10 signs we& #39;re headed for a new $ETH bull market  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏼" title="Down pointing backhand index (medium light skin tone)" aria-label="Emoji: Down pointing backhand index (medium light skin tone)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏼" title="Down pointing backhand index (medium light skin tone)" aria-label="Emoji: Down pointing backhand index (medium light skin tone)">

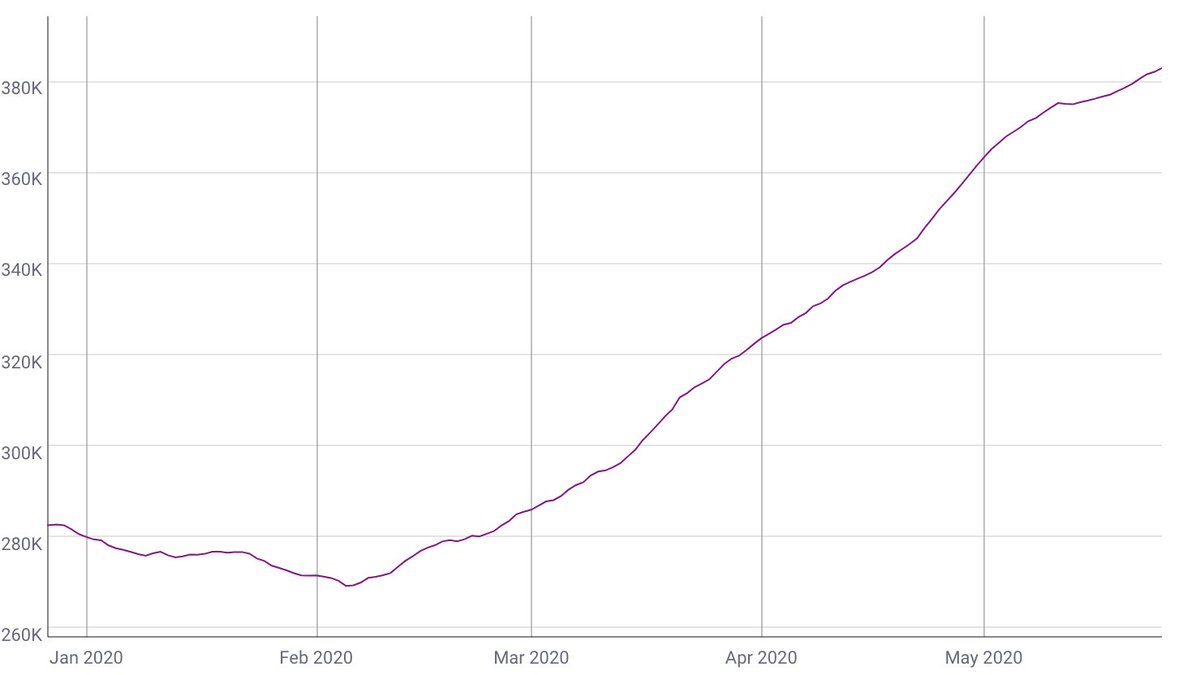

#1: Ethereum has 380k daily active addresses (90-day MA) -- a figure not seen in over 2 years.

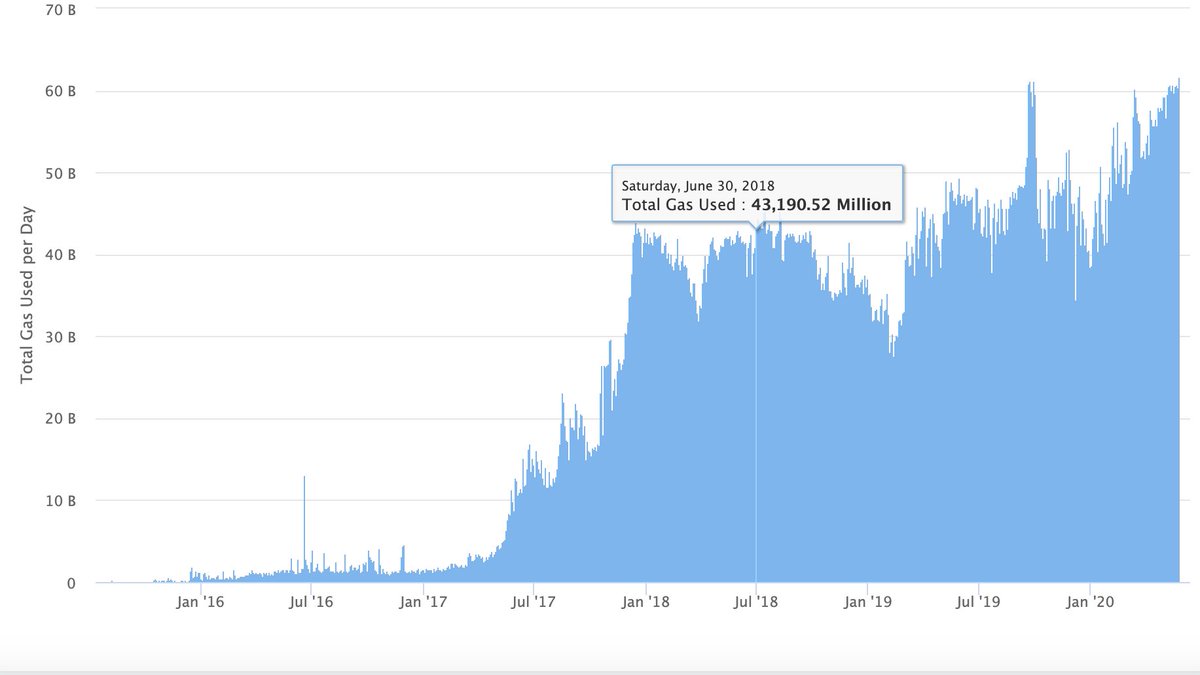

#2: More than 60 billion gas is now being used on a daily basis -- a sign that Ethereum blockspace demand has never been higher.

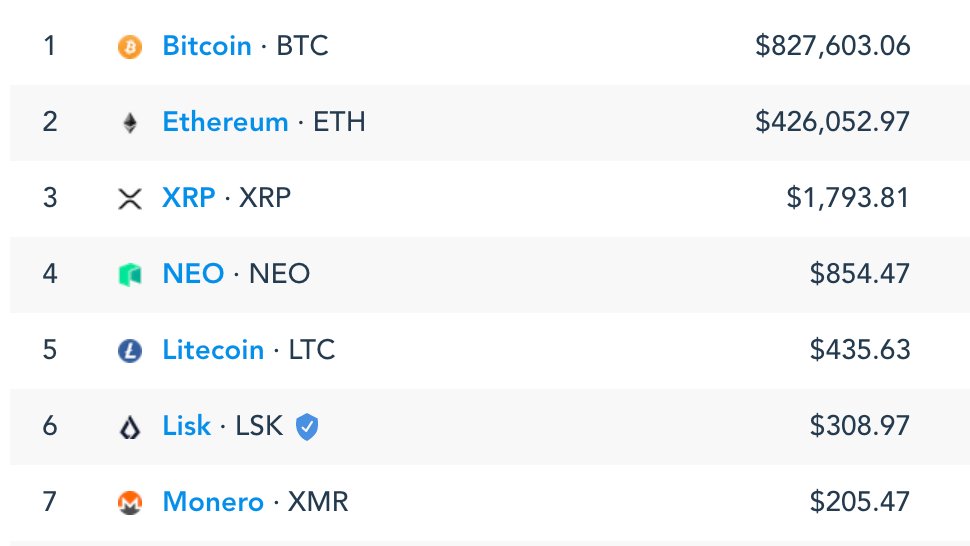

#3: Ethereum is the only network besides Bitcoin that has a meaningful market for security paid in fees. ETH fees have totaled $426k in the past 24 hours -- more than 237x the next closest coin $XRP.

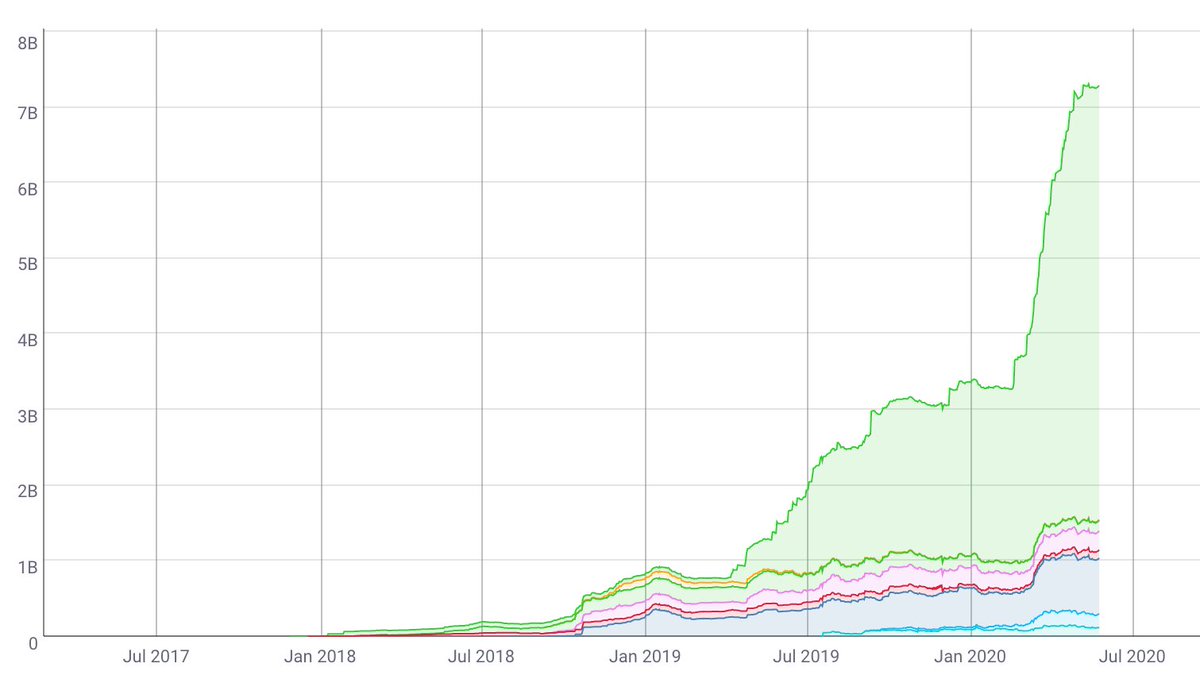

#4: More than $7 billion in stablecoins have now been issued on Ethereum, including almost $4b in new issuance over the past 3 months -- a sign of major demand for cryptodollars.

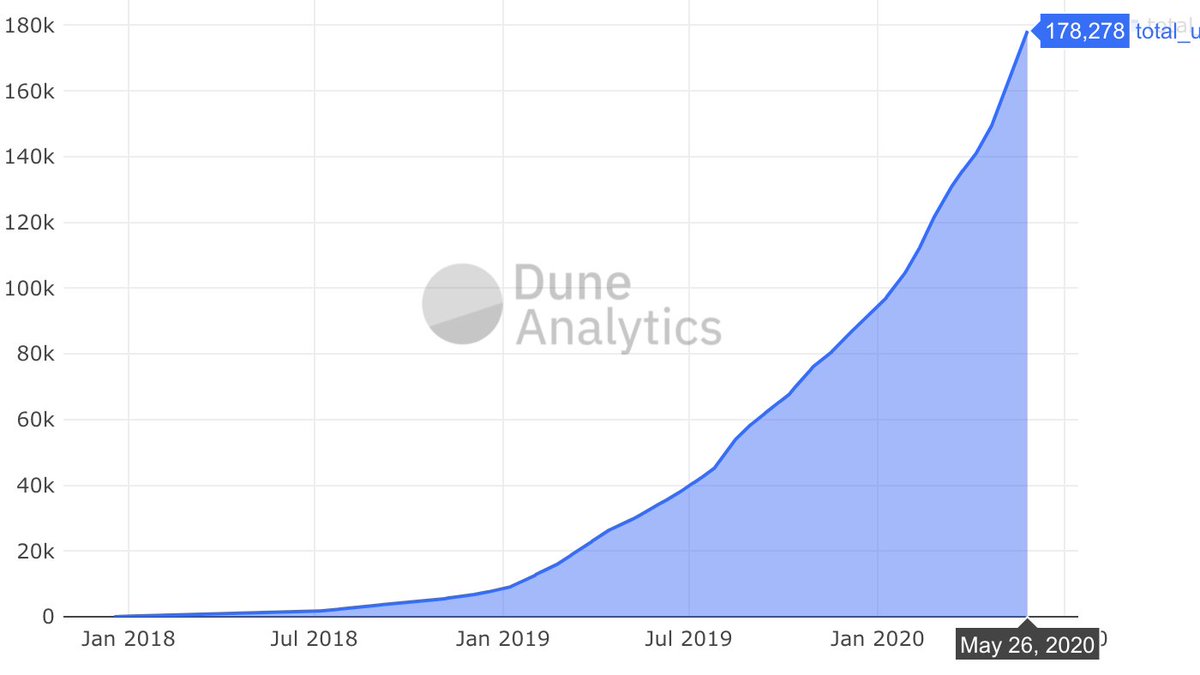

#5: There are now 178k #DeFi users, up from 90k only 5 months ago -- a sign that Ethereum& #39;s biggest use case is starting to go parabolic?

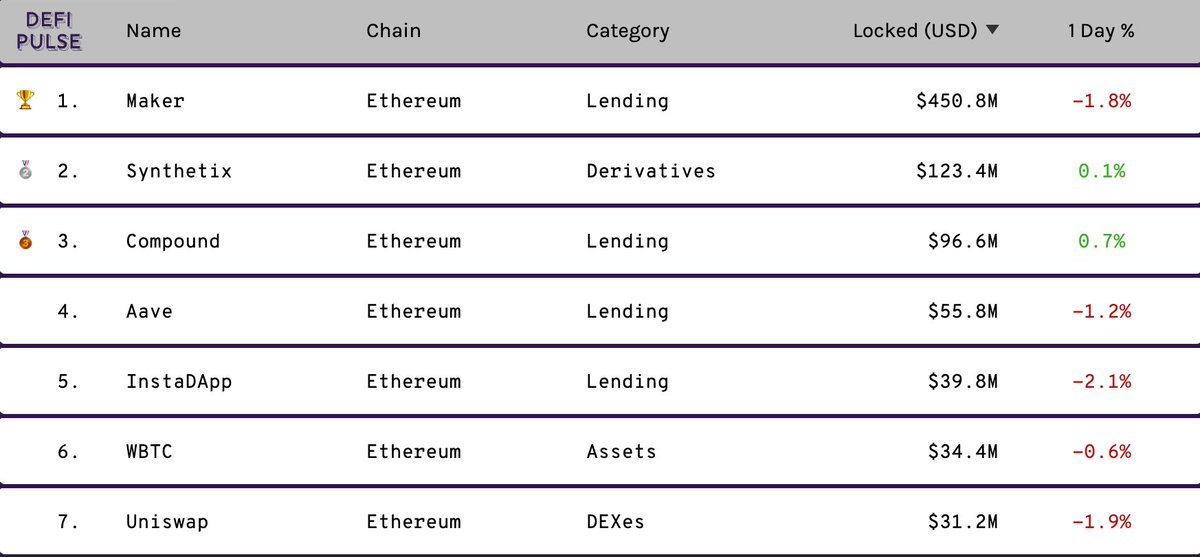

#6: 7 different #DeFi projects have more than $30m AUM, up from just 1 project a year ago -- a sign that the ecosystem is maturing rapidly.

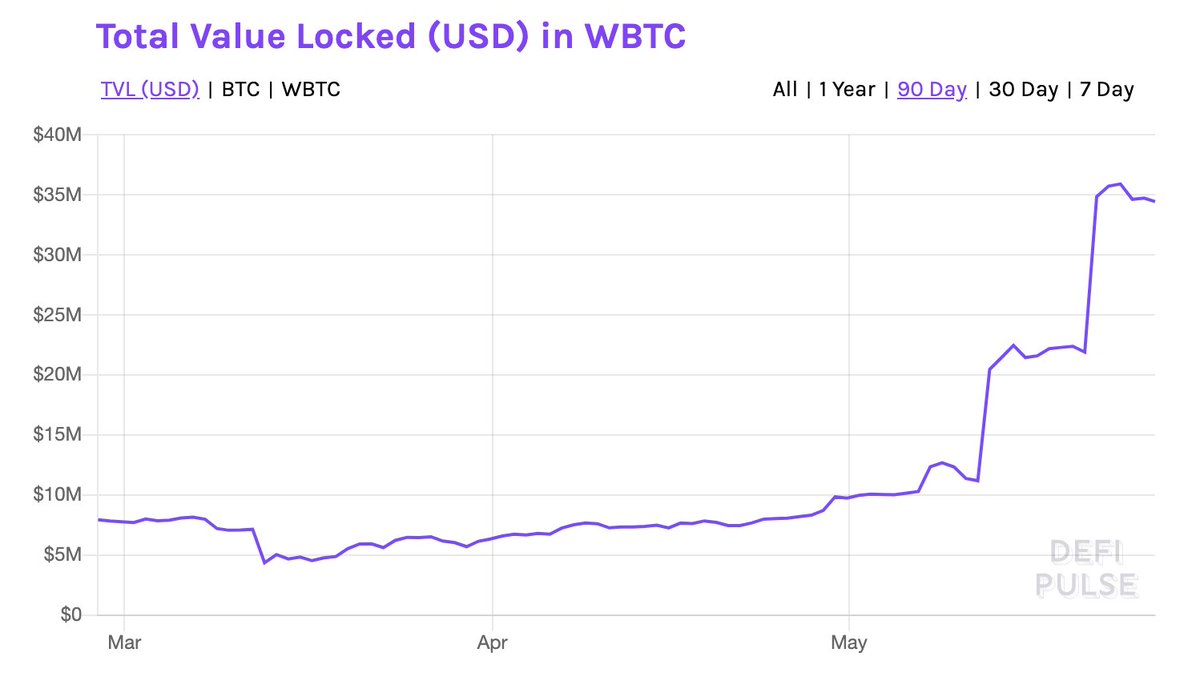

#7: $25 million of $WBTC has been minted since May 1st -- a sign that Ethereum is becoming an economic vacuum for all assets, starting with Bitcoin.

#8: 1 million new shares of @GrayscaleInvest& #39;s $ETHE have been issued in the past 3 weeks -- a sign that institutions are either investing in $ETH or locking up their existing holdings at a pace of roughly $1 million per day.

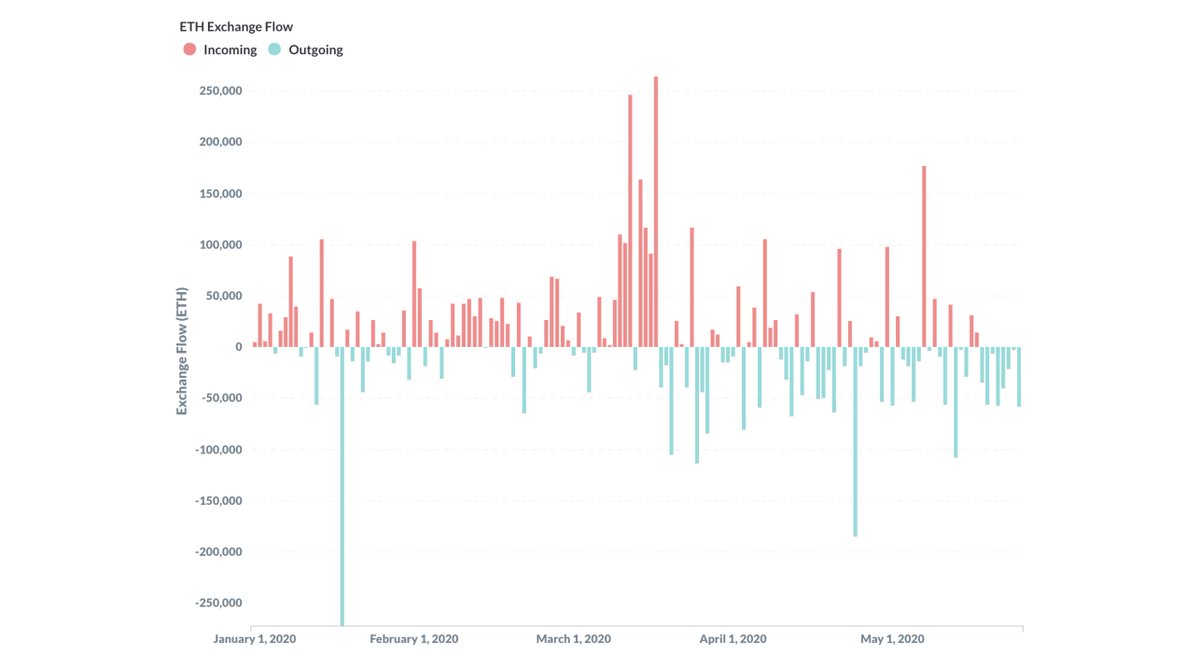

#9: Post-Black Thursday (March 12) there has been a net outflow of $ETH from exchanges, with 62% of days showing net outflows -- a sign of accumulation.

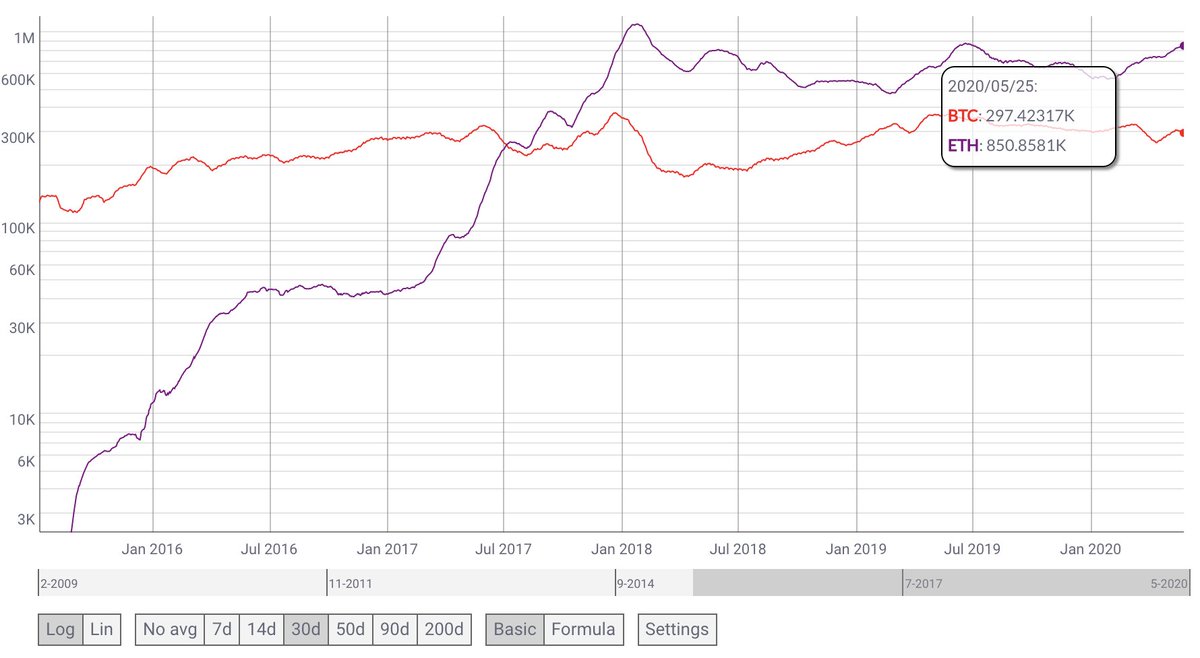

#10: Ethereum averages 850k transactions per day, up from 580k in early January. To put this in perspective, that& #39;s 3x more than Bitcoin averages on a daily basis -- a clear sign of increased usage.

Looking for more $ETH fundamentals? Subscribe to my crypto analytics newsletter @OurNetwork__: https://ournetwork.substack.com/subscribe?utm_source=menu&simple=true&next=https%3A%2F%2Fournetwork">https://ournetwork.substack.com/subscribe...

Read on Twitter

Read on Twitter