1/ Teaching my four kids about money, finances, and investing is a topic I& #39;ve given a lot of thought to.

I& #39;m sure this is far from perfect, but this is how I& #39;ve approached it. https://twitter.com/BrianFeroldi/status/1263411673702051840">https://twitter.com/BrianFero...

I& #39;m sure this is far from perfect, but this is how I& #39;ve approached it. https://twitter.com/BrianFeroldi/status/1263411673702051840">https://twitter.com/BrianFero...

2/ When my eldest son was ~10 yrs old, I sat him down and talked to him about money. Honestly, there were only 2 things I wanted him to understand at that age:

1) You pay money to borrow, you get paid money to save

2) Stocks were small pieces of companies that you could own

1) You pay money to borrow, you get paid money to save

2) Stocks were small pieces of companies that you could own

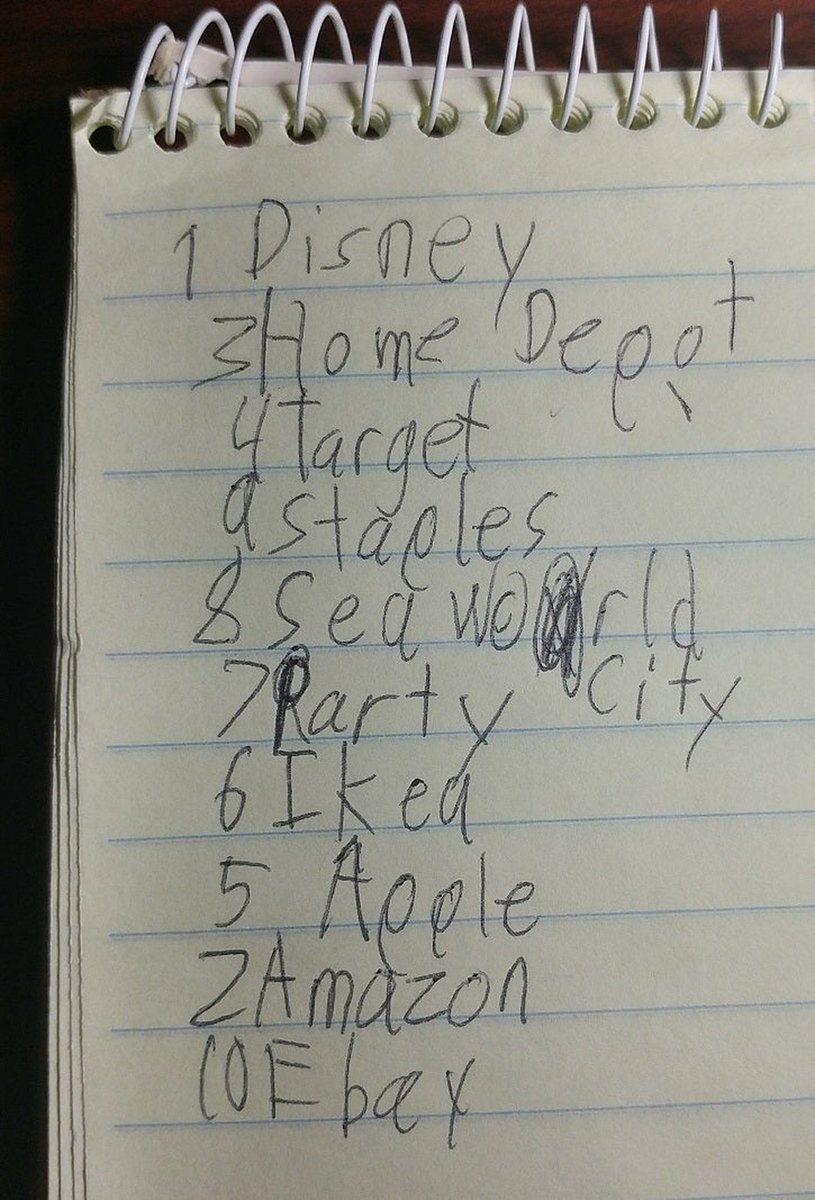

3/ I did my best to explain to him what stocks are and how they work. After working through a few basic examples, I had him make a list of about 10 cos. Some were private companies but many were not only public, but also solid investment opportunities.

4/ After making the list, we ranked them together. This is my opportunity as a parent to steer him away from things like Sea World $SEAS (he had recently been to its water park) and Party City $PRTY (where he got his Halloween costume from) and towards cos like $AMZN and $DIS.

5/ That year $AMZN and $DIS were his top two choices, so I invested in both of them in his and his younger siblings& #39; Coverdell ESAs.

I like using this account b/c 1) It& #39;s used for college savings; 2) It allows for self-directed investments. https://www.savingforcollege.com/article/coverdell-esa-investment-options">https://www.savingforcollege.com/article/c...

I like using this account b/c 1) It& #39;s used for college savings; 2) It allows for self-directed investments. https://www.savingforcollege.com/article/coverdell-esa-investment-options">https://www.savingforcollege.com/article/c...

6/ Side notes:

Coverdells allow max contributions of $2K/yr. After that college savings are directed to 529 funds.

FL has no state income tax. Not sure how I would feel about forgoing state income tax benefit that 529s offer that Coverdells don& #39;t if I lived in different state

Coverdells allow max contributions of $2K/yr. After that college savings are directed to 529 funds.

FL has no state income tax. Not sure how I would feel about forgoing state income tax benefit that 529s offer that Coverdells don& #39;t if I lived in different state

7/ Every yr, we have another sit down talk about money, reviewing and diving deeper. It ends with his HW assignment of making another list of cos that we then review for that yr& #39;s Coverdell investments. When his oldest sister reached 10, she was brought into these conversations.

8/ More side notes:

Talks are about an hour. Just once/yr, except for when they bring up the topic of money or investing during the year.

Talks cover basic personal finance and investing.

When child #3 reaches 10, she& #39;ll be brought into the talks as well.

Talks are about an hour. Just once/yr, except for when they bring up the topic of money or investing during the year.

Talks cover basic personal finance and investing.

When child #3 reaches 10, she& #39;ll be brought into the talks as well.

9/ FWIW, their portfolios have done very well. This year, they picked $ADBE (my son loves to edit videos) and $MSFT (more for Xbox and Minecraft than anything else, but we always discuss other things a company does).

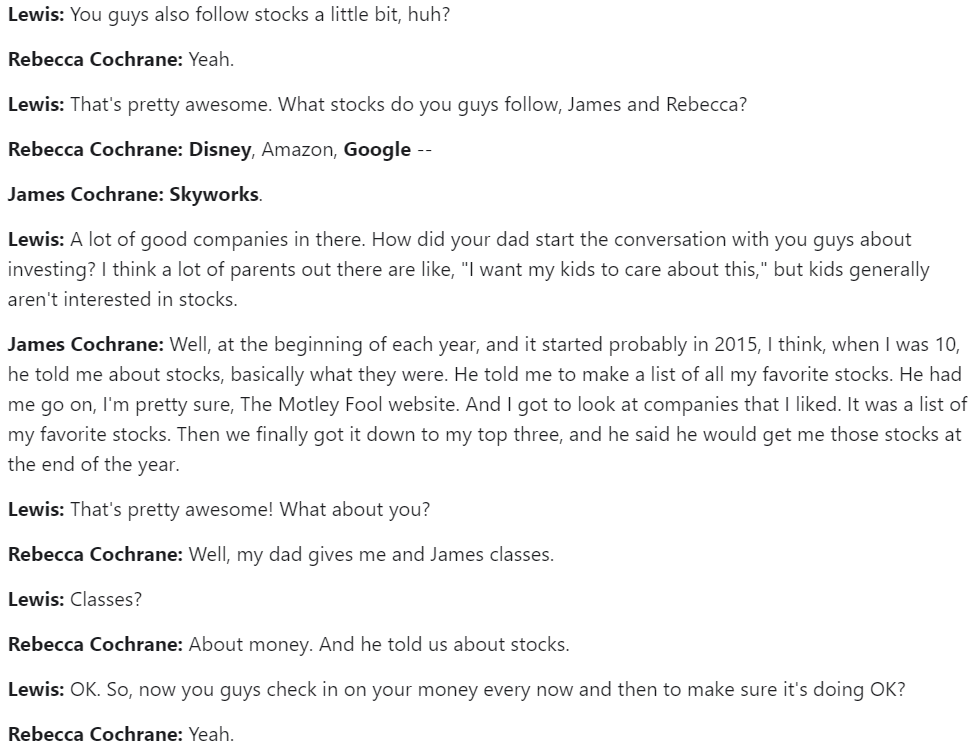

10/ Last year, my kids were interviewed at the end of an @MFIndustryFocus episode with the always excellent @WilyLewis, who did a great job of making them feel comfortable and welcome as they discussed their investing process and portfolios! https://www.youtube.com/watch?time_continue=1423&v=-Ve9vSE9Mis&feature=emb_logo">https://www.youtube.com/watch...

11/ Here& #39;s a transcript of that interview:

12/ I& #39;ve also given my kids reading material over the years. My son has read books like The Richest Man in Babylon, Better than a Lemonade Stand, and the first 5 chaps of Joel Greenblatt& #39;s The Little Book That Beats the Market (love how Greenblatt walks through simple exercises).

13/ Would love to hear what others have to say.

@bwithbike has given excellent advice on this topic over the years. Can you chime in Brian?

Would also love to hear from @7AustinL @7investingSteve @TMFStoffel and any others with their experiences sharing with their kids.

@bwithbike has given excellent advice on this topic over the years. Can you chime in Brian?

Would also love to hear from @7AustinL @7investingSteve @TMFStoffel and any others with their experiences sharing with their kids.

14/ We also give our kids allowances putting them in charge of discretionary income. We provide them w/ everything they need, but if we went to Disney World they would be in charge of paying for any souvenirs, etc.

15/ And stupid careless omission on my part. We need to hear from @RyanKruegerROI on raising kids and teaching them about financial responsibility and finances. He& #39;s my go-to resource and mentor for this stuff!

Read on Twitter

Read on Twitter