1/ After observing @FTX_Official& #39;s new #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> hash rate futures contracts since their recent launch, I have a few observations below

https://abs.twimg.com/hashflags... draggable="false" alt=""> hash rate futures contracts since their recent launch, I have a few observations below

Definitely not trading advice! https://help.ftx.com/hc/en-us/articles/360043631671-Hashrate-Futures-Specs">https://help.ftx.com/hc/en-us/...

Definitely not trading advice! https://help.ftx.com/hc/en-us/articles/360043631671-Hashrate-Futures-Specs">https://help.ftx.com/hc/en-us/...

2/ Firstly, great work by the @FTX_Official team on launching the first publicly tradable mining related product  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👏" title="Clapping hands sign" aria-label="Emoji: Clapping hands sign"> This is a step towards providing industry participants with the tools required to partially hedge mining operations and speculate on Bitcoin’s hash rate

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👏" title="Clapping hands sign" aria-label="Emoji: Clapping hands sign"> This is a step towards providing industry participants with the tools required to partially hedge mining operations and speculate on Bitcoin’s hash rate

3/ However, naming it a hash rate product is misleading, as it is really a difficulty product. This is an important distinction as hash rate represents a timely portrayal of mining activity, whereas difficulty levels can lag hash rate by up to 2016 blocks (~2 weeks)

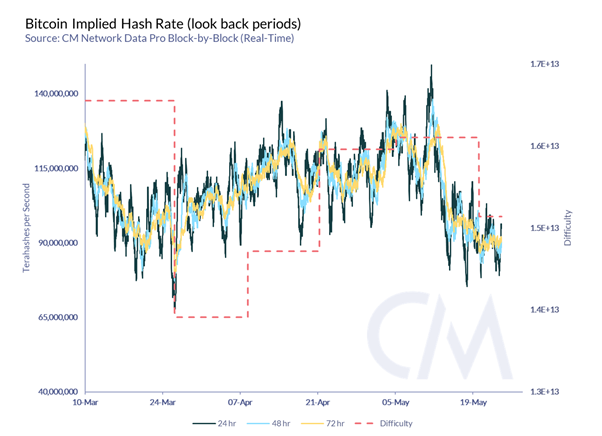

4/ Notice in the below how difficulty adjusts depending on the previous epoch& #39;s hash rate levels

5/ This is an important distinction for traders to understand, as the Q32020 contract will likely represent the hash rate from mid-June to mid-September, not July 1 to September 30

6/ Given this, it is foreseeable that the last two weeks plus of the contract become untradable, since once there is a difficulty adjustment after September 16, it is likely that the contracts settlement level is known by traders

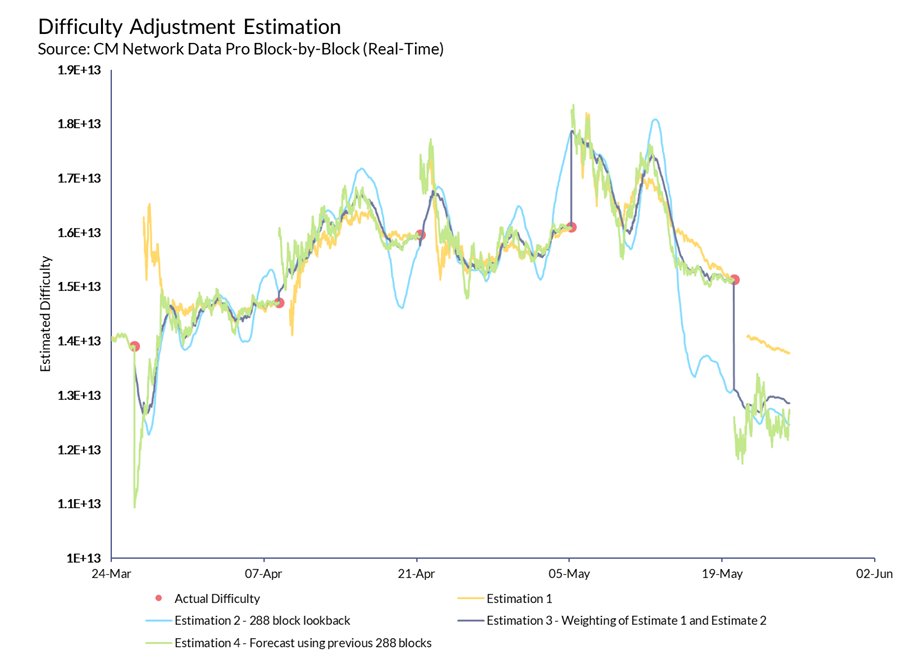

7/ Another interesting observation is that I am unsure how well the FTX trading community understands hash rate and difficulty. Based on my estimates, hash rate is set to drop ~16% to under 1.3E13

8/ Yes this is a noisy indicator as evidenced above, but when paired with other indicators since the last difficulty adjustment such as persistent slow block times (~12 mins) and a hash rate of ~90TH/s, I’m pretty confident right now in estimation 2,3 and 4

9/ So unless there are significant expectations that will lead to hash rate becoming cheaper (or a significant BTC price increase), I’m unsure that the average hash rate from mid-June to mid-September will result in an average difficulty of 1.7E13

10/ #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">’s hash rate has to be 122 exahashes per second for difficulty to be 1.7E13, since the contract is an average, if it starts with hash rate at 1.3E13, assuming a linear increase, it would need to finish at 2.1E13, or a hash rate of 150 EH/s

https://abs.twimg.com/hashflags... draggable="false" alt="">’s hash rate has to be 122 exahashes per second for difficulty to be 1.7E13, since the contract is an average, if it starts with hash rate at 1.3E13, assuming a linear increase, it would need to finish at 2.1E13, or a hash rate of 150 EH/s

11/ Seems unlikely, but I am always wrong with predictions so...

To reiterate again, not investment advice!

To reiterate again, not investment advice!

Read on Twitter

Read on Twitter