Another excellent @RLI_ACR webinar, "Trends in Corporitzation, part II". A very important topic for #RadRes, @ACRRFS, and @ACRYPS.

Special thanks to @NatashaMongaMD for moderating.

Here is a summary of my take on some of the key points:

Special thanks to @NatashaMongaMD for moderating.

Here is a summary of my take on some of the key points:

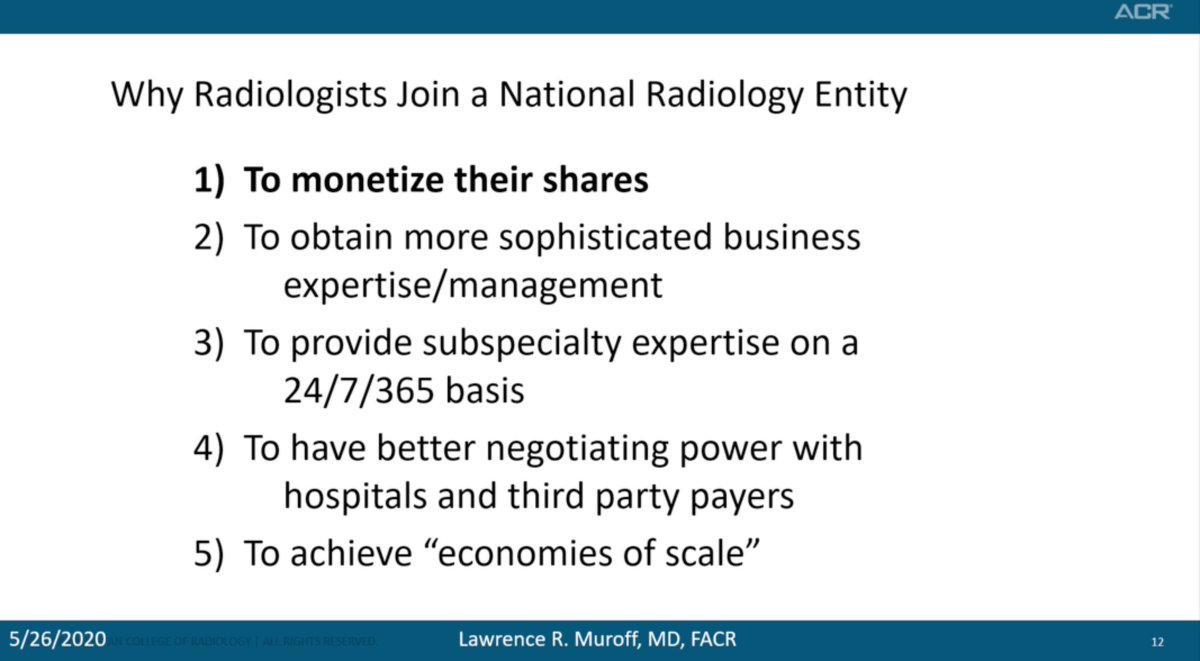

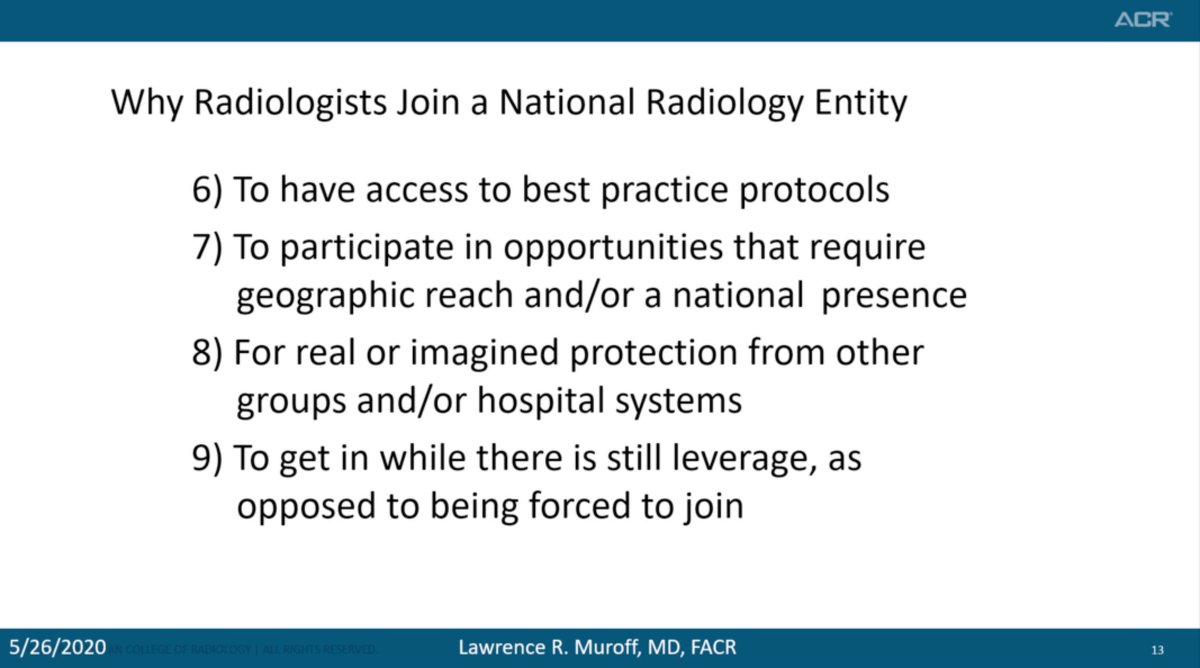

To start, let& #39;s look at some of the PERCEIVED pros of joining a National #radiology entity. Although many of these sound attractive, they are often not fully realized by the employees.

@danortizmd addresses a few of these perceived "benefits of scale" of national entities and how small practices can provide the same benefits through smart business decisions while providing more local control of operations

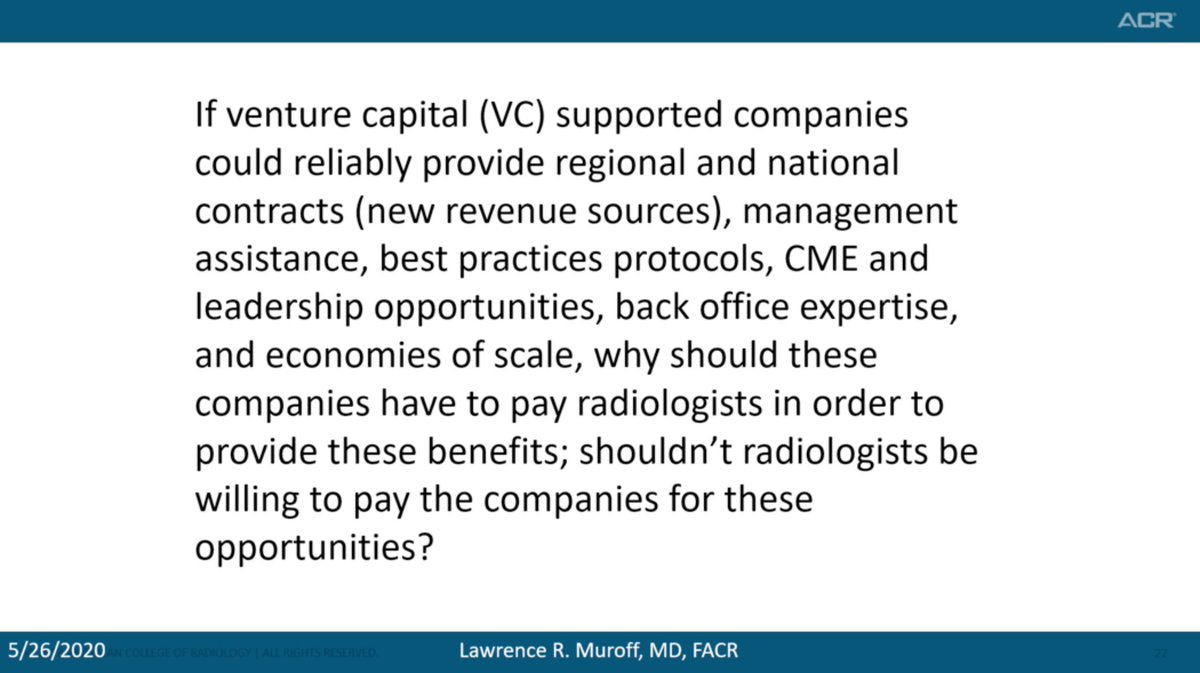

A big question is, "does this math add up"? If VC companies can provide all the above benefits, why do they have to offer big buyout checks? If they are so great, shouldn& #39;t we be paying them for their services instead? Well, you probably are whether you realize it or not.....

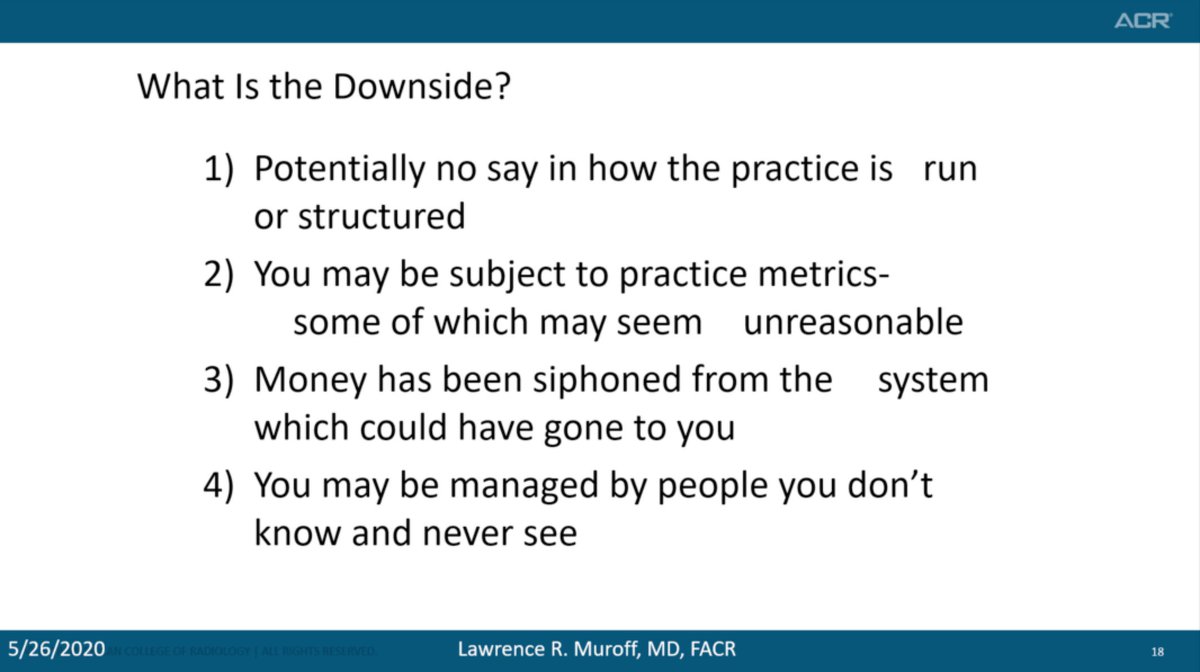

But that& #39;s not all, this is where things get really scary! The original buyout is not the end of the story. Private equity investments work in a cycle. These groups will have an exit strategy, of which you have no control over, that may prove worse than the original buyout.

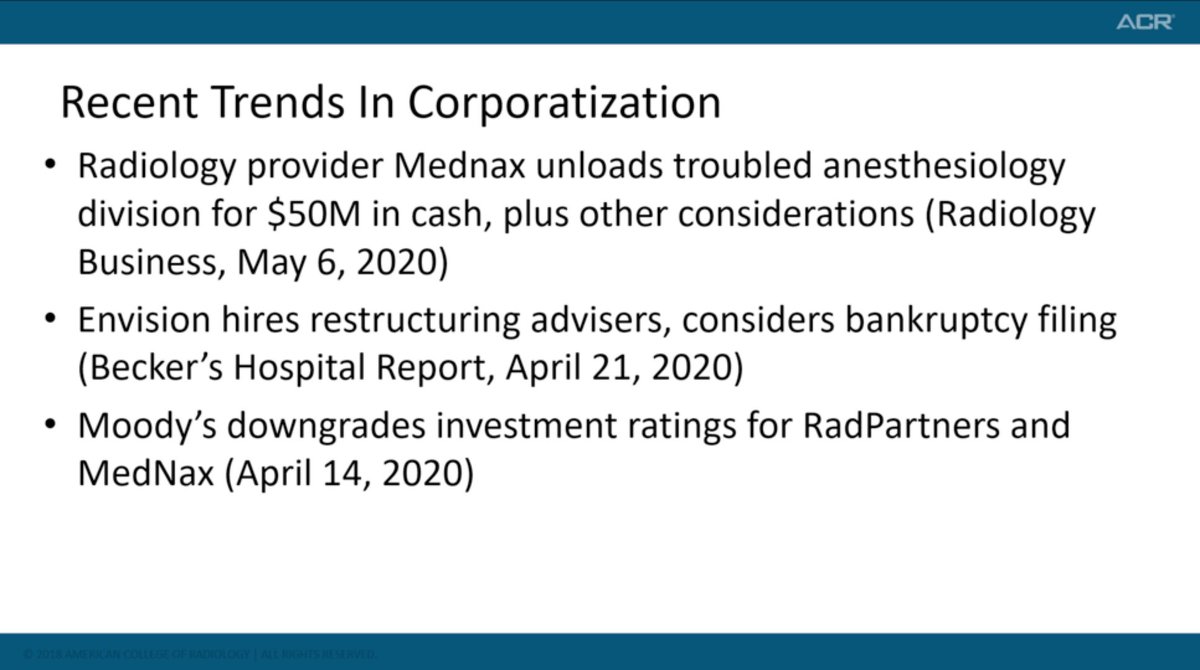

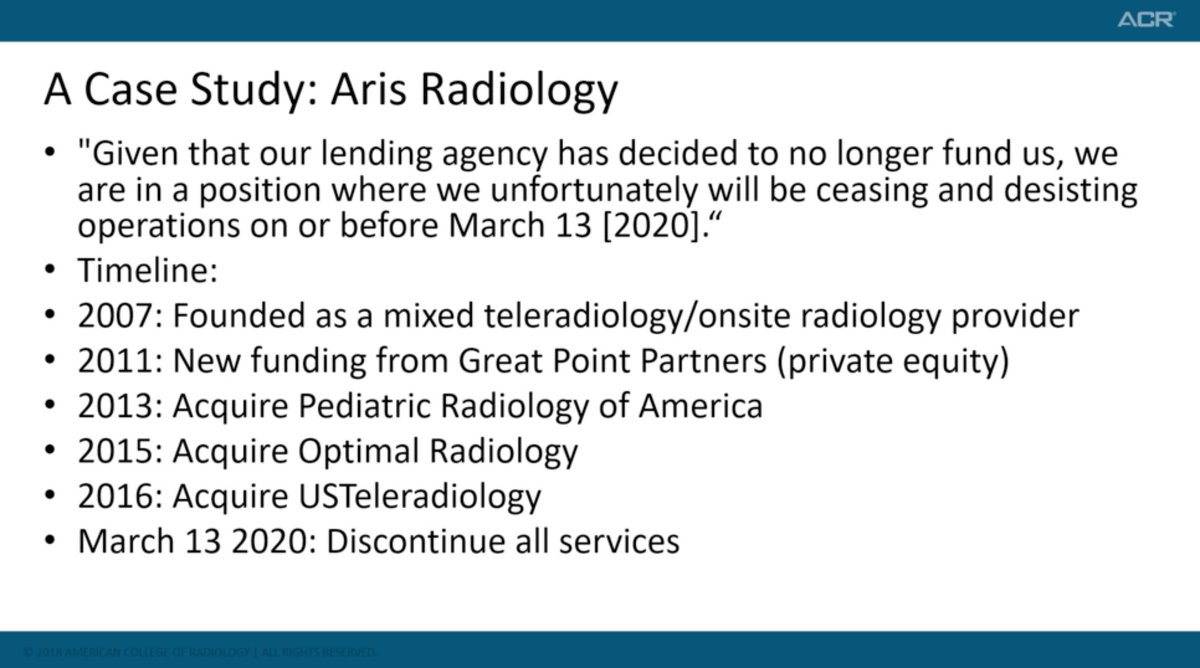

There have been a few prominent examples of these second sells or bankruptcy proceedings in radiology recently. The story of Aris Radiology provides a particularly pertinent warning of how your future in a VC backed firm could result.

Aris Bankruptcy: https://www.auntminnie.com/index.aspx?sec=log&itemID=128477">https://www.auntminnie.com/index.asp...

Aris Bankruptcy: https://www.auntminnie.com/index.aspx?sec=log&itemID=128477">https://www.auntminnie.com/index.asp...

Read on Twitter

Read on Twitter