Quick  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇨🇦" title="Flag of Canada" aria-label="Emoji: Flag of Canada"> risk thread for #fintwit.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇨🇦" title="Flag of Canada" aria-label="Emoji: Flag of Canada"> risk thread for #fintwit.

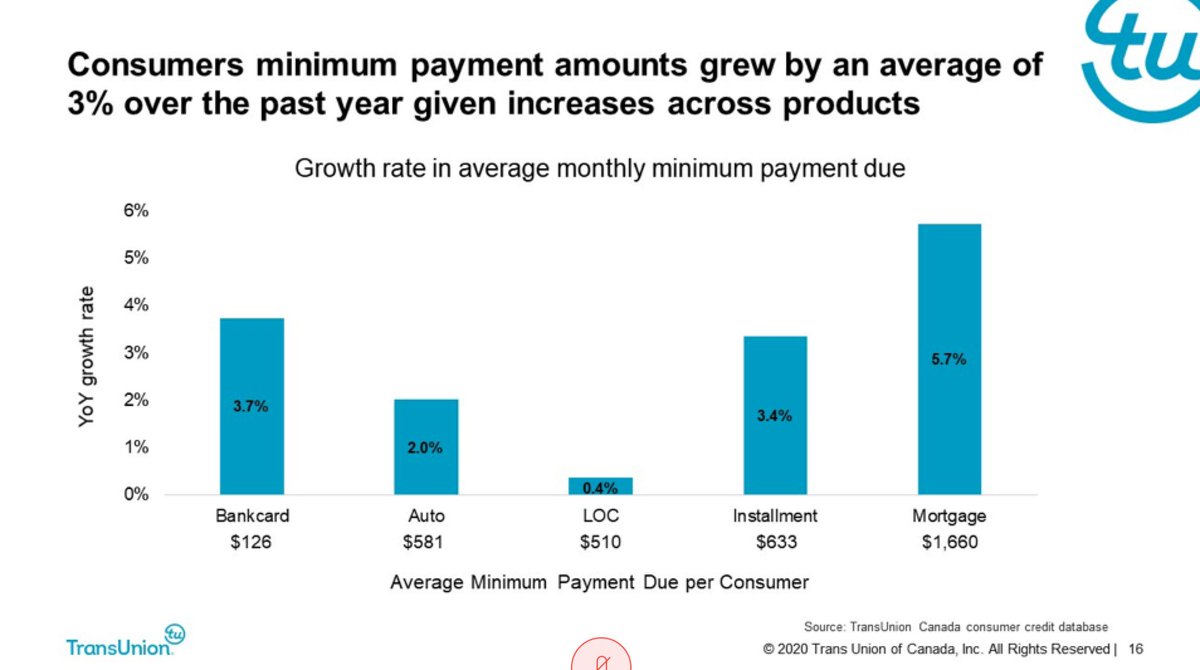

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇨🇦" title="Flag of Canada" aria-label="Emoji: Flag of Canada"> households saw minimum payments rise 3 points higher than inflation. That extra income going to servicing debt, and not recirculated in the economy.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇨🇦" title="Flag of Canada" aria-label="Emoji: Flag of Canada"> households saw minimum payments rise 3 points higher than inflation. That extra income going to servicing debt, and not recirculated in the economy.

btw, the closer borrowers are to min. payments, the riskier they are to borrowers.

btw, the closer borrowers are to min. payments, the riskier they are to borrowers.

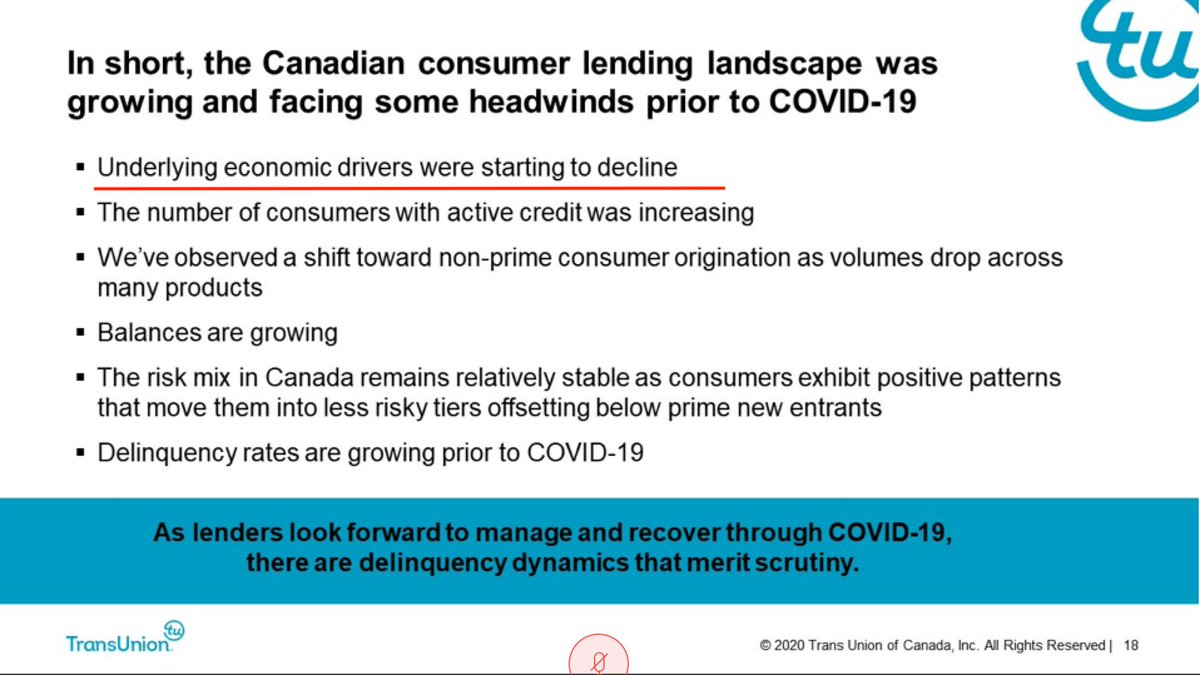

Consumers: The economy was amazing before COVID19.

Risk firms behind the scene: The economy was deteriorating before COVID19.

Risk firms behind the scene: The economy was deteriorating before COVID19.

Canada& #39;s bet on the oil industry was an execution for a lot of people. This was pre-COVID-19 btw.

Good thing we& #39;re doubling down on oil, and we& #39;ll get some more people in an industry that depends on precarious employment.

Good thing we& #39;re doubling down on oil, and we& #39;ll get some more people in an industry that depends on precarious employment.

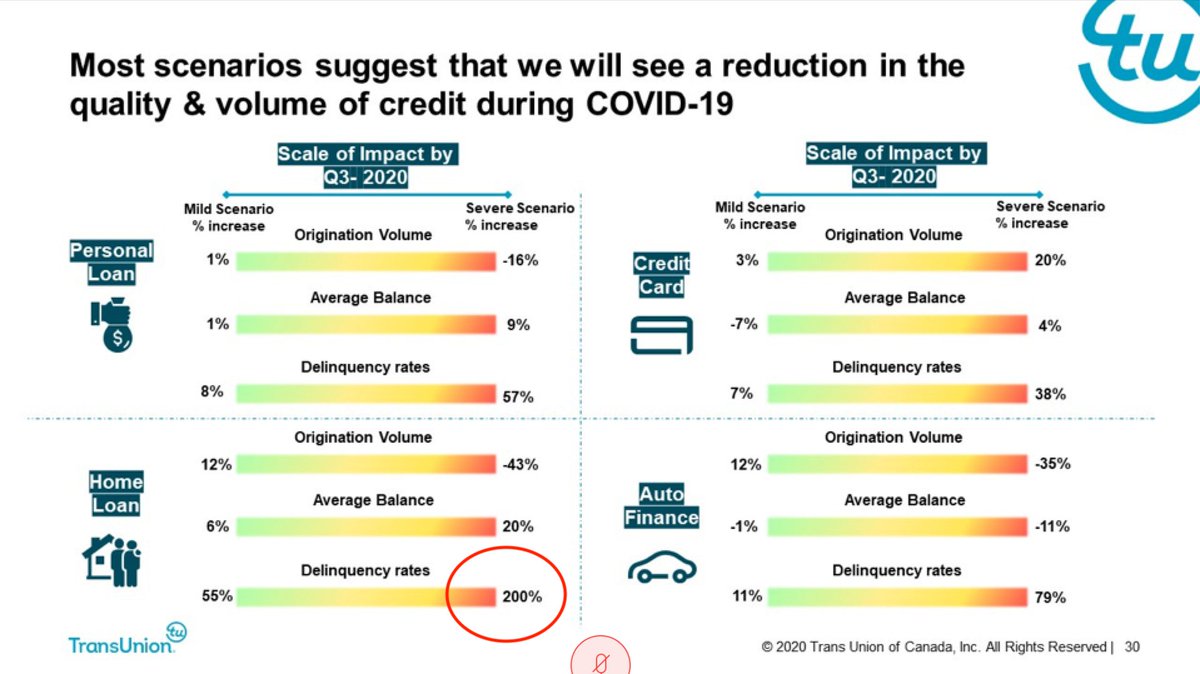

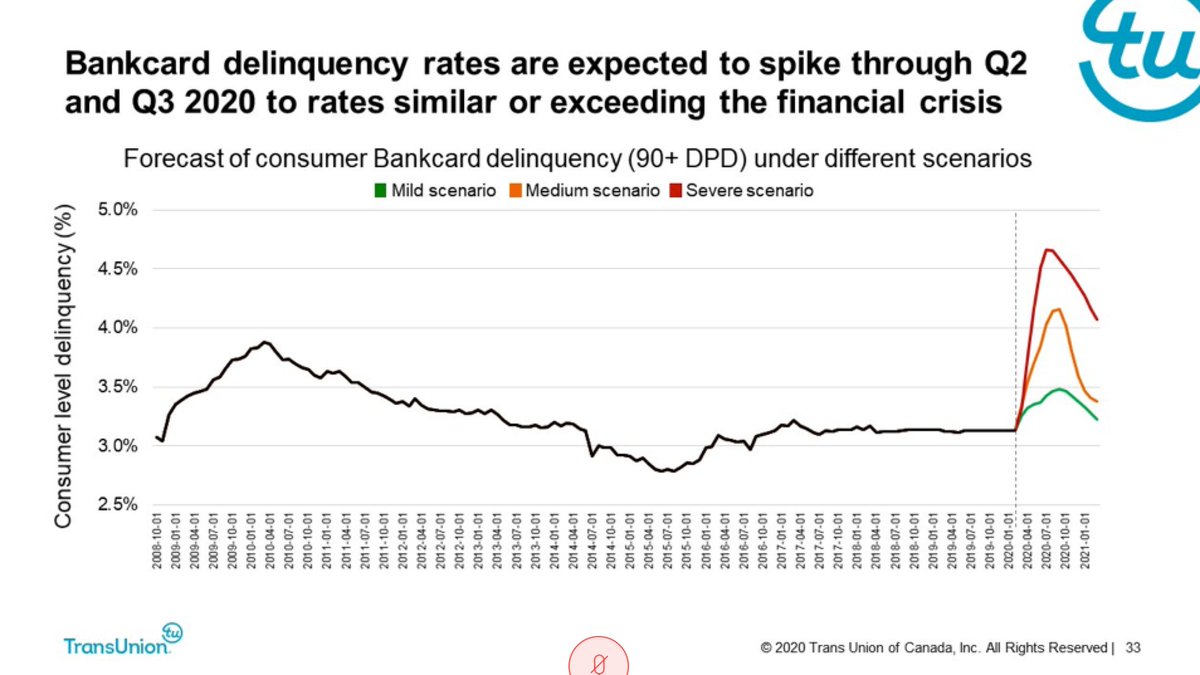

TransUnion is forecasting a "severe" scenario for credit. They originally thought it was going to be "medium," but indicators recently moved to severe.

Bank card delinquencies are going to make a big jump.

Remember, they& #39;re now expecting the severe scenario.

Remember, they& #39;re now expecting the severe scenario.

TransUnion developed an index to tell lenders how much they can lose on each borrower over the next 24 months.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Face with tears of joy" aria-label="Emoji: Face with tears of joy">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Face with tears of joy" aria-label="Emoji: Face with tears of joy">

*sweats in lender*

*sweats in lender*

Read on Twitter

Read on Twitter risk thread for #fintwit.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇨🇦" title="Flag of Canada" aria-label="Emoji: Flag of Canada"> households saw minimum payments rise 3 points higher than inflation. That extra income going to servicing debt, and not recirculated in the economy. btw, the closer borrowers are to min. payments, the riskier they are to borrowers." title="Quick https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇨🇦" title="Flag of Canada" aria-label="Emoji: Flag of Canada"> risk thread for #fintwit.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇨🇦" title="Flag of Canada" aria-label="Emoji: Flag of Canada"> households saw minimum payments rise 3 points higher than inflation. That extra income going to servicing debt, and not recirculated in the economy. btw, the closer borrowers are to min. payments, the riskier they are to borrowers." class="img-responsive" style="max-width:100%;"/>

risk thread for #fintwit.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇨🇦" title="Flag of Canada" aria-label="Emoji: Flag of Canada"> households saw minimum payments rise 3 points higher than inflation. That extra income going to servicing debt, and not recirculated in the economy. btw, the closer borrowers are to min. payments, the riskier they are to borrowers." title="Quick https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇨🇦" title="Flag of Canada" aria-label="Emoji: Flag of Canada"> risk thread for #fintwit.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🇨🇦" title="Flag of Canada" aria-label="Emoji: Flag of Canada"> households saw minimum payments rise 3 points higher than inflation. That extra income going to servicing debt, and not recirculated in the economy. btw, the closer borrowers are to min. payments, the riskier they are to borrowers." class="img-responsive" style="max-width:100%;"/>

*sweats in lender*" title="TransUnion developed an index to tell lenders how much they can lose on each borrower over the next 24 months. https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Face with tears of joy" aria-label="Emoji: Face with tears of joy"> *sweats in lender*" class="img-responsive" style="max-width:100%;"/>

*sweats in lender*" title="TransUnion developed an index to tell lenders how much they can lose on each borrower over the next 24 months. https://abs.twimg.com/emoji/v2/... draggable="false" alt="😂" title="Face with tears of joy" aria-label="Emoji: Face with tears of joy"> *sweats in lender*" class="img-responsive" style="max-width:100%;"/>