(1/9) Gold vs Bitcoin: Differences + Characteristics https://bit.ly/3b4u85K

A">https://bit.ly/3b4u85K&q... thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">

A">https://bit.ly/3b4u85K&q... thread

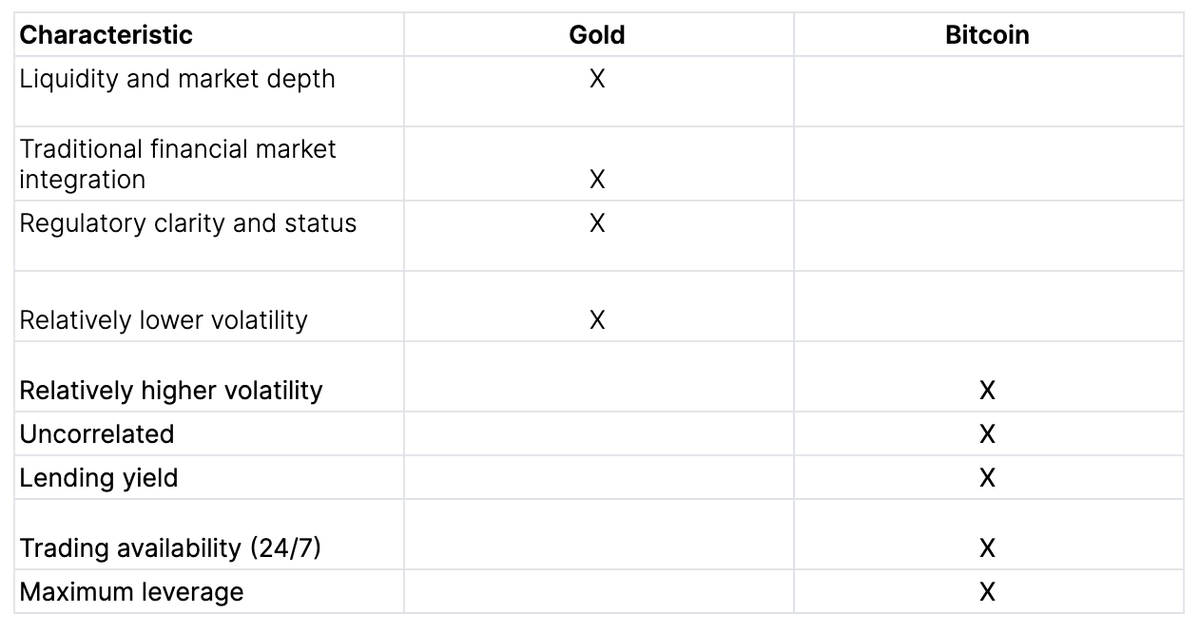

(2/9) Bitcoin and gold can both be traded and accessed via different financial instruments and markets. We compare the two across a number of financial market dimensions in the image below.

(3/9) No attempt has been made to weigh any of the financial market characteristics as their respective importance will vary across individuals and institutions.

(4/9) For example, all cryptoassets combined is ~$200 billion, whereas the size of the gold market is at least an order of magnitude greater, meaning than many institutional investors simply see cryptoassets as too small to invest in at present.

(5/9) Gold is also a more mature asset with regulatory clarity compared to bitcoin, meaning that investing in bitcoin may simply not be an option for many institutional investors at this stage.

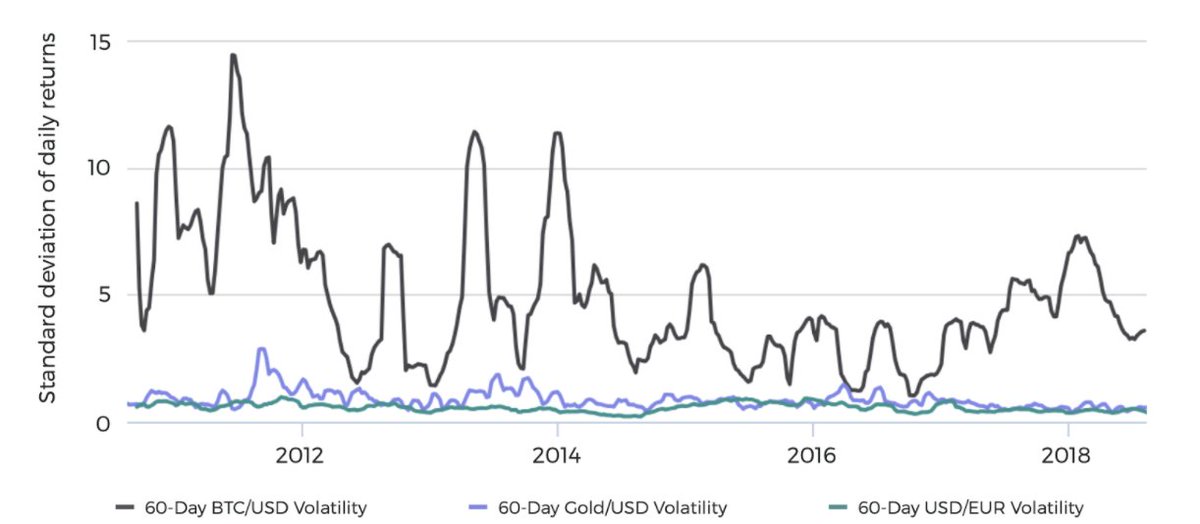

(6/9) One of the main concerns often expressed around bitcoin is its extraordinary volatility relative to gold and other financial assets.

(7/9) While it is true that bitcoin is substantially more volatile than gold and most other currencies and financial assets, outsized volatility is not always a disadvantage.

(8/9) Outsized volatility has played a positive role to date in the growth of cryptocurrency use and adoption. Volatility helps boost liquidity and fund development of critical infrastructure, such as cryptocurrency exchange “on-ramps”.

(9/9) There are numerous other points worth considering when comparing bitcoin to gold. Curious to learn what they are + in need of a good Sunday read?  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Right pointing backhand index" aria-label="Emoji: Right pointing backhand index"> https://bit.ly/3b4u85K .">https://bit.ly/3b4u85K&q...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Right pointing backhand index" aria-label="Emoji: Right pointing backhand index"> https://bit.ly/3b4u85K .">https://bit.ly/3b4u85K&q...

Read on Twitter

Read on Twitter