Folk let us talk Money. Let us talk STOCKS, EQUITIES and How to Identify and profit from emerging OPPORTUNITIES. Short Thread. I don’t know about you, but the VIRUS outbreak has been very rewarding to Equity investors...DEPENDING ON what sectors they are invested in.

The truth is, investing money is a lot of hard work. One of the worst feelings you can ever have as an investor is losing money. It is even worse when you lose other people’s money. With that in mind, ONE , question often asked is; How do I know what to Buy as a new investor?

How do I spot and identify emerging opportunities? There is NO ONE WAY or easy way to do that. BUT, this virus has provided a fairly good template for doing just that. But I will give you one or two hints in this short thread.

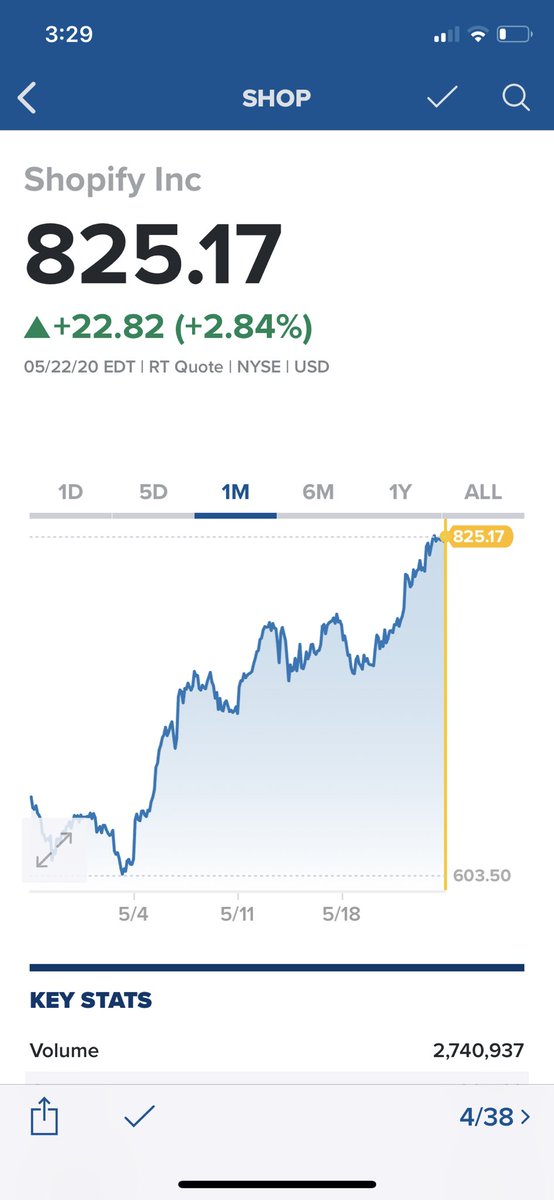

Suppose you have identified two companies you want to invest in. Let us for this thread use Google and Shopify to explain. One of the FIRST two metrics you WANT TO PAY attention to, is, % of ownership by INSTITUTIONS. That is, what % is owned by INSTITUTIONS?

In the case of these two companies, large mutual funds and institutions including government agencies have pension funds in BILLIONS invested in them. Both of these have 68%++ institutional ownership. THIS IS VERY important because, institutions are in for a long time!

Read on Twitter

Read on Twitter