Regional Rural Banks were formed in Sept 1975 (Ordinance), later "RRB Act 1976 " recommendation of "Narsimhan Committee" to provide inclusive Credit & Banking Services in Rural areas where more that 70% Population lives.

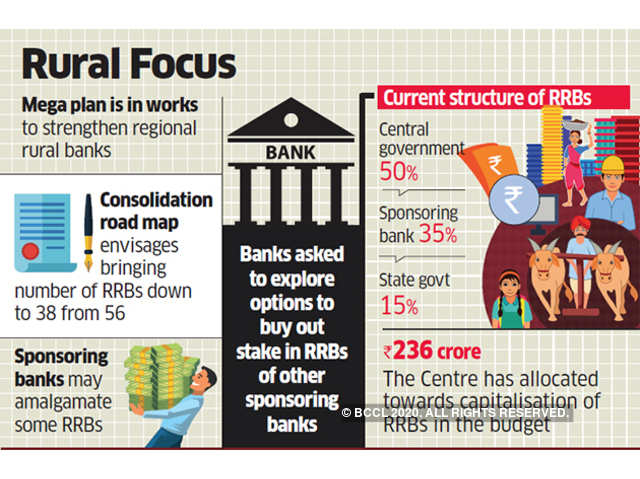

Stake as 50:15:35 (Central/State/SponsorBank)

#GraminBank

Stake as 50:15:35 (Central/State/SponsorBank)

#GraminBank

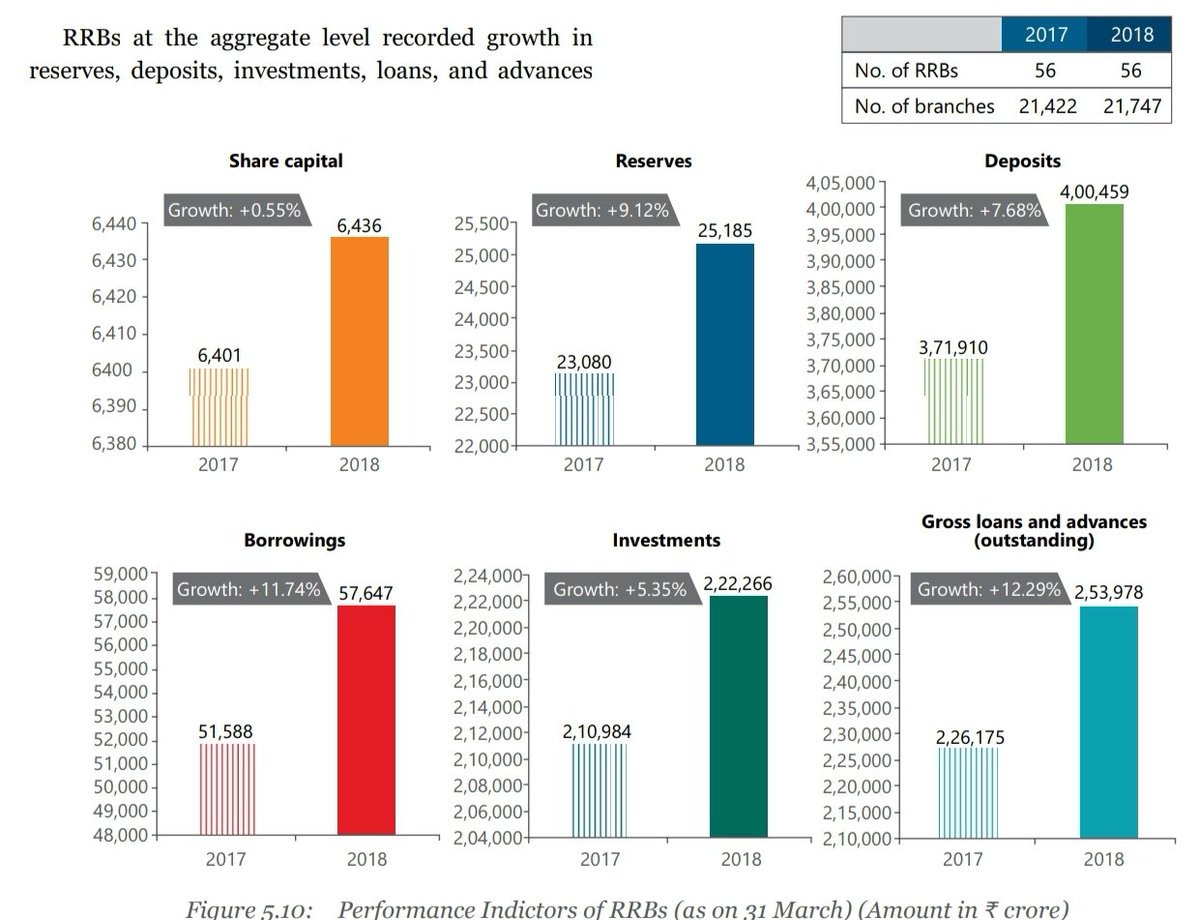

The number of Regional Rural Banks (RRBs) stood at 56 as on 31 March 2019 with a branch network of 21,747. RRBs at the aggregate level recorded growth in reserves, deposits, investments, loans, and advances. At present 43 #GraminBank in functioning, 95% branches in Most Interiors

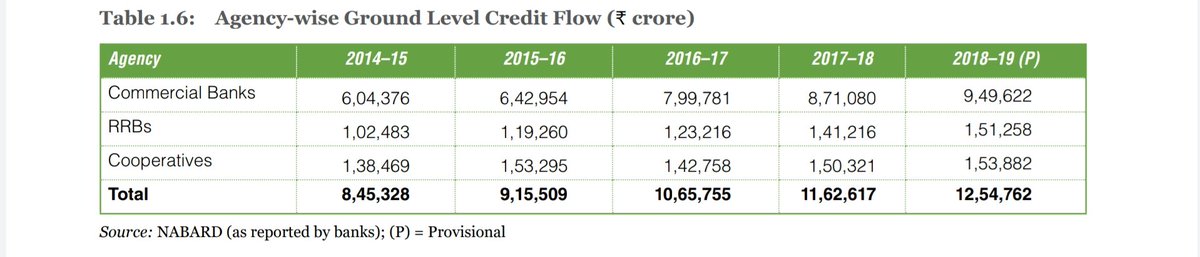

Credit flow in #GraminBank increased rapidly due to their geographical distribution & in-depth reach in rural areas, its comparatively low to PSBs but bifurcation of Credit reveals that RRBs r ahead of Pvt Banks in Rural Credits as it& #39;s Key Service area of RRBs!!

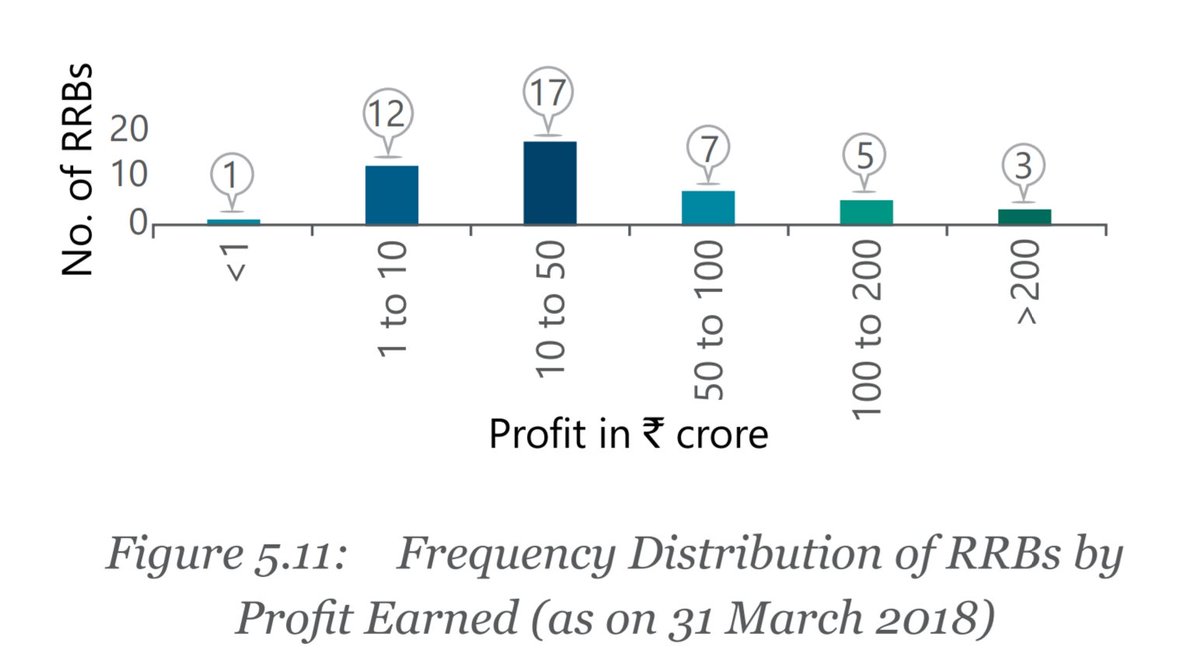

During 2017-18,

8 RRBs earned profits more than ₹100 crore

13 RRBs recorded profit of

less than ₹10 crore

Rising NPAs is a concern for RRBs, also a major factor for increase in number of loss making

& low profit earning #GraminBank, mainly due to Stressed Agri Sector..

8 RRBs earned profits more than ₹100 crore

13 RRBs recorded profit of

less than ₹10 crore

Rising NPAs is a concern for RRBs, also a major factor for increase in number of loss making

& low profit earning #GraminBank, mainly due to Stressed Agri Sector..

Phase-I amalgamation of RRBs was initiated in 2005–06, Num of RRBs reduced to 82 by 2010

In Phase II (2011-12) No of RRBs was brought down to 56 in 2014–15.

In Phase III in 2018–19 on d principle of & #39;1State–1RRB’ As on 31/3/2019 there were 53 #GraminBank which now 43 at present!!

In Phase II (2011-12) No of RRBs was brought down to 56 in 2014–15.

In Phase III in 2018–19 on d principle of & #39;1State–1RRB’ As on 31/3/2019 there were 53 #GraminBank which now 43 at present!!

Since inception of #GraminBank its ensured that they shall be functioning mainly to Rural Area, Employees & Branches of RRBs also treated in same way. Mostly branches doesn& #39;t have coolers available (ACs in RRBs branches r joke), also in many branches even toilets r not available

Getting promoted is a Real Nightmare in #GraminBank unlike their Sponsor banks!!

From clerical to Officer it takes 5-8Years while in PSBs in takes 2-3 Years only.

Scale 1 to Scale 2 also takes 6-8 Years whereas in PSBs one can be Scale 3-4 in that time.

Really de-motivating!!

From clerical to Officer it takes 5-8Years while in PSBs in takes 2-3 Years only.

Scale 1 to Scale 2 also takes 6-8 Years whereas in PSBs one can be Scale 3-4 in that time.

Really de-motivating!!

In implementation of social security schemes #GraminBank r way ahead to Private Banks.

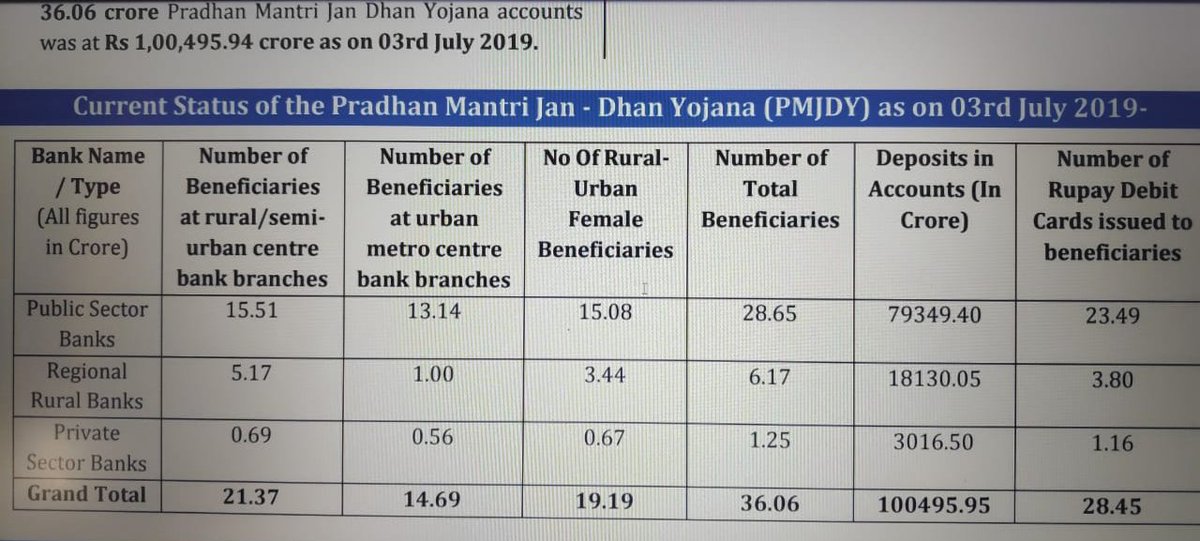

As of 3.7.2019 out of 36.06 Crore PMDJY A/c, 6.17 Crore Ac was maintained by RRBs whereas only 1.25 Crore Ac was with Pvt Banks.

Same goes with PMJBY/PMSBY/Atal Pension schemes!!

As of 3.7.2019 out of 36.06 Crore PMDJY A/c, 6.17 Crore Ac was maintained by RRBs whereas only 1.25 Crore Ac was with Pvt Banks.

Same goes with PMJBY/PMSBY/Atal Pension schemes!!

Read on Twitter

Read on Twitter