And the day has come! We just launched the World Energy Investment report with a plus this year: what is expected for 2020.

Spoiler alert: #Covid19 has triggered the largest annual fall in global energy investment in history (-20%). Before Covid it was set to increase [THREAD]

Spoiler alert: #Covid19 has triggered the largest annual fall in global energy investment in history (-20%). Before Covid it was set to increase [THREAD]

This @iea report tracks and quantifies investment data across the energy sector, with sections on fuel supply, power, energy end-use and efficiency, energy financing and funding, and R&D and technology innovation >> summary here https://iea.li/3c2JmJ3 ">https://iea.li/3c2JmJ3&q... w/ access to full report

It includes a MASSIVE amount of information and it was a LOT of work, so please check it out (and yes, it& #39;s FREE!)  https://abs.twimg.com/emoji/v2/... draggable="false" alt="😍" title="Smiling face with heart-shaped eyes" aria-label="Emoji: Smiling face with heart-shaped eyes">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😍" title="Smiling face with heart-shaped eyes" aria-label="Emoji: Smiling face with heart-shaped eyes">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">Below are my #top5 charts/messages

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">Below are my #top5 charts/messages

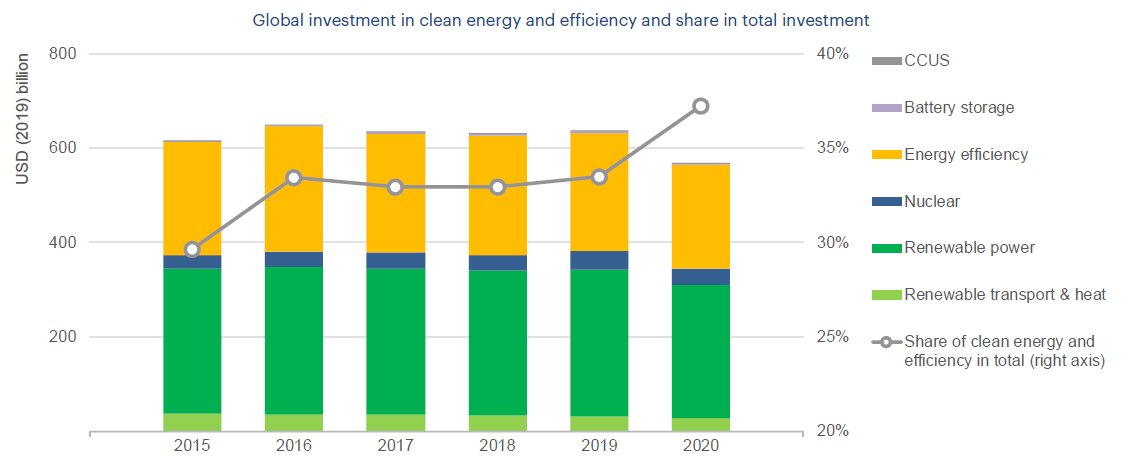

#2: Clean energy investments have been relatively resilient, but trends and levels are still low and poorly aligned with a sustainable path

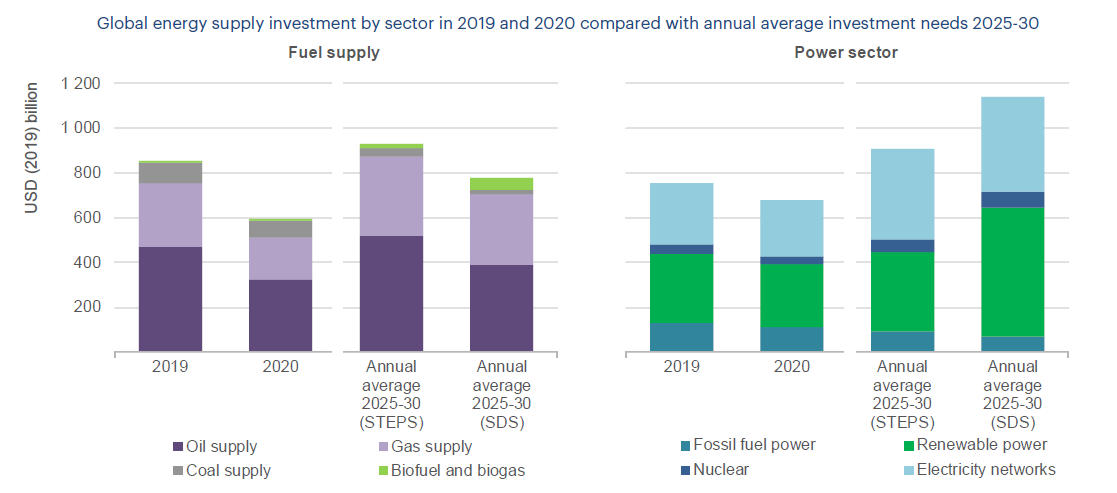

In the power sector, much more investment in renewable and grids was and is still needed

In the power sector, much more investment in renewable and grids was and is still needed

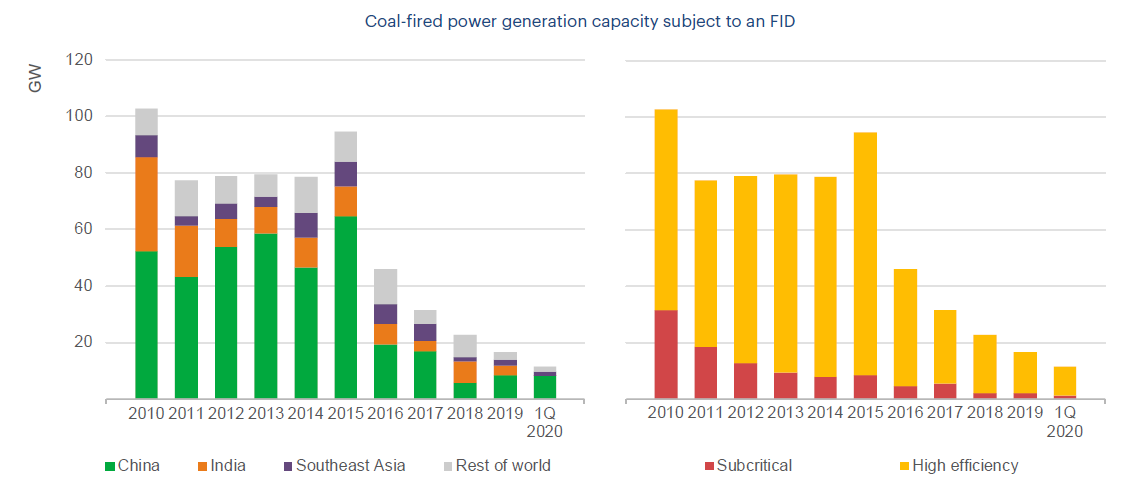

#3: Coal power investment is lowering, but it& #39;s not gone. Coal power generation has been decreasing over the last years, but approvals for coal power plants are still happening - they edged up in 2019 and more is expected in 2020

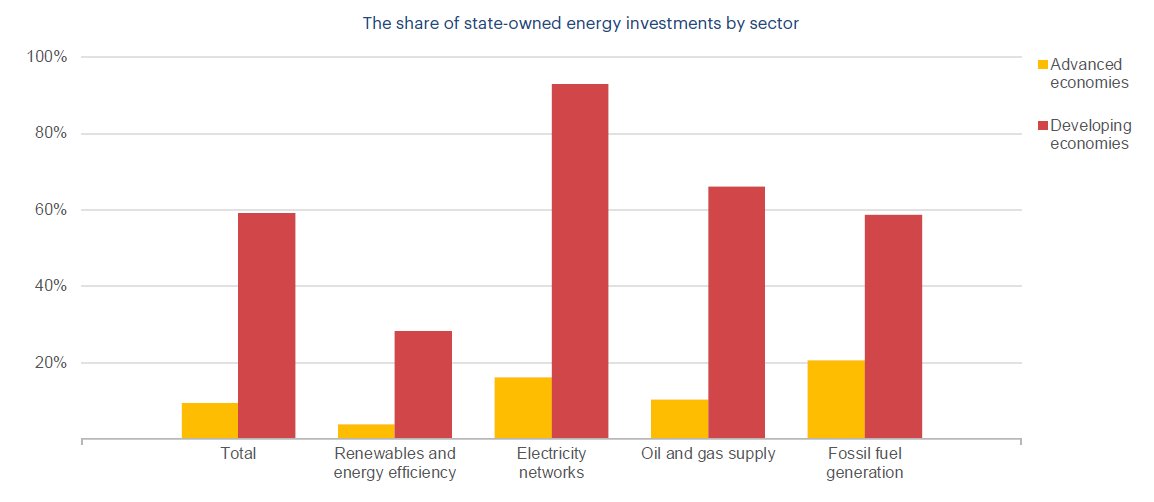

#4: The role of the private and public actors varies substantially by region and sector >> this has strong implications on how different countries are able to support their energy sector, attract capital to it and mitigate the impact of the economic crisis

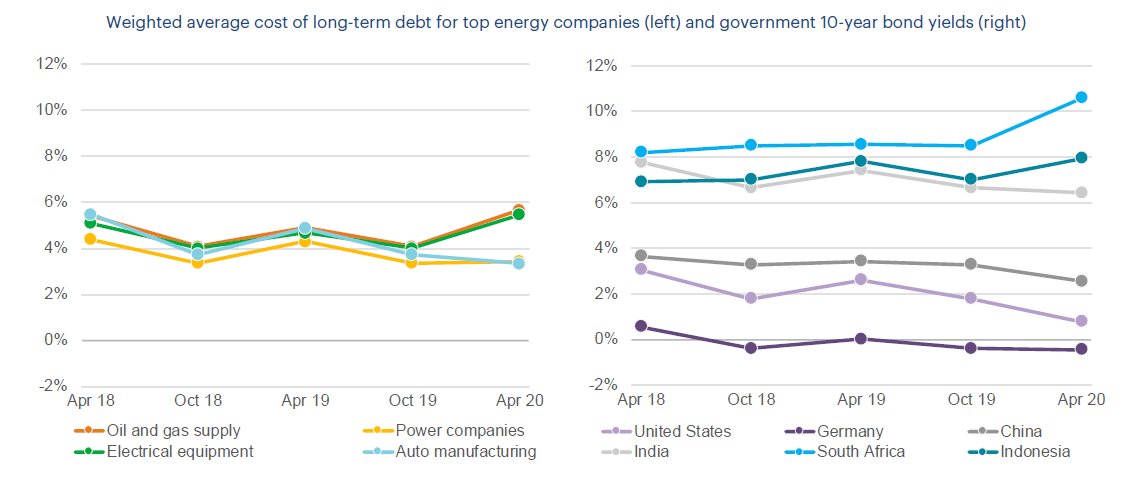

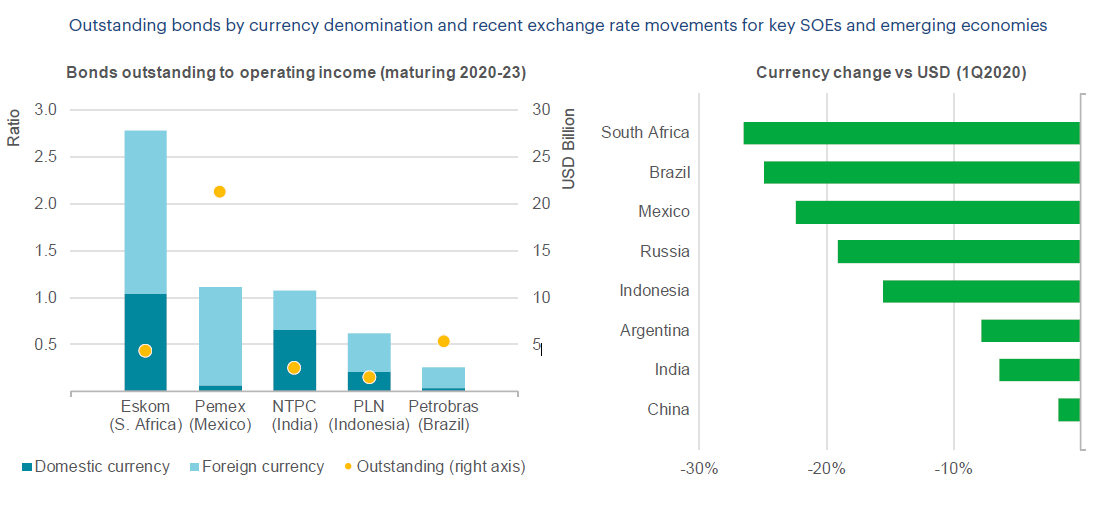

#5: Borrowing costs and credit conditions are showing worrying signs, especially for some public utilities in emerging and developing countries

PS. I will come back with more charts (you weren& #39;t thinking this was the top5 of the entire report right?) More to come [END]

Read on Twitter

Read on Twitter![And the day has come! We just launched the World Energy Investment report with a plus this year: what is expected for 2020. Spoiler alert: #Covid19 has triggered the largest annual fall in global energy investment in history (-20%). Before Covid it was set to increase [THREAD] And the day has come! We just launched the World Energy Investment report with a plus this year: what is expected for 2020. Spoiler alert: #Covid19 has triggered the largest annual fall in global energy investment in history (-20%). Before Covid it was set to increase [THREAD]](https://pbs.twimg.com/media/EZA7KmQWkAEbW0v.jpg)