Random Observations and Unorganized Thoughts

Covid-19 + Uncertainty + Making Money in Stock Markets

A THREAD

Covid-19 + Uncertainty + Making Money in Stock Markets

A THREAD

1/n…

A job of an investor is not be be intellectually superior, but to make money by trying to reduce chaos and bring actionable insight to the information we have, by being as rational as one can be.

…

A job of an investor is not be be intellectually superior, but to make money by trying to reduce chaos and bring actionable insight to the information we have, by being as rational as one can be.

…

2/n…

Generally, investors, even good ones are extremely confused with the rise in the stock markets to near ATHs during the greatest uncertainty and health crisis of our lifetimes.

…

Generally, investors, even good ones are extremely confused with the rise in the stock markets to near ATHs during the greatest uncertainty and health crisis of our lifetimes.

…

3/n…

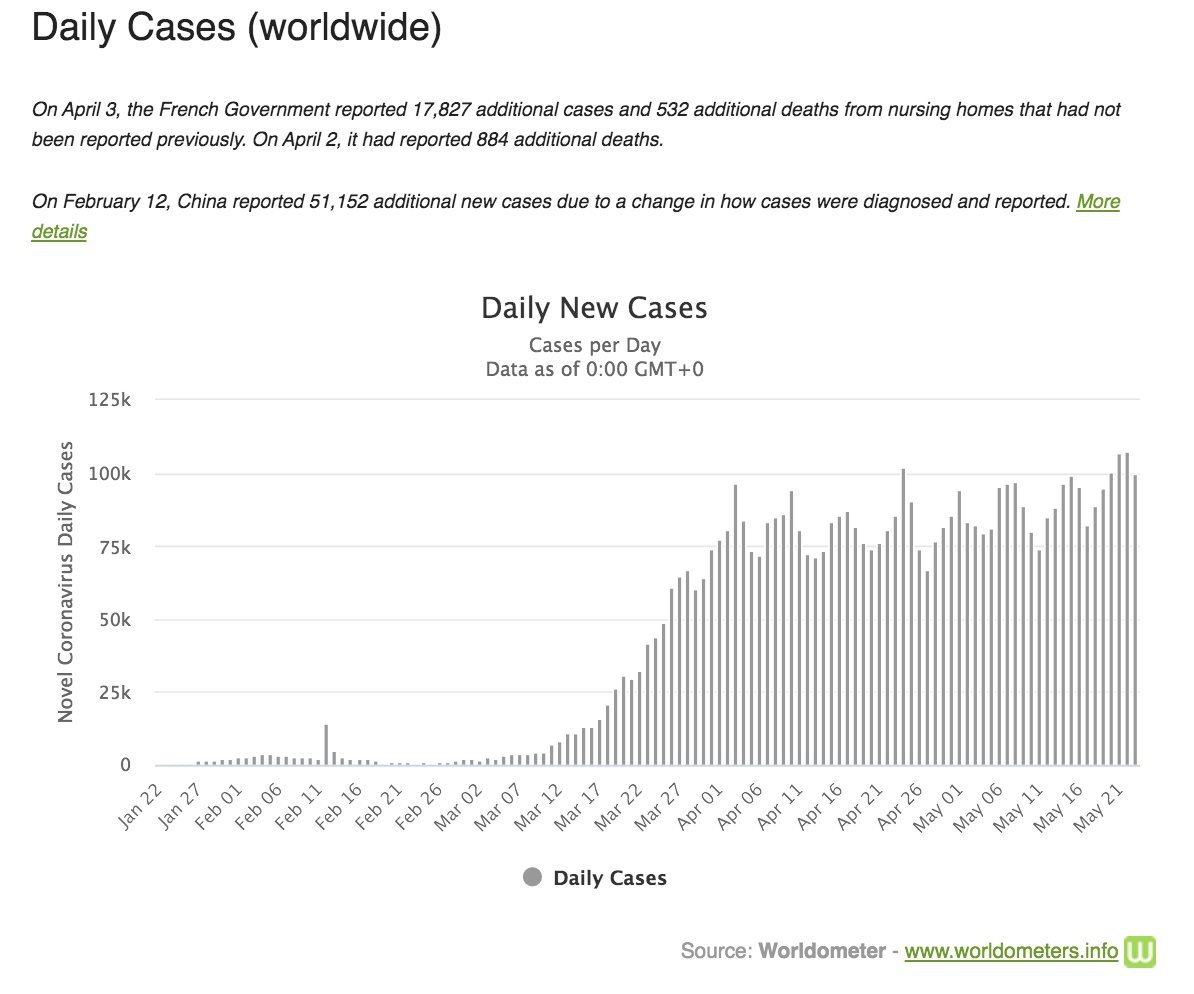

Here is the number of Covid cases in the world. Why have markets risen despite the increase in the number of Covid cases?

#total-cases">https://www.worldometers.info/coronavirus/worldwide-graphs/ #total-cases">https://www.worldometers.info/coronavir...

Here is the number of Covid cases in the world. Why have markets risen despite the increase in the number of Covid cases?

#total-cases">https://www.worldometers.info/coronavirus/worldwide-graphs/ #total-cases">https://www.worldometers.info/coronavir...

4/n…

The incoherent media sent us a wide range of messages that there would be an end of civilization with the cases rising exponentially, and sold phrases/words such as “Flattening of the Curve”, “Black Swan” and “Unprecedented”.

…

The incoherent media sent us a wide range of messages that there would be an end of civilization with the cases rising exponentially, and sold phrases/words such as “Flattening of the Curve”, “Black Swan” and “Unprecedented”.

…

5/n…

Even those with nearly zero English language proficiency have learned those phrases. But things couldn’t have been more linear *if you bought the scare at its face value*. With an exceptional % rise in the no. of cases, markets bottomed. 23rd March!

...

Even those with nearly zero English language proficiency have learned those phrases. But things couldn’t have been more linear *if you bought the scare at its face value*. With an exceptional % rise in the no. of cases, markets bottomed. 23rd March!

...

6/n…

The governments across the world locked down, and the flattening began. This - what you see is a FLATTENED curve.

The governments across the world locked down, and the flattening began. This - what you see is a FLATTENED curve.

7/n…

Then we read - the news is about to get worse for developing/poor countries like India. Here also, we don’t see anything “exponential”. Rise ≠ Exponent!

...

Then we read - the news is about to get worse for developing/poor countries like India. Here also, we don’t see anything “exponential”. Rise ≠ Exponent!

...

8/n…

Usually, markets trade based on the probability of rumors materializing, not news. On average, markets collectively act, individuals react. The “news”, as reported, did get worse but the terrible economic reality didn’t fall to become “worse than” what markets priced in.

…

Usually, markets trade based on the probability of rumors materializing, not news. On average, markets collectively act, individuals react. The “news”, as reported, did get worse but the terrible economic reality didn’t fall to become “worse than” what markets priced in.

…

9/n…

And the markets kept rising, frustrating investors hoping for a pullback.

What do markets give you? = Terrible News + High Uncertainty + Great Prices

What do investors want? = Great News + High Certainty + Great Prices

If you don’t see any problem with that, stay in cash.

And the markets kept rising, frustrating investors hoping for a pullback.

What do markets give you? = Terrible News + High Uncertainty + Great Prices

What do investors want? = Great News + High Certainty + Great Prices

If you don’t see any problem with that, stay in cash.

10/n…

While r/r is one’s judgement, investors are paid the highest for taking “risk” during uncertainty, which was high; it still is. But you may reasonably think that a bulk of smart money may’ve been made this year, already when some of even Dow stocks have nearly 2x’d.

…

While r/r is one’s judgement, investors are paid the highest for taking “risk” during uncertainty, which was high; it still is. But you may reasonably think that a bulk of smart money may’ve been made this year, already when some of even Dow stocks have nearly 2x’d.

…

11/n…

Many are resentful, waiting for a pullback. I recall @michaelbatnick in one of his videos talks about the stock market ending the year of maximum no. of deaths from Spanish Flu with ~40% rise on the index. I couldn’t find the video, though. Ask Michael!

…

Many are resentful, waiting for a pullback. I recall @michaelbatnick in one of his videos talks about the stock market ending the year of maximum no. of deaths from Spanish Flu with ~40% rise on the index. I couldn’t find the video, though. Ask Michael!

…

12/n…

Back to developing economies! If you extrapolate data from one continent and implement strategies, thinking the similar pattern would repeat in the other, w/o understanding ground realities and contexts, you’re a fool. Developed economies are not used to so many deaths;

…

Back to developing economies! If you extrapolate data from one continent and implement strategies, thinking the similar pattern would repeat in the other, w/o understanding ground realities and contexts, you’re a fool. Developed economies are not used to so many deaths;

…

13/n…

(un)fortunately, developing countries are. In India, a minuscule ~3Mn people have been tested. And 132K tested +ve. 4.5%! The no. of deaths have been 3,899. That’s ~3%. In the US also, the fatality rate is ~5%. I want to understand how the civilization ends here.

…

(un)fortunately, developing countries are. In India, a minuscule ~3Mn people have been tested. And 132K tested +ve. 4.5%! The no. of deaths have been 3,899. That’s ~3%. In the US also, the fatality rate is ~5%. I want to understand how the civilization ends here.

…

14/n…

@MarcellusInvest & #39;s team collected a lot of basic data. It found that India has needed ~5,000 ventilators for people who required hospital treatment. For the other 125K people, the symptoms were so mild that it didn’t even need hospitalization. https://www.youtube.com/watch?v=qZuMUs_XZJE&t=1210s

…">https://www.youtube.com/watch...

@MarcellusInvest & #39;s team collected a lot of basic data. It found that India has needed ~5,000 ventilators for people who required hospital treatment. For the other 125K people, the symptoms were so mild that it didn’t even need hospitalization. https://www.youtube.com/watch?v=qZuMUs_XZJE&t=1210s

…">https://www.youtube.com/watch...

15/n…

“Marcellus gathered further data from burial grounds and hospitals, and found that these organizations are laying people off.” ~Saurabh Mukherjea, @MarcellusInvest

…

“Marcellus gathered further data from burial grounds and hospitals, and found that these organizations are laying people off.” ~Saurabh Mukherjea, @MarcellusInvest

…

16/n…

“Why are they laying off people?

Out of 10Mn Indians who die every year, 250K Indians die of infectious diseases per month, and out of that 20K/Month die of Tuberculosis which is highly contagious. Another 20K/Month die of industrial/road accidents.”

…

“Why are they laying off people?

Out of 10Mn Indians who die every year, 250K Indians die of infectious diseases per month, and out of that 20K/Month die of Tuberculosis which is highly contagious. Another 20K/Month die of industrial/road accidents.”

…

17/n…

The normal death toll in India is ~250K/Month. Bec of lockdown, people didn’t die of accidents, and hospitals/crematoriums are empty. Unlike Develope economies, India may have increased the economic pain, but satirically reduced the no. of total deaths.

…

The normal death toll in India is ~250K/Month. Bec of lockdown, people didn’t die of accidents, and hospitals/crematoriums are empty. Unlike Develope economies, India may have increased the economic pain, but satirically reduced the no. of total deaths.

…

18/n…

Markets rising! Demand Curve - This is Whirlpool demand chart in China and Italy. You can see, as the lockdown opens, the demand for the electronics rises.

Source: @MarcellusInvest

Markets rising! Demand Curve - This is Whirlpool demand chart in China and Italy. You can see, as the lockdown opens, the demand for the electronics rises.

Source: @MarcellusInvest

19/n…

"The Car is Staging a Comeback"

Also, the data from China and Italy suggest that oil demand is rising. As soon as we come out of lockdown, the auto demand is soaring, which is discretionary consumption.

https://www.bloomberg.com/news/articles/2020-05-10/the-car-is-staging-a-comeback-spurring-oil-s-recovery

…">https://www.bloomberg.com/news/arti...

"The Car is Staging a Comeback"

Also, the data from China and Italy suggest that oil demand is rising. As soon as we come out of lockdown, the auto demand is soaring, which is discretionary consumption.

https://www.bloomberg.com/news/articles/2020-05-10/the-car-is-staging-a-comeback-spurring-oil-s-recovery

…">https://www.bloomberg.com/news/arti...

20/n…

The US, being as free as it is, couldn’t have a strict lockdown, so the demand didn’t drop as much as it did in Asia.

Extrapolation: If discretionary spending is good, economic engines get some grease.

“A couple of quarters of profits, not years of profits, are wiped out.”

The US, being as free as it is, couldn’t have a strict lockdown, so the demand didn’t drop as much as it did in Asia.

Extrapolation: If discretionary spending is good, economic engines get some grease.

“A couple of quarters of profits, not years of profits, are wiped out.”

21/n…

Markets were quick to figure this out.

Depression! So many news outlets used the word. They’ve no frickin clue what it means. If you ask them to explain 1929, most won’t be able to. They’re not students of financial history. I read, but I can’t explain you properly.

...

Markets were quick to figure this out.

Depression! So many news outlets used the word. They’ve no frickin clue what it means. If you ask them to explain 1929, most won’t be able to. They’re not students of financial history. I read, but I can’t explain you properly.

...

22/n…

No one knows what happened during the great depression, except people who experienced it; most of them are dead. We, as investors, got caught in the middle of chaos. We consistently gave ourselves false reasons for our uncompetitiveness to do one thing - make money.

...

No one knows what happened during the great depression, except people who experienced it; most of them are dead. We, as investors, got caught in the middle of chaos. We consistently gave ourselves false reasons for our uncompetitiveness to do one thing - make money.

...

23/n…

I don’t know whether we’ve seen the bottom, but while many of us chickened out and waited for bottom, great investors have made 10 years worth of money in 2 months - in the middle of the one of most uncertain periods of our lives.

I don’t know whether we’ve seen the bottom, but while many of us chickened out and waited for bottom, great investors have made 10 years worth of money in 2 months - in the middle of the one of most uncertain periods of our lives.

Read on Twitter

Read on Twitter