Manchester United have announced financial results for Q3 of 2019/20, incorporating the first 9 months of the season. This covers January to March 2020, so provides some early insight into the impact of the football lockdown. Some thoughts in the following thread #MUFC

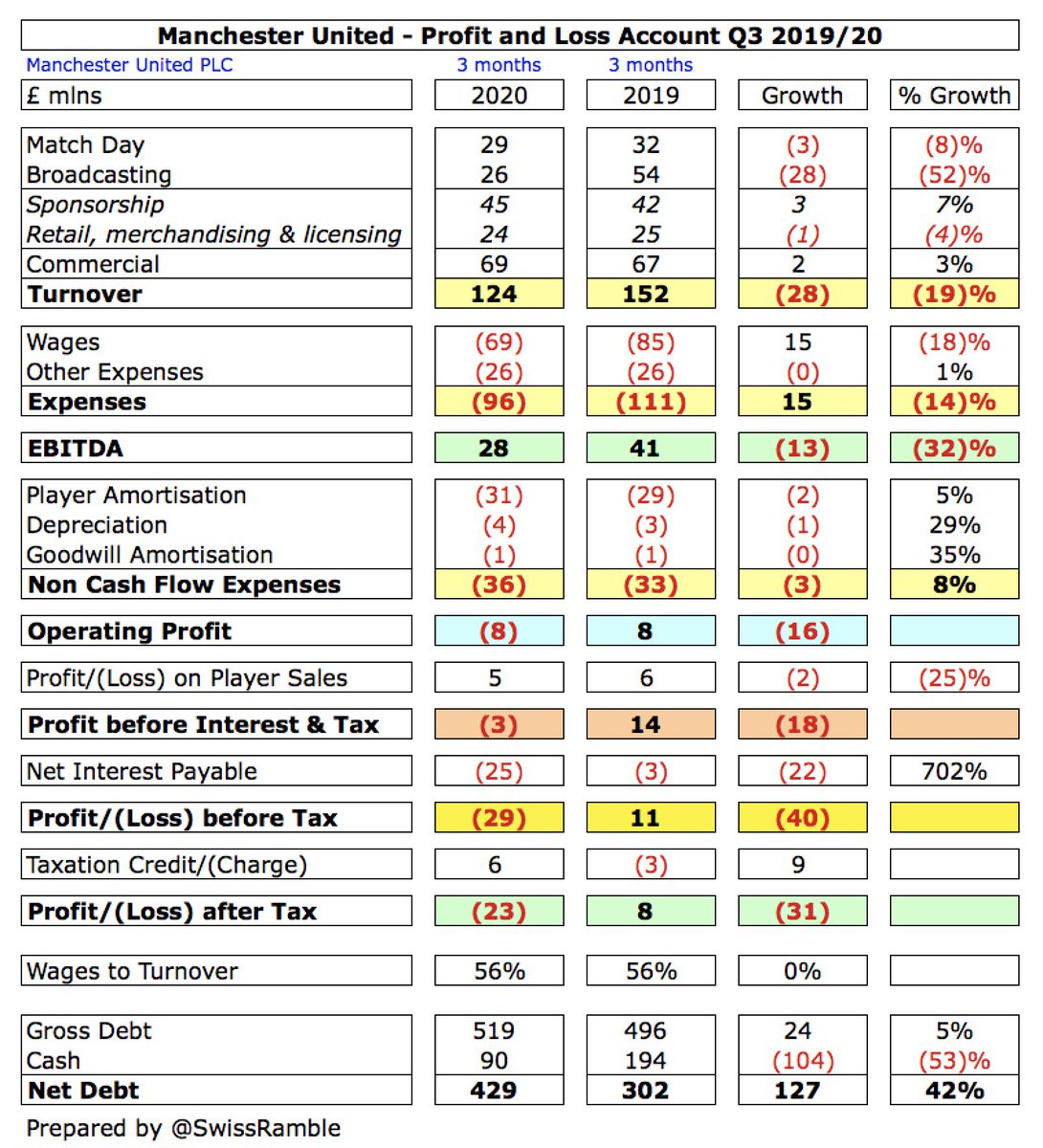

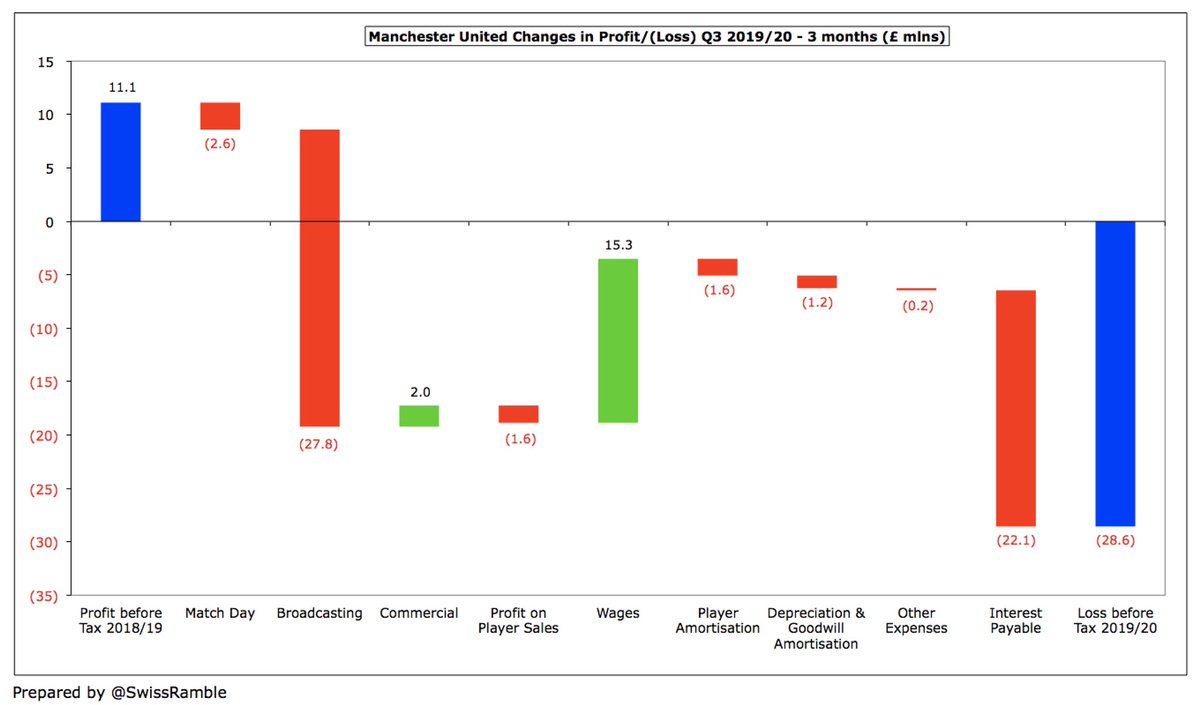

#MUFC swung from £11m profit before tax to £29m loss for Q3, as revenue fell by £28m (19%) from £152m to £124m, partly offset by £15m (18%) reduction in wages to £69m. Hit by interest payable rising £22m from £3m to £25m (forex losses). Loss after tax £23m due to £6m tax credit.

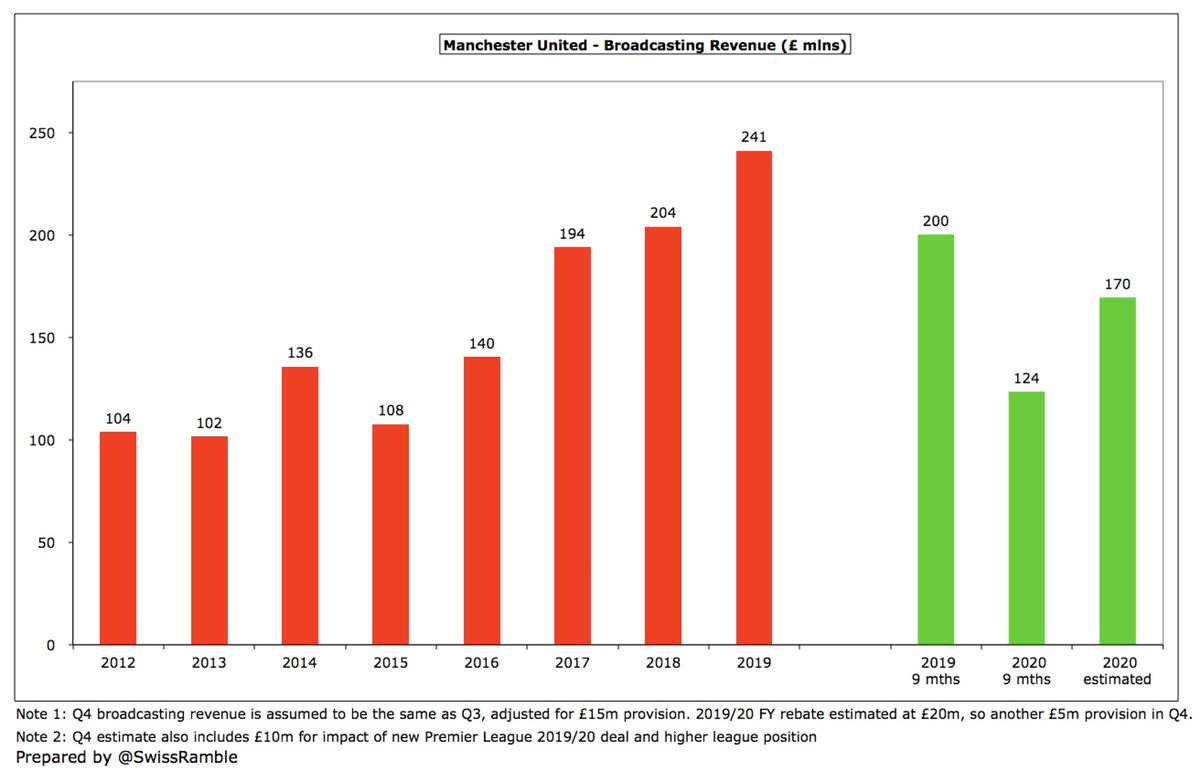

The main reason for #MUFC £28m revenue reduction was broadcasting, which more than halved from £54m to £26m, due to £15m provision for COVID-19 rebate and playing in the far less lucrative Europa League, compared to the previous season’s Champions League.

#MUFC match day income was down £3m (8%) to £29m, but commercial up £2m (3%) to £69m, thanks to new sponsors compensating for lower retail sales, e.g. Old Trafford Megastore closed from mid-March. CFO Cliff Baty said COVID-19 was responsible for £23m of £28m revenue decrease.

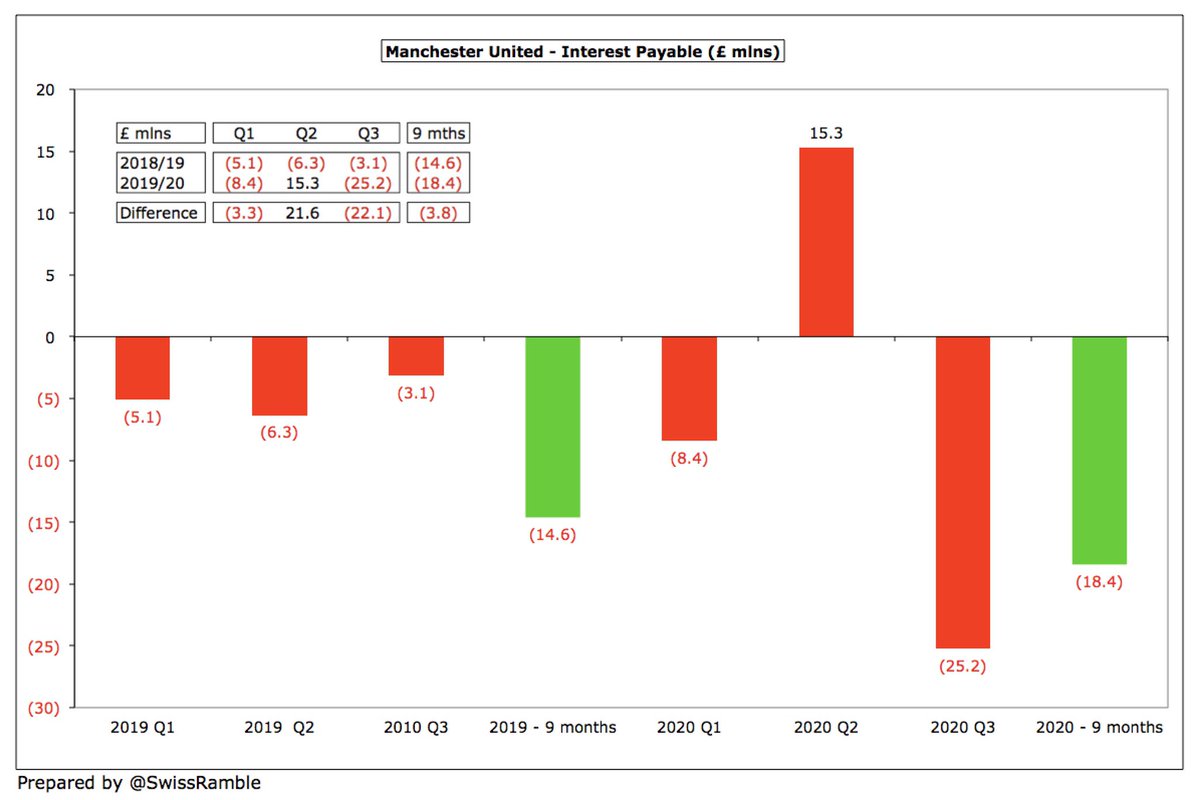

#MUFC increase in interest payable from £3m to £25m was very largely due to unrealised foreign exchange losses on the club’s debt, which is denominated in USD. This essentially reversed a similar sized gain in the previous quarter, so the net difference over 9 months is only £4m.

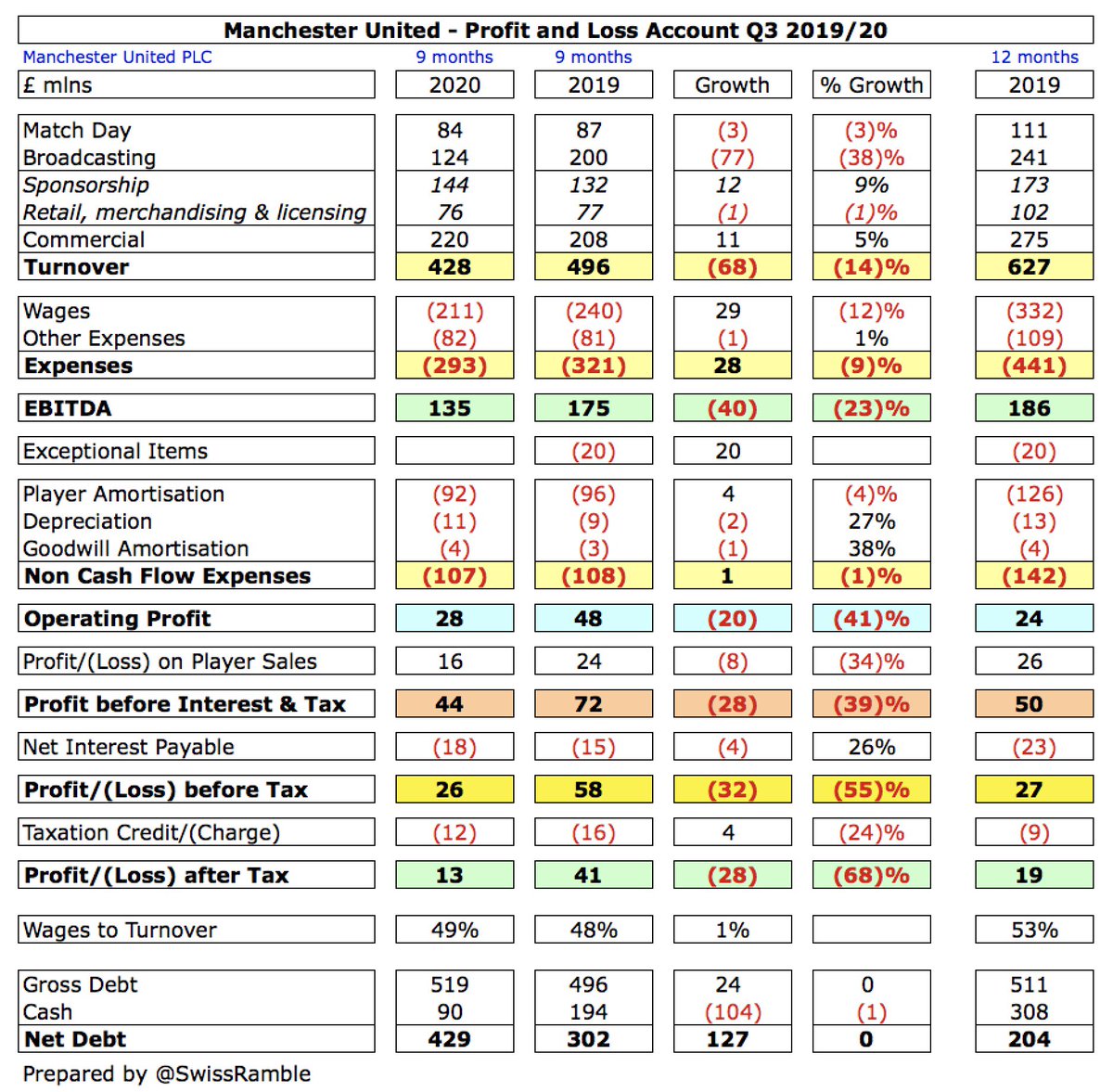

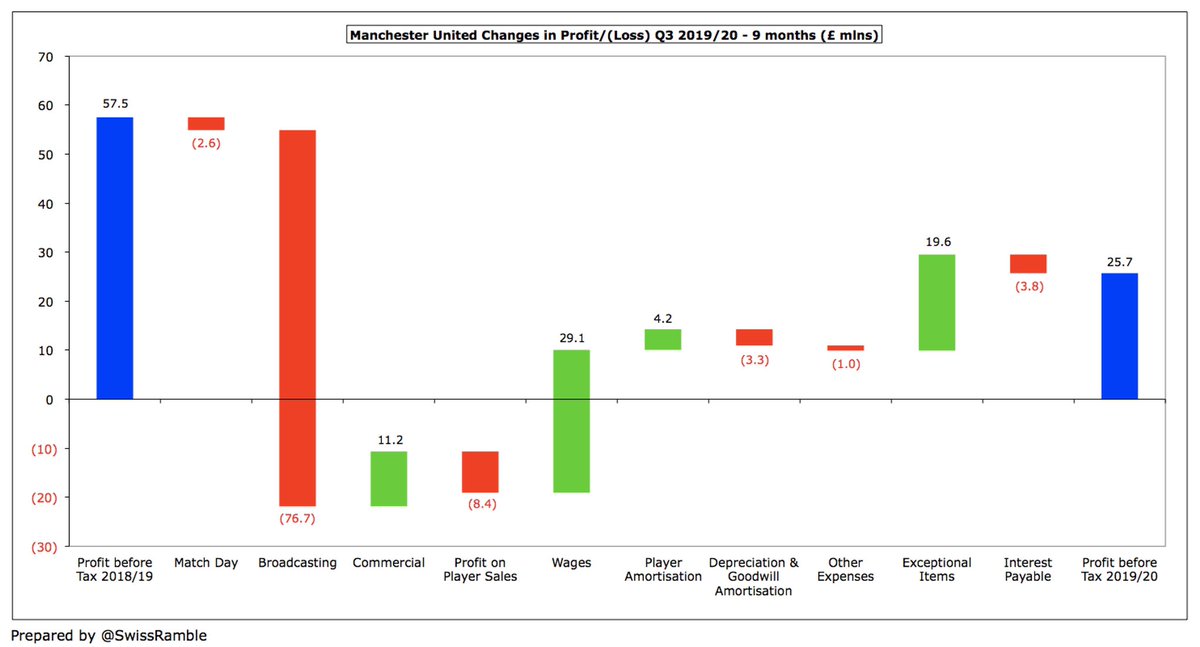

Over 9 months #MUFC still reported a pre-tax profit, though this dropped £32m from £58m to £26m, as revenue fell £68m (14%) from £496m to £428m and profit on player sales was down £8m to £16m. This was partly offset by a £45m reduction in expenses.

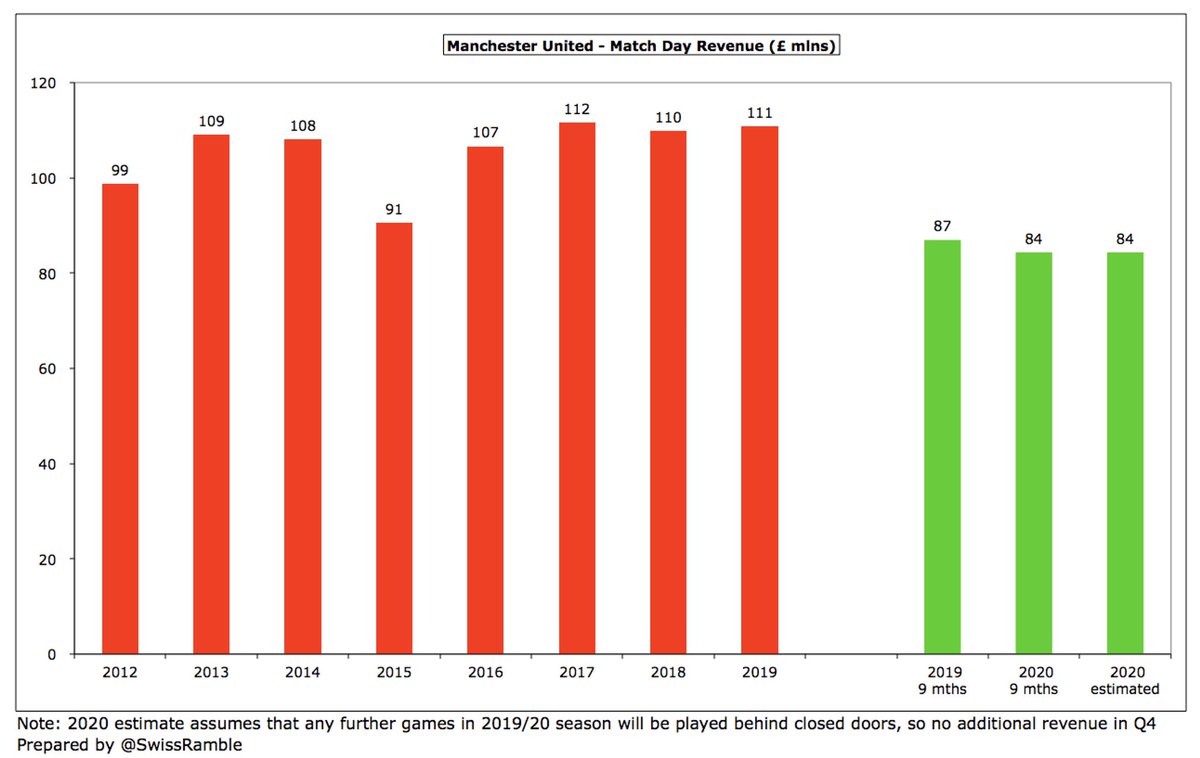

Over 9 months #MUFC £68m revenue reduction was again almost entirely due to £77m (38%) drop in broadcasting to £124m. Match day was slightly down £3m (3%) to £84m, but new sponsors contributed to £11m (5%) growth in commercial to £220m.

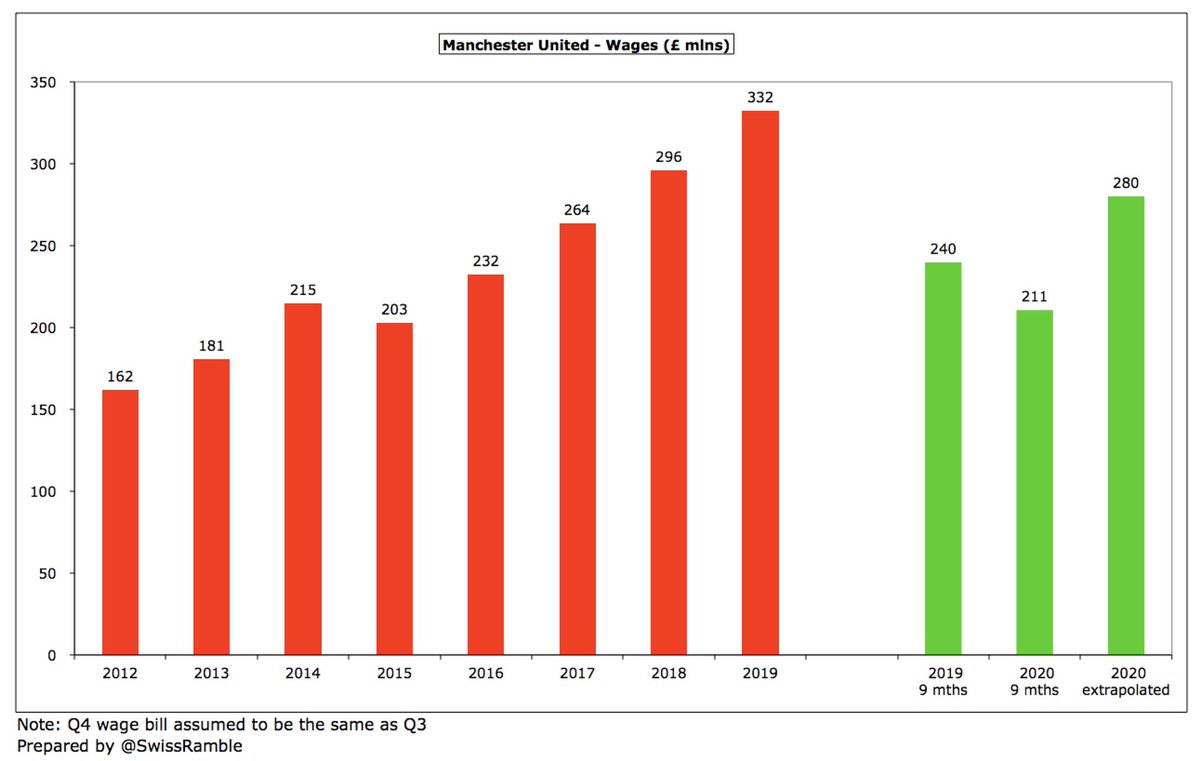

Over 9 months #MUFC wage bill fell £29m (12%) to £211m, driven by lower bonus payments, while player amortisation was cut £4m (4%) to £92m. However, depreciation rose £2m to £11m. Figures were boosted by no repeat of prior season’s £20m pay-off to Mourinho and his coaching staff.

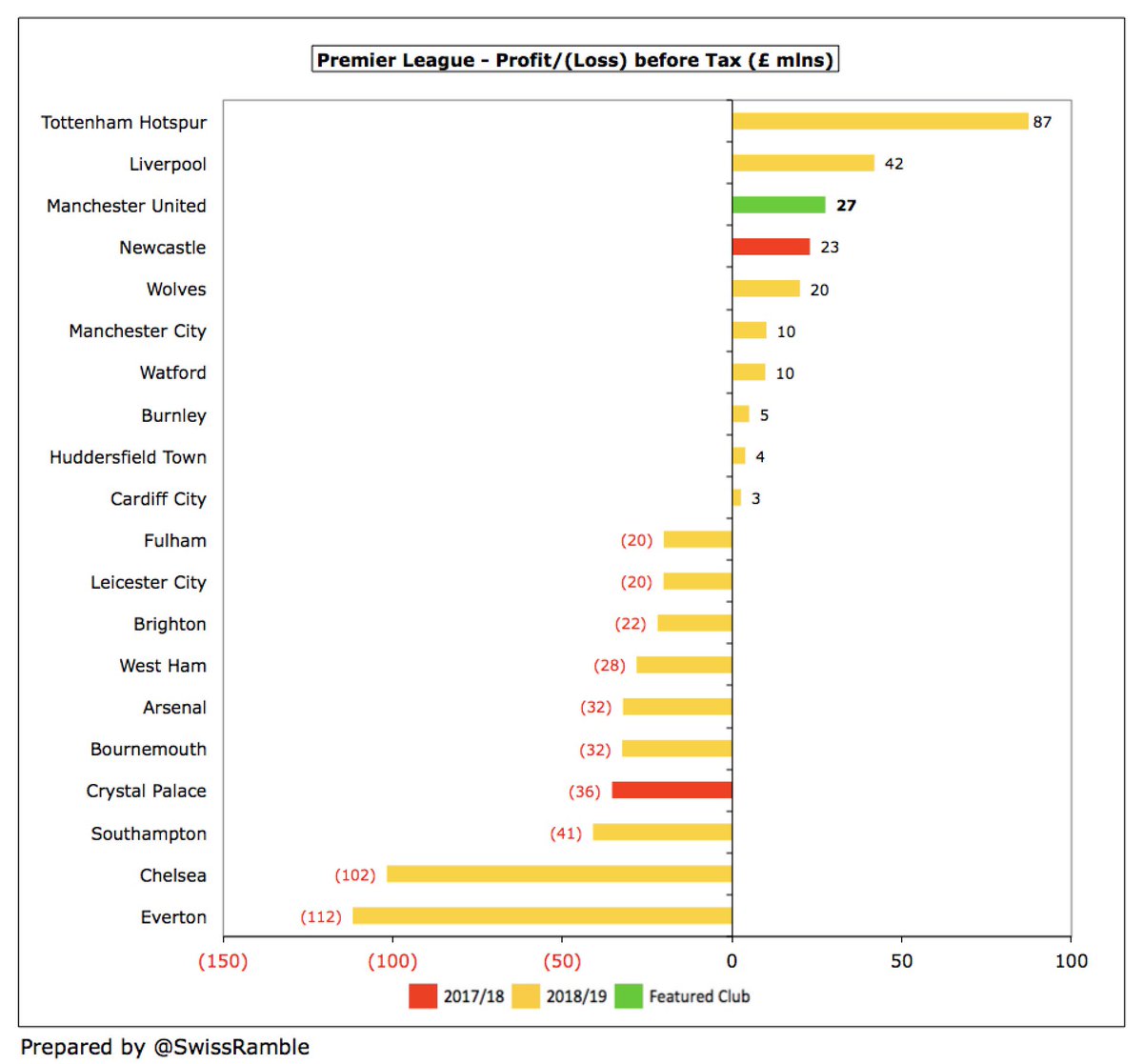

It is worth noting that #MUFC £26m profit over 9 months in 2019/20 is better than every other Premier League club’s financial result last season, except for #THFC and #MUFC. Everything is relative – and half the clubs in the top flight lost money even before Coronavirus.

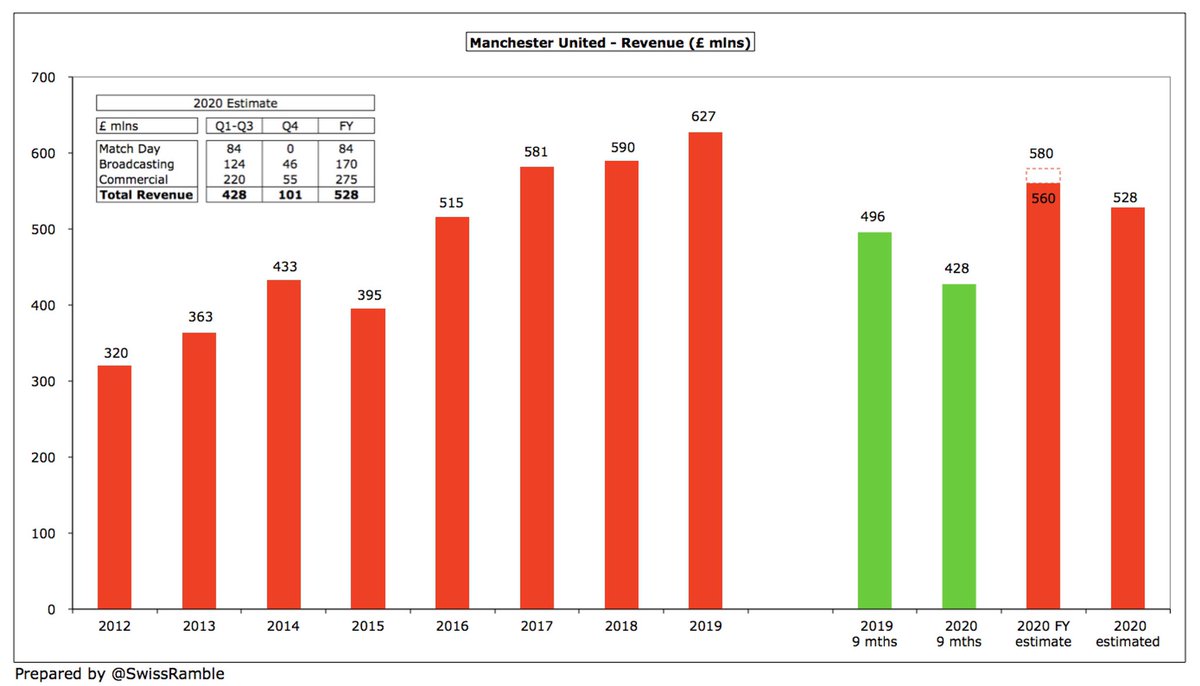

#MUFC had already forecast a fall in revenue in 2019/20 from £627m to £560-580m, but are no longer providing guidance, due to COVID-19 uncertainty. However, based on a few quick assumptions, I am estimating £528m, which would represent a £99m (16%) decrease from prior season.

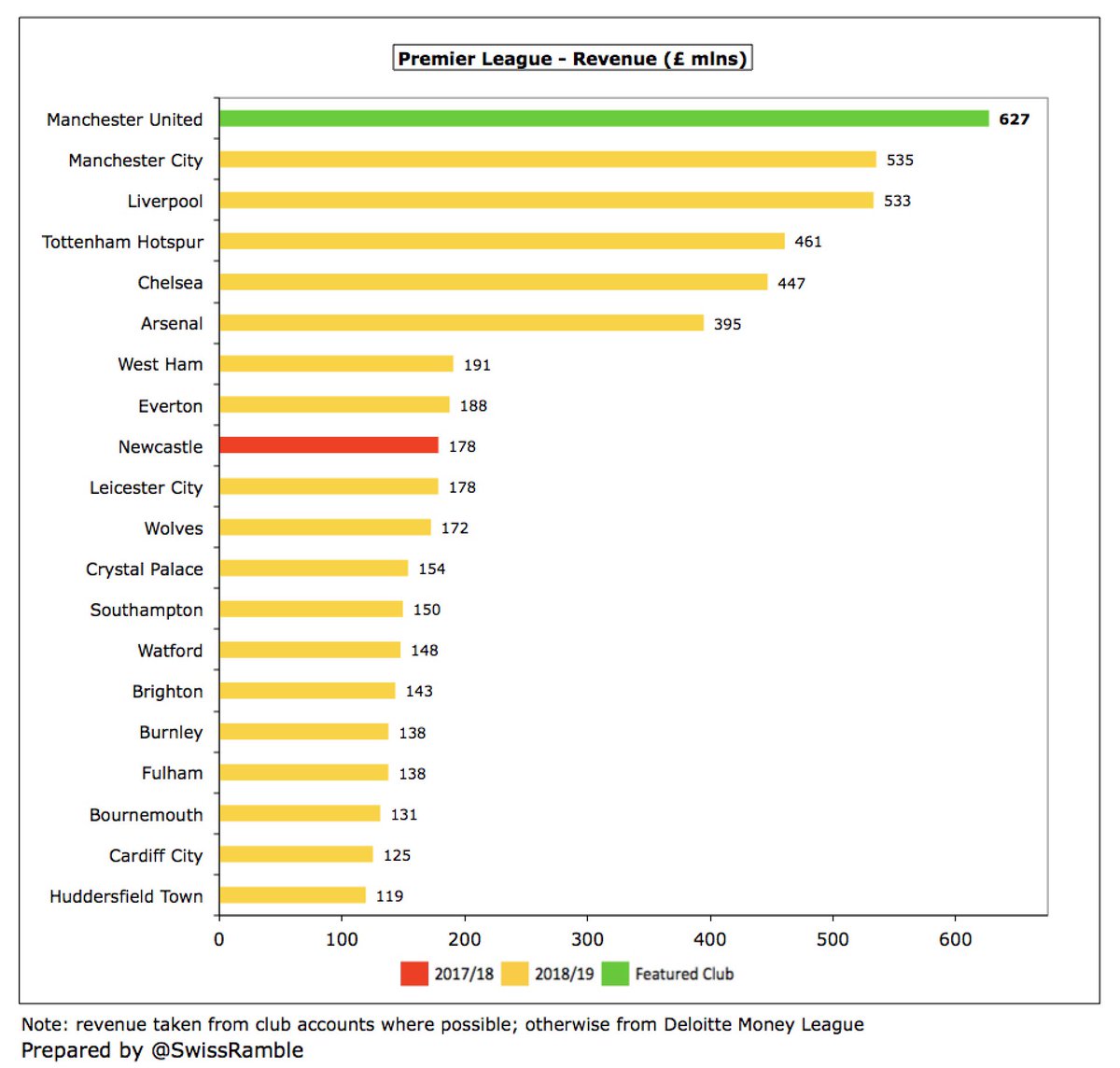

To place this into perspective, #MUFC £627m was by far the highest revenue in the Premier League in 2018/19, around £100m ahead of #MCFC £535m and #LFC £533m. That said, there was a good chance of those clubs overtaking them in 2019/20, due to United playing in the Europa League.

If we assume that all #MUFC remaining games in the 2019/20 season will be played behind closed doors, they will not earn any more match day income in Q4, so their total for the season will remain at £84m, which would be £27m (24%) lower than prior season’s £111m.

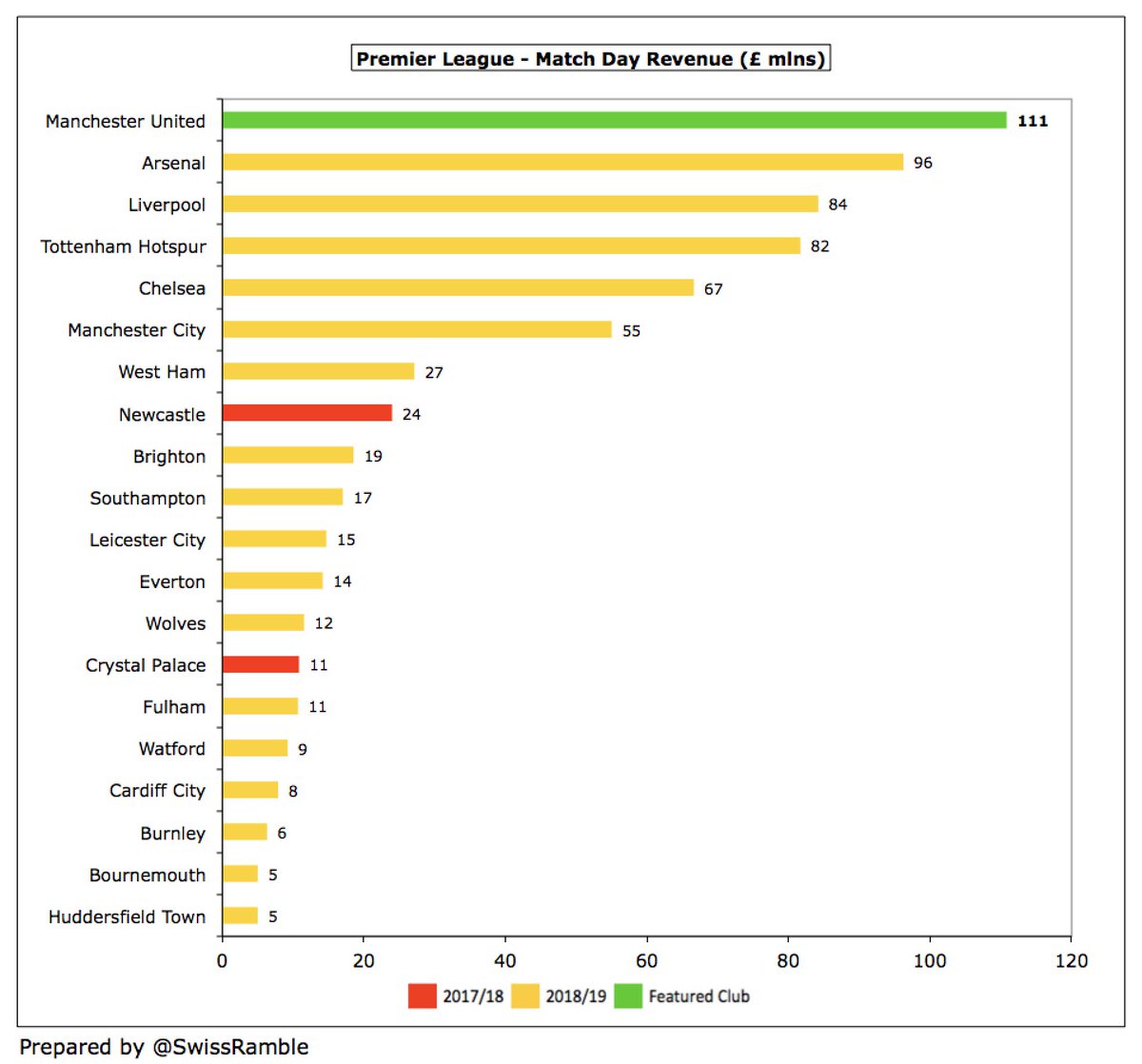

Again, #MUFC lead the way in the Premier League with match day income of £111m, comfortably more than #AFC £96m, #LFC £84m, #THFC £82m and #CFC £67m. Looked at another way, they have more to lose without fans coming to the stadium, though it represents only 18% of total revenue.

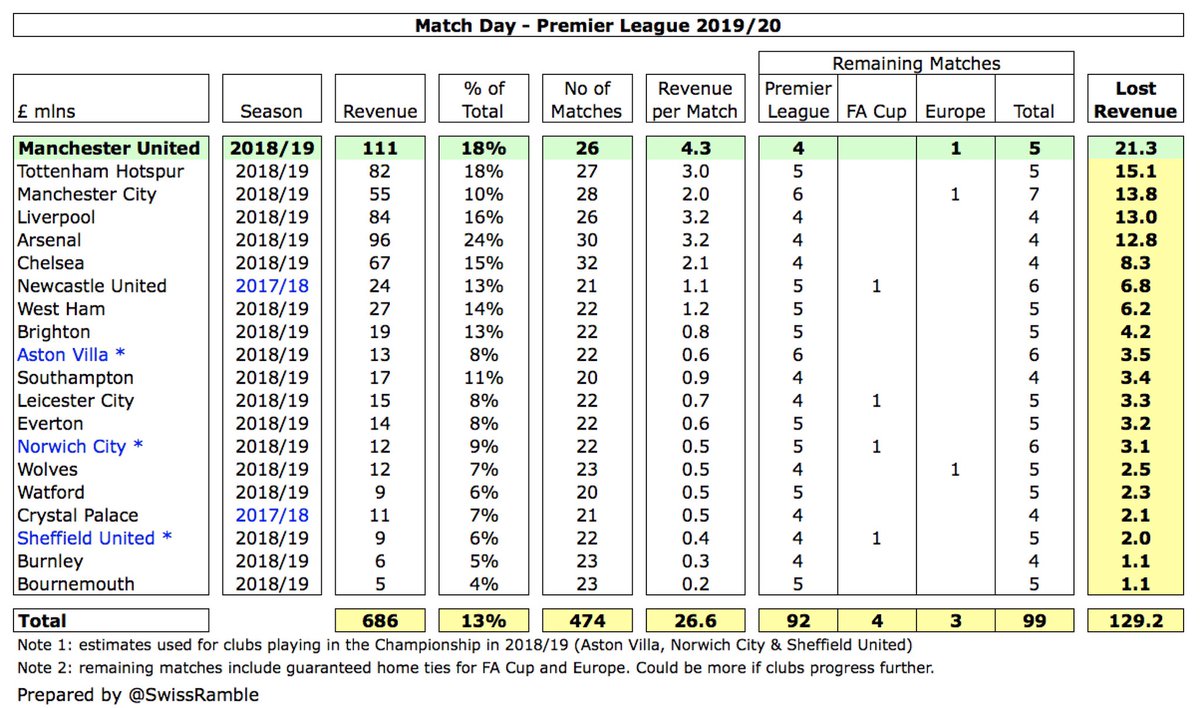

Based on average revenue per game, #MUFC will lose £21m match day income if their 5 remaining home games (4 Premier League, 1 Europa League) are played behind closed doors. Will be even higher if they progress in Europa League or FA Cup. Club has confirmed pro-rata ST rebates.

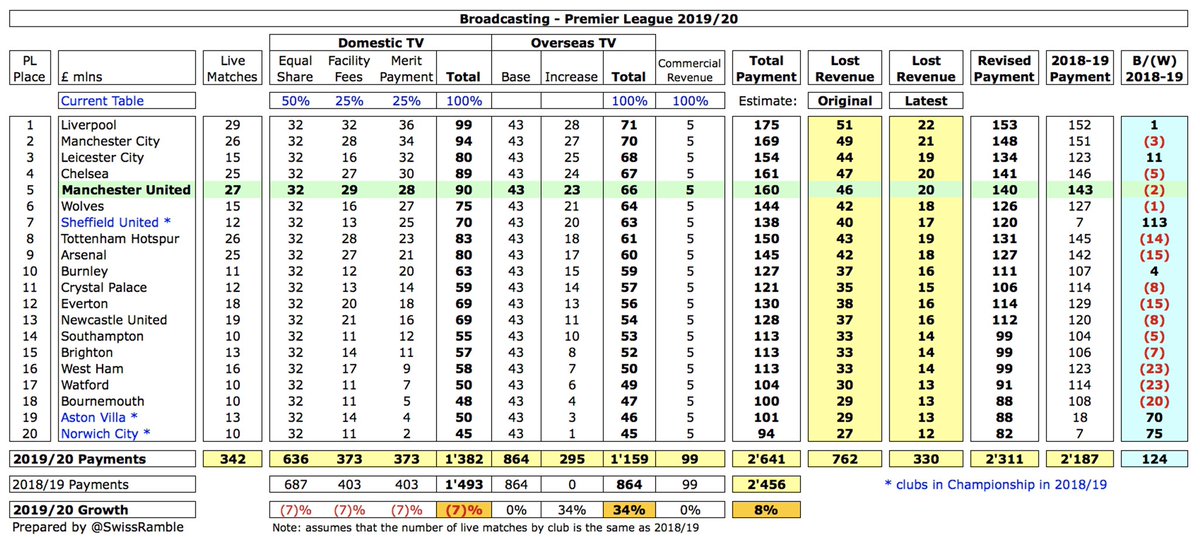

Q3 TV income includes £15m provision for #MUFC share of Premier League rebate to broadcasters, which would mean £20m for the full year. This is in line with my model, based on media reports of £330m rebate if games played behind closed doors (original £762m assumed no restart).

It is worth noting that 2019/20 TV deal is 8% higher than previous season (domestic down 7%, overseas up 34%), so loss compared to 2018/19 would be partially offset, especially as overseas increase is based on league position, e.g. #MUFC loss would be net £2m (instead of £20m).

On the basis that Q3 £15m provision covers ¾ of the 2019/20 rebate, Q4 would include a £5m provision, so TV revenue would be £10m higher than Q3. I’ve also included £10m for new PL deal and higher #MUFC league position, which would give £170m, thus £71m (30%) lower than 2018/19.

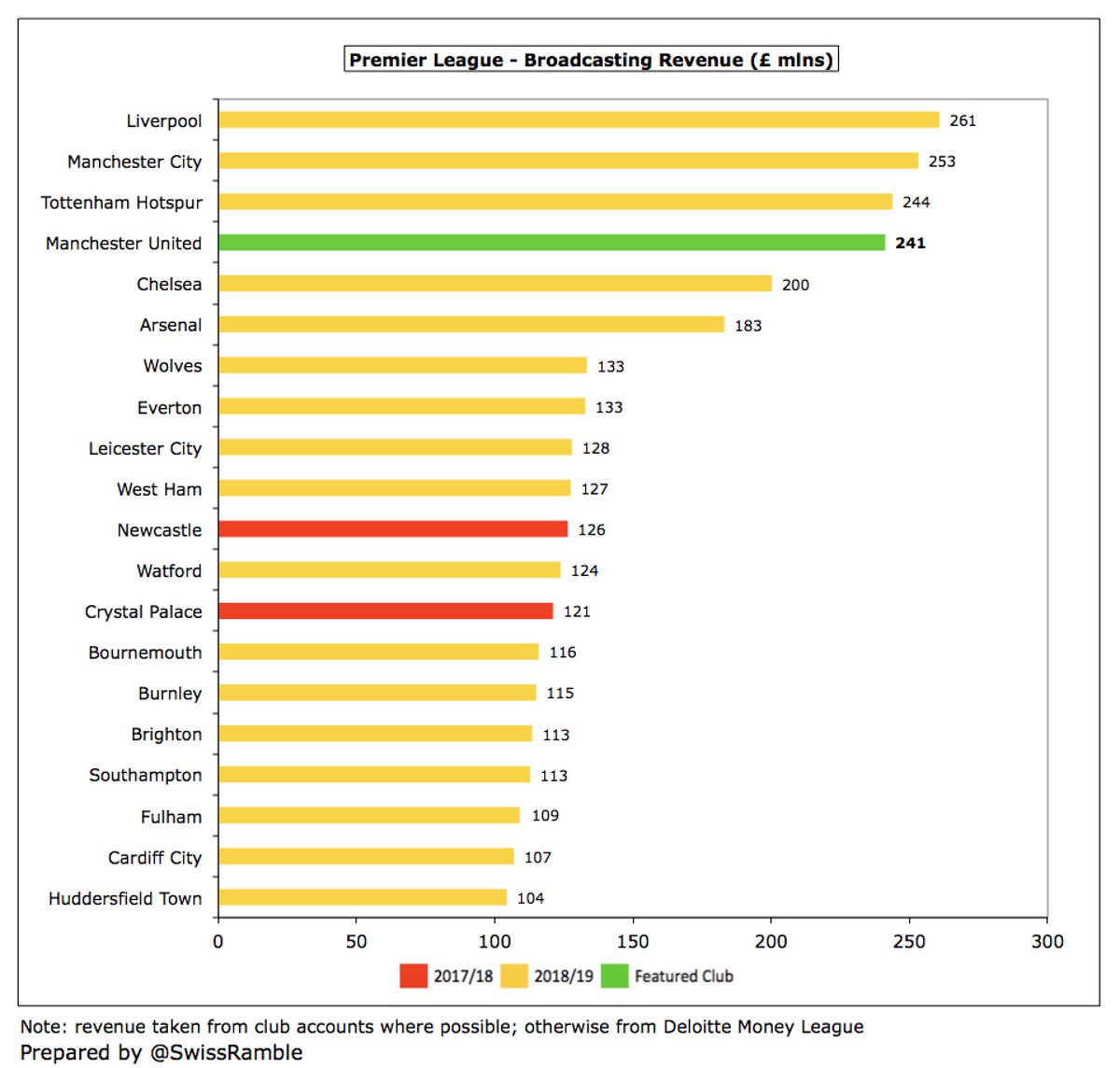

Broadcasting was already the only stream where #MUFC did not have the highest revenue in the Premier League, as their £241m in 2018/19 was surpassed by #LFC £261m, #MCFC £253m and #THFC £244m. Much of the difference is due to performance in European competitions.

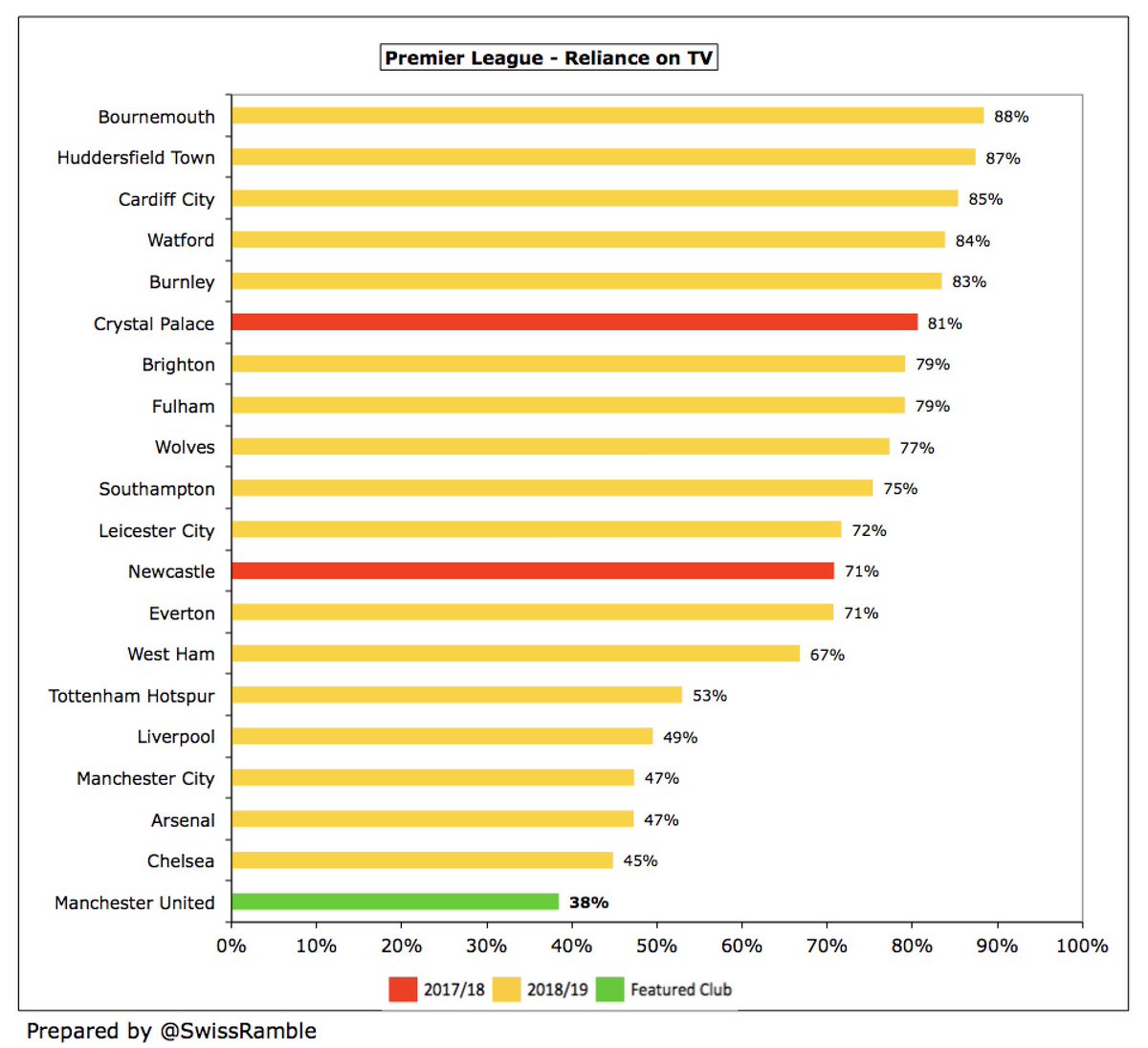

To an extent, that actually works in #MUFC favour, as broadcasting contributes just 38% to their total revenue, which is the lowest in the Premier League. A rebate is much more of an issue for other clubs, as they are hugely dependent on TV money, e.g. it’s 88% of #AFCB total.

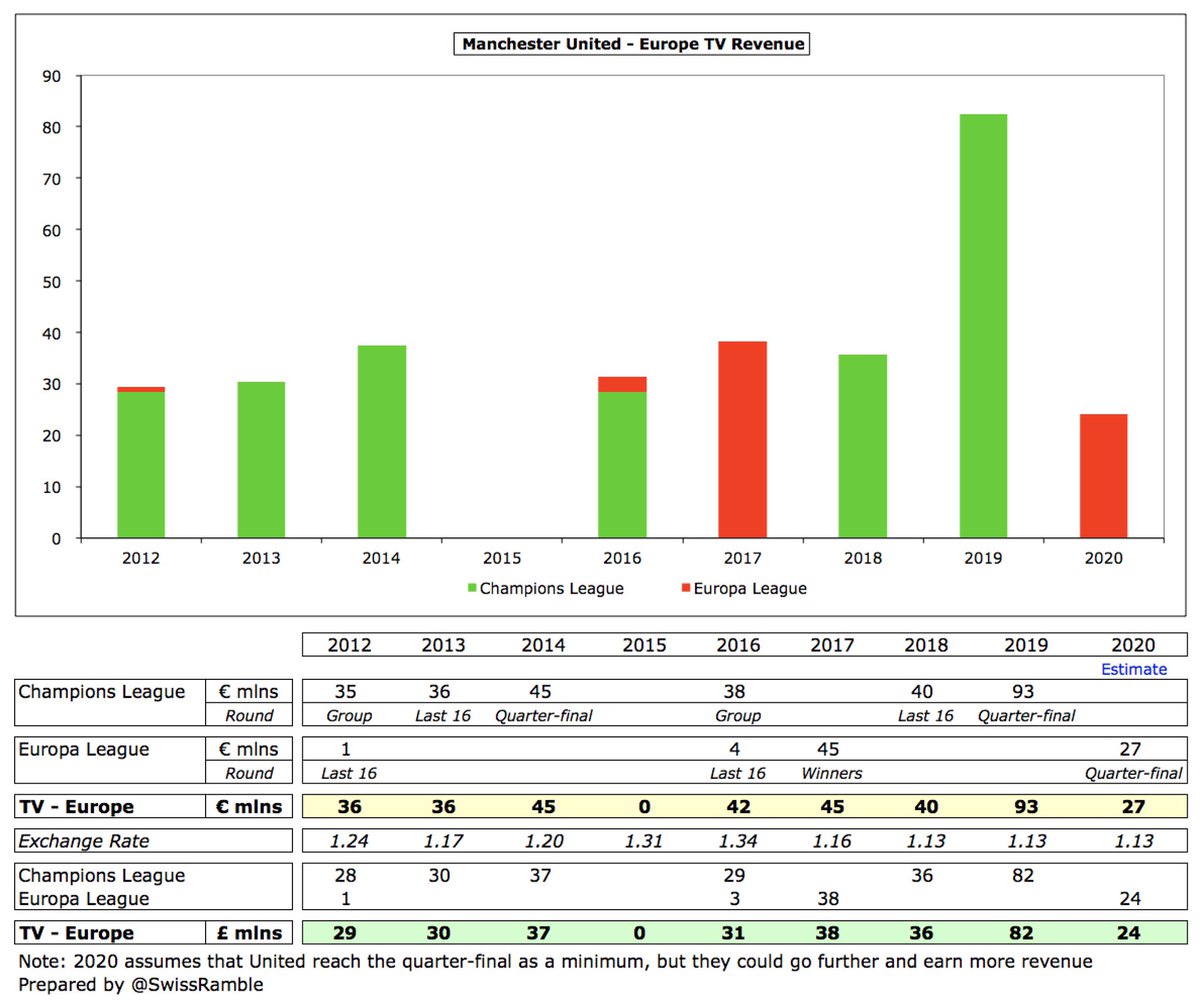

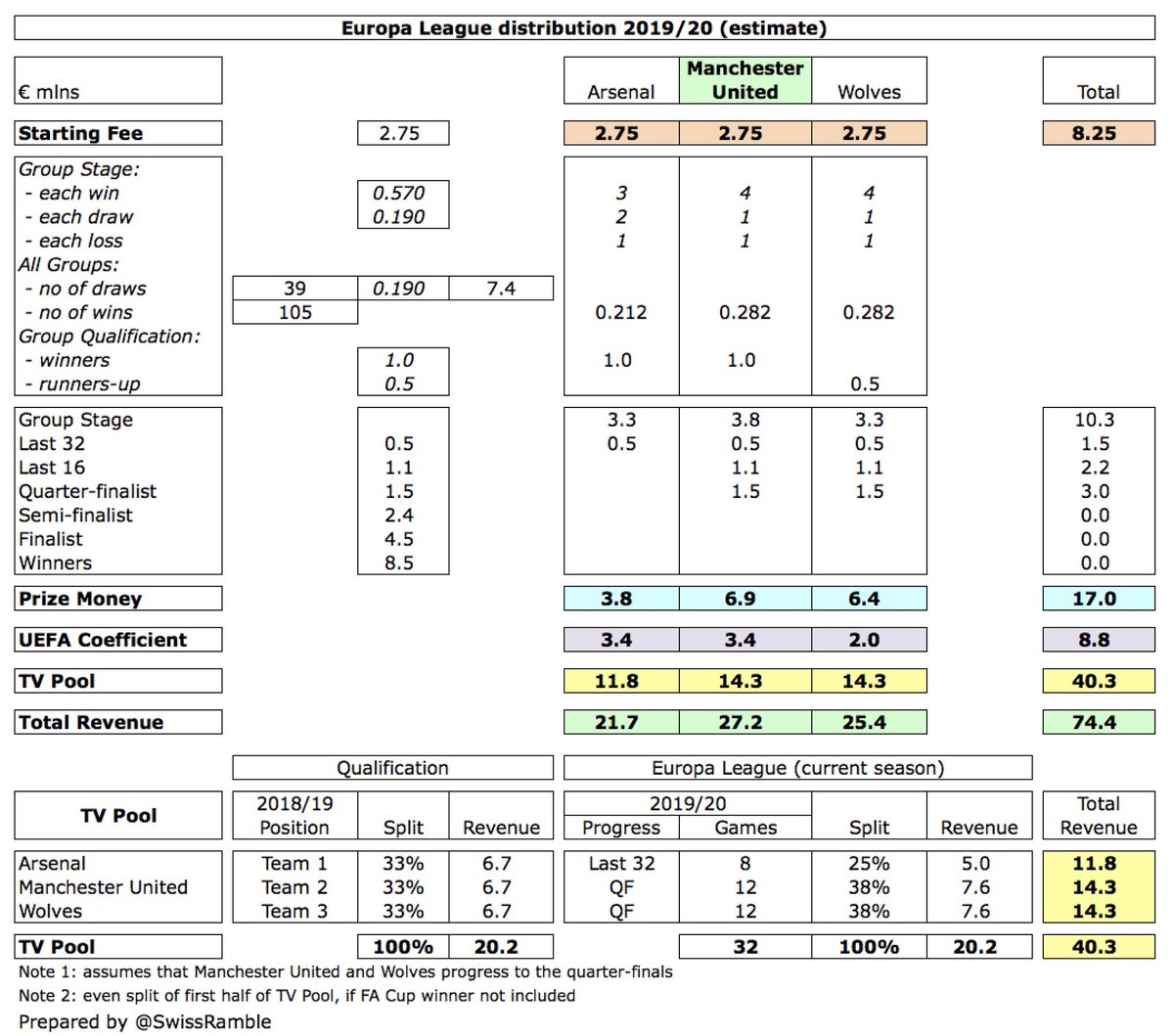

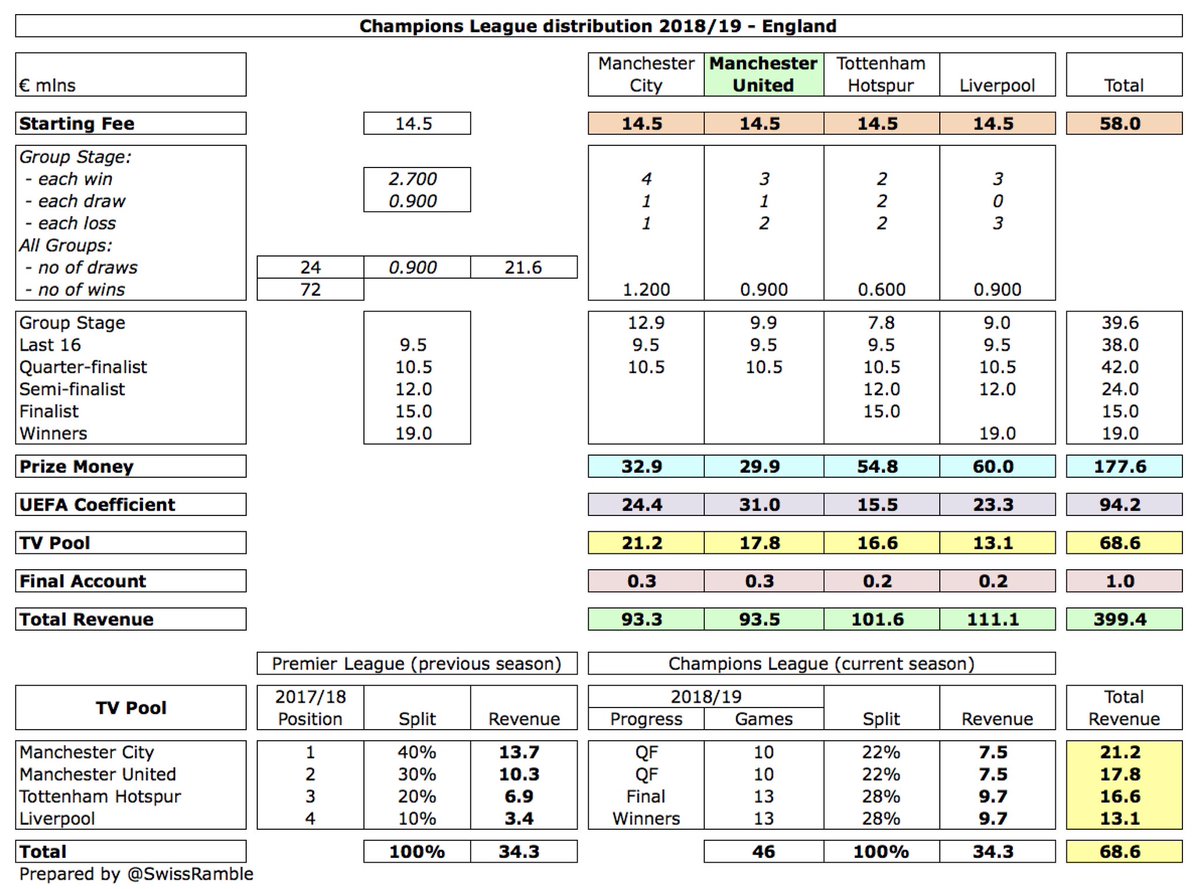

However, the main driver for lower #MUFC TV money in 2019/20 is playing in the Europa League instead of the far more lucrative Champions League. They earned £82m for reaching the CL quarter-finals in 2018/19, but to date have only earned an estimated £24m in the EL this season.

The €27m (£24m) estimate for #MUFC Europa League money this season is based on them reaching the quarter-finals (5-0 up against LASK after last 16 away tie), but would be more if they go further. Share of the TV pool depends on how far United and Wolves progress.

In 2018/19 #MUFC earned £82m (€93m) from the Champions League, boosted by finishing 2nd in the prior season’s Premier League, which meant that they got 30% of the first half of the UK TV pool. Also benefited from a new UEFA coefficient payment (based on results over 10 years),

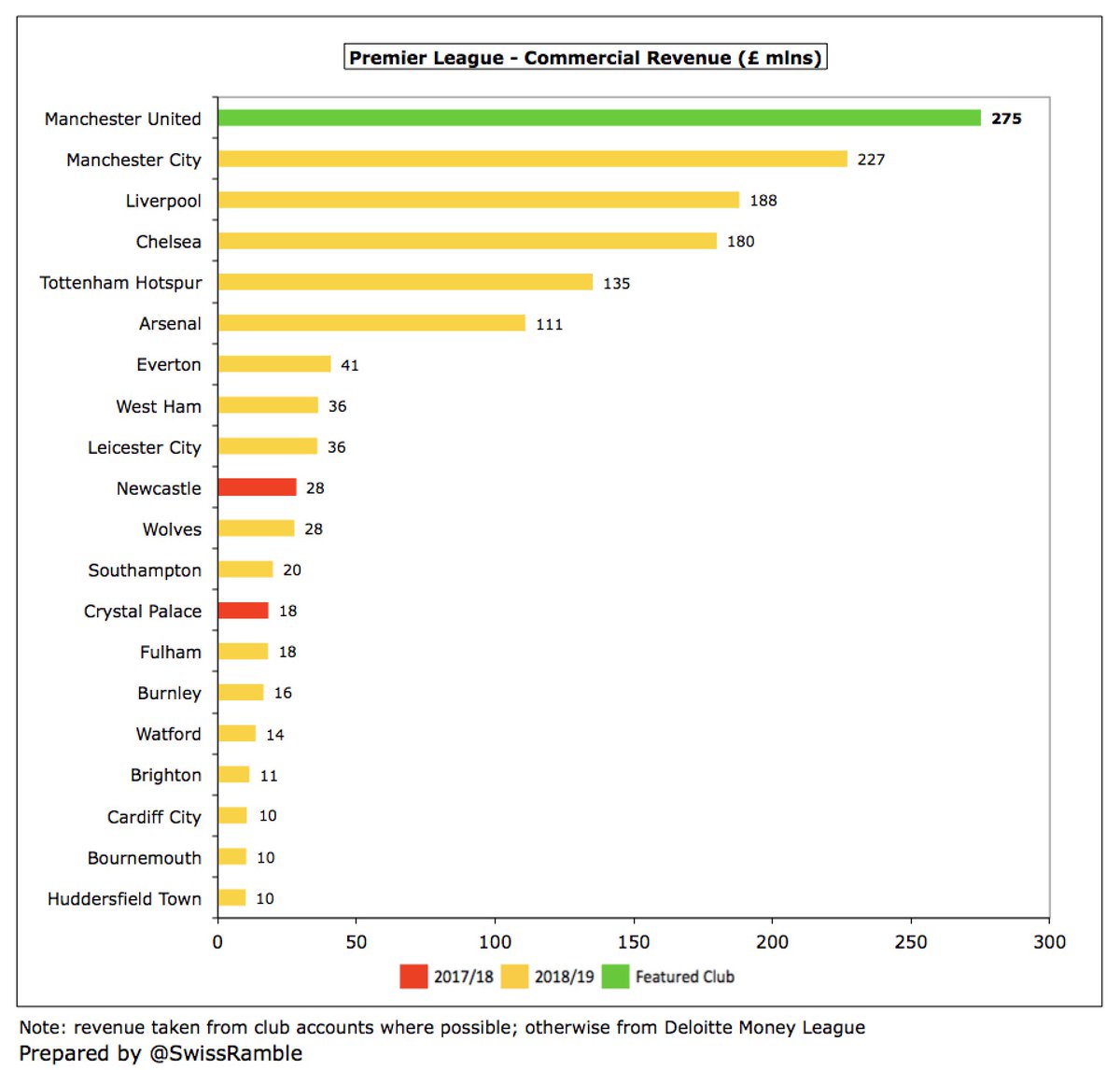

#MUFC revenue advantage over other clubs has traditionally been due to their commercial prowess, which generated £275m revenue in 2018/19, well ahead of #MCFC £227m, #LFC £188m and #CFC £180m. Includes huge sponsorship deals with Adidas £75m and Chevrolet £64m.

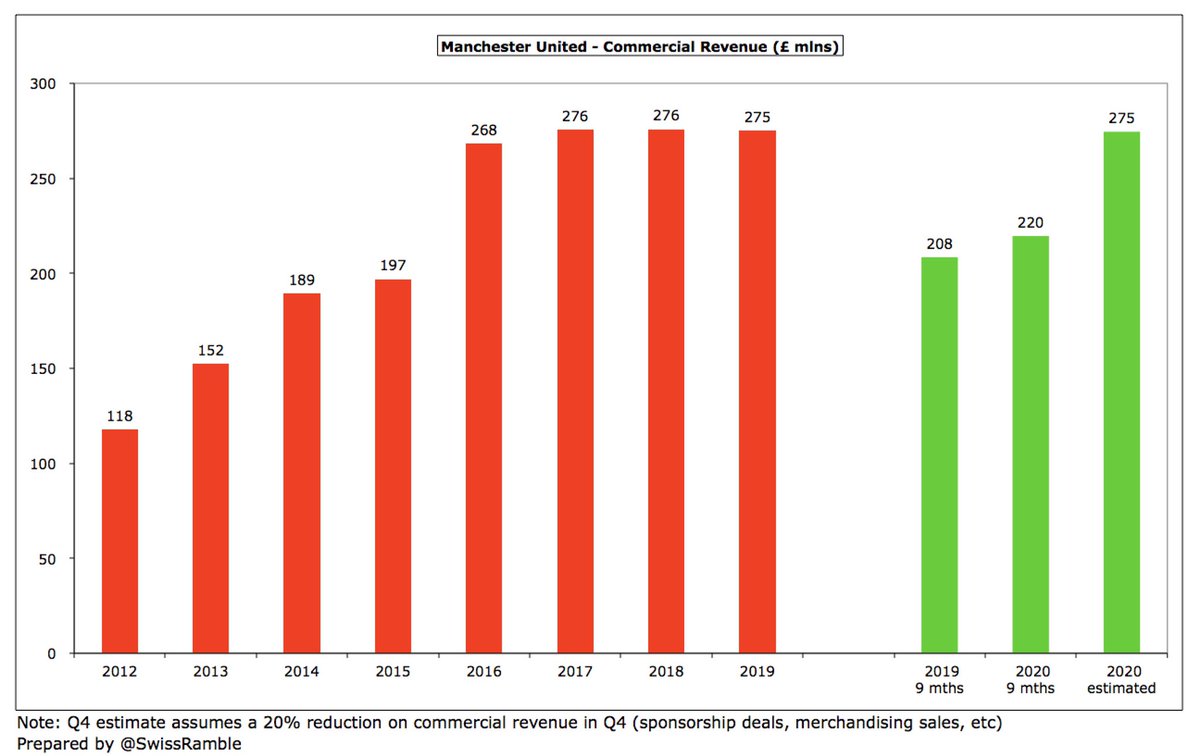

#MUFC commercial income was flat for last 4 years, but 2019/20 is up, thanks to new sponsors, so first 9 months saw 5% increase to £220m. However, lockdown likely means a fall in Q4, due to lower exposure and retail sales. Assuming 20% cut would give £275m (same as last year).

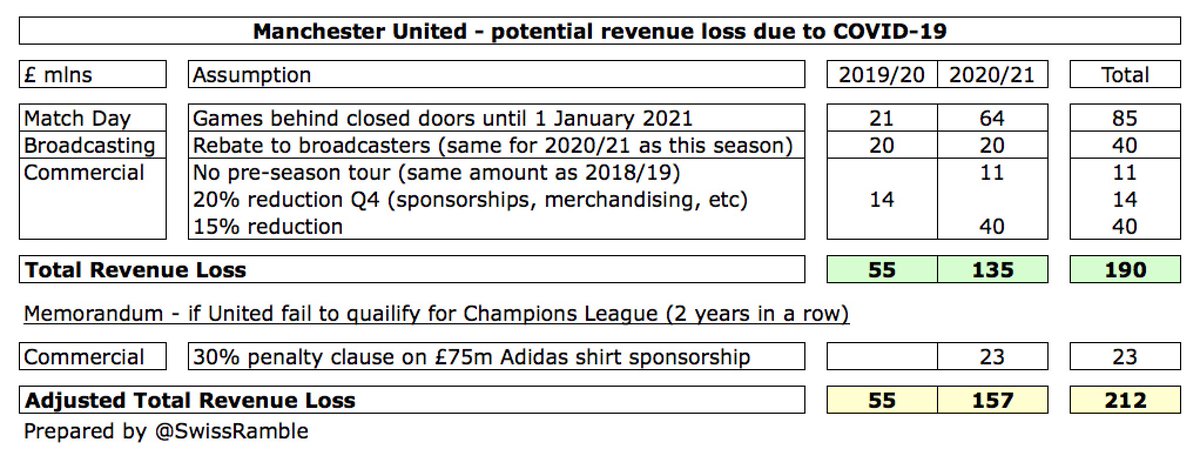

These assumptions suggest COVID-19 revenue impact of £55m in 2019/20, though likely to be higher next season. Estimated at £135m: match day £64m (games behind closed doors until January); broadcasting £20m (same as this season); no pre-season tour £11m; commercial £40m (15% cut).

Obviously, these “guesstimates” can only be considered as indicative, intended to give an idea of the drivers for #MUFC revenue. For example, it is possible that the broadcasters would push for higher rebates if they felt the “product” was compromised by no fans at the grounds.

In addition, #MUFC Adidas £75m sponsorship has a 30% penalty clause, if United fail to qualify for the Champions League for two consecutive seasons. This would cost £22.5m, though spread over remaining 5 years of deal. Club does not expect this scenario to happen.

#MUFC wage bill cut by £29m (12%) from £240m to £211m in first 9 months of 2019/20, mainly due to lower bonuses for non-participation in the Champions League and player departures. Assuming Q4 is the same as Q3 (£69m), full year would be £280m, £52m (16%) lower than prior season.

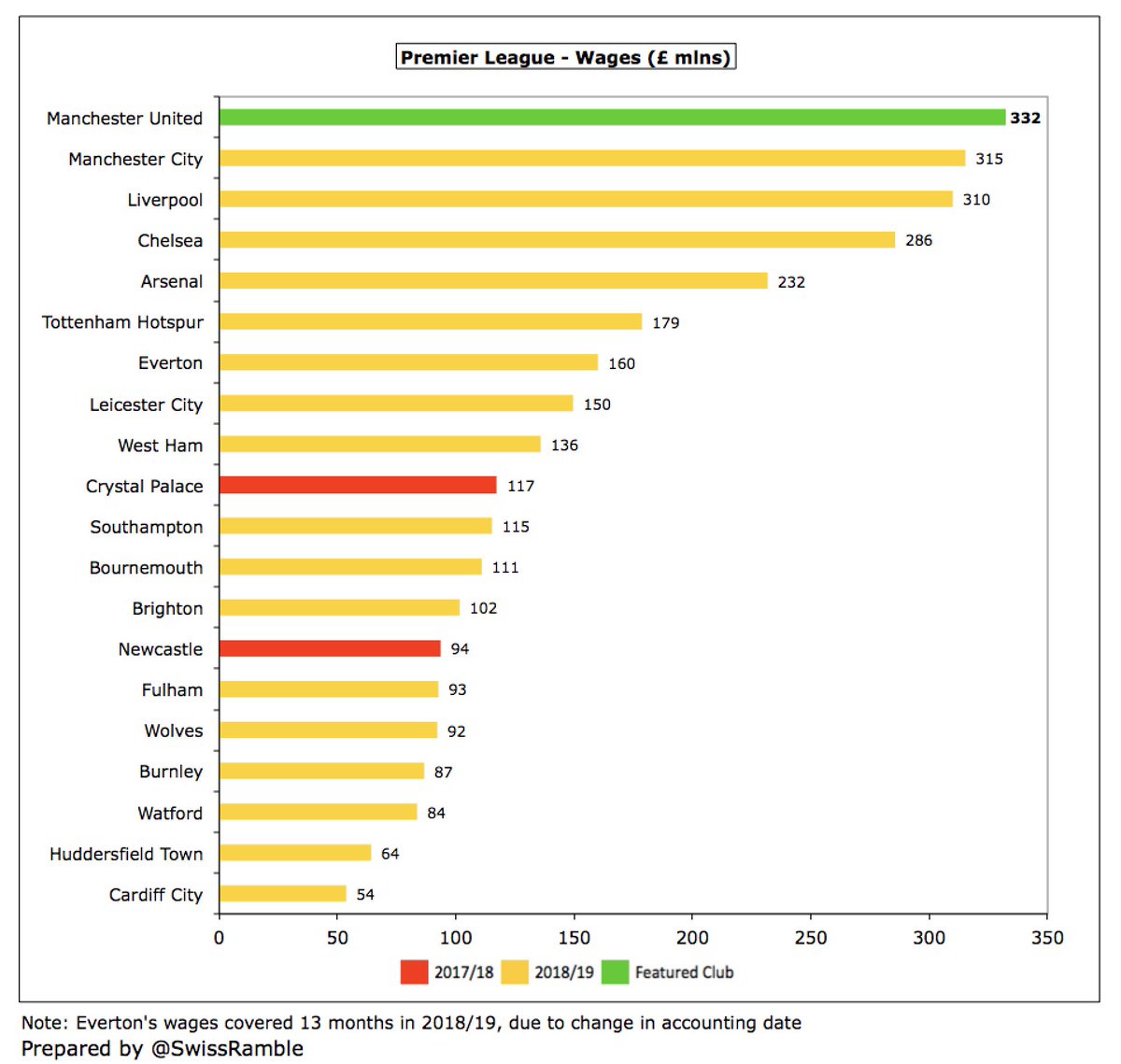

In 2018/19 #MUFC £332m was highest wage bill in the Premier League, ahead of #MCFC £315m, #LFC 310m and #CFC £286m, though it will be interesting to see this season’s rankings, as those 3 clubs all qualified for the Champions League, while United are only in the Europa League.

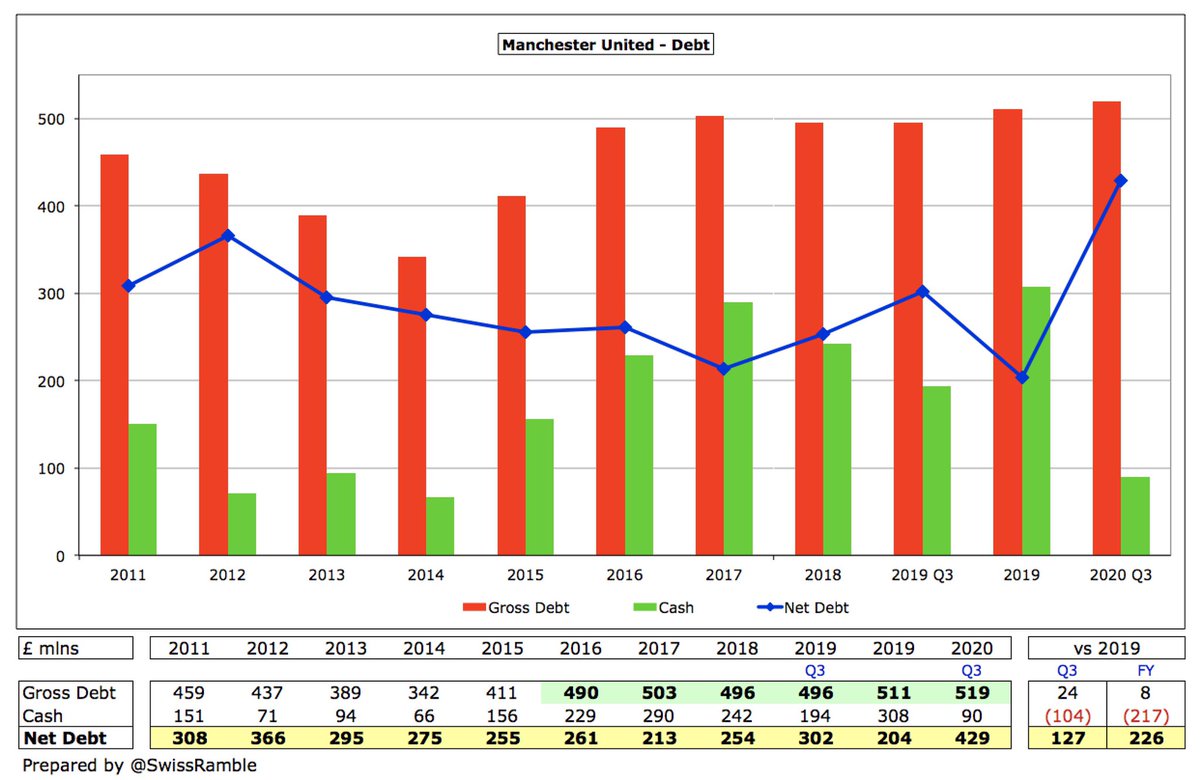

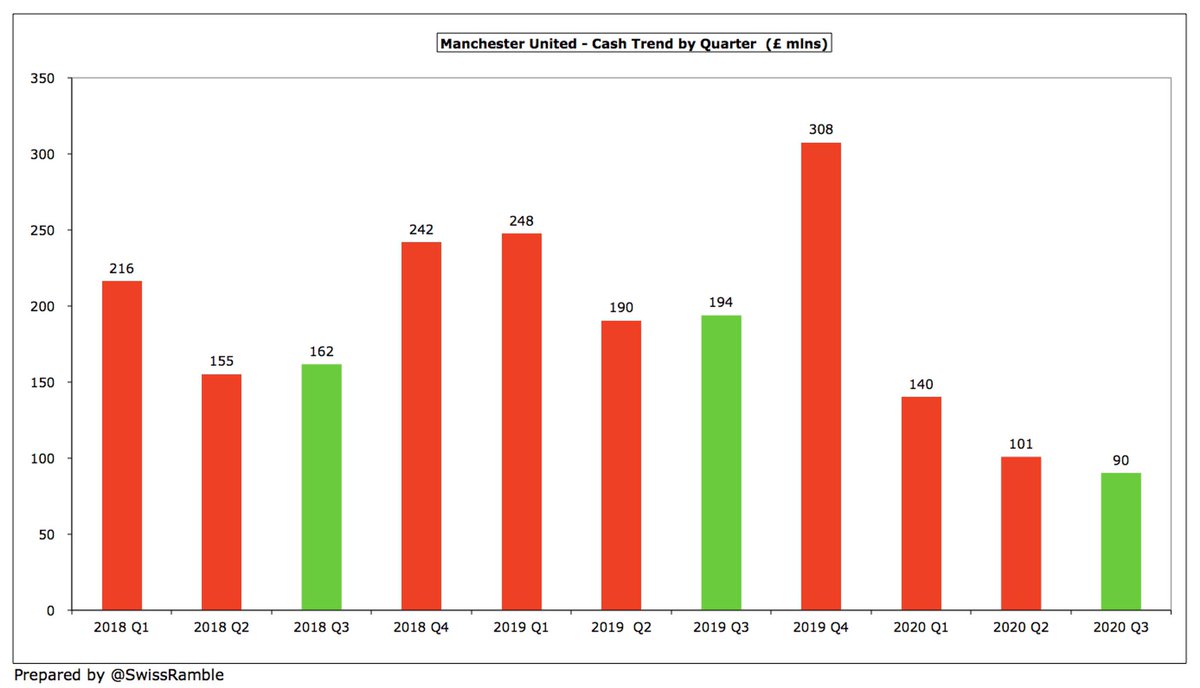

Eyebrows were raised when #MUFC net debt surged £127m from £302m in Q3 2019 to £429m, but this is almost entirely due to £104m decrease in cash. Gross debt only rose £24m from £496m to £529m. In fact, the underlying USD debt has been unchanged for the last 5 years.

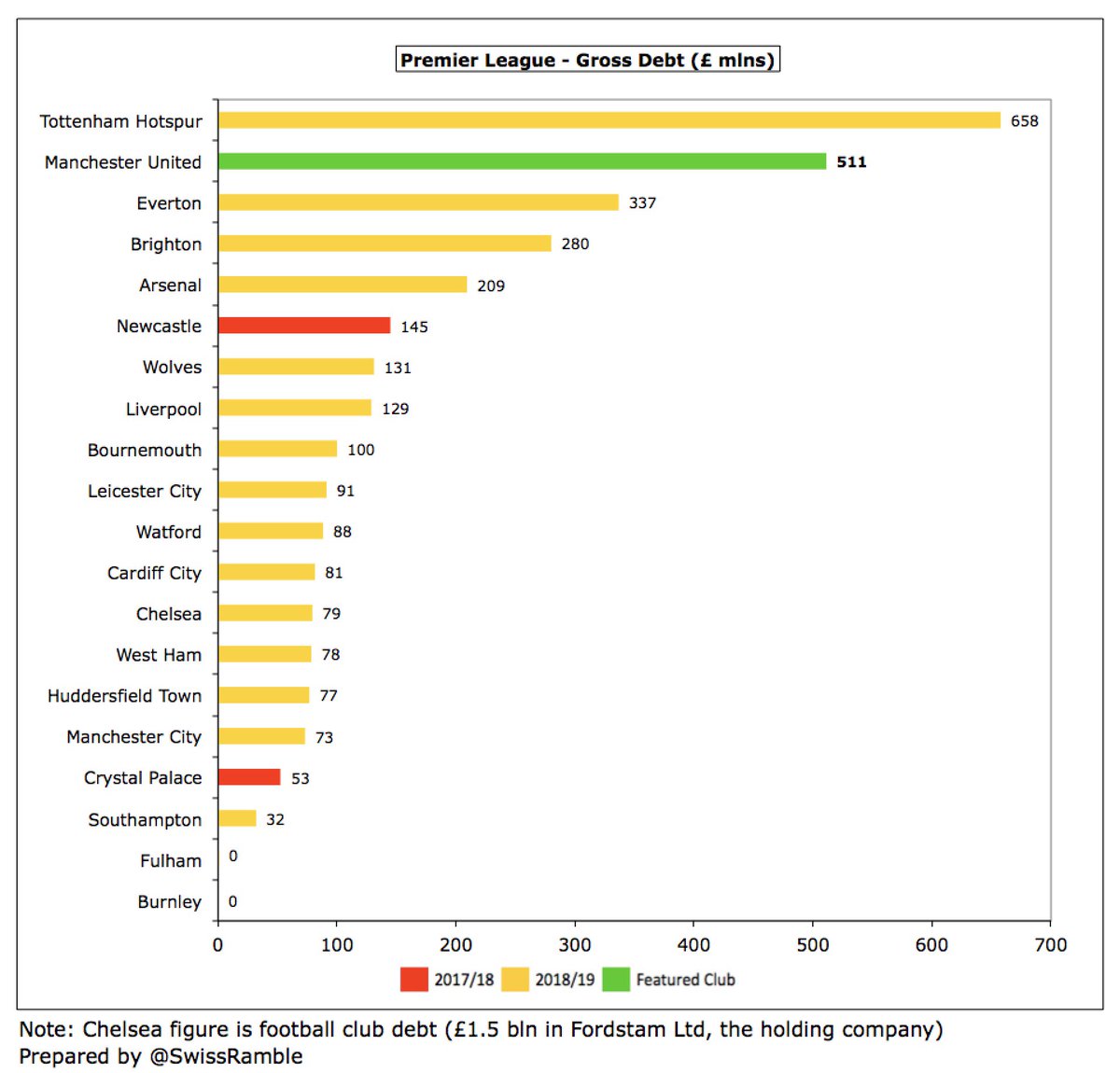

That said, #MUFC debt is still very high at over half a billion pounds, even after all the various refinancings by the Glazer family. It is only surpassed by #THFC £658m – and that was for building their new stadium, as opposed to financing a leveraged buy-out.

#MUFC significant cash reduction should come as no surprise, as the balance had already fallen from a very high £308m at 2019 year-end to £101m in Q2, so it has only dropped by £11m in Q3. That said, the £90m balance is relatively low for United in Q3 (2018 £162m, 2019 £194m).

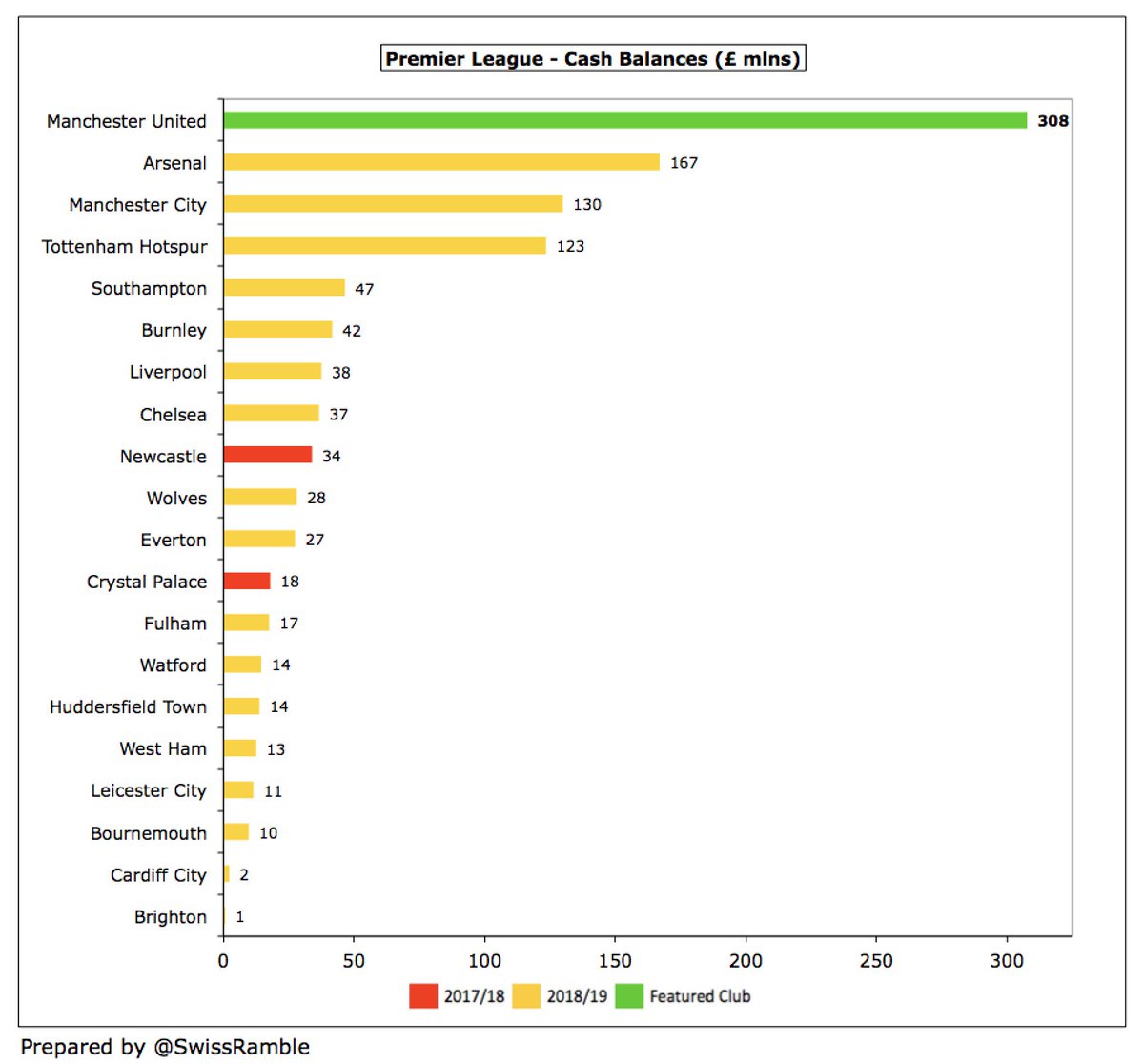

To highlight how high #MUFC £308m cash balance was in 2019, this was a chunky £140m more than the closest challenger, #AFC £167m. Looked at another way, it was as much as the bottom 15 Premier League clubs combined.

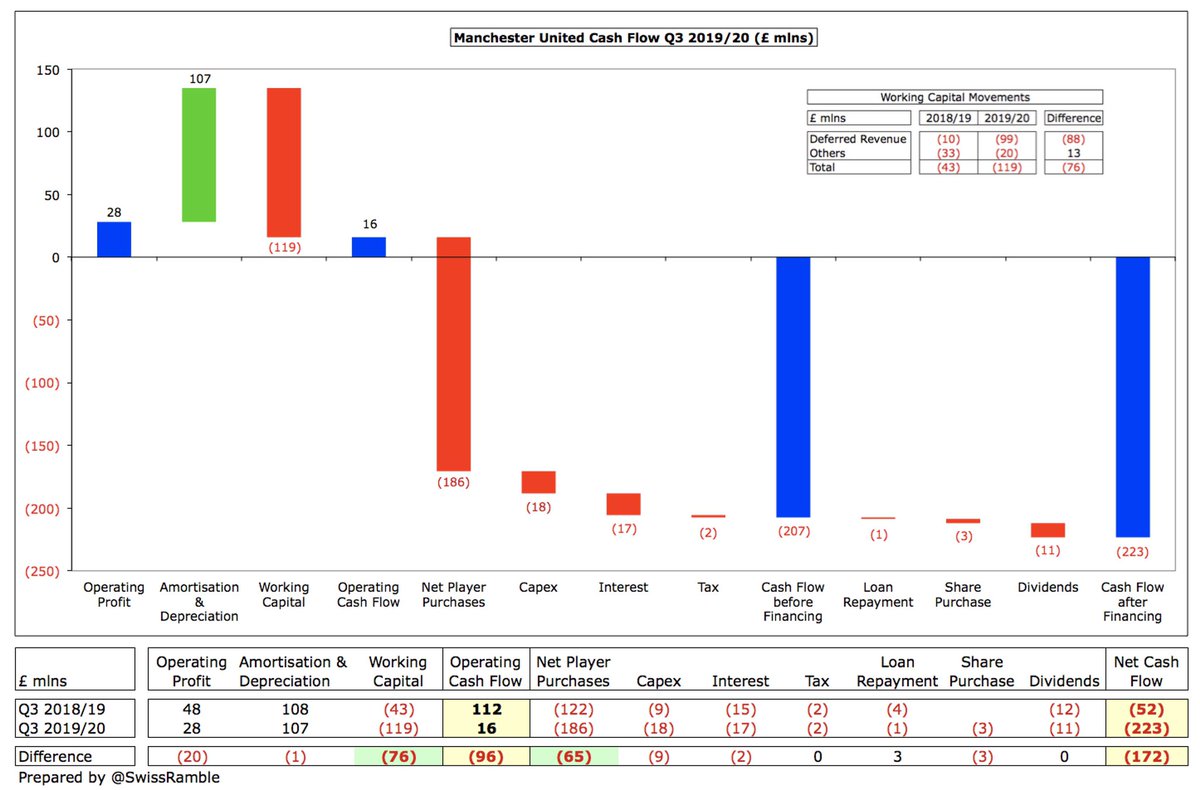

There are two main differences between this season’s cash flow and prior season: (1) #MUFC spent £65m more on net player purchases (£186m vs. £122m); (2) working capital movements were £76m worse, mainly due to deferred revenue, e.g. slower season ticket receipts.

Incidentally, #MUFC also spent £3.4m as part of a share repurchase scheme of up to $35m that they announced in March, which seems a little strange when the club is facing so many financial challenges.

Following the quarter-end, #MUFC have drawn down £140m of the £150m revolving credit facility. The club described this as “a precautionary measure, in order to increase its cash position, preserve financial flexibility and maintain liquidity in response to the COVID-19 outbreak.”

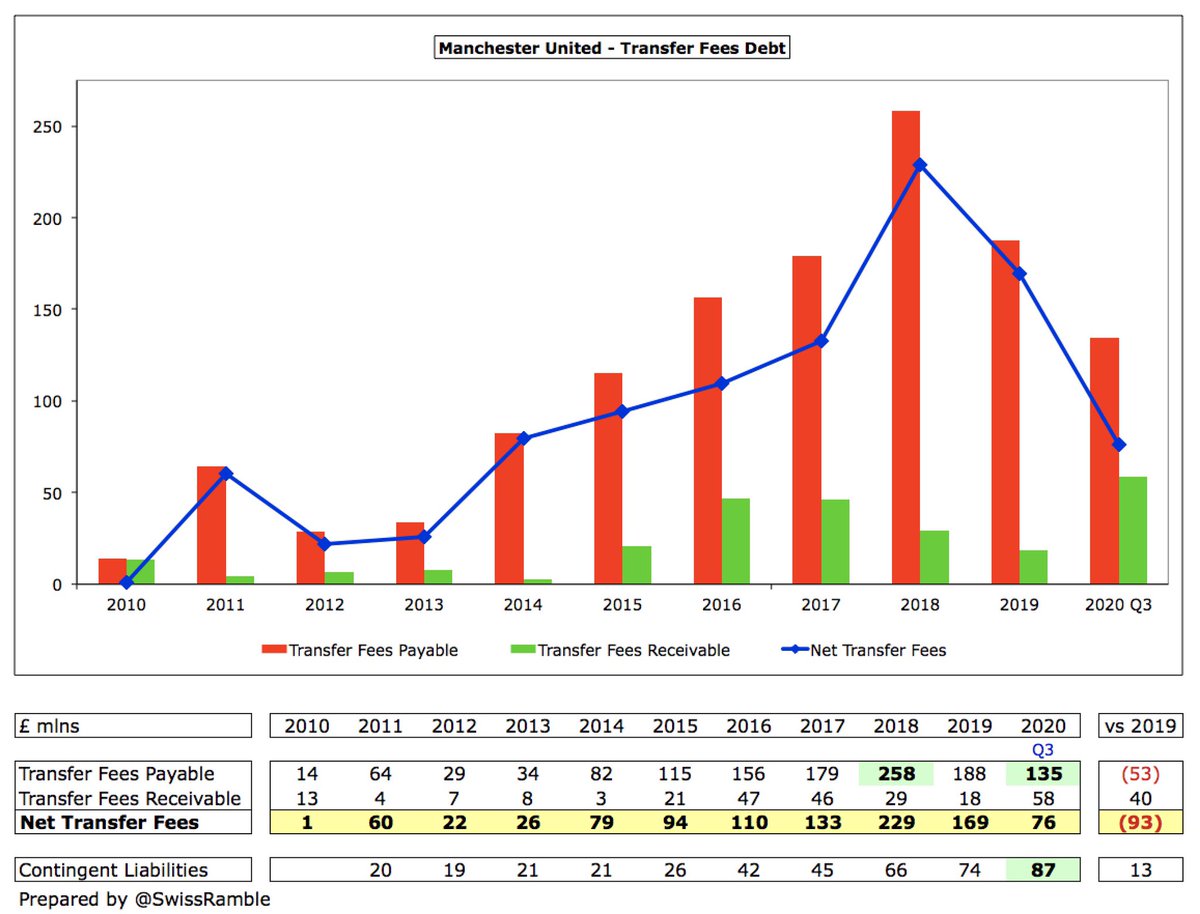

Much of the cash has been used to pay outstanding stage payments on transfer fees, so #MUFC transfer debt has fallen from £188m to £135m, having been as high as £258m two years ago. Transfer receivables have increased from £18m to £58m, so net transfer fees are down to £76m.

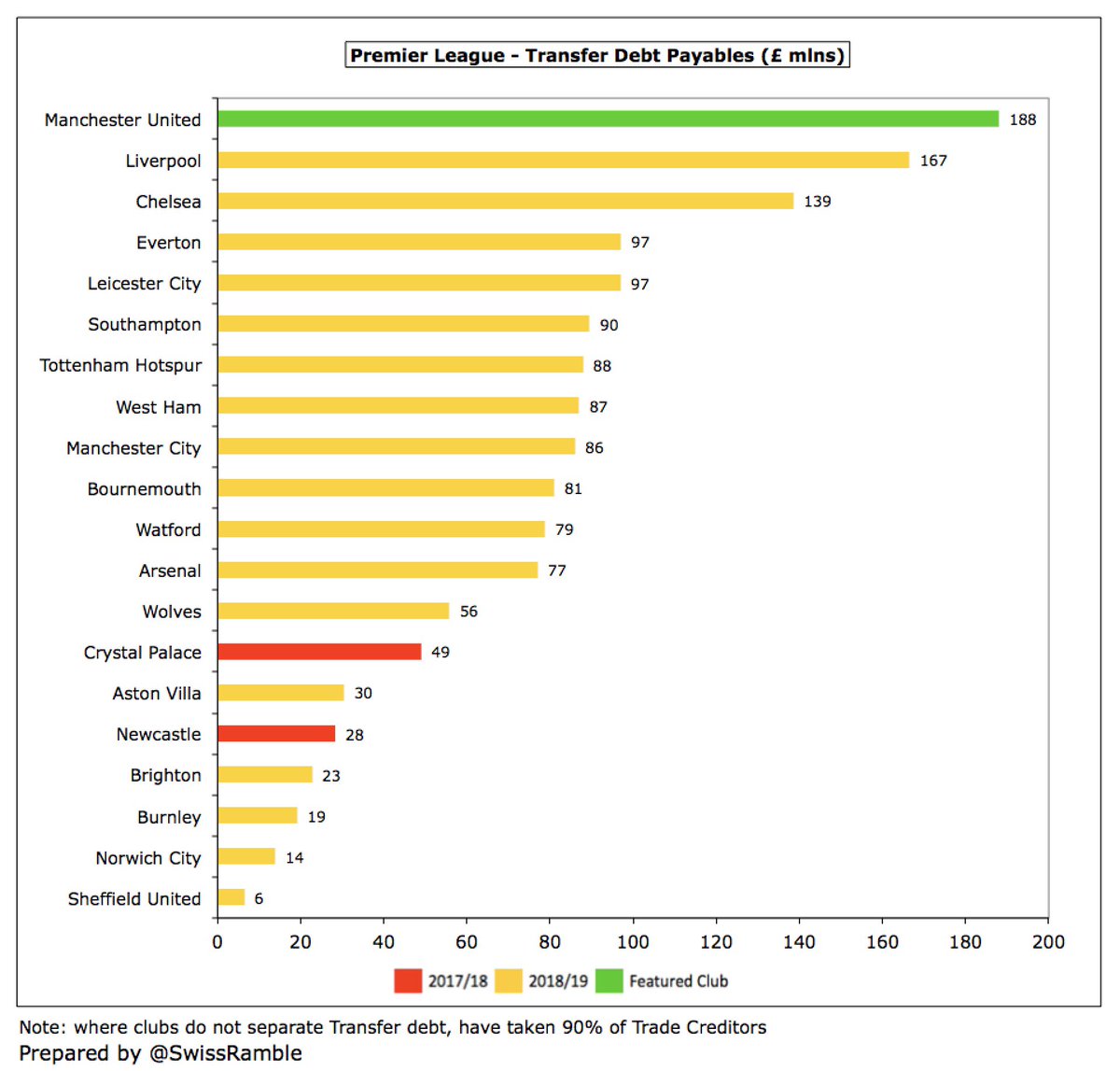

#MUFC £188m was the highest transfer debt in the Premier League in 2018/19, ahead of #LFC £167m and #CFC £139m (both estimated at 90% of Trade Creditors). However, their cash muscle is such that they reportedly paid Harry Maguire’s £80m fee upfront last summer.

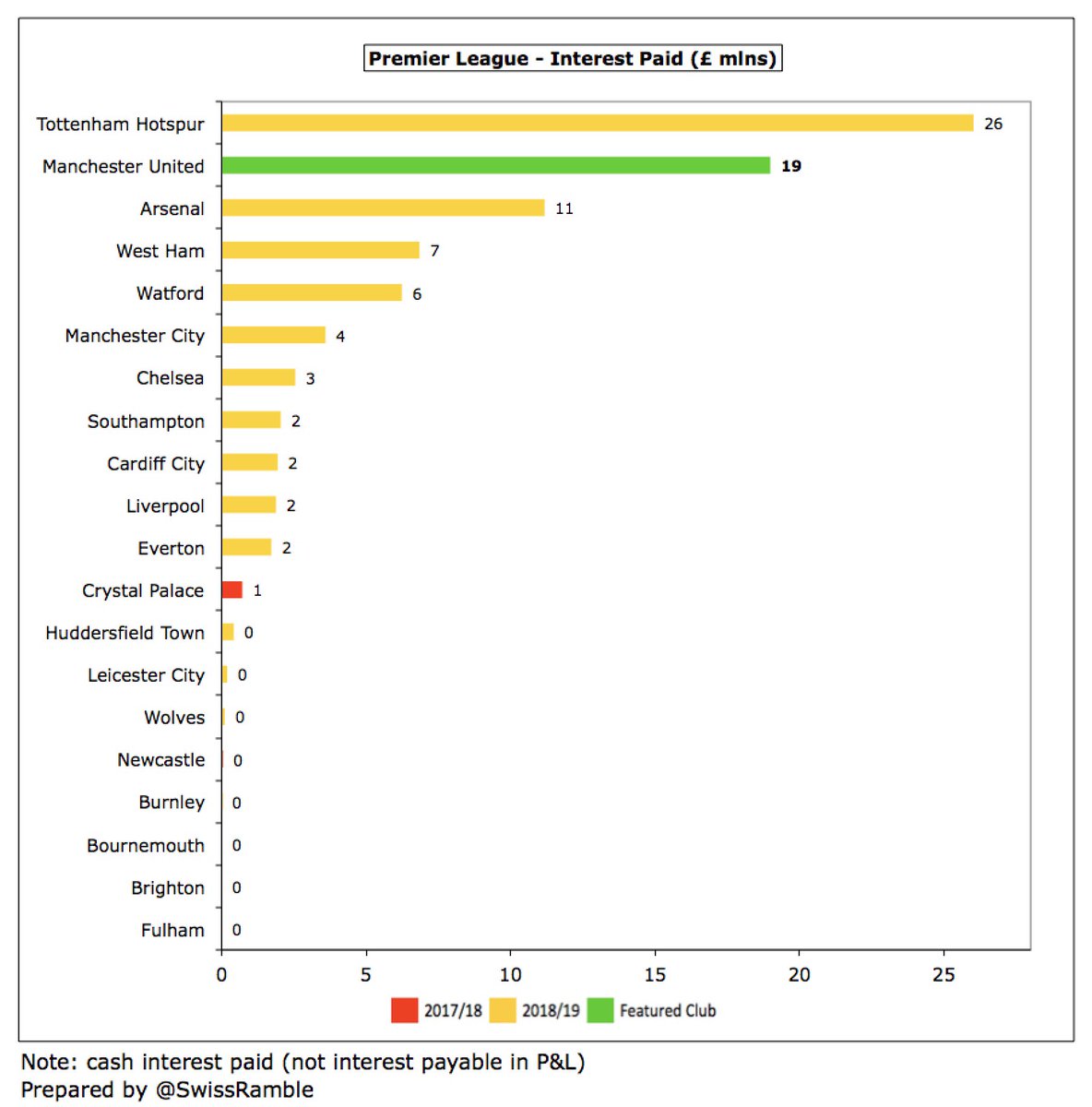

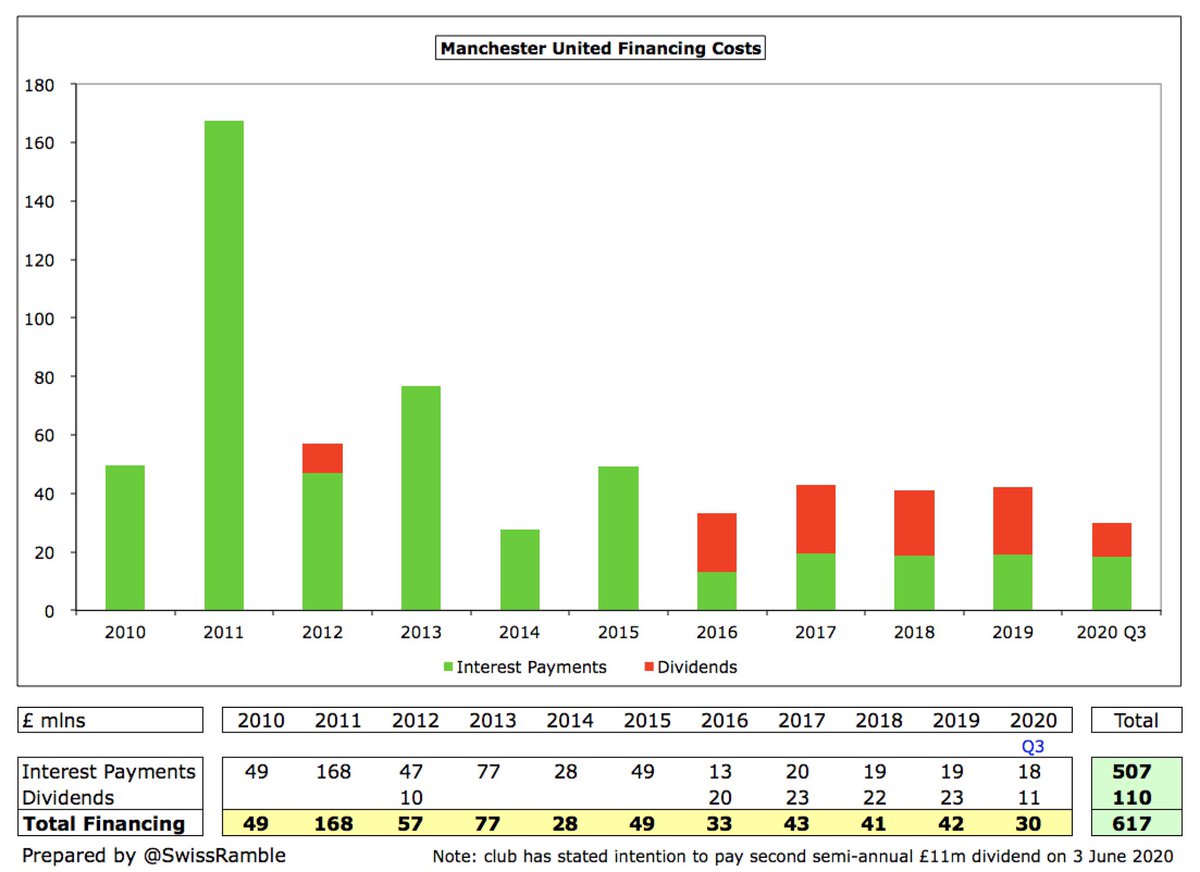

Although it has fallen from its peak, #MUFC annual interest payment of £19m is a lot more than every other Premier League club, except #THFC where stadium debt has recently increased their interest to £26m. More relevantly, #MCFC and #LFC only pay £4m and £2m respectively.

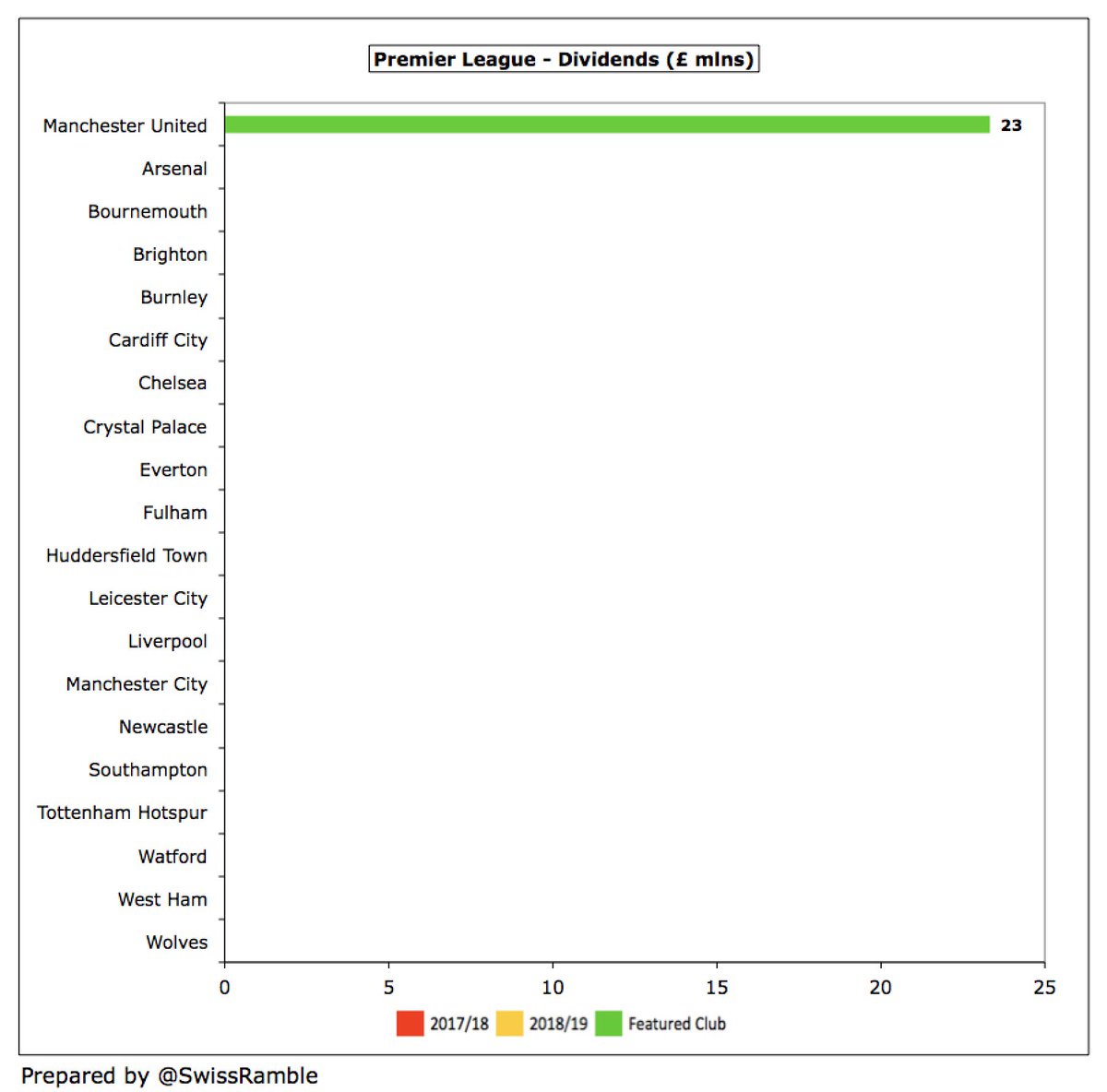

Despite the financial constraints, #MUFC have still found enough cash to pay their shareholders (mainly the Glazers) a full dividend. First half has already been paid, while second half will be paid on 3 June. United were the only Premier League club to pay a dividend in 2018/19.

#MUFC would have had even more money to spend if they did not have to bear the cost of the Glazers’ leveraged buy-out. In fact, since 2010 they have spent an extraordinary £617m on servicing the loans with £507m interest and £110m dividends – and that excludes debt repayments.

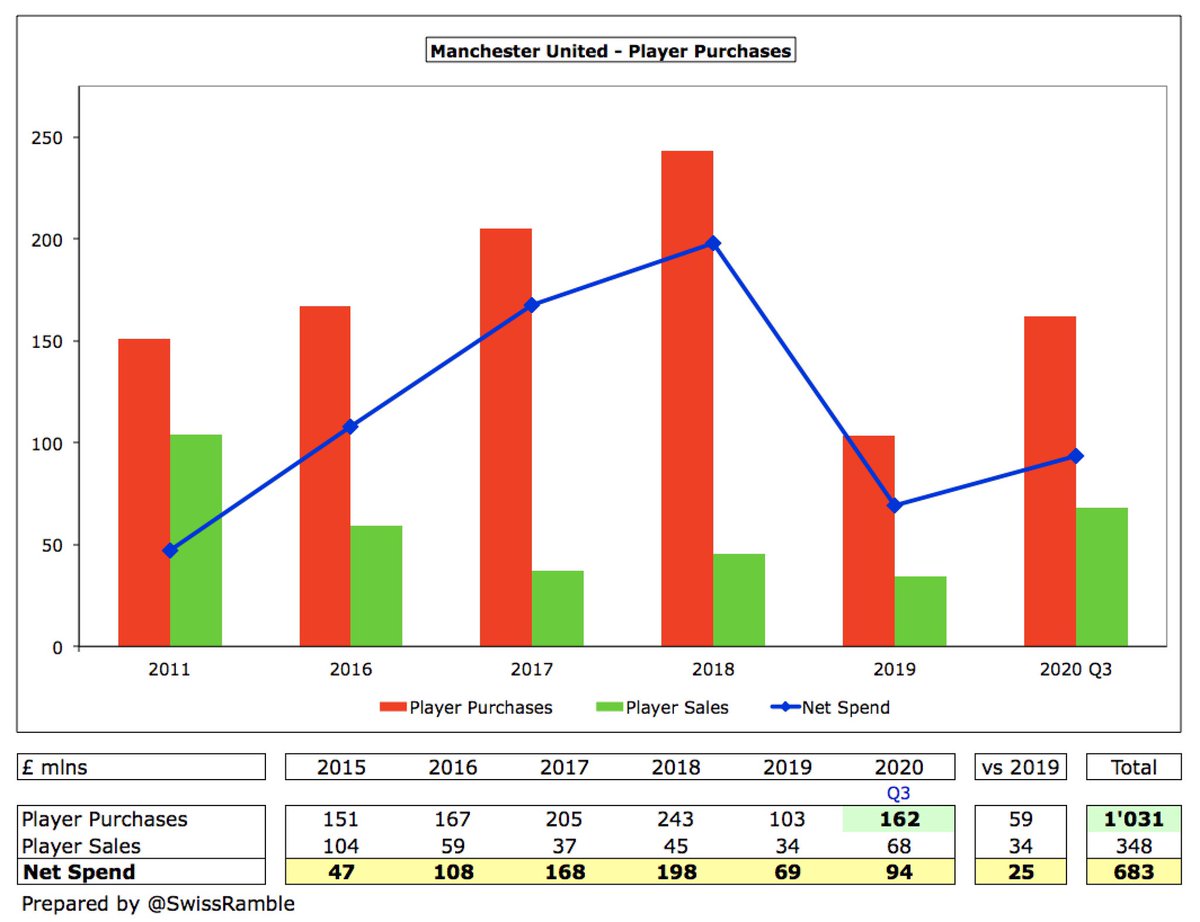

#MUFC have spent £162m on player purchases in the first 9 months of 2019/20. This is £59m more than the £103m spent last season, though that was the lowest annual spend by United since 2012/13. On the other hand, United have splashed out over a billion in the last 6 years.

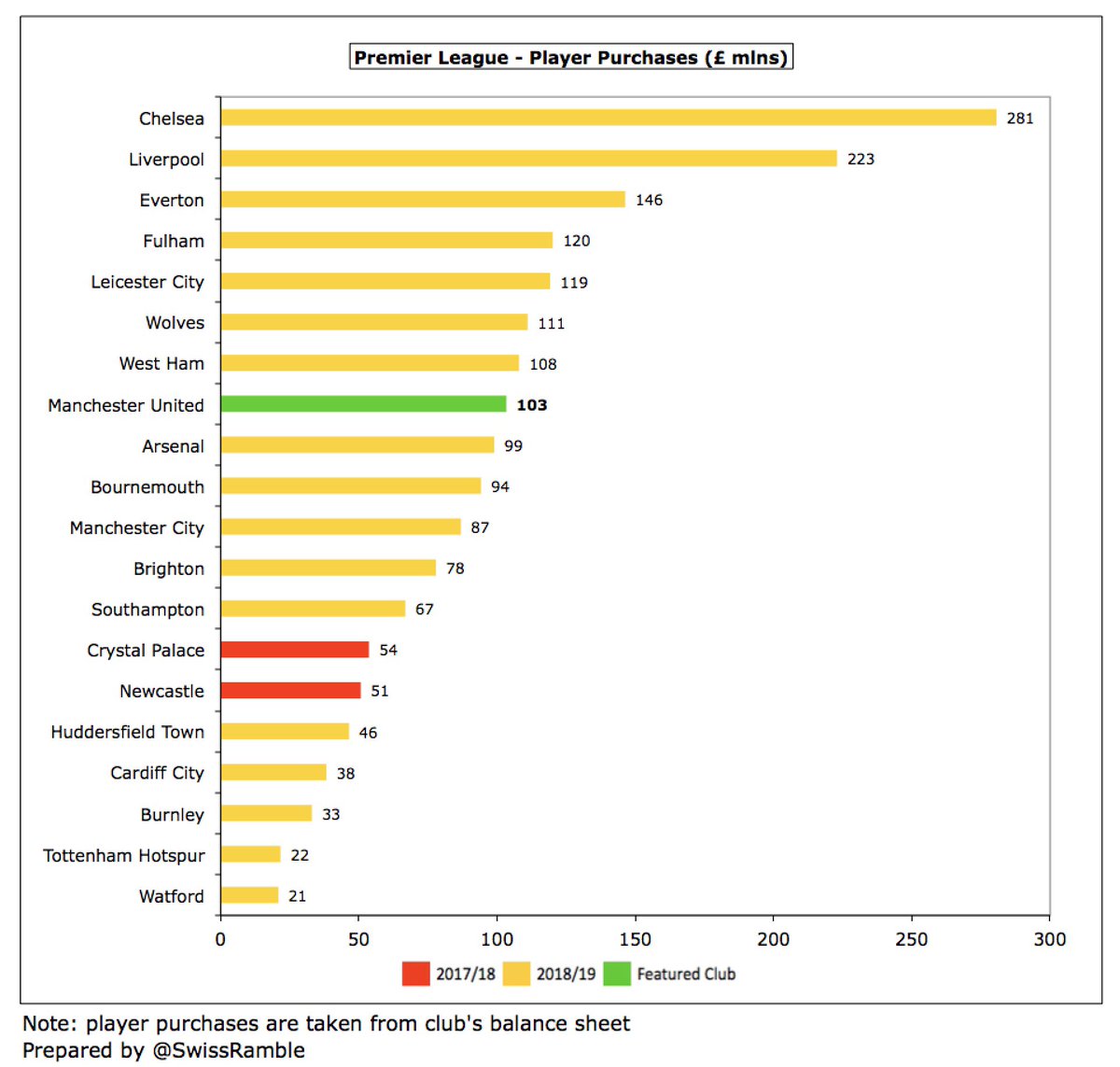

However, #MUFC are not alone in spending big. Indeed, in 2018/19 their £103m outlay on players was only 8th highest in the Premier League, when they were massively outspent by #CFC £281m and #LFC £223m. More surprisingly, they were also behind #EFC, #FFC, #LCFC, #WWFC and #WHUFC.

#MUFC have been criticised for deferring a £10m VAT payment, but it is likely that they will not be the only football club to take advantage of this government support measure. Otherwise, they have done well in the current crisis by making a commitment not to furlough staff.

Ed Woodward warned that Q3 results “reflect a partial impact that the pandemic has had on #MUFC, while the greater impact will be in the current quarter and likely beyond.” He added, “There are still profound challenges ahead – it will not be business as usual for a long time.”

The harsh reality is that if a club as powerful and resilient as #MUFC is going to struggle with the financial challenges posed by COVID-19, then it will be even more difficult for almost every other football club, who lack United’s strong balance sheet and commercial partners.

More optimistically, Woodward said, “We’re well positioned, both operationally and financially, to navigate this global crisis, and we very much look forward to returning to play and building upon the strong on-pitch momentum #MUFC experienced up to mid-March when we stopped.”

Read on Twitter

Read on Twitter