Today& #39;s date will be saved forever in the history for Failure of Trade Unionism in Banks, Exactly 5 years ago on 25.05.2015, Unions concluded their 10th BPS, effected from 01.11.2012 (935Days Delay) & today BPS has crossed its 2nd Worst Delivery, 8thBPS took 943 Days;

#936Days

#936Days

There were 2 Major breakthrough happened in 10thBPS,

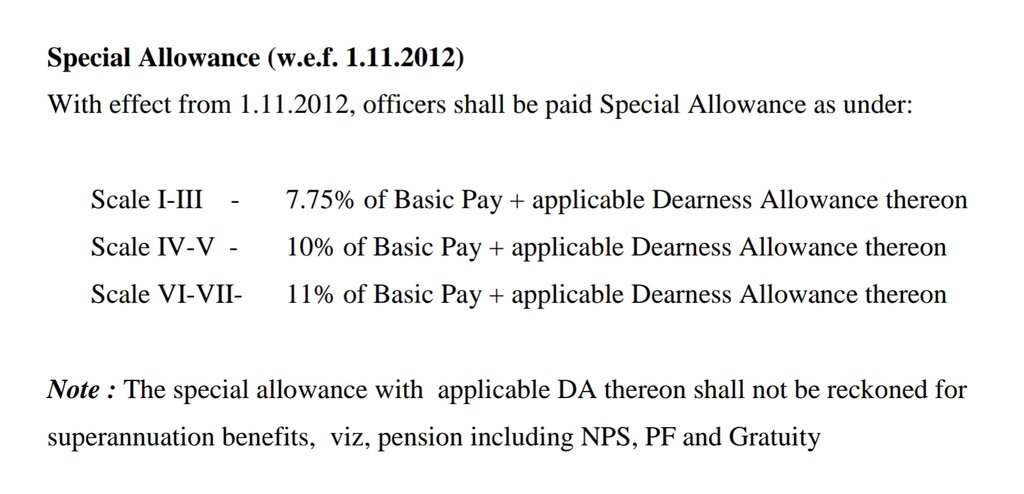

1- Introduction of Special pay

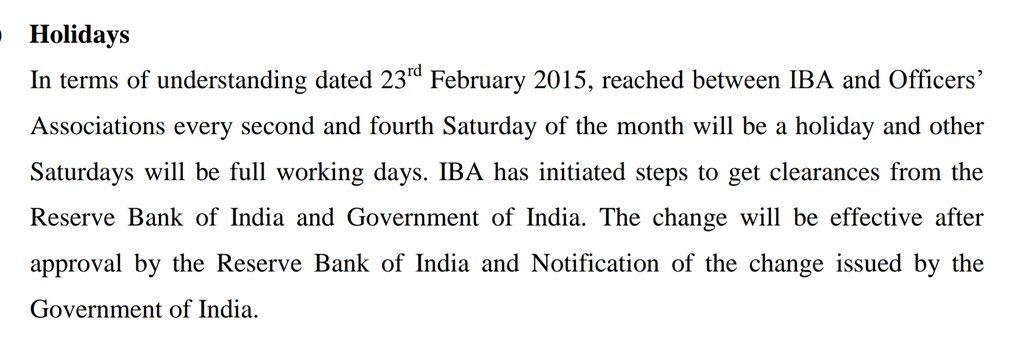

2- 2nd/4th Sat Off

Now When ALL other stakeholders enjoying 5DaysWeek working, there was No rationality of this 2nd/4th Sat off, its still unknown why they surrendered when they were that close??

1- Introduction of Special pay

2- 2nd/4th Sat Off

Now When ALL other stakeholders enjoying 5DaysWeek working, there was No rationality of this 2nd/4th Sat off, its still unknown why they surrendered when they were that close??

Another yet Major Failure of UFBU was to accept Scaldelous Special Pay of 7.5%,

Quote, "The Special Allowance with DA thereon SHALL NOT be reckoned with superannuation Benefits, viz pension Including PF & NPS and Gratuity".

UnquoteI wonder what makes it SPECIAL(for Us) then??

Quote, "The Special Allowance with DA thereon SHALL NOT be reckoned with superannuation Benefits, viz pension Including PF & NPS and Gratuity".

UnquoteI wonder what makes it SPECIAL(for Us) then??

This Special Pay is SPECIAL only on BANK& #39;s/Govt POV as it doesn& #39;t attract any superannuation benefit, hence No Gratuity on this will be paid, neither this 7.5% increase will be passed to our NPS (Post 2010 Bankers) contribution. Banks r at Win-Win situation both Side!!

#936Days

#936Days

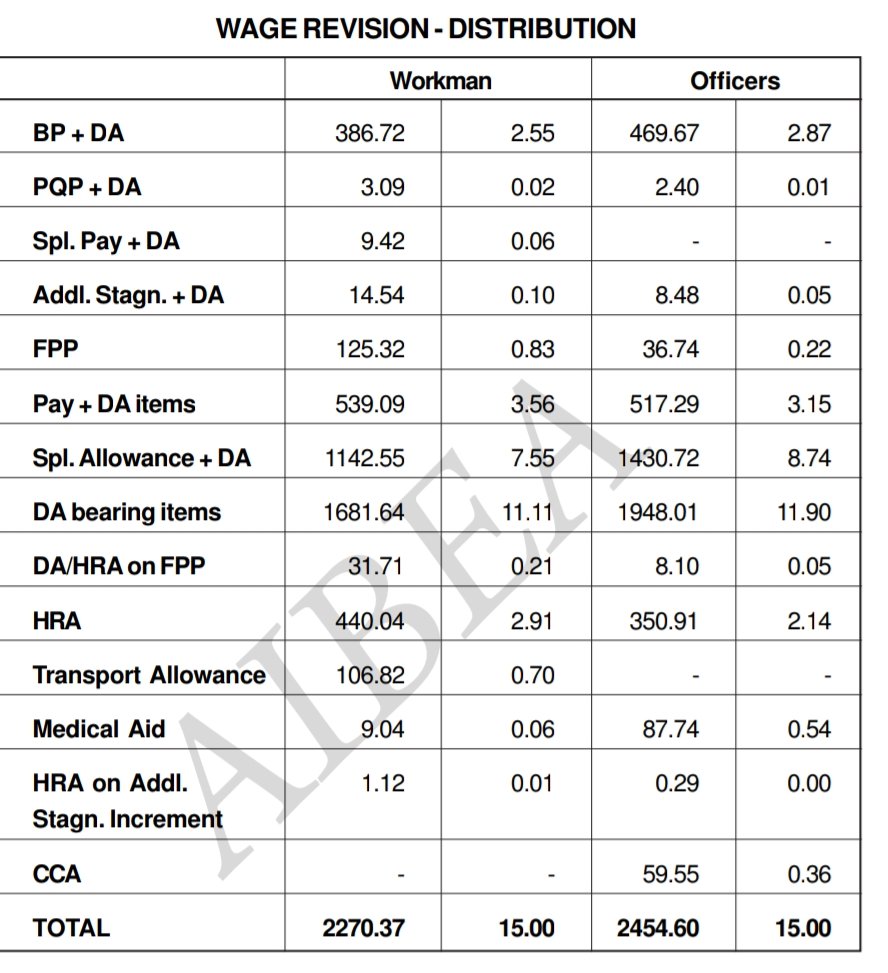

If one take a Close look on 15% Distribution of HISTORIC 10thBPS, its evidently clear that out of 15%, 8.74% is given to

Special Allowance +DA alone, 58% of total Increase won& #39;t attract Superannuation Benefits(????).

When they say they will give15%, that& #39;s what they meant!!

Special Allowance +DA alone, 58% of total Increase won& #39;t attract Superannuation Benefits(????).

When they say they will give15%, that& #39;s what they meant!!

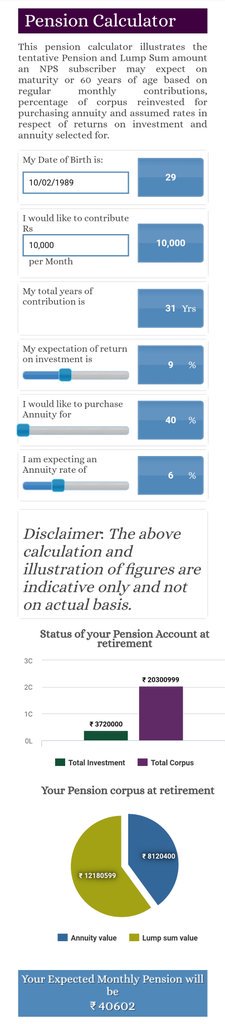

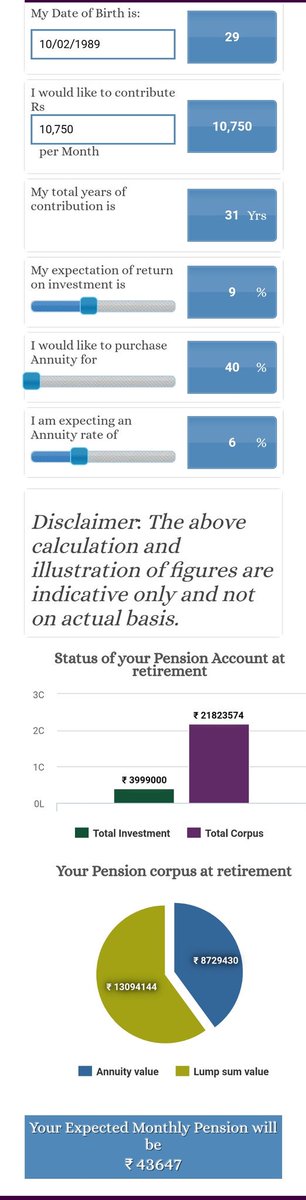

What If we say that U r losing around 10Lakh in corpus fund & 3-5000 In pension if Special pay is not merged in Basic??? For proof, go to any online NPS calculator,

Put ur Present NPS contribution & Note data.

Now add 10% of Special Pay+DA in ur NPS contribution & compare both!!

Put ur Present NPS contribution & Note data.

Now add 10% of Special Pay+DA in ur NPS contribution & compare both!!

Read on Twitter

Read on Twitter