1\ Witnessed some debate on whether bitcoin follows a random walk or not. Here are some remarks from my side. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">

2\ First it is useful to have a look at what exactly a random walk is. I highly recommend Ben Lambert& #39;s explanations on statistical concepts in general and also on the concept of a random walk. https://youtu.be/ouahL4HbwBE ">https://youtu.be/ouahL4Hbw...

3\ The second concept I like to introduce is the idea of a random walk with drift. Here& #39;s another great video by Ben Lambert on that concept as well. https://youtu.be/Nxcqi7UZenc ">https://youtu.be/Nxcqi7UZe...

4\ So, most strict definition of a random walk:

X_t = X_t-1 + eps_t

Where eps_t is independent and identically distributed and follows N(0,sigma) distribution; a normal distribution with mean zero and variance sigma.

X_t = X_t-1 + eps_t

Where eps_t is independent and identically distributed and follows N(0,sigma) distribution; a normal distribution with mean zero and variance sigma.

5\ Now, if we look at the distribution of daily return data for bitcoin (see earlier tweets on that as per below), there

doesn& #39;t seem to be much empirical support for a mean return of zero. https://twitter.com/BurgerCryptoAM/status/1262317025407504387?s=20">https://twitter.com/BurgerCry...

doesn& #39;t seem to be much empirical support for a mean return of zero. https://twitter.com/BurgerCryptoAM/status/1262317025407504387?s=20">https://twitter.com/BurgerCry...

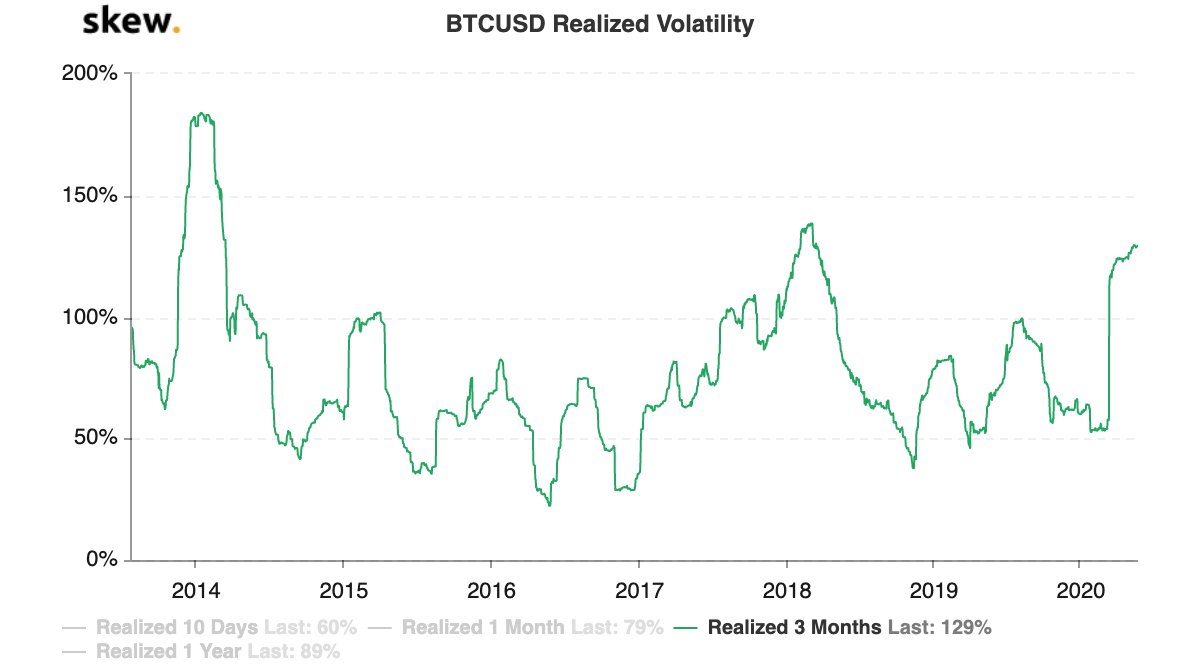

6\ In case we look at volatility of bitcoin over time, there seems to more evidence for volatility clustering than for constant volatility over time. ==> implying that bitcoin return data shows heteroskedasticity while a random walk requires homoskedasticity.

7\ So can we now conclude bitcoin doesn& #39;t follow a random walk?

No. There are different types of random walks. The first video by Ben Lambert introduced the most strict form. But there are other types that relax the assumptions.

No. There are different types of random walks. The first video by Ben Lambert introduced the most strict form. But there are other types that relax the assumptions.

8\ One of the better known and widely used relaxations is by assuming that the distribution is INID instead of IID, which allows for non constant variance. Used among others in the Heston model.

https://en.wikipedia.org/wiki/Independent_and_identically_distributed_random_variables">https://en.wikipedia.org/wiki/Inde...

https://en.wikipedia.org/wiki/Independent_and_identically_distributed_random_variables">https://en.wikipedia.org/wiki/Inde...

9\ The next relaxation would be by no longer assuming independency which allows the variance to be a function of itself over time.

10\ If you like to state or prove that bitcoin doesn& #39;t follow a random walk you have to be very specific about which interpretation we& #39;re talking to begin with.

11\ The weaker the form, the harder it is to proof it doesn& #39;t hold. So, when we talk about whether or not bitcoin follows a random walk, pls be very clear on what kind of random walk you mean exactly.

12\ Last remark: the idea of a random walk matches well with the efficient market hypothesis. But please be aware that there& #39;s another theory out there as well; the AMH:

https://www.investopedia.com/terms/a/adaptive-market-hypothesis.asp

Personally,">https://www.investopedia.com/terms/a/a... I consider AMH a better fit for the bitcoin market than the EMH.

https://www.investopedia.com/terms/a/adaptive-market-hypothesis.asp

Personally,">https://www.investopedia.com/terms/a/a... I consider AMH a better fit for the bitcoin market than the EMH.

13\ Personally, I don& #39;t really care much about the labelling, but more about a proper way to simulate bitcoin prices over time and use these simulations for risk management purposes and option valuation.

Read on Twitter

Read on Twitter