A few thoughts on the ECB Financial Stability Review and their analysis on banks& #39; asset quality (while we wait for the "desktop" stress test.) There are quite a few interesting dta points in there.

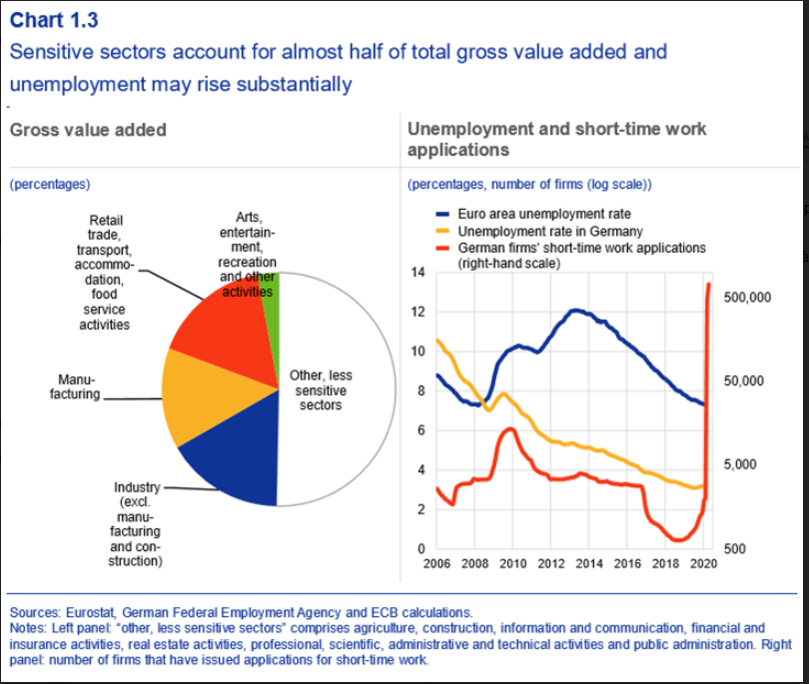

Very much like the BOE, the ECB wants to analyze the cash flows weaknesses of sectors impacted by Covid and see how it translates into loan losses. So the starting point is this chart showing the share of such sectors in total VA

Clearly, it& #39;s a massive share of the economy.

Clearly, it& #39;s a massive share of the economy.

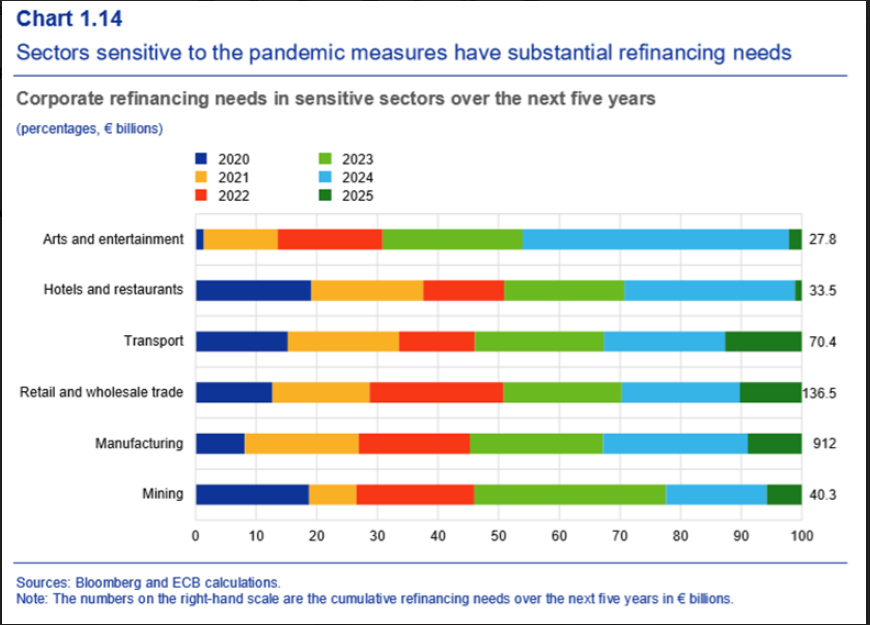

then they look at refinancing profiles of sectors, in this chart.

It& #39;s not exactly lucky that one of the worst sector (hotels and restaurants) has the worst refi profile... but on absolute numbers, the biggest risk is retail (though you would have to remove food from that imo)

It& #39;s not exactly lucky that one of the worst sector (hotels and restaurants) has the worst refi profile... but on absolute numbers, the biggest risk is retail (though you would have to remove food from that imo)

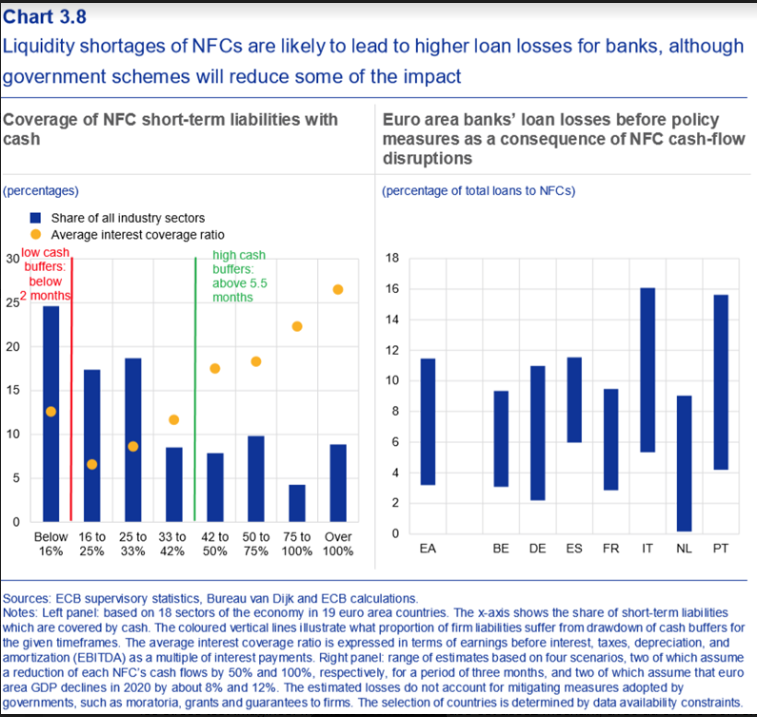

The stress analysis uses those refi risk with cash flows assumptions (50% loss, 100% loss) for 3m to create negative CF NFC which they translate into defaults. This is very similar to the BOE approach but is also very harsh (<0 CF doesn& #39;t really mean default)

This gets them to this chart where you can see (right) loan losses as % of loans in the range of scenarios. The less severe scenarios is already much worse than most ST I& #39;ve seen, not to mention banks guidance! (e.g. Italy cost of risk over 5%)

in €, we& #39;re talking 160bn€ to 600bn€ of losses. Oops. again, this is very harsh and I suspect the desktop stress test will have much lower losses. But it& #39;s useful to compare countries.

Italy, Portugal and Spain are clearly most at risk, but the Netherlands also has a very large gap between the two scenarios - so more downside risk there.

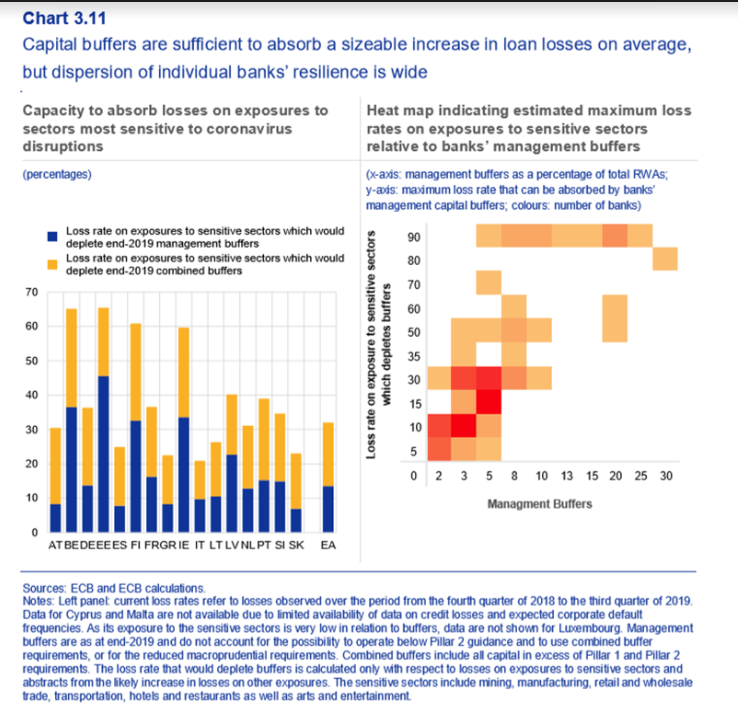

The next step is to try and see if the banks are able to absorb the shock. The graphic below is hard to read but important:

On the left, it gives, by country, the losses in% of loans on risky sectors which take capital to P2G, therefore eliminates the management buffer, for systemic institutions. We see that there is not much room of maneuver in Germany, Austria, Spain.

The yellow bar is for eating all the CBR, which is not really interesting because no bank will go there without trying to do a right issue first.

The graph on the right is important because it gives an indication of the dispersion around this average. Each square is a bank. X-axis is the size of the management buffer (therefore deviation from P2G) and Y-axis is the size of the absorbable shock.

So we have 6 systemic banks unable to absorb 10% of losses (in% of risk sectors) without going under P2G. That& #39;s not a very comfortable position to be in (even if the whole calculation is a bit theoretical.) I& #39;ll let you guess which bank, I have my ideas :-)

BUT ALL THAT WAS BEFORE LOAN GUARANTEES.

As you know, gvts have announced huge loan guarantee programs. And the ECB did a fantastic job of digging into the details to assess how each program will impact bank losses.

As you know, gvts have announced huge loan guarantee programs. And the ECB did a fantastic job of digging into the details to assess how each program will impact bank losses.

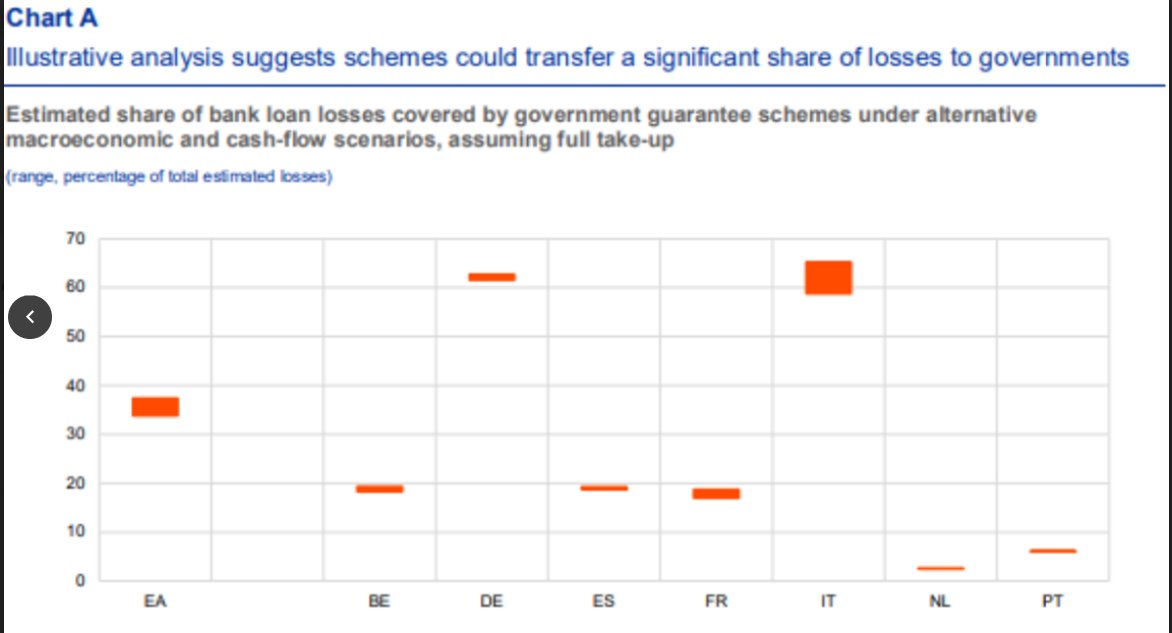

Once guarantees are taken into account, the ECB believes 2 things will happen : there will be less defaults, because more financing will be available (that& #39;s a 15%-20% drop in losses) and 30%-35% of the remaining defaults will be covered by guarantees.

Which brings me to the most interesting chart - which i tweeted earlier - which shows how that 30%-35% is actually split in the EZ. Italy, Germany are protecting the banks. The Dutch and the Portuguese, not so much.

So if you combine a) loan loss risk and weak sectors b) banks& #39; solidity before the crisis and c) the various impacts of guarantees, you get two obvious hotspots in the EZ : Spain and Portugal.

(Not to mention smaller countries not included, like GR or CYP, because the ECB lacks data) Last point, for GER and ITA banks: believe me, making the State pay on those guarantees, for dozens of billions, isn& #39;t going to be a piece of cake, esp. if we have populists in gvt!

Read on Twitter

Read on Twitter