1/ Formal Verification& #39;s latest & #39;In The Network& #39; research is out where we dive deep on @loopringorg. Some of our findings below https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">

https://formalverification.substack.com/p/in-the-network-loopring

https://formalverification.substack.com/p/in-the-... href="https://twitter.com/daniel_loopring">@daniel_loopring @finestonematt @CamiRusso @RyanSAdams

https://formalverification.substack.com/p/in-the-network-loopring

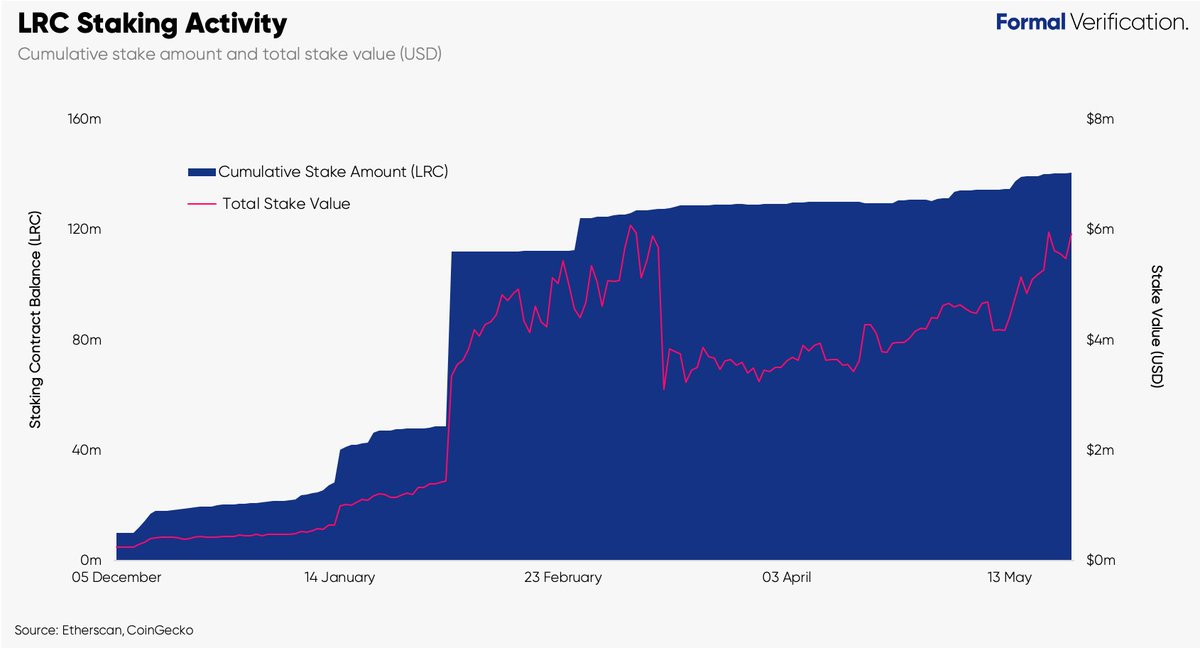

2/ $LRC continues to increase with ~140m $LRC total staked in staking pool contract (10% of the total supply) This translates to ~$6m in value locked. Bulk of inflows come from the team who committed the team supply allocation and developer funds @daniel_loopring @finestonematt

3/ $LRC can be staked for protocol fees and $ZRX can be staked to receive fees accumulated by MMs on @0xProject. Comparing the stake ratio between networks, @loopringorg staking participation is rather distinct to @0xProject which has a <2% stake ratio

4/ Comparing @loopringorg Exchange volume to @0xProject (off-chain order book model) and @KyberNetwork @UniswapProtocol (leading pooled liquidity venues), it has ~2% of the combined volume. It will be interesting to see how this may change with their API and smart wallet release

5/ @loopringorg Exchange balance (USD) is still low at ~$5m. This is a chicken/egg problem for Loopring -

Loopring’s model becomes more efficient with increased usage due to tx batching. DEX operators pay the ultimate cost, not the users - high usage is key for operator survival

Loopring’s model becomes more efficient with increased usage due to tx batching. DEX operators pay the ultimate cost, not the users - high usage is key for operator survival

6/ @loopringorg operators are incentivised to batch as many txs/block. In March, the majority of trade block sizes were largely 128 (~13% of upper limit 1024). Positively, there is now greater variance in block sizes with 256/512 starting to take up ~20% of total blocks committed

7/ Find out more about Formal Verification research  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index"> https://formalverification.substack.com/about ">https://formalverification.substack.com/about&quo...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index"> https://formalverification.substack.com/about ">https://formalverification.substack.com/about&quo...

Read on Twitter

Read on Twitter