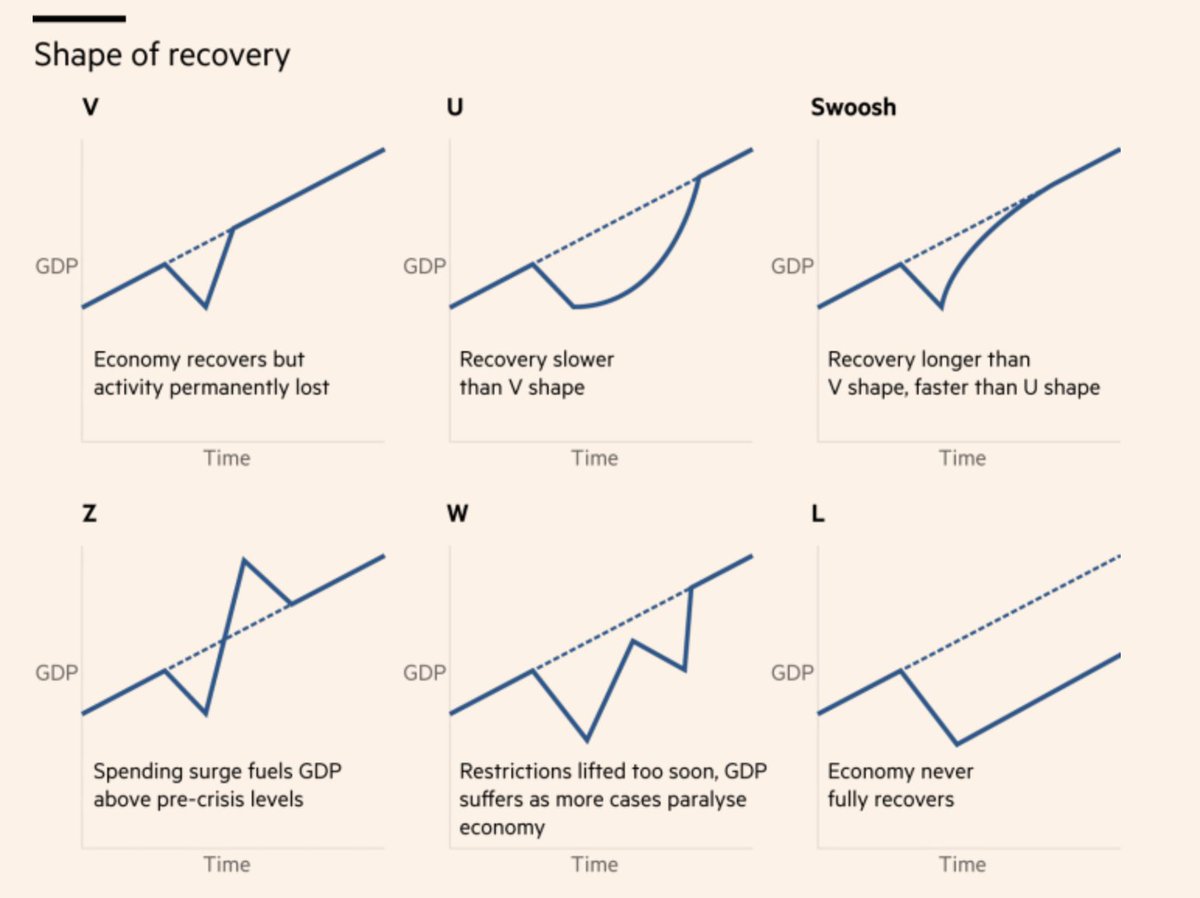

This chart from https://www.ft.com/content/113529d8-cefb-41f1-a61d-cc12b194f685">https://www.ft.com/content/1... is mind-blowing. It attempts to illustrate different recovery scenarios, but 5 of 6 show a return to the pre-crisis trend path! This didn& #39;t happen last time & is unlikely this time in the absence of Fed adopting & #39;make-up& #39; policy... (1/n)

To return to the pre-crisis trend path---and not just the pre-crisis level---the economy has to grow really rapidly for a sustained period. That is faster-than-normal growth for multiple quarters and probably coupled a temporary surge of inflation above 2%... (2/n)

For reason laid out in this @Neil_Irwin piece https://www.nytimes.com/2020/05/19/upshot/virus-economic-data-upended.html,">https://www.nytimes.com/2020/05/1... most observers and policymakers will start freaking out at such high growth rates of GDP and inflation and force policy to be dialed back before the pre-crisis trend path is reached... (3/n)

To return to a trend path, observers & policymakers need a new framework to operate in that allows them to feel okay with temporarily rapid growth & higher inflation. It& #39;s called level targeting. I prefer a NGDP level target version, but one can also do a price level version(4/n)

Read on Twitter

Read on Twitter