Bank of Korea meeting Thursday & we expect a 25bps cut (just like markets) to 0.5%. South Korea is out of the woods in terms of financial markets, esp the mayhem in March, but its economy isn& #39;t.

Even with containment, and I argue that this is the best strategy, the economy weak https://twitter.com/Trinhnomics/status/1262948481402056705">https://twitter.com/Trinhnomi...

Even with containment, and I argue that this is the best strategy, the economy weak https://twitter.com/Trinhnomics/status/1262948481402056705">https://twitter.com/Trinhnomi...

South Korea manages to bend the curve & more importantly never locked down its economy and so domestic mobility never completely collapsed even at the peak in end Feb and early March.

Google mobility shows only -2% from base line & so almost normalized. That said, growth weak.

Google mobility shows only -2% from base line & so almost normalized. That said, growth weak.

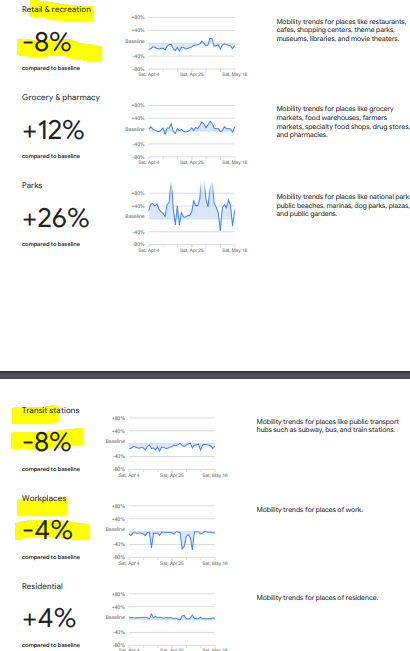

If u look at the details of Google Mobility by 16 May, then u see that there is a huge divergence:

a) Retail & recreation, transit, work places still falling

b) Essentials like food + parks + home up.

Worse still, the retail & recreation doesn& #39;t tell u the volume of transaction.

a) Retail & recreation, transit, work places still falling

b) Essentials like food + parks + home up.

Worse still, the retail & recreation doesn& #39;t tell u the volume of transaction.

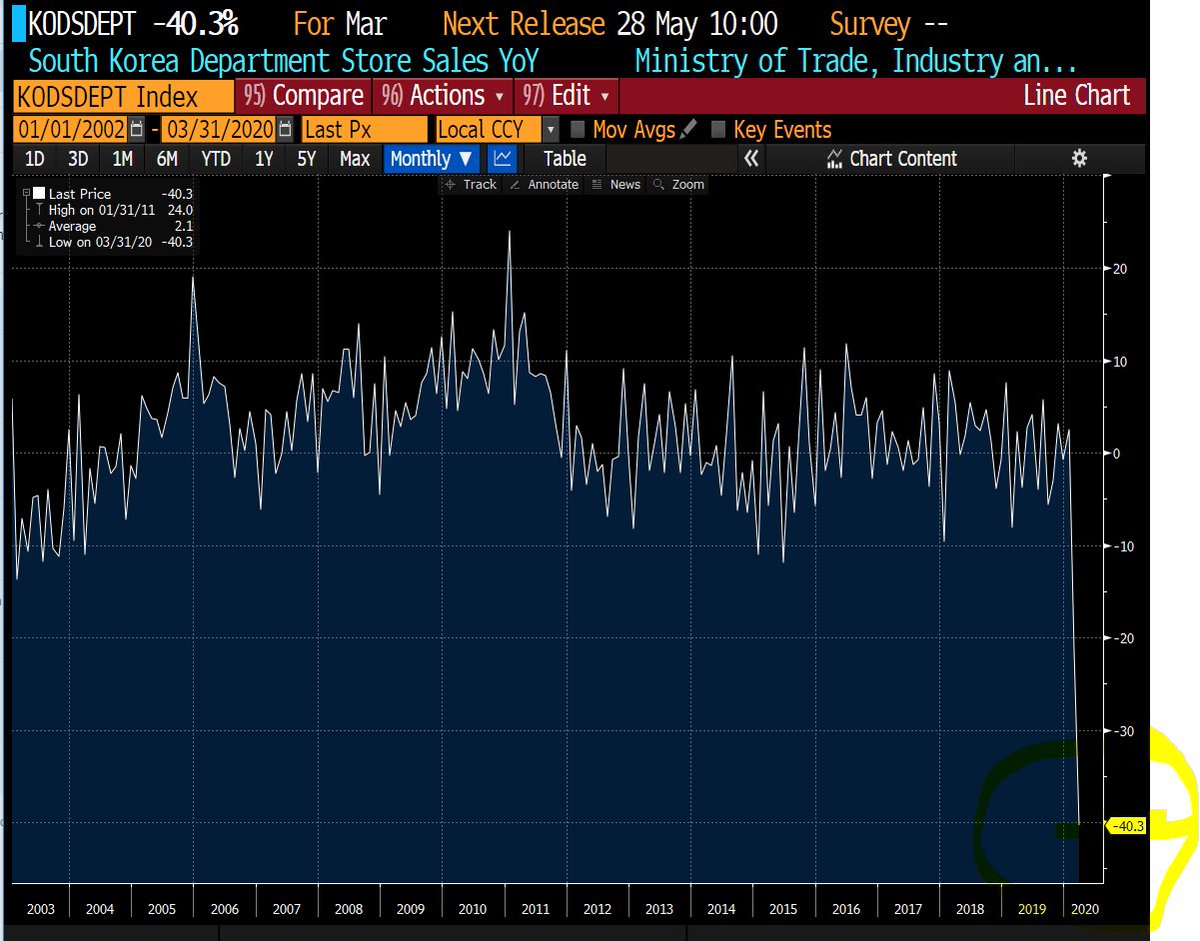

So when you see people tweeting about people moving about in shopping malls & if it appears like we& #39;re back or as some people in China like to call "revenge shopping", a term I loathe & I find totally distasteful, remember this:

While mobility is -8%, SALES DOWN -40%YoY

Why?

While mobility is -8%, SALES DOWN -40%YoY

Why?

Because of the income side of the equation - EARNINGS DOWN. Let& #39;s use department store sales & exports as proxy for the latest earnings of domestic & external sectors.

What do they tell u? Lower earnings & domestic even worse than external even as domestic mobility improves more

What do they tell u? Lower earnings & domestic even worse than external even as domestic mobility improves more

As a result of decline of earnings despite relatively normalized mobility, we can see that people in South Korea feel that their future is WORSE and therefore react appropriately.

This is called risk management. You do more window shopping or buy cheaper items etc vs LEVERAGING.

This is called risk management. You do more window shopping or buy cheaper items etc vs LEVERAGING.

Don& #39;t forget that this economy has 2 problems re domestic demand:

a) High household debt

b) High dependency of SMEs for employment yet SMEs are squeezed & hence gov trying to do more fiscal.

Either way, this does not bode well for growth, which requires people to spend &demand

a) High household debt

b) High dependency of SMEs for employment yet SMEs are squeezed & hence gov trying to do more fiscal.

Either way, this does not bode well for growth, which requires people to spend &demand

Oh I forgot demographic woes too. Anyway, you may ask why is department store sales down -40%YoY vs a -25.1%YoY of exports in April BUT MOBILITY IS BETTER DOMESTICALLY THAN EXTERNAL?

Why?

As I stated in the TV interview, chips can be normalized but people, well, more cautious.

Why?

As I stated in the TV interview, chips can be normalized but people, well, more cautious.

Why do I despise the term "revenge shopping"?

Discretionary consumption is aspirational & isn& #39;t really about revenge. That is what advertisers try to sell you, tapping into your psyche of the life/self u aspire & hope to achieve through purchases.

Do u buy an LV bag to revenge?

Discretionary consumption is aspirational & isn& #39;t really about revenge. That is what advertisers try to sell you, tapping into your psyche of the life/self u aspire & hope to achieve through purchases.

Do u buy an LV bag to revenge?

Such an angry term for what is supposedly an aspirational act. What do you take revenge against?

And what does that say about a society that coins such a term? Why so vengeful? And so the act of consuming material things, esp discretionary, is used as a weapon. To avenge! What?

And what does that say about a society that coins such a term? Why so vengeful? And so the act of consuming material things, esp discretionary, is used as a weapon. To avenge! What?

When u buy a bag/shoe/thing u don& #39;t need, u do it not to avenge a time u were locked down, but rather, u do it to aspire to be seen in a certain light.

The messages are about u can afford conspicuous things as ur essentials are met (nice house, food etc) & go on to consume.

The messages are about u can afford conspicuous things as ur essentials are met (nice house, food etc) & go on to consume.

Here is an ad of Philippe Patek. What do u so u see?

A legacy. A family w/an estate, eluded in the background, & dad likely owns a mode of production & son likely to inherit that.

The watch is for people to aspire to have such legacy wealth so ad target is for nouveau riche.

A legacy. A family w/an estate, eluded in the background, & dad likely owns a mode of production & son likely to inherit that.

The watch is for people to aspire to have such legacy wealth so ad target is for nouveau riche.

Read on Twitter

Read on Twitter