Fundamentals of Interledger Protocol

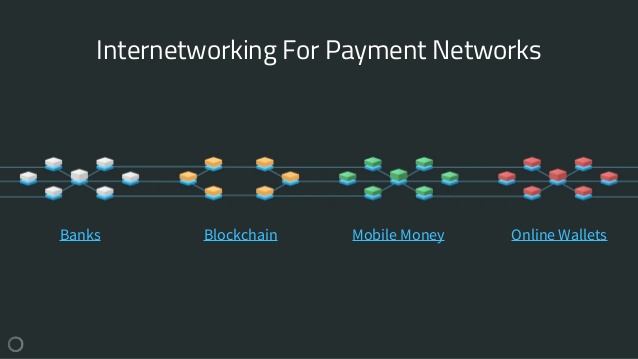

1/ ILP as a standard allows the connecting of value networks (a network of networks). The networks allow for value to flow across many ledgers while preserving value (avoiding double-spend) so long as the routing table is verified / reputable

1/ ILP as a standard allows the connecting of value networks (a network of networks). The networks allow for value to flow across many ledgers while preserving value (avoiding double-spend) so long as the routing table is verified / reputable

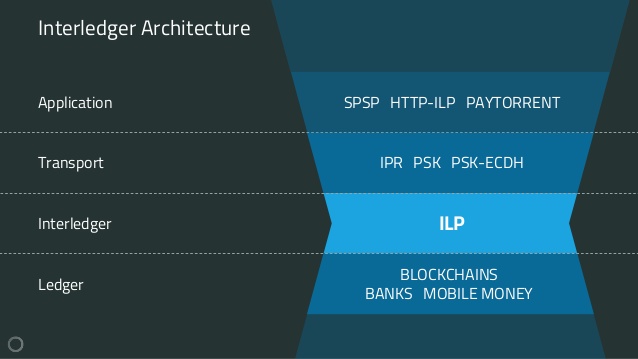

2/ The underlying architecture rests on top of accessible ledgers, like API enabled PayPal, or public permissionless blockchains like BTC. ILP enables the routing of value packets across these ledgers. ILP stacks become interoperable.

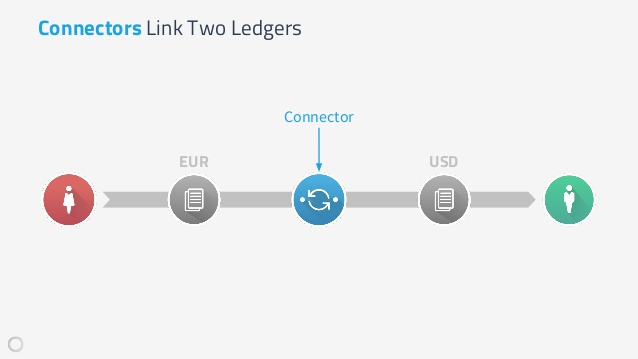

3/ Value is transferred from party A to party B via Connectors. These connectors act as market makers & have ledger wallets on each value pool. Example, Party A on Euro TARGET2 bank network, Connector has FX swap on Target2 to Paypal in the US, then ACH to party B in $.

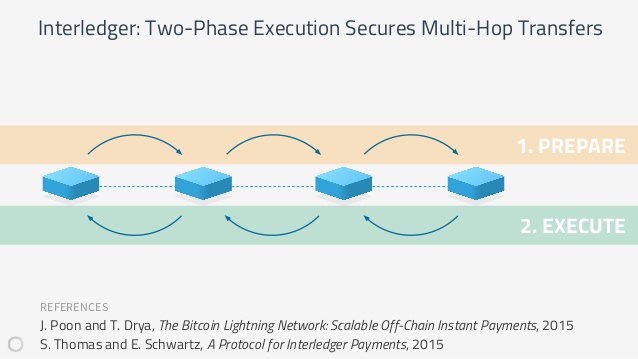

4/ Things get really interesting w/ multi-hop across multiple connectors. Value can start flowing cross-many networks! Market makers enable along the way with tight spreads (competitive), value starts becoming interoperable. Sender / receiver preferences are respected.

5/ Suddenly Party B no longer has to accept the currency of Party A in order to transact, with the likewise being true. Connectors facilitate & compete for the business of facilitating swaps at the lowest spread & value transfer approaches theoretical limit of friction free.

Read on Twitter

Read on Twitter