Some initial thoughts on the EU’s recovery plan announced by the Commission today, which will be welcomed by most member states who are in need of short-term funding. First – AGAIN on the figures. 1/ #NextGenerationEU

THE AMOUNT: Commission President Von der Leyen said in her speech today the EU recovery plan totalled a sum of €2.4tn, including €1.85tn in new funds added to the ‘first response package’ of €540bn. Let’s break it down. 2/

The €1.85tn figure consists of €750bn of new funding for member states (MS), to be borrowed through a common instrument by the Commission in financial markets, with €500bn to be disbursed as “grants” and €250bn as loans 3/

The €1.1tn is just the EU’s budget, the Multi-annual Financial Framework( MFF), raised by own resources, mainly contributions from member states. This figure is LOWER than the €1.135tn proposed for the 2021-2027 MFF by the Commission in 2018. 4/

The €750bn ‘Next Generation’ figure is intended to be a pleasant surprise after media reports of the German-French agreement on €500bn. This came in response to the EU Parliament’s demand for a recovery fund of at least €2tn ON TOP of the MFF 5/

There is NO WAY that the Commission would have proposed €750bn instead of €500bn without the go-ahead from Germany and France. The French-German original announcement was an exercise in managing (lowering) expectations 6/

It’s also highly likely that Germany agreed to a higher figure in order to assure sovereign bond markets following the ruling of its constitutional court on the ECB’s bond-buying programme 7/

So we are not looking at EU recovery spending of €2.4tn but around 1/4 of that, €525bn; the rest is borrowing to fund loans that must be repaid, or aiming to mobilise the private sector; & the ESM funds are loans (and most of the amount has not yet been paid in by MS) 8/

Let’s look at the Next Generation €750bn. For sure, it is a significant amount that will have a positive impact. It is an unprecedented step for the EU to borrow this amount through a common debt instrument, and for it to be disbursed mainly by grants. 9/

But, if endorsed by the 27MS, note it is a ONE-OFF move unlikely to be repeated in the near future due to political opposition in the North. The €2tn proposed by the Parliament wasn’t plucked from the air, but based on economic forecasts of bare minimum spending necessary 10/

I won’t go into the details now of the supposed €540bn ‘first response package’, except to point out that in reality it actually only amounts to €25bn of spending that isn’t loans or mobilisation of private capital. I outlined this here: https://tribunemag.co.uk/2020/04/the-eurozones-coronavirus-debt-crisis">https://tribunemag.co.uk/2020/04/t... 11/

ECONOMIC NEEDS: To put this in context: the EU’s GDP was US$18.8tn in 2018. The ECB has predicted a contraction in EU GDP of 5-12%, publicly focusing on 7-8%. Yesterday it warned we are looking at the HIGH end of that estimate, with a new official forecast due next week. 12/

The April figures have emerged and they& #39;re GRIM. In April EU GDP was down by 3.8% in the euro area and by 3.5% in the EU https://ec.europa.eu/eurostat/documents/2995521/10294708/2-30042020-BP-EN.pdf/526405c5-289c-30f5-068a-d907b7d663e6">https://ec.europa.eu/eurostat/... 13/

CONDITIONS: On the surface all of this doesn’t look so bad. The funds aren’t attached to a Troika memo, after all. But don’t think grants or loans are free from conditions; they are all conditional on obedience to the EU’s “liberalising machine” dynamic. 14/

The major instrument of Next Generation, pitched as “grants”, is a mixture of investment and reforms. “Member States will design their own tailored national recovery plans, based on the investment and reform priorities identified as part of the #EuropeanSemester”. 15/

I went through the trauma of reading every one of the Commission’s country-specific recommendations under the European Semester from 2011-2018 so you don’t have to. The Commission has developed an IMF-style detailed structural adjustment programme for every member state. 16/

The Commission& #39;s most common demands: Raise the pension age; put everyone to work in insecure jobs; cut spending on hospitals/aged care; shift taxes from “labour” (income) to “environment” (consumption) – i.e shift tax from a progressive to a regressive system. 17/

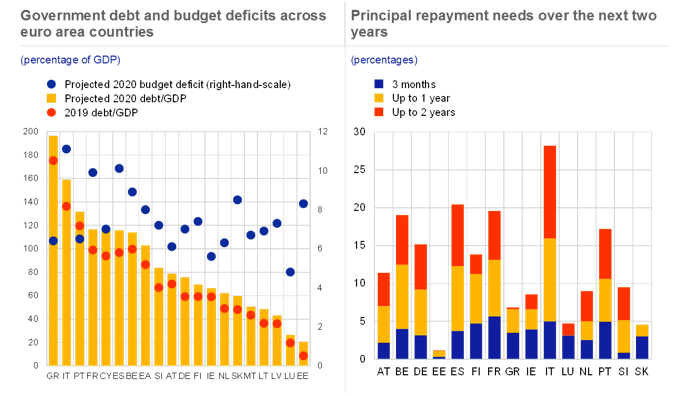

On sovereign debt: Risk over the past months has surged for Italy and Spain and to a lesser extent France. The ECB predicts public debt will reach 200% of GDP in Greece, 160% in Italy, 130% in Portugal and 120% in France and Spain https://www.ft.com/content/4d60cbfd-722e-4eee-af4a-50198321e0f8">https://www.ft.com/content/4... 18/ Image @FT

Side note: Given these figures, PERHAPS we should consider ditching the Stability and Growth Pact thresholds of a 60% debt-to-GDP ratio and an annual 3% deficit!!! 19/

Only Greece has so far made noises about using the ESM, with Italy hesitating and needing to pass it through Parliament. The head of Greece’s Central Bank unapologetically wants to use the ESM https://www.ekathimerini.com/253047/article/ekathimerini/business/bog-head-wants-bad-bank-and-esm-credit-line">https://www.ekathimerini.com/253047/ar... 20/

THE MFF:

I won’t go into all the figures of the (2021-2027) MFF here. But the goals and figures are fiercely disputed by the three EU institutions. A major inter-institutional fight is looming on the MFF this year. 21/

I won’t go into all the figures of the (2021-2027) MFF here. But the goals and figures are fiercely disputed by the three EU institutions. A major inter-institutional fight is looming on the MFF this year. 21/

The Commission today suggested the MFF would be agreed by December; this is very optimistic. Today’s proposal does not differ much from that of Council President Michel’s, which includes cuts of -12% to cohesion funds and -14% to agriculture, both hotly opposed by MEPs. 22/

Both the size of the MFF & where it will be spent are opposed by progressives because it is (1) insufficient to achieve fiscal transfers from the rich countries to the poor, & (2) directed at the wrong priorities – with (eg) a proposed increase of 648% on military spending! 23/

SUMMARY: So to sum up. The €2.4bn figure is inaccurate. The €500bn of grants to be disbursed is, sadly, conditional on “structural reforms”. The MFF figure proposed by the Commission’s to lift the EU out of a depression is even less ambitious than it was in 2018. 24/

Member states can resist the €750bn package in the Council – but it is likely it will only be opposed by the”frugal” states opposed to spending. We should demand this minimum of fundraising and spending is agreed upon. 25/

I haven’t even started upon the issue of how to ensure the funds are spent according to need and not to existing strengths; that’s for another thread. 26/

More importantly, I’m working on a detailed analysis of the unique problems posed by public debt in the EU & #Eurozone, and the role and mandate of the #ECB, to be published in June, so these issues will be addressed in that report. 27/

Finally: This is significant. But it’s not a sufficient amount of spending, or indeed of transfers. It adds to sovereign debt and it& #39;s conditional – even more so than usual. And it ignores the potential positive role the ECB could play #NextGenerationEU ENDS 28/28

Read on Twitter

Read on Twitter