FORD MOTOR - 2020 Q1

Ford has now submitted its 10Q to the SEC

Quick Highlights

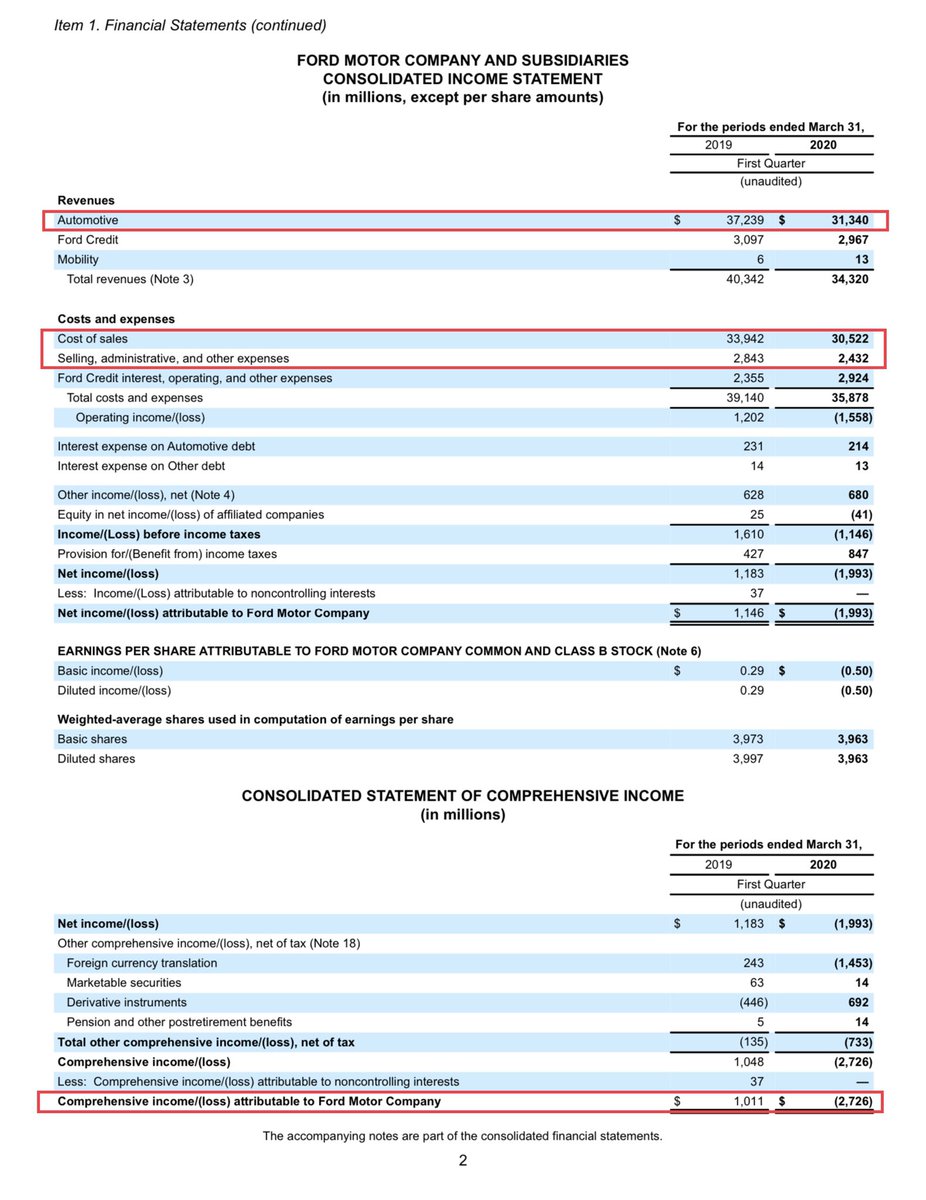

INCOME STATEMENT

1. Revenues fell by -15.8% YOY to $31.340 billion from $37.239 billion

2. Automotive Gross Margin fell to 2.6% from 8.9%

3. SG&A was reduced by $0.411 billion or -14.5%

Ford has now submitted its 10Q to the SEC

Quick Highlights

INCOME STATEMENT

1. Revenues fell by -15.8% YOY to $31.340 billion from $37.239 billion

2. Automotive Gross Margin fell to 2.6% from 8.9%

3. SG&A was reduced by $0.411 billion or -14.5%

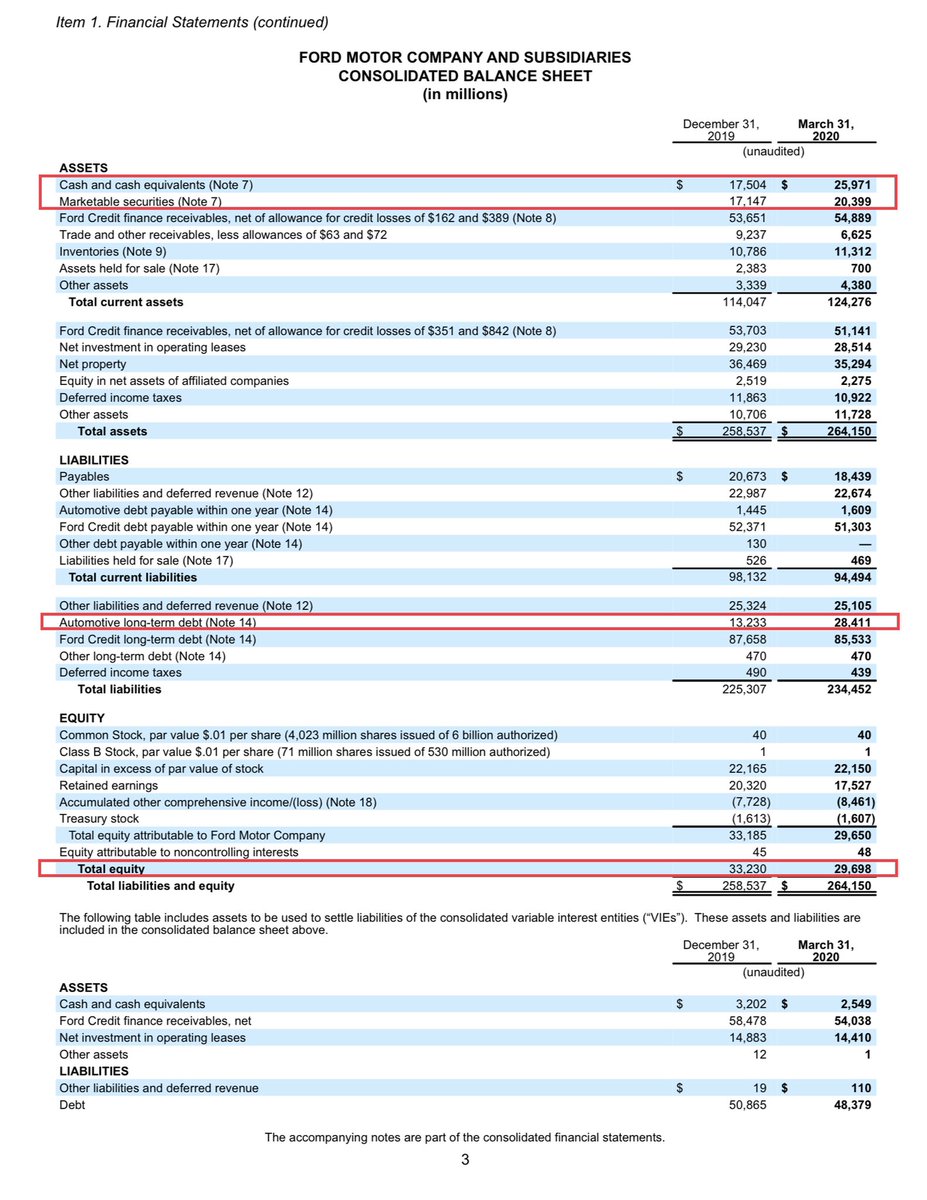

BALANCE SHEET

4. Shareholders Equity fell by -$3.532 billion QOQ to $26.698 billion

5. Automotive Long-Term Debt increased by +$15.178 billion QOQ

6. Cash + Marketable Securities increased by +$11.719 billion QOQ

4. Shareholders Equity fell by -$3.532 billion QOQ to $26.698 billion

5. Automotive Long-Term Debt increased by +$15.178 billion QOQ

6. Cash + Marketable Securities increased by +$11.719 billion QOQ

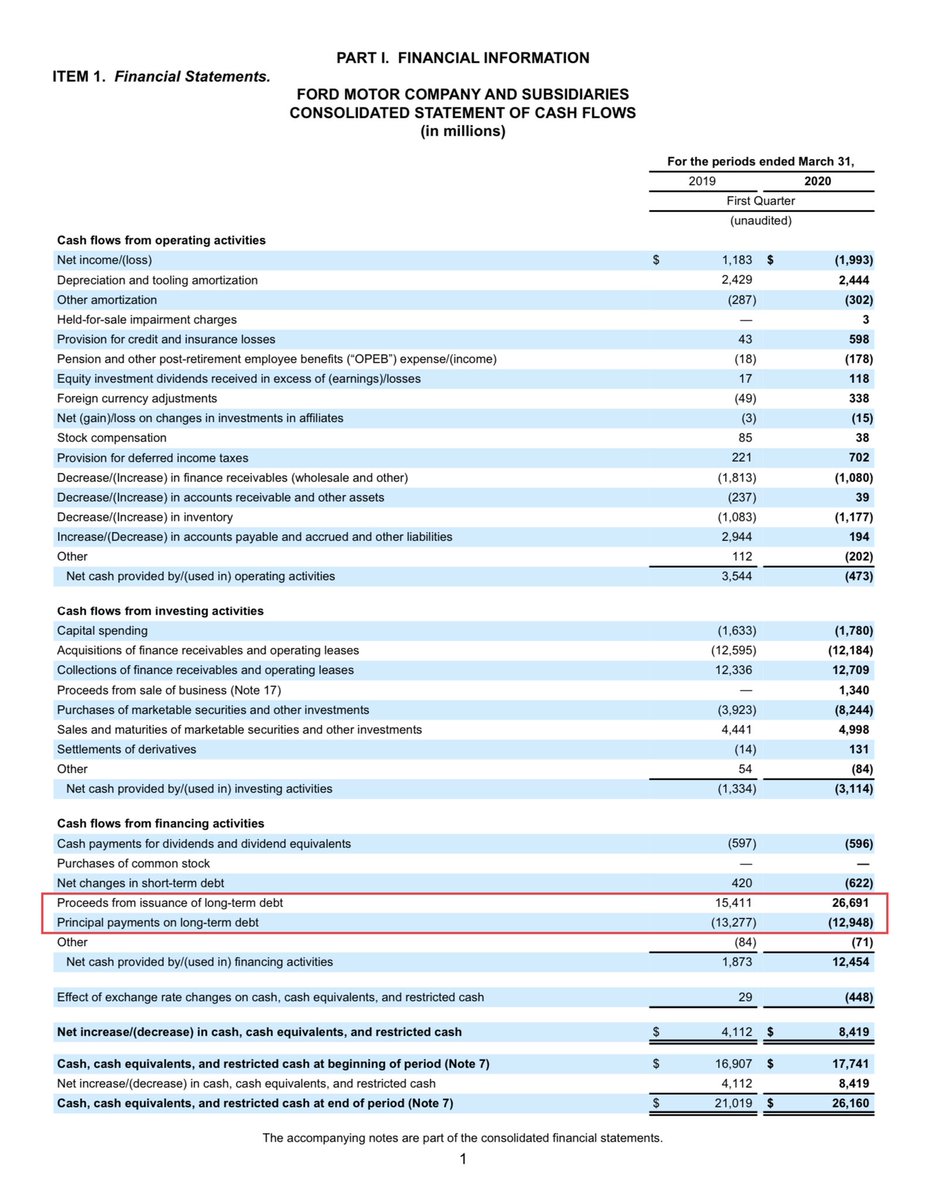

CASH FLOW STATEMENT

7. Net increase in Cash was +$8.419 billion QOQ

8. Payments on Long-Term Debt were -$12.948 billion QOQ

9. Proceeds from issuance of Long-Term Debt were +$26,691 billion QOQ

10. Dividend payments made were $596 million

7. Net increase in Cash was +$8.419 billion QOQ

8. Payments on Long-Term Debt were -$12.948 billion QOQ

9. Proceeds from issuance of Long-Term Debt were +$26,691 billion QOQ

10. Dividend payments made were $596 million

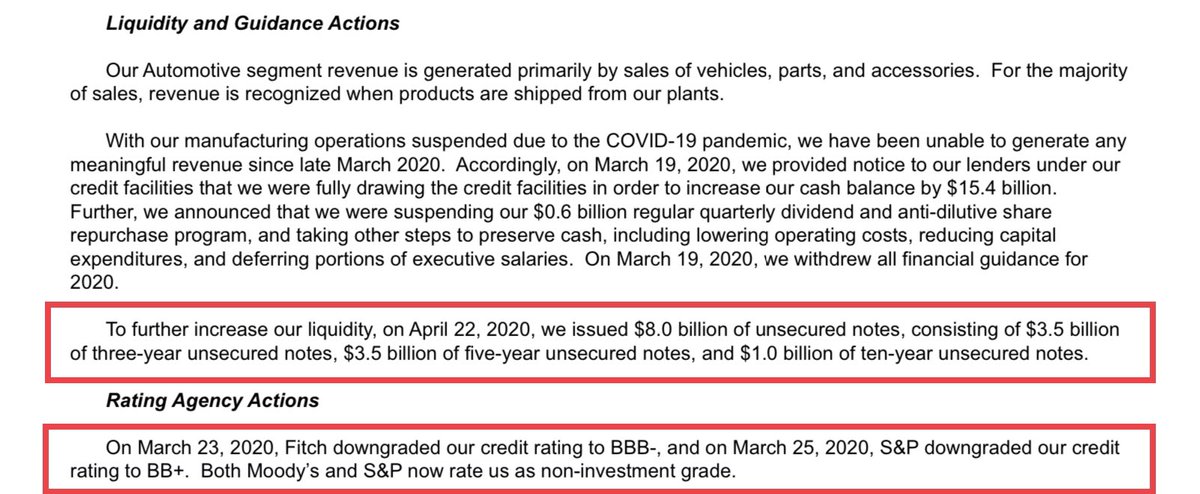

COMMENTS

A. Revenues must be expected to fall for 2020 Q2

B. Losses must be expected to increase for 2020 Q2

C. Cash Outflows must be expected to increase during 2020 Q2

- Accounts Payable balance is -$18.439 billion

- Accounts Receivable balance is only $6.625 billion

A. Revenues must be expected to fall for 2020 Q2

B. Losses must be expected to increase for 2020 Q2

C. Cash Outflows must be expected to increase during 2020 Q2

- Accounts Payable balance is -$18.439 billion

- Accounts Receivable balance is only $6.625 billion

Read on Twitter

Read on Twitter