After *years* in the works, with a baby born on the way, my paper on the emerging speculative practices of new rental housing companies in Barcelona (e.g. @blackstone) is out in @HousingJournal

THREAD

THREAD

The Spanish state developed new real estate-related legislation to start a new speculative cycle focused on rent and to reduce the enormous quantity of empty foreclosed/evicted properties in early 2010s: the bad bank the SAREB, REIT legislation (SOCIMIs) and the 2013 Rental Law

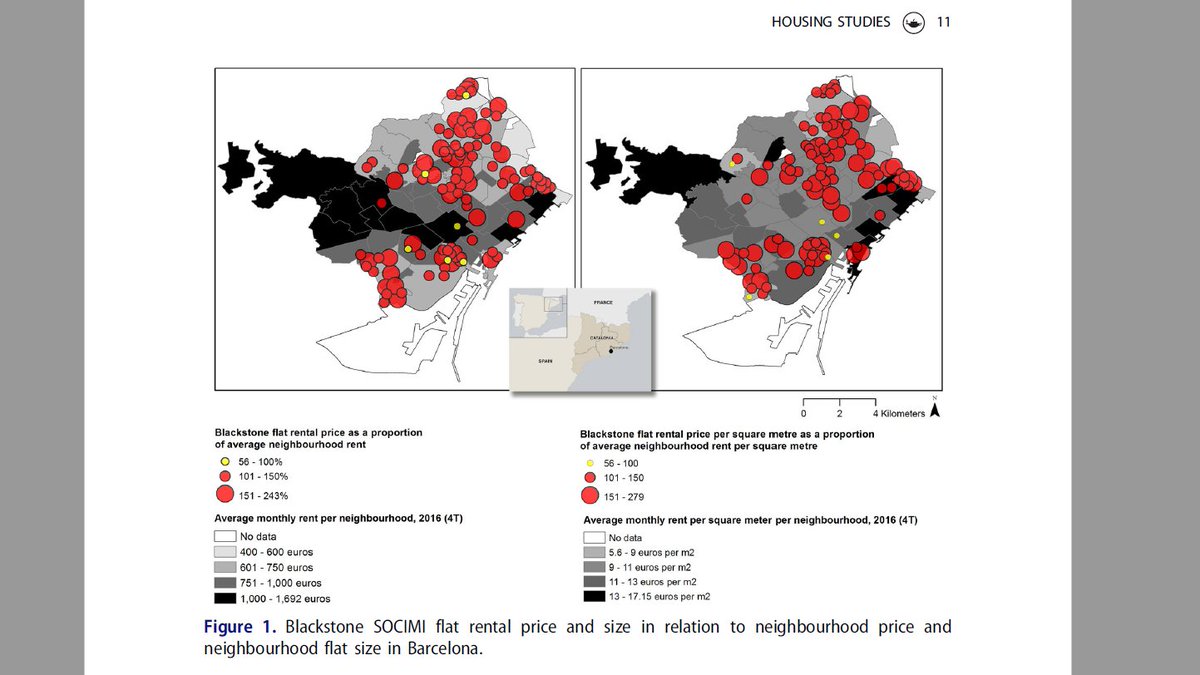

I found that new residential REITs – Blackstone’s – reinforce urban inequality and dispossession: in BCN properties are located in working-class districts hardest hit by foreclosure and eviction. Properties are on average are listed for 38% more than flats in same neighbourhood

The private rental sector is built on layers of dispossession. REITs get foreclosed/evicted properties en masse at bargain prices. Rents can legally be increased w no limit upon contract renewal. Blackstone has contracts that oblige new tenants to pay legacy debts from utilities

For more, check out the article. If you don’t have access get in touch, happy to send a free copy https://www-tandfonline-com.are.uab.cat/doi/abs/10.1080/02673037.2020.1769034?journalCode=chos20">https://www-tandfonline-com.are.uab.cat/doi/abs/1...

Read on Twitter

Read on Twitter