DM Queries Thread No. 9!

#TastyBite - Popular Request!

#LongThread #Stock #SmallCap

Sharing my Personal Experience,data collected from Annual Reports,Ambit & other free sources available on internet.

Not a Recommendation! Just my analysis & facts for Educational Purpose.

1n

#TastyBite - Popular Request!

#LongThread #Stock #SmallCap

Sharing my Personal Experience,data collected from Annual Reports,Ambit & other free sources available on internet.

Not a Recommendation! Just my analysis & facts for Educational Purpose.

1n

4-5 yrs ago, I smelled aroma of daal-makhani at office, my American colleague was having Madras Lentils, I was little surprised. He introduced me to Tasty Bite. His family/kids love them for its mild taste & creamy texture. 60sec microwave in a BPA free pouch(convenience)

2n

2n

An Indian Colleague (next to him) had his cupboard full of them. He is strict vegetarian & holds a high position at Temple. He even doesn’t buy milk with fish oil (most of milk in US is fortified with fish oil for Omega-3 & DHA). He talked with me in length about Tasty Bite.

3n

3n

Now I am biggest fan of Tasty Bite. As a family we are strict NO to RTE & Tin products & prefer home cooked meal. Tasty bite is only exception & found place in our shelf. It is our go-to meal for any vacation/trips. Why(?) Keep reading ..

@TastyBite @Ashokvasudevan

4n

@TastyBite @Ashokvasudevan

4n

I buy Tasty Bite’s Madras Lentils & Vegetable Tikka Masala from Costco.Probably I have tried Channa Masala too. Last 1-2 yrs buying Organic version. All Natural, Kosher, Vegetarian/Vegan, Non-GMO, Gluten Free, NO additives/preservatives/chemicals/artificial flavors/additives.

5n

5n

Costco(wholesale) is known for its Quality&Standards (NO 2nd opinion). All talk to my wife didn’t convince her to try Tasty bite, being sold at Costco made her change mind. My Little one loves it & hence we found our go-to meal for our trips & occasionally use at home/office.

6n

6n

In Costco I have seen they have 2-3 varieties in 4X4 sqft space (an incredible feat). Brands face tough fight to get into Costco & even if they get in, they may not have 2 -3 different items. Costco does product sampling & I have seen people queuing to try Madras Lentils.

7n

7n

Costco near me sells them for $11.99 8 pouch packet & Organic for $13.99. Online http://Costco.com"> http://Costco.com Organic are listed at $15.49. Each pouch Net Wt 10 Oz or 285g. On Madras lentils they claim each pouch for 2 servings (it should be 1), I feel they should remove that.

8n

8n

Exceptional retort pouches developed for the Apollo space program. Tested to withstand extreme temperatures and heights from well below sea level to as high as the moon. This made Tasty Bites favorite with campers, mountain climbers, sailing expeditions and desert safaris.

9n

9n

Few years back when I researched, I read they have patented packaging technology which allow 0 bacterial growth hence no need of preservatives (Can’t find it now, so can’t claim) & last easily 18-24months You can either microwave pouch for 60sec or boil it in water for 5min

10n

10n

Tasty Bite journey classified in 3 phases –

Tasty Bite 1.0 - Ist 15yrs struggled to survive, declared Sick & place under BIFR. Lasted till 1998.

Tasty Bite 2.0 - Started in 1999 with turnaround & transformation. One of the most Respected food companies in country…

11n

Tasty Bite 1.0 - Ist 15yrs struggled to survive, declared Sick & place under BIFR. Lasted till 1998.

Tasty Bite 2.0 - Started in 1999 with turnaround & transformation. One of the most Respected food companies in country…

11n

… India& #39;s top 50 companies to work for.

Tasty Bite 3.0 - Future Phase called Wholesome Mazaa (in AR 2018). Global Expansion with help from parent Mars Inc.

12n

Tasty Bite 3.0 - Future Phase called Wholesome Mazaa (in AR 2018). Global Expansion with help from parent Mars Inc.

12n

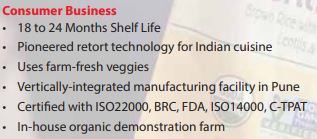

Established 1985, manufactures ready-to-serve(RTS) food, frozen vegetables & sauces.

Factory -> Village Bhandgaon, Taluka Daund, Pune, Maharashtra

Factory is ISO9001-2000, HACCP (Hazard Analysis and Critical Control Point), and ISO14000 (environmental management) certified.

13n

Factory -> Village Bhandgaon, Taluka Daund, Pune, Maharashtra

Factory is ISO9001-2000, HACCP (Hazard Analysis and Critical Control Point), and ISO14000 (environmental management) certified.

13n

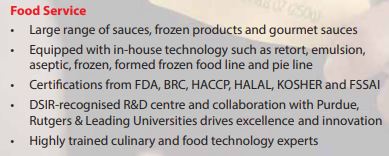

Promoter Change history (see attached pic).

Ist Owner Ghai Family (Kwality Ice Cream). Unable to survive, Company was referred to Board of Industrial & Financial Restructuring & then sold to HLL (now HUL).

14n

Ist Owner Ghai Family (Kwality Ice Cream). Unable to survive, Company was referred to Board of Industrial & Financial Restructuring & then sold to HLL (now HUL).

14n

Management buy-out ->Mr. (Ashok Vasudevan & Ravi Nigam) convinced HUL to sell it to them.

13 yrs gone since inception (1986), small operation & no profits.

They turnaround the company & aggressive growth started.

1995 - ‘Tasty Bite’ brand launched in USA.

15n

13 yrs gone since inception (1986), small operation & no profits.

They turnaround the company & aggressive growth started.

1995 - ‘Tasty Bite’ brand launched in USA.

15n

1999 – 5 Cr Revenue & Ist time Profit

Tasty bite Eatables Ltd owned by Preferred Brands International (PBI), Stamford, CT, USA which in turn now owned by Mars Food UK since 2017. Mars Food is a segment of Mars Inc.

Mars Brands - M&Ms, Snickers, Twix, Orbit …

16n

Tasty bite Eatables Ltd owned by Preferred Brands International (PBI), Stamford, CT, USA which in turn now owned by Mars Food UK since 2017. Mars Food is a segment of Mars Inc.

Mars Brands - M&Ms, Snickers, Twix, Orbit …

16n

… 3 Musketeers, Dove, Milky Way, Skittles Juicy Fruit, Altoids, Extra, Seeds of Change, Ebly, Dolmio, Masterfoods, Uncle Ben& #39;s (rice), Kan Tong, Suzi Wan

Mars Pet food brands like Pedigree, Royal Canin, Whiskas

& many more brands list is really long …

17n

Mars Pet food brands like Pedigree, Royal Canin, Whiskas

& many more brands list is really long …

17n

Mars Inc is a 107 yrs old American Private company. Mars family net worth is $90 billion as per Bloomberg. They are America’s 3rd richest wealthiest ‘dynasty’ as per Forbes.

https://www.businessinsider.com/mars-inc-family-fortune-net-worth-lifestyle-snickers-twix-2019-3

18n">https://www.businessinsider.com/mars-inc-...

https://www.businessinsider.com/mars-inc-family-fortune-net-worth-lifestyle-snickers-twix-2019-3

18n">https://www.businessinsider.com/mars-inc-...

Read the history about Mars past acquisitions you will know how serious & successful they have been in building the brands and using their brand network.

Can the same happen to Tasty Bite? I think so. Continue reading you will know soon..

19n

Can the same happen to Tasty Bite? I think so. Continue reading you will know soon..

19n

Tasty bite a small company that has build a global brand. It is into Indian & Asian ready-to-eat (RTE) food & supplies to QSR industry

It is No. 1 RTE Indian Food Brand (you read it right not Haldiram, MTR, Deep Foods etc) and fastest growing Asian brand in US.

20n

It is No. 1 RTE Indian Food Brand (you read it right not Haldiram, MTR, Deep Foods etc) and fastest growing Asian brand in US.

20n

2 Businesses-

Tasty Bite Eatables Limited (TBEL)- 66.1% turnover 2019 AR. US, Canada, UK,Australia,New Zealand, Germany & Japan.Marketed through PBI -retail/wholesale chains Costco, Walmart,Target, Kroger,Woolworths (List below). This RTE business launched in 1995 in US.

21n

Tasty Bite Eatables Limited (TBEL)- 66.1% turnover 2019 AR. US, Canada, UK,Australia,New Zealand, Germany & Japan.Marketed through PBI -retail/wholesale chains Costco, Walmart,Target, Kroger,Woolworths (List below). This RTE business launched in 1995 in US.

21n

Tasty Bite Food Service (TFS)- Smaller (33.2% turnover 2019 AR) but fastest Growing. Quick Service Restaurant (QSR) & Hotel/Restaurants/Caterers (HORECA) in India. Expanded to South East Asia, Middle East & Africa (2019 AR). This is frozen food & Sauces business.

22n

22n

RTE 4 Categories - Indian, Asian, Rice, Spice & Simmer

It had more than 60 products in 2018 & that no. must be way higher now.

Quality & product innovation is top-notch. Good distribution network & deep penetration (US, India, UK, Japan, Australia, Canada & New Zealand).

23n

It had more than 60 products in 2018 & that no. must be way higher now.

Quality & product innovation is top-notch. Good distribution network & deep penetration (US, India, UK, Japan, Australia, Canada & New Zealand).

23n

US – most of supermarkets

Canada & Australia – Dominant market share

New Zealand & Japan – growing fast presence

India – Supplies Formed Frozen Products (FFP) & sauces to food service industry (FSI).

Tasty Bite products sell in following stores -

24n

Canada & Australia – Dominant market share

New Zealand & Japan – growing fast presence

India – Supplies Formed Frozen Products (FFP) & sauces to food service industry (FSI).

Tasty Bite products sell in following stores -

24n

US stores – I consolidated following list ->

http://Amazon.com"> http://Amazon.com

Costco

Walmart

Target

Hy Vee

Whole Foods (owned by Amazon)

Natural Grocers

Bakers Supermarket

Fresh Thyme Farmers Market

Shoprite

Family Fare Supermarket

7 Eleven

CVS Pharmacy

Morton Williams Supermarket

25n

http://Amazon.com"> http://Amazon.com

Costco

Walmart

Target

Hy Vee

Whole Foods (owned by Amazon)

Natural Grocers

Bakers Supermarket

Fresh Thyme Farmers Market

Shoprite

Family Fare Supermarket

7 Eleven

CVS Pharmacy

Morton Williams Supermarket

25n

Gristedes

Wohlners Grocery & Deli

Acme Market

Kings Supermarket

Albertsons

Gonzalez Northgate

Ralphs Grocery

Smart & Final

Safeway Store

Lucky California

Sprouts Farmers Market

Mollie Stone& #39;s Markets

Giant Food Store

Streets Market

Yes Organic

Harris Teeter

& many more..

26n

Wohlners Grocery & Deli

Acme Market

Kings Supermarket

Albertsons

Gonzalez Northgate

Ralphs Grocery

Smart & Final

Safeway Store

Lucky California

Sprouts Farmers Market

Mollie Stone& #39;s Markets

Giant Food Store

Streets Market

Yes Organic

Harris Teeter

& many more..

26n

On http://Amazon.com"> http://Amazon.com (in US) - Lot of varieties you will find (Indian, Thai, Rice, Spice & Simmer)

I filtered by brand Tasty Bite & I had to navigate to 4 pages to see all items listed.

https://www.amazon.com/s?k=tasty+bite&rh=p_89%3ATasty+Bite&dc&qid=1589921004&rnid=2528832011&ref=sr_pg_1

27n">https://www.amazon.com/s...

I filtered by brand Tasty Bite & I had to navigate to 4 pages to see all items listed.

https://www.amazon.com/s?k=tasty+bite&rh=p_89%3ATasty+Bite&dc&qid=1589921004&rnid=2528832011&ref=sr_pg_1

27n">https://www.amazon.com/s...

UK Stores – I found following ->

ASDA

Sainsbury& #39;s

TESCO

Ocado

Morrisons

.. may be more

Canada Stores – list is long. Exercise for you (Use Zipcode & find list) –

http://ca.tastybite.com/where-to-buy/

Australia">https://ca.tastybite.com/where-to-... – Woolworths, IGA, Costco, Countdown

UK, Japan – Costco

28n

ASDA

Sainsbury& #39;s

TESCO

Ocado

Morrisons

.. may be more

Canada Stores – list is long. Exercise for you (Use Zipcode & find list) –

http://ca.tastybite.com/where-to-buy/

Australia">https://ca.tastybite.com/where-to-... – Woolworths, IGA, Costco, Countdown

UK, Japan – Costco

28n

Ethical & Competent Management. I was really impressed with profile & experience.

Ashok Vasudevan & wife Meera Vasudevan

https://www.tastybite.co.in/ashok-vasudevan.html

https://www.tastybite.co.in/ashok-vas... href=" https://www.csaw.co/who-we-are.php

https://www.csaw.co/who-we-ar... href=" https://mavfoundation.org/about-us/

https://mavfoundation.org/about-us/... href="

29n">https://youtu.be/e4LoSf1mn...

Ashok Vasudevan & wife Meera Vasudevan

https://www.tastybite.co.in/ashok-vasudevan.html

29n">https://youtu.be/e4LoSf1mn...

Key Person Continued –

Ravi Nigam – MD (till 02Nov18)

https://www.tastybite.co.in/ravi-nigam.html

Abhijit">https://www.tastybite.co.in/ravi-niga... Upadhye - MD (wef from 03Nov18)

https://www.tastybite.co.in/abhijit-upadhye.html

Gaurav">https://www.tastybite.co.in/abhijit-u... Gupta (CFO)

https://www.tastybite.co.in/gaurav-gupta.html

Anila">https://www.tastybite.co.in/gaurav-gu... Thomas (Dy. GM HR)

https://twitter.com/anilathomas71?lang=en

30n">https://twitter.com/anilathom...

Ravi Nigam – MD (till 02Nov18)

https://www.tastybite.co.in/ravi-nigam.html

Abhijit">https://www.tastybite.co.in/ravi-niga... Upadhye - MD (wef from 03Nov18)

https://www.tastybite.co.in/abhijit-upadhye.html

Gaurav">https://www.tastybite.co.in/abhijit-u... Gupta (CFO)

https://www.tastybite.co.in/gaurav-gupta.html

Anila">https://www.tastybite.co.in/gaurav-gu... Thomas (Dy. GM HR)

https://twitter.com/anilathomas71?lang=en

30n">https://twitter.com/anilathom...

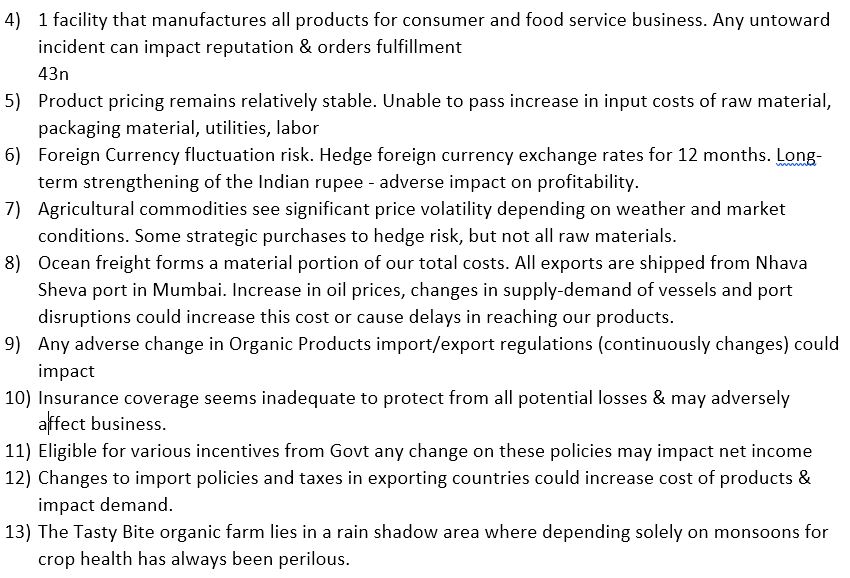

Risks-

1)AR 2019 -High inflation, increase in our organic sourcing and long-term contracts for key commodities our material cost increase by 1.4% to 58% of revenues. Shocked & concerned me, hope it is typo. Would need to seek clarification from Management. @Ashokvasudevan

32n

1)AR 2019 -High inflation, increase in our organic sourcing and long-term contracts for key commodities our material cost increase by 1.4% to 58% of revenues. Shocked & concerned me, hope it is typo. Would need to seek clarification from Management. @Ashokvasudevan

32n

Risks-

2)The US Government announced earlier this year that it would terminate GSP benefits for Indian exports to the US. (AR 2019)

3)No long-term contracts with customers and they could stop purchasing with little or no notice period

33n

2)The US Government announced earlier this year that it would terminate GSP benefits for Indian exports to the US. (AR 2019)

3)No long-term contracts with customers and they could stop purchasing with little or no notice period

33n

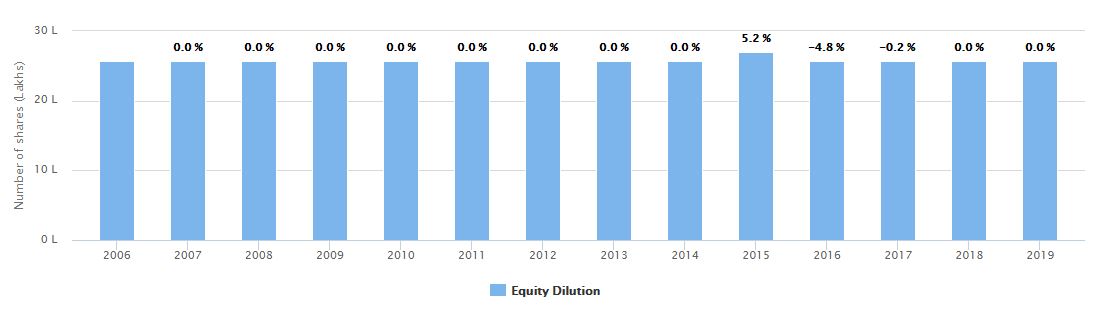

Tasty bite is a small cap company and liquidity is low.

Equity Capital is just 2.57 cr

Promotor change has happened (Kagome & then Mars Inc) but there is no major insider trading in last 5-6 yrs. (Good Sign)

MF holding is low reason may be low float (not enough shares to buy)

35n

Equity Capital is just 2.57 cr

Promotor change has happened (Kagome & then Mars Inc) but there is no major insider trading in last 5-6 yrs. (Good Sign)

MF holding is low reason may be low float (not enough shares to buy)

35n

Corporate Governance looks ok (Not great). It’s improving.

Remuneration of Executives are within limit of Company Act 2013.

Total Managerial Remuneration 2,24,50,674 (AR 2019)

Ceiling as per the Companies Act 2013 2,47,66,123

36n

Remuneration of Executives are within limit of Company Act 2013.

Total Managerial Remuneration 2,24,50,674 (AR 2019)

Ceiling as per the Companies Act 2013 2,47,66,123

36n

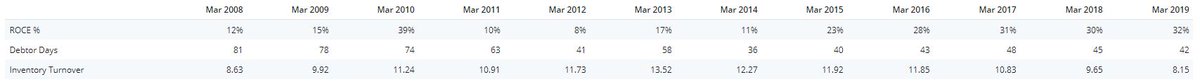

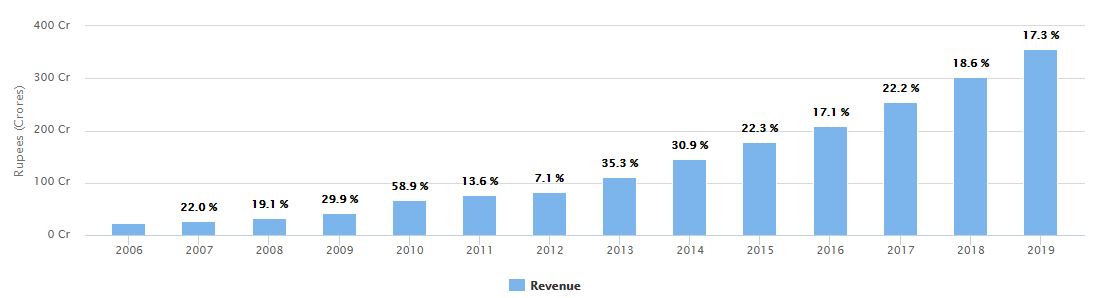

Excellent growth in Sales, Profit, ROE & Stock Return in last 10yrs.

In fact it is part of my ‘IMPECCABLE 10Yr RECORD- ROE ROCE Profit CashFlow’ Screener which has just 3 companies.

https://twitter.com/Coolfundoo/status/1261497799713214464?s=20

37n">https://twitter.com/Coolfundo...

In fact it is part of my ‘IMPECCABLE 10Yr RECORD- ROE ROCE Profit CashFlow’ Screener which has just 3 companies.

https://twitter.com/Coolfundoo/status/1261497799713214464?s=20

37n">https://twitter.com/Coolfundo...

Excellent ROCE. 10-12 yrs Steady Rise in ROCE (12% to 32%). A tough feat to achieve.

Debtor/Receivables Days has been decreasing (81 to 42). Great!

Inventory Turnover has been stable.

38n

Debtor/Receivables Days has been decreasing (81 to 42). Great!

Inventory Turnover has been stable.

38n

No Overall Stock Dilution for last 13yrs(Excellent Sign)

No Pledge shares(Good)

Excellent Revenue Growth in 10yrs

EPS & NetProfit was fluctuating from 2006-13.Excellent Rise in last 5yrs

Net Profit vs EPSgrowth are going hand-in-hand(Good Sign)

PHENOMENAL GROWTH since 2014

39n

No Pledge shares(Good)

Excellent Revenue Growth in 10yrs

EPS & NetProfit was fluctuating from 2006-13.Excellent Rise in last 5yrs

Net Profit vs EPSgrowth are going hand-in-hand(Good Sign)

PHENOMENAL GROWTH since 2014

39n

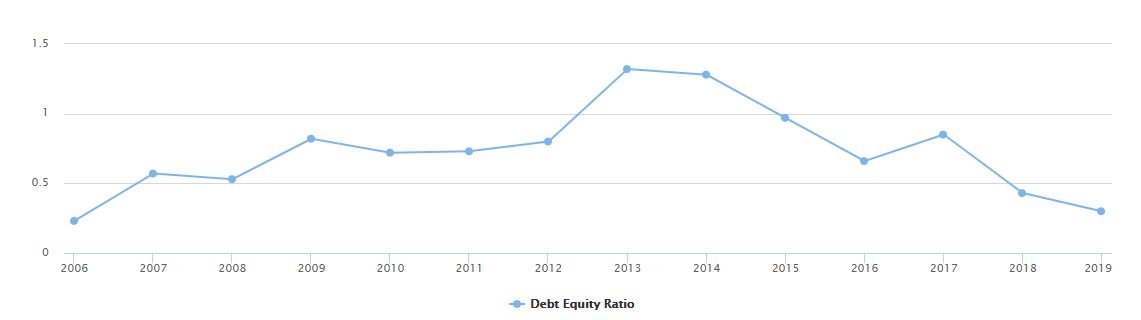

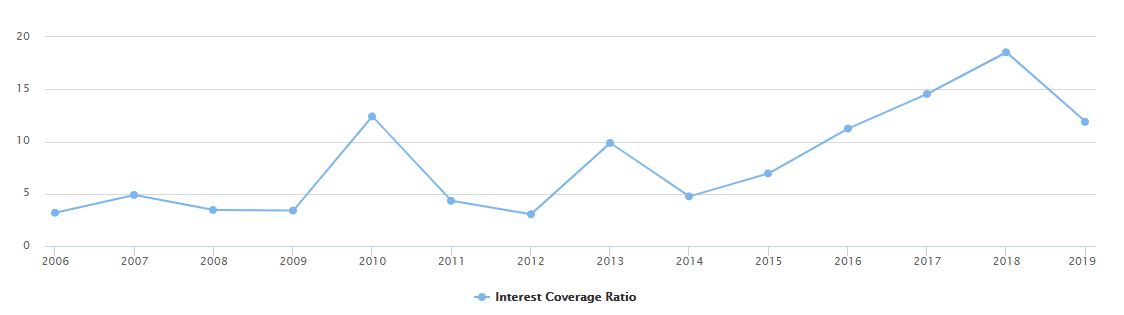

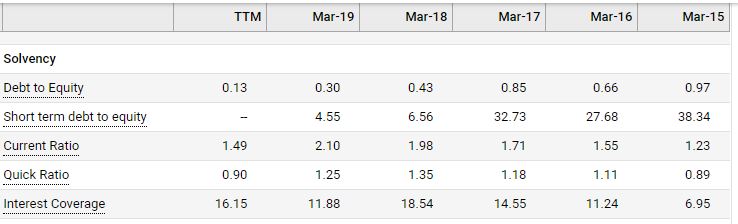

Lot of debt until 2013 to fund expansion then kept on reducing every yr.

Current Ratio was declining trend (2006-14) steadily rose thereafter.

Interest Coverage Ratio has been fluctuating until 2014. Great thereafter.

All looks great now & gives SENSE of SAFETY.

40n

Current Ratio was declining trend (2006-14) steadily rose thereafter.

Interest Coverage Ratio has been fluctuating until 2014. Great thereafter.

All looks great now & gives SENSE of SAFETY.

40n

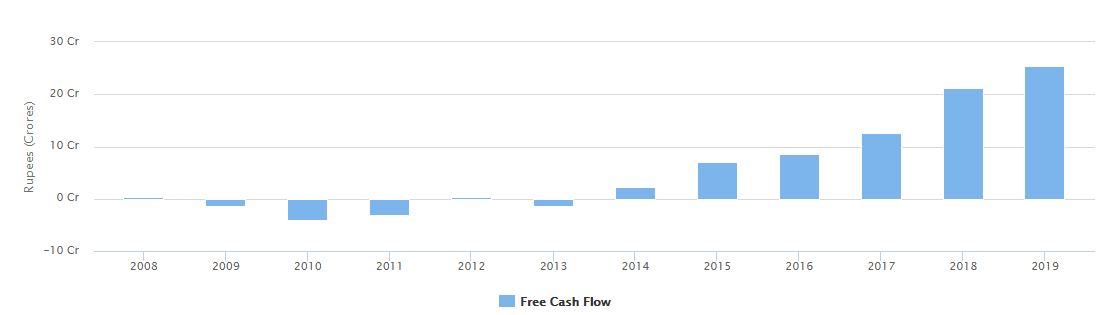

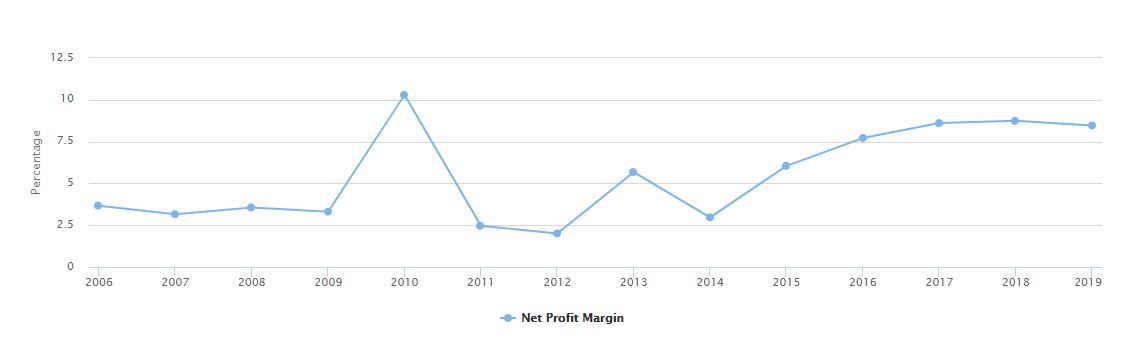

Free Cash Flow, NPM, ROE – fluctuating until 2014 & Steady rise thereafter.

Similar Story in Net Profit vs Revenue. They started going hand-in-hand after 2014.

Check out 14 yr (4 graphs) in screen-shot.

REMARKABLE PERFRORMANCE since 2014.

41n

Similar Story in Net Profit vs Revenue. They started going hand-in-hand after 2014.

Check out 14 yr (4 graphs) in screen-shot.

REMARKABLE PERFRORMANCE since 2014.

41n

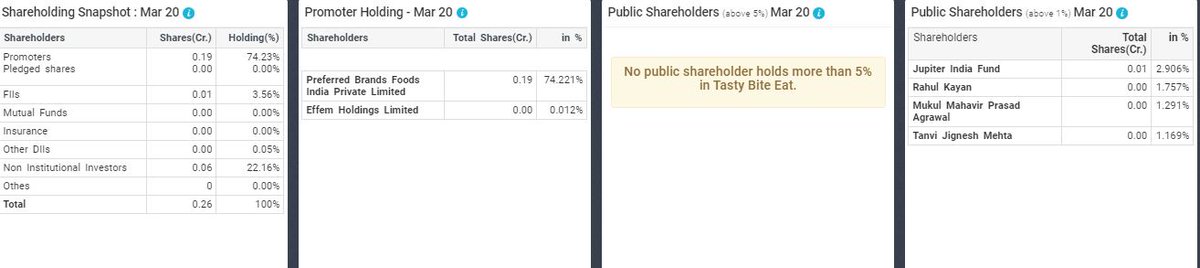

Promoter holding is high (74.22%) & highly reputed (Mars).

Promoter timeline History screen-shot.

FII has been increasing holding for 5 Quarters.

Largest FII - Jupiter India Fund - 74562 shares

No. of Public Shareholders (5879)-> 25.77% (Less than 6K people hold its shares)

42n

Promoter timeline History screen-shot.

FII has been increasing holding for 5 Quarters.

Largest FII - Jupiter India Fund - 74562 shares

No. of Public Shareholders (5879)-> 25.77% (Less than 6K people hold its shares)

42n

If we Exclude Other Income, Operating Profit has been flat in last few years & OPM is under pressure looks like Company may not have much pricing power & unable to pass the rise of cost to customers.

Cash flow from Operations has been Great.

Balance Sheet good.

43n

Cash flow from Operations has been Great.

Balance Sheet good.

43n

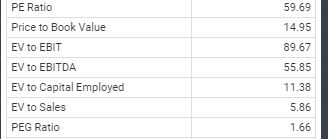

Tasty Bite Valuation on absolute terms looks Expensive (Screen-shot)

But,

PE (59.68) < 5yr Median PE (66.53)

P/BV (15) < Median P/BV (16)

Peter Lynch Dividend Adjusted PEG Ratio = 1.21 is Cheaper than Hatsun Agro (6.48) but expensive than DFM Foods (0.89)

44n

But,

PE (59.68) < 5yr Median PE (66.53)

P/BV (15) < Median P/BV (16)

Peter Lynch Dividend Adjusted PEG Ratio = 1.21 is Cheaper than Hatsun Agro (6.48) but expensive than DFM Foods (0.89)

44n

In terms of EV to Operating Cash, EV to EBITDA & M.Cap to Sales its expensive than Both

In terms of EV to FCF its cheaper than Hatsun but expensive than DFM

Last 1 yr Price has increased by 13.82% but Earnings has increased by 35.88%. So, there is scope of catching up.

45n

In terms of EV to FCF its cheaper than Hatsun but expensive than DFM

Last 1 yr Price has increased by 13.82% but Earnings has increased by 35.88%. So, there is scope of catching up.

45n

Debt is lower than most of its peers.

It will take 1.31 Years to Pay of Debt from its CFO

(Hatsun = 2.85, DCM = 1.42). See Screenshot in 45n

No Solvency issue.

No Creative Accounting with Financial No.

46n

It will take 1.31 Years to Pay of Debt from its CFO

(Hatsun = 2.85, DCM = 1.42). See Screenshot in 45n

No Solvency issue.

No Creative Accounting with Financial No.

46n

Good Capital Allocation.

Cash flow from Operations is now big Source of Cash & Net Borrowings became lesser significant compared to Tasty Bite 1.0

Cash Conversion Cycle has significantly improved from 70 days in 1998 to 52 in 2019.

Both are Good Sign.

47n

Cash flow from Operations is now big Source of Cash & Net Borrowings became lesser significant compared to Tasty Bite 1.0

Cash Conversion Cycle has significantly improved from 70 days in 1998 to 52 in 2019.

Both are Good Sign.

47n

In last 5yrs Overall Operator Efficiency has been good but Cash Conversion Cycle & Working Capital Days has increased.

CCY (2015) - 14,26,40,47,45 (2019)

WC (2015) - 87,91,108,121,126 (2019)

This trend & fluctuation worried me a little.

Plz comment if you find (?).

48n

CCY (2015) - 14,26,40,47,45 (2019)

WC (2015) - 87,91,108,121,126 (2019)

This trend & fluctuation worried me a little.

Plz comment if you find (?).

48n

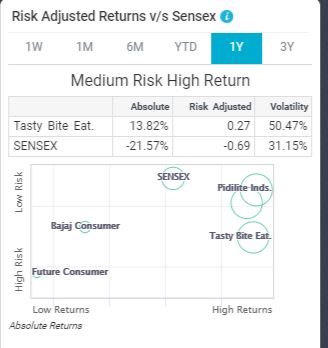

Dividend Yield – 0.2%. Its growth company dividend investors may not like it.

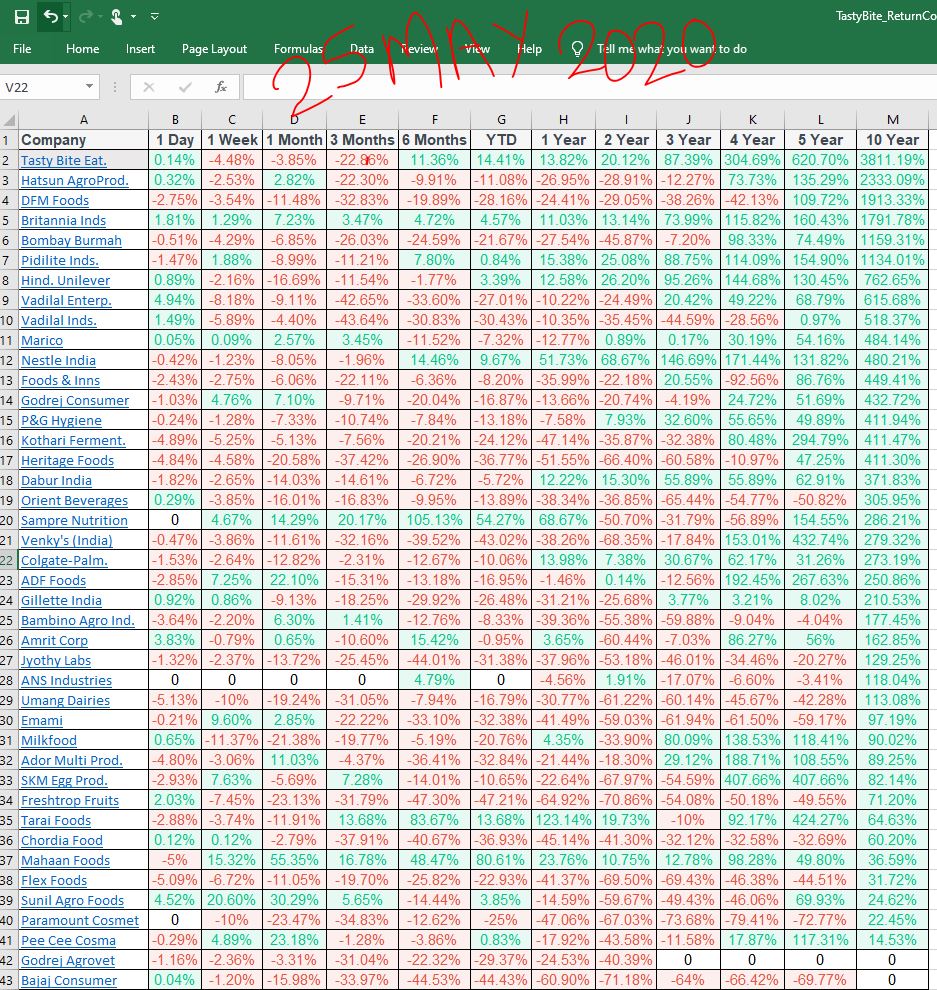

Tasty Bite 10yr Return 3811.19% vs Sensex Return 86.51%

Tasty Bite is a Medium Risk High Return Stock & its Volatility & Beta is higher than Sensex.

Risk Adjusted Returns vs Sensex (See Screenshot)

49n

Tasty Bite 10yr Return 3811.19% vs Sensex Return 86.51%

Tasty Bite is a Medium Risk High Return Stock & its Volatility & Beta is higher than Sensex.

Risk Adjusted Returns vs Sensex (See Screenshot)

49n

Tasty Bite is best performing stock in FMCG in last 10 yrs. Yes you read it right (it’s not Hindustan Lever, Hatsun Agro or DFM).

I compared return of approx. 90 FMCG companies & arranged them wrt highest return in 10yrs. See Screenshot for Top 42 companies.

50n

I compared return of approx. 90 FMCG companies & arranged them wrt highest return in 10yrs. See Screenshot for Top 42 companies.

50n

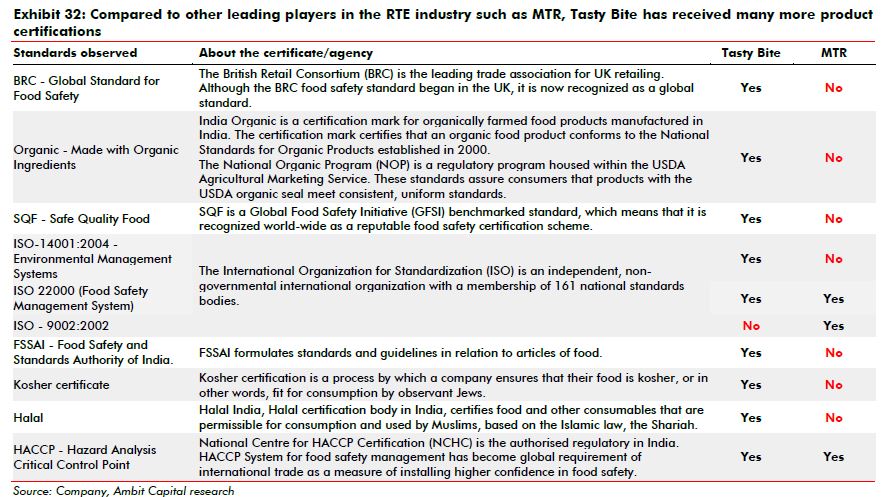

R&D Spend - As per AR 2019 they spend 0.52% of Revenue on R&D. Speaks volume about their Product innovation. Haldiram & other such competitors spend significantly less.

Won various awards & accolades. Quality Certification they hold may be highest. See Screenshot

51n

Won various awards & accolades. Quality Certification they hold may be highest. See Screenshot

51n

Let’s try to find Answers to some Qns which aroused in my head & people asked me too

Q1-How Tasty bite RTE is different from Haldiram, MTR, Deep foods, other Indian Brands? Why so premium?

Me- We know from above, Tasty bite focuses on Supermarkets,retail/wholesale chains…

52n

Q1-How Tasty bite RTE is different from Haldiram, MTR, Deep foods, other Indian Brands? Why so premium?

Me- We know from above, Tasty bite focuses on Supermarkets,retail/wholesale chains…

52n

..where most of the native 99% of population shops. Other Indian brands are mostly available in Indian stores where only Indians go(<1% of population). Tasty Bite is Non-GMO, Kosher & is milder or medium spicy in taste which goes well with their taste-bud. See QC in 51n

53n

53n

Q2 - Why other Indian brands RTE are limited to mainly Indian stores?

Me - They don’t meet Quality standards of these stores, usually fail inspection & have confrontation with USFDA.

See attached QC comparison between Tasty Bite & MTR

54n

Me - They don’t meet Quality standards of these stores, usually fail inspection & have confrontation with USFDA.

See attached QC comparison between Tasty Bite & MTR

54n

Q3 - Ashok Vasudevan, Meera Vasudevan, Ravi Nigam, Sohel Shikari, Hans Taparia - founding team members in 1998 after buying it from HUL.

Mr. Ravi Nigam appointed MD for 5yrs in Sep 2016.

Why Tasty Bite’s long-term CFO & MD resigned at same time before their term finished?

55n

Mr. Ravi Nigam appointed MD for 5yrs in Sep 2016.

Why Tasty Bite’s long-term CFO & MD resigned at same time before their term finished?

55n

Me – I would guess this is part of usual Corporate re-structuring which happens after a company is acquired, Mars acquired Tasty Bite in 2017. So may be related to it.

56n

56n

Conclusion –

Me - I feel Year 2014 onwards was inflection point for Tasty Bite. It’s like some kind of rejuvenation happened. It was trading in 600+ level in 2015. Overall Sales & Profit Growth, Operating efficiency,

significant market expansion in India & abroad,..

57n

Me - I feel Year 2014 onwards was inflection point for Tasty Bite. It’s like some kind of rejuvenation happened. It was trading in 600+ level in 2015. Overall Sales & Profit Growth, Operating efficiency,

significant market expansion in India & abroad,..

57n

Me - .. reduction of debt helped it reach where it is today.

Tasty Bite 3.0 with Mars I get +ive vibes. It is taking leverage of Mars reach & expanding fast. Mars is a private firm. Tasty bite is a small Equity capital & not much FII & Mutual fund holding will knows Mars

58n

Tasty Bite 3.0 with Mars I get +ive vibes. It is taking leverage of Mars reach & expanding fast. Mars is a private firm. Tasty bite is a small Equity capital & not much FII & Mutual fund holding will knows Mars

58n

may try to delist it? Who knows, we may get idea about it if we read into Mars past acquisitions.

If it has potential & bright looking future there are certain significant risks associated please do read them in 32n ,33n & 34n.

59n

If it has potential & bright looking future there are certain significant risks associated please do read them in 32n ,33n & 34n.

59n

Finally, ending the thread. Do watch a 4min Corporate film of Tasty Bite & a 6min Conversation with ex-CEO & Current Chairman Ashok Vasudevan.

It gives a feel of Company, Facility & people –

https://www.youtube.com/watch?v=Nmqb5gSkrNk

https://www.youtube.com/watch... href="

60n">https://www.youtube.com/watch...

It gives a feel of Company, Facility & people –

https://www.youtube.com/watch?v=Nmqb5gSkrNk

60n">https://www.youtube.com/watch...

Missed 1 Imp Point.

Tastybite experimented with packaging Strategy & it played well. Initially starting with 1 packet they increased to 2 to 4 to 6 to 8.

Volume gain by 30% & customer lost was only 5-7%.Lot of +ive customer feedback.

61n

Tastybite experimented with packaging Strategy & it played well. Initially starting with 1 packet they increased to 2 to 4 to 6 to 8.

Volume gain by 30% & customer lost was only 5-7%.Lot of +ive customer feedback.

61n

Initially I used to buy 6 pack packets at Costco last 2 yrs only 8 pouch packets are available. Volume gain  https://abs.twimg.com/emoji/v2/... draggable="false" alt="😃" title="Smiling face with open mouth" aria-label="Emoji: Smiling face with open mouth">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😃" title="Smiling face with open mouth" aria-label="Emoji: Smiling face with open mouth">

On http://Amazon.com"> http://Amazon.com Tastybite is selling Pack of 18,24,26,72,198 & 144 too. Not sure if they are 8 pouch packet or single boxes.

62n

On http://Amazon.com"> http://Amazon.com Tastybite is selling Pack of 18,24,26,72,198 & 144 too. Not sure if they are 8 pouch packet or single boxes.

62n

@threadreaderapp unroll

Read on Twitter

Read on Twitter