Variable vs Fixed Interest Rates Home Loan

Do you have a Home-loan or Planning to have one?

Are you undecided between Variable or Fixed Interest Rates, or just wondering what the fuss about them is

A #Thread

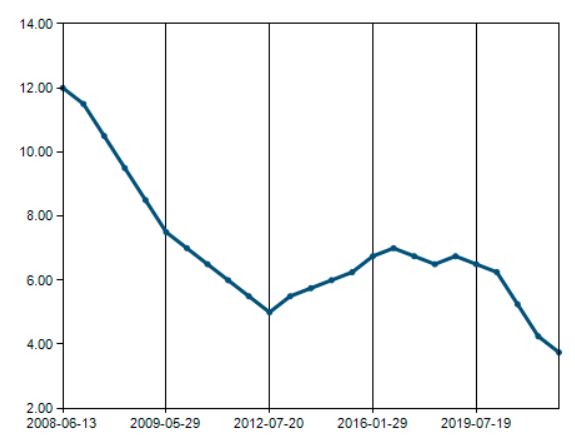

REPO rate is 3.75% the lowest it has been in over 50 years

Do you have a Home-loan or Planning to have one?

Are you undecided between Variable or Fixed Interest Rates, or just wondering what the fuss about them is

A #Thread

REPO rate is 3.75% the lowest it has been in over 50 years

Definitions

Variable interest rate

A variable interest rate sometimes called an “adjustable” rate is an interest rate on a loan or security that fluctuates over time because it is based on an underlying benchmark interest rate or index that changes periodically

Variable interest rate

A variable interest rate sometimes called an “adjustable” rate is an interest rate on a loan or security that fluctuates over time because it is based on an underlying benchmark interest rate or index that changes periodically

For the Major banks, variable interest is linked to the REPO rate fluctuations. Except for SA Home Loans, they use a different approach entirely. Their interest rate is linked to the JIBAR rate (just have this in mind, we will discuss it in a separate thread, focus)

Fixed interest rate:

A fixed interest rate is an unchanging rate charged on a liability, such as a car loan or home loan. It might apply during the entire term of the loan or for just part of the term, but it remains the same throughout a set period.

#propertytipswithnthato

A fixed interest rate is an unchanging rate charged on a liability, such as a car loan or home loan. It might apply during the entire term of the loan or for just part of the term, but it remains the same throughout a set period.

#propertytipswithnthato

Home loans can have multiple interest-rate options, including one that combines a fixed rate for some portion of the term and an adjustable-rate for the balance. These are referred to as “hybrids” (remember this)

#propertytipswithnthato

#propertytipswithnthato

Let us Start with: Fixed Interest Rates

Current Homeowners who have existing fixed interest rates before the three rate cuts seen this year (-1%,-1% & -0.5%), it simply means you most likely paying +-5% above the current prime rate.

Current Homeowners who have existing fixed interest rates before the three rate cuts seen this year (-1%,-1% & -0.5%), it simply means you most likely paying +-5% above the current prime rate.

Logic behind this is that fixed rates are on average 2-3% higher than variable interest rates

Prime rate in Dec 2019 was 9.75%, if fixed you’d have an averaged addition of 2.5%

Calculated as follows: ((2+3)/2) = 2.5%

That would give you an interest rate of 9.75+2.5%=12.25%

Prime rate in Dec 2019 was 9.75%, if fixed you’d have an averaged addition of 2.5%

Calculated as follows: ((2+3)/2) = 2.5%

That would give you an interest rate of 9.75+2.5%=12.25%

This is obviously a lot compared to what the rest of the country is paying.

We also note the following:

-Others may have fixed their interests at lower rates than the Dec 2019 rate

-The majority of people get higher than prime interest, i.e they are paying more than 12.25%

We also note the following:

-Others may have fixed their interests at lower rates than the Dec 2019 rate

-The majority of people get higher than prime interest, i.e they are paying more than 12.25%

What are your options?

Option 1:

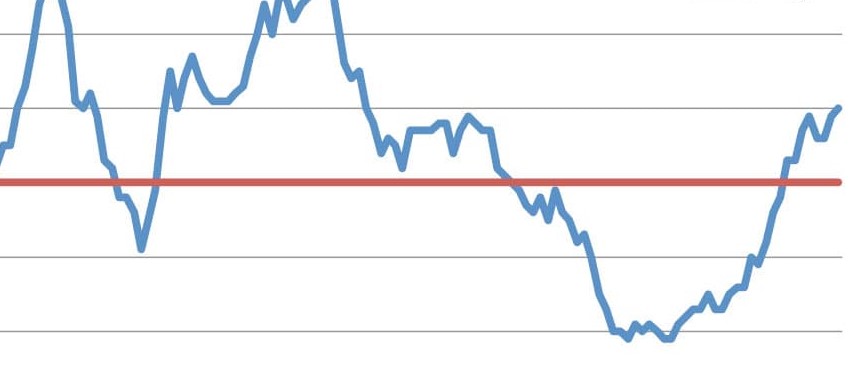

Be strong and see this through, keeping in mind that interest rates will go up, as seen in the 2008 REPO rate high of 12% or further back, the highest REPO rate of 23.99% in the year 1998.

#propertytipswithnthato

Option 1:

Be strong and see this through, keeping in mind that interest rates will go up, as seen in the 2008 REPO rate high of 12% or further back, the highest REPO rate of 23.99% in the year 1998.

#propertytipswithnthato

Option 2:

Refinance based on the last ten years data, with highest REPO rate of 7% and the lowest point of 3.75% we are currently experiencing

#propertytipswithnthato

Refinance based on the last ten years data, with highest REPO rate of 7% and the lowest point of 3.75% we are currently experiencing

#propertytipswithnthato

Home loan refinancing

Getting a new home loan to replace the original is called home loan refinancing. Refinancing is done to allow a borrower to obtain a better interest term and rate. The first loan is paid off, allowing the second loan to be created.

#propertytipswithnthato

Getting a new home loan to replace the original is called home loan refinancing. Refinancing is done to allow a borrower to obtain a better interest term and rate. The first loan is paid off, allowing the second loan to be created.

#propertytipswithnthato

Now is arguably the best time in South Africa’s history to fix one’s home loan, apply for refinancing on your existing fixed-rate and fix it at this lower interest.

E.g.

From 9.75(prime) + 2.5 = 12.25%

To 7.25(prime) + 2.5 = 9.75 %

E.g.

From 9.75(prime) + 2.5 = 12.25%

To 7.25(prime) + 2.5 = 9.75 %

However, the saving should be justified:

When one refinances, the old bond is settled and a new one is registered at the deeds office, this means you SHALL be liable for Bond registration costs AGAIN! Rule of thumb is that your savings should be more than these fees.

When one refinances, the old bond is settled and a new one is registered at the deeds office, this means you SHALL be liable for Bond registration costs AGAIN! Rule of thumb is that your savings should be more than these fees.

You need to give your bank three months’ notice, else you will be liable for early termination of contract costs, which are 3 times your monthly repayment.

E.g. if you pay R5000 p/m you will pay R15 000 in these costs.

#propertytipswithnthato

E.g. if you pay R5000 p/m you will pay R15 000 in these costs.

#propertytipswithnthato

Lastly, the outstanding interest up until the day of the settlement will be estimated and added on your settlement figure

e.g process takes 2 months, then the bank calculates your interest payable in the period, then adds to your quoted settlement figure

#propertytipswithnthato

e.g process takes 2 months, then the bank calculates your interest payable in the period, then adds to your quoted settlement figure

#propertytipswithnthato

New Homeowners:

Borrowers are more likely to opt for fixed interest rates during periods of low-interest rates when locking in the rate is particularly beneficial. The opportunity cost is still much less than during periods of high-interest rates if interest rates go lower.

Borrowers are more likely to opt for fixed interest rates during periods of low-interest rates when locking in the rate is particularly beneficial. The opportunity cost is still much less than during periods of high-interest rates if interest rates go lower.

For a R1M home loan, fixed at a rate of 7.25+2.5 = 9.75%

The home loan repayment will be R9 485 fixed!

It is important to note that the majority of ‘Fixed Interest Home Loans” in South Africa are actually ‘hybrid’ interest rates.

I told you earlier to remember this term

The home loan repayment will be R9 485 fixed!

It is important to note that the majority of ‘Fixed Interest Home Loans” in South Africa are actually ‘hybrid’ interest rates.

I told you earlier to remember this term

The biggest disadvantage of fixed rates in South Africa is that they’re only offered for relatively short terms - a maximum of 60 months, as opposed to your home loan’s total term of 20 or 30 years.

At the end of this period, you’ll either revert to your originally quoted variable rate or have to renegotiate with your bank for a new fixed-rate offer.

#propertytipswithnthato

#propertytipswithnthato

This limits your Opportunity costs, think about it, fixing at the lowest interest at an extra 2.5%, only to have to relinquish that ‘fixed’ interest 5 years later, was the savings worth it?

#propertytipswithnthato

#propertytipswithnthato

Banks Limit the term of a fixed rate as a way to minimize the potential impact of any prime interest rate fluctuations, it allows them to address any shortfalls if they underestimated how fast interest rates would be adjusted upwards before they eat into their bottom line.

To avoid Information Overload, we will post a separate #Thread on variable interest rates.

I will present you with the facts, ultimately the choice is yours to make based on your risk appetite and financial needs.

Look out for my YouTube Channel in the coming weeks!

I will present you with the facts, ultimately the choice is yours to make based on your risk appetite and financial needs.

Look out for my YouTube Channel in the coming weeks!

Read on Twitter

Read on Twitter