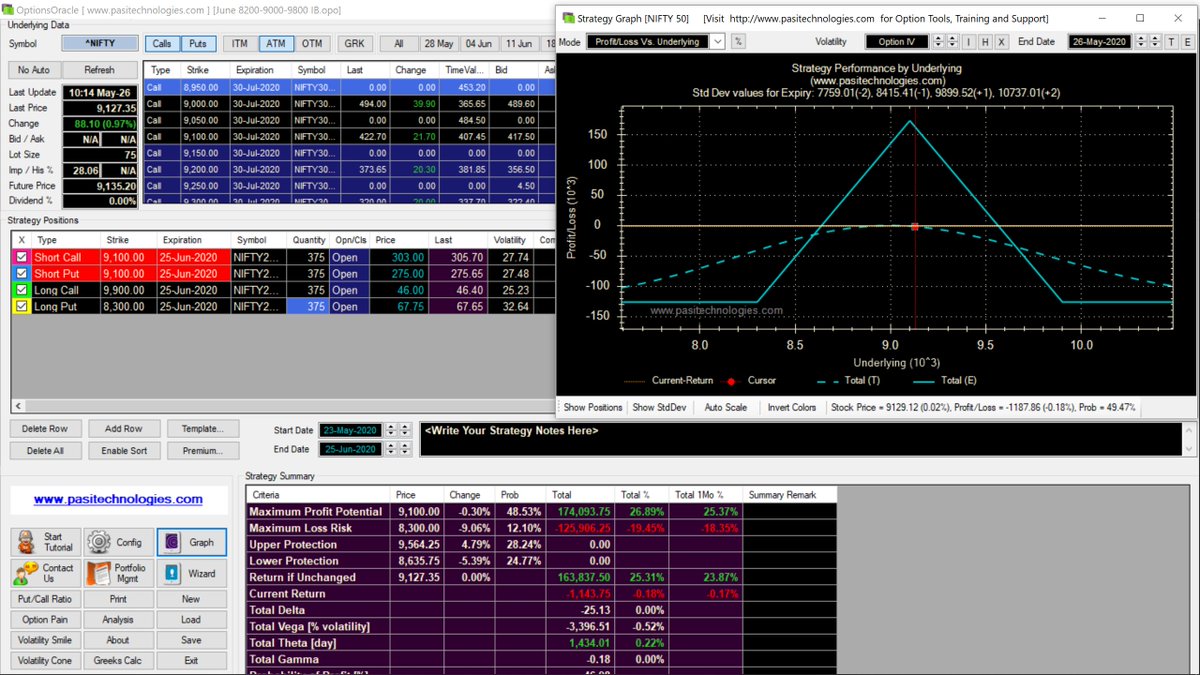

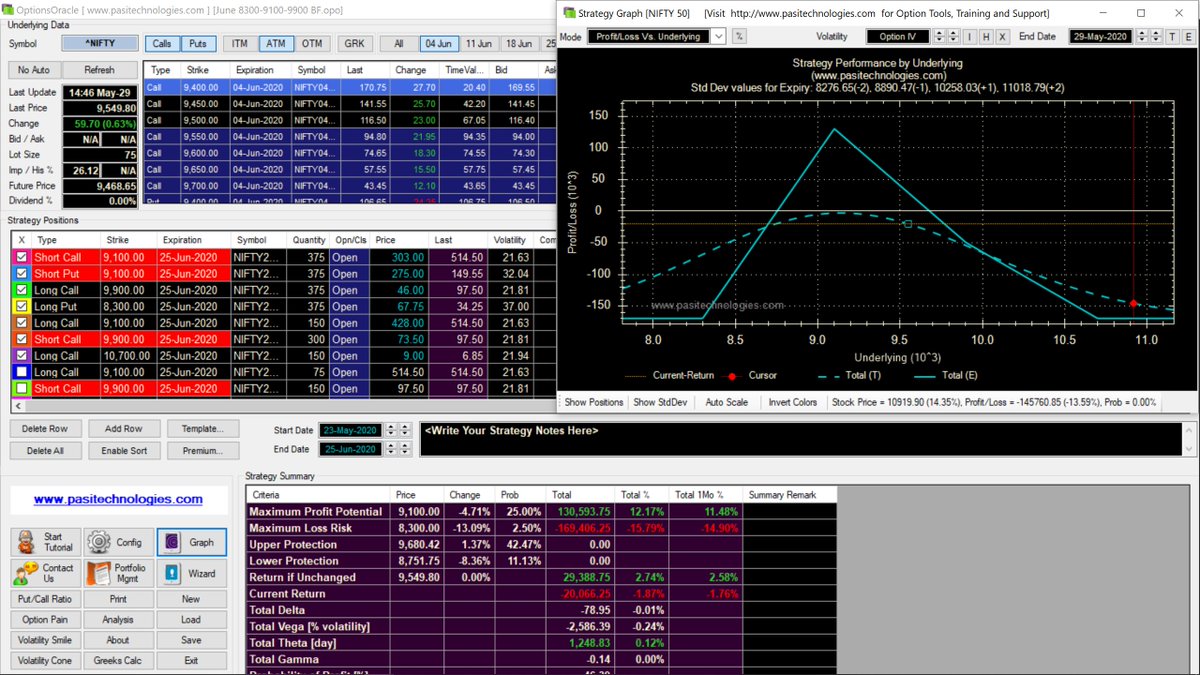

Established first Butterfly today with small size until things on the Margin Front become clearer. With ATM Vol being around 28, the 1SD move is near 750 points, so bought the Wings 800 points out. Will Trade a version I learned from my mentor called the & #39;Heart Friendly Butterfly

The Butterfly starts off with a relatively low POP-in this case about 47%- but with proper adjustments made at the right time, is a high Probability Strategy over a wide Range. This one is starting Delta negative and so will require more aggressive adjustments on the upside.

A good adjustment requires that Delta be cut by a third to a half and if possible, more theta be introduced into the Trade. In this case the idea is to & #39;Condorize& #39; the Butterfly by buying a CE side BF on the upside or a PE side BF on the downside.

My estimate is that theTrade will require a Gross Margin of Rs 87k less the Premium of Rs 32k per lot making for a Net Margin of Rs 55k per lot. My Profit Target is 50% of the Max Profit 7DTE which currently is about Rs 14k per lot or about 25% and my SL is 20% or Rs 11k per lot

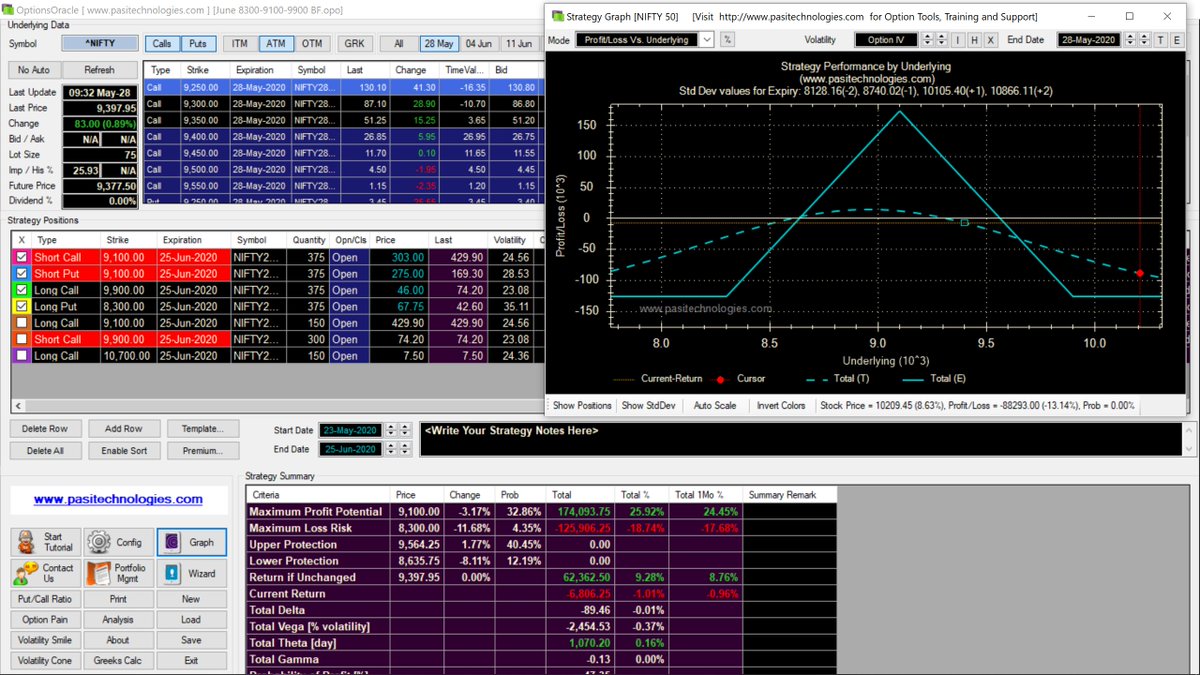

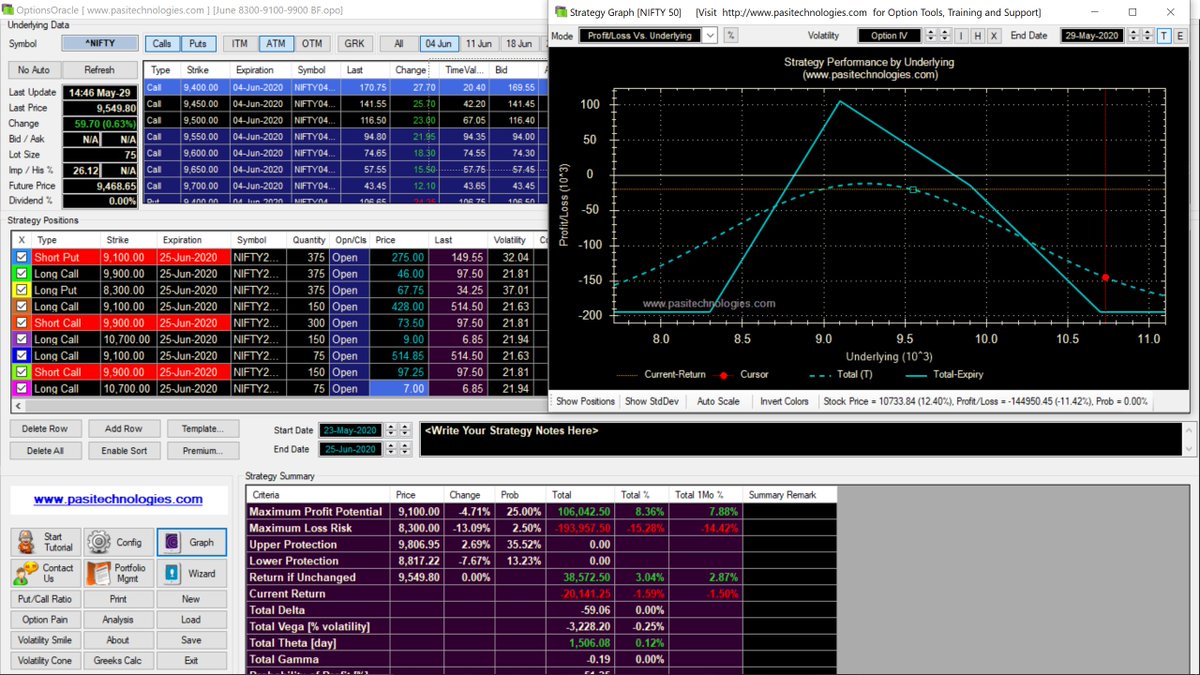

Hated doing it and will probably repent it, but Rules are Rules. Made the adjustment and reduced Delta by half. Adjusting so early in the Trade has a terrible impact on Profit Target which is now down to about 30k.

The first Priority is always to keep Delta under control and adjust at the right time to be able to stay in the Trade as long as possible to let Theta work even if multiple adjustments are required. The next adjustment point is around 9500-9550

On the positive side, the fall in Volitility is helping the Position and inspite of a move of over 300 points in 2 days, the MTM loss is only around 5k

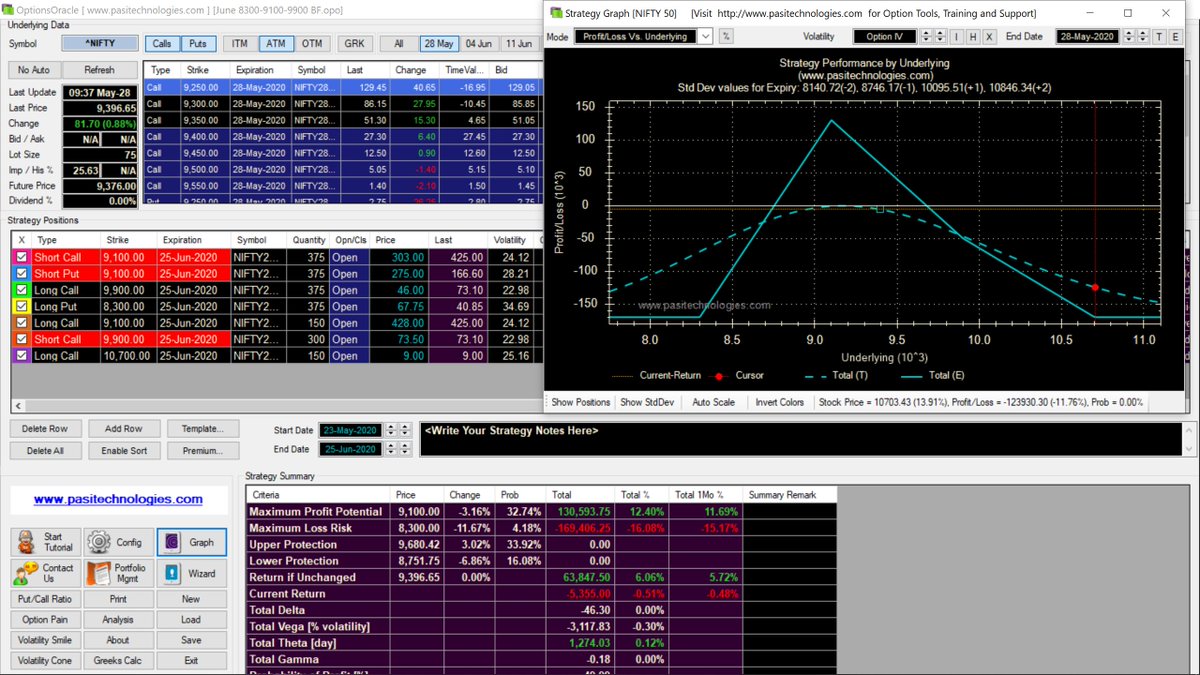

A 500 Point or over 5% move in just 2 days can never be good for a Delta Neutral Strategy. But we are still ok thanks to a drop in Volatility. The next adjustment will be at 9550 where I will buy 3 more CE BF& #39;s and convert the Position to a Condor-5x8300/9100 and 2x9900/10700

Another bad day for the Trade. The Market just keeps going up! Don& #39;t want to adjust because the Dow Futures are down and there is the Trump PC in the evening. Also every adjustment reduces potential Profit. But Deltas are high so buying 1 BF to cut them by a fourth.

This also added a runway of 120 Points on the upside BE. But cost 24k of Potential Profit. Will add the balance 2 BF& #39;s if the Market continues up.

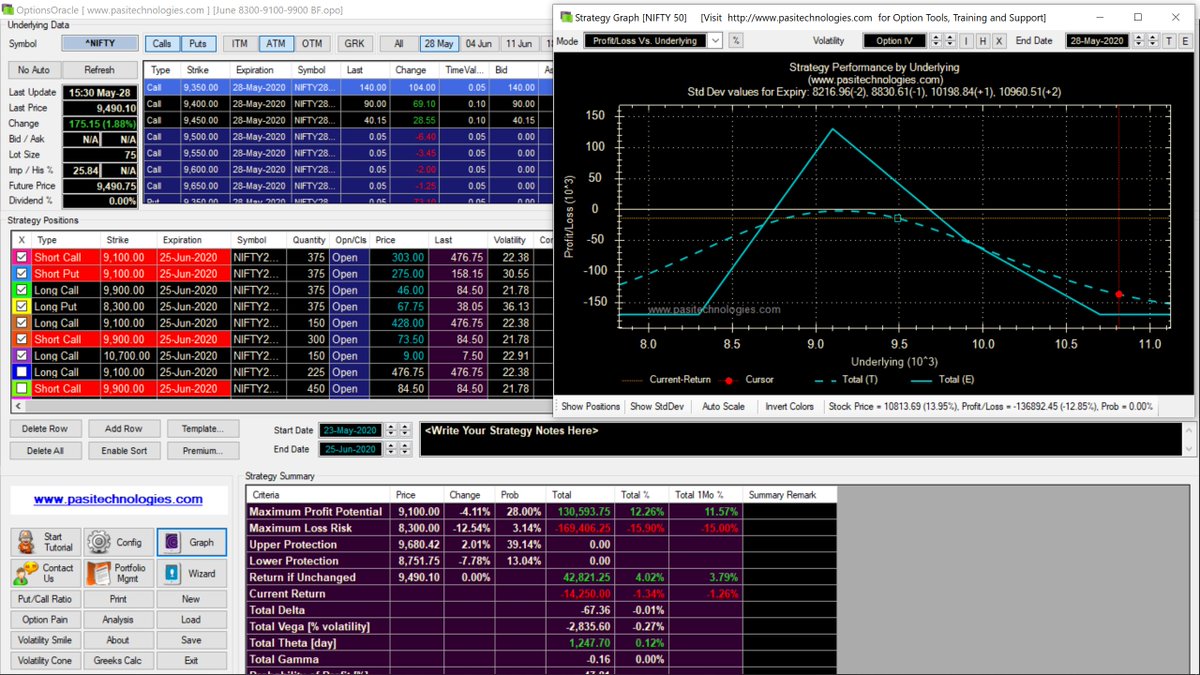

Sudden violent upmove in just 3 days so early in the Trade has damaged RR of the Trade. Normally would have converted to Iron Condor and then rolled the CE side up by 200 if Market had continued up.If Market continues up, instead of adjusting, will exit and establish fresh BF

Read on Twitter

Read on Twitter