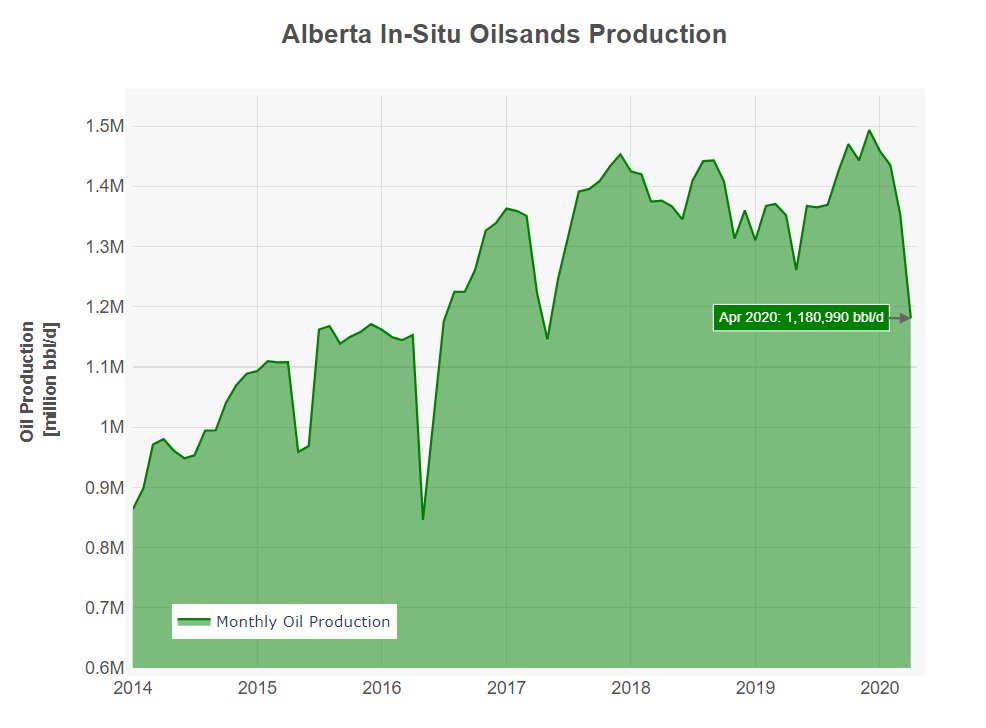

A THREAD looking at Alberta In-Situ Oilsands Production shut-ins and rampbacks. All data from AER, up to April 2020. #OOTT #EFT

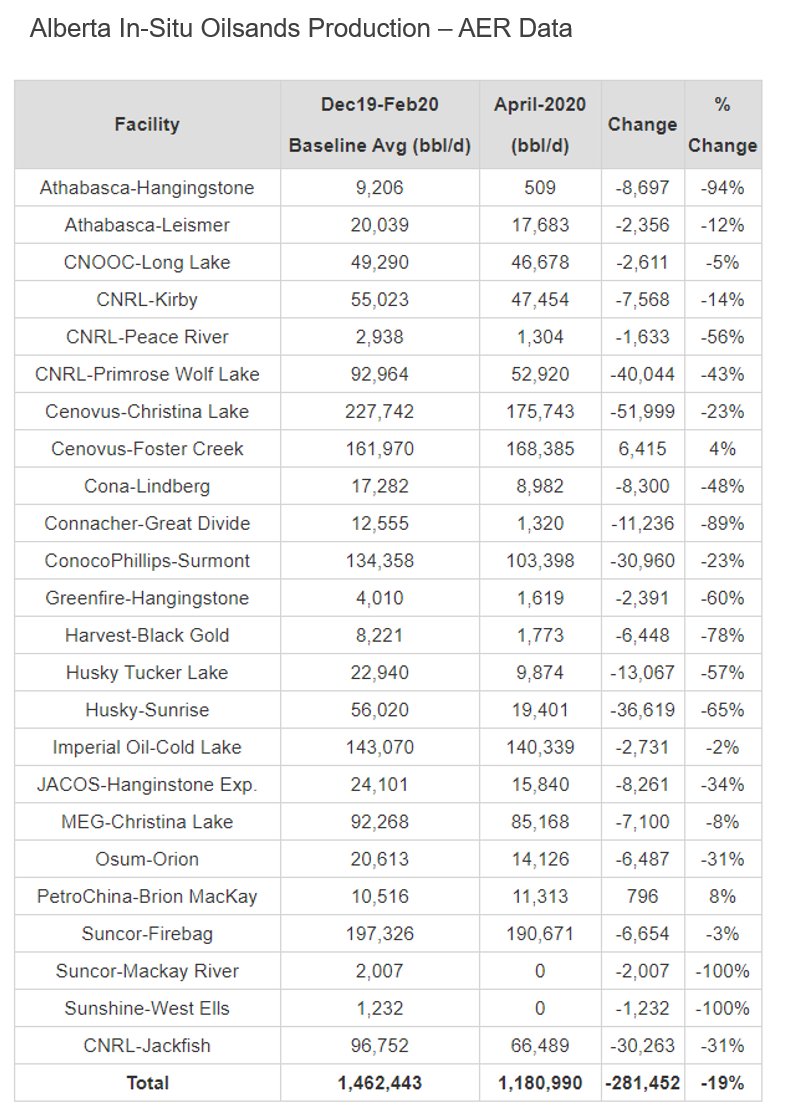

Using a 3 month baseline avg of Dec19 - Feb20, April 2020 in-situ production declined ~280K bbl/d or almost ~20%

Using a 3 month baseline avg of Dec19 - Feb20, April 2020 in-situ production declined ~280K bbl/d or almost ~20%

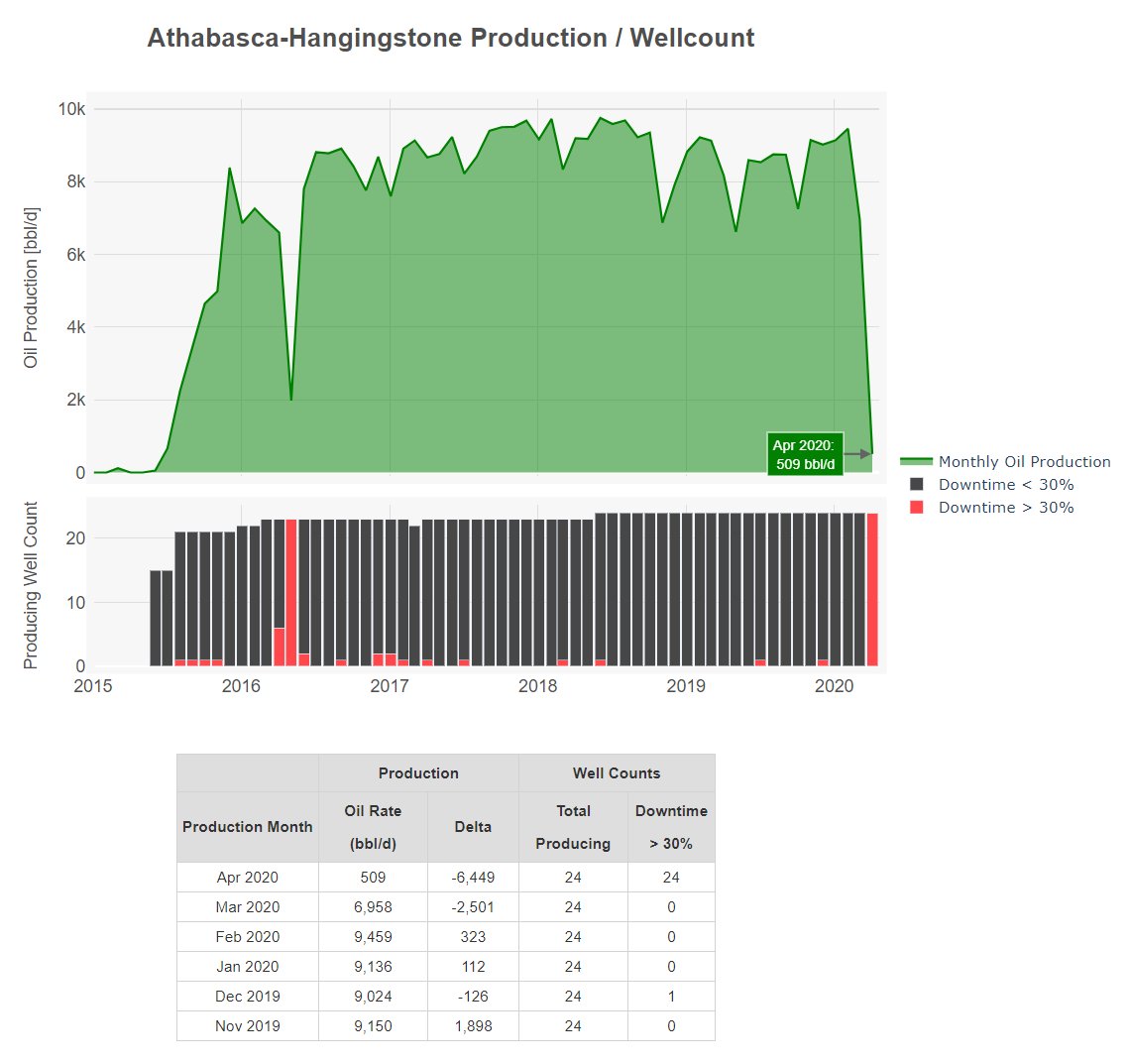

$ATH Hangingstone asset on its way to being fully shut-in as previously announced.

All producing wells had downtime > 30% of the month indicating wells are being shut-in.

All producing wells had downtime > 30% of the month indicating wells are being shut-in.

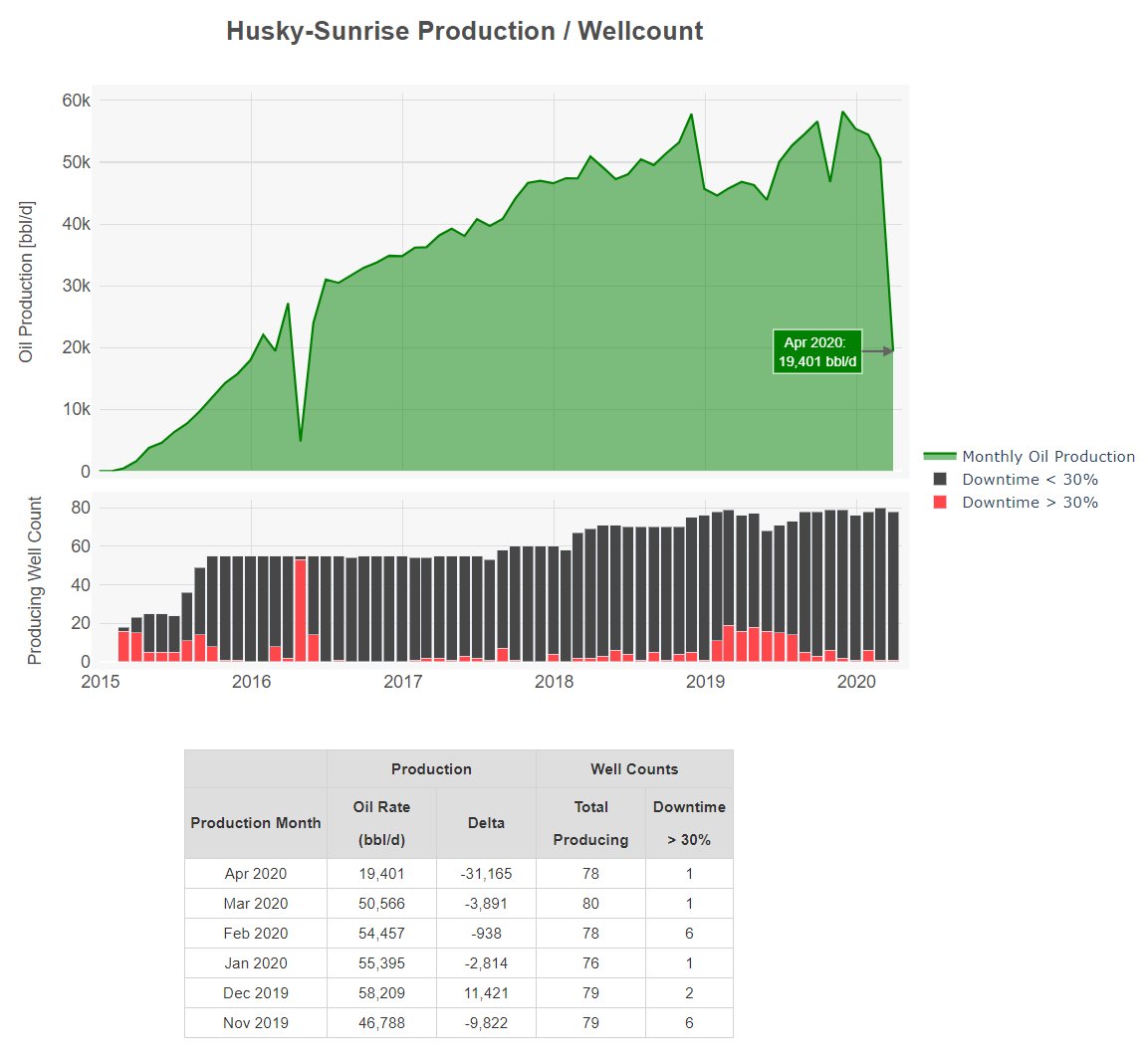

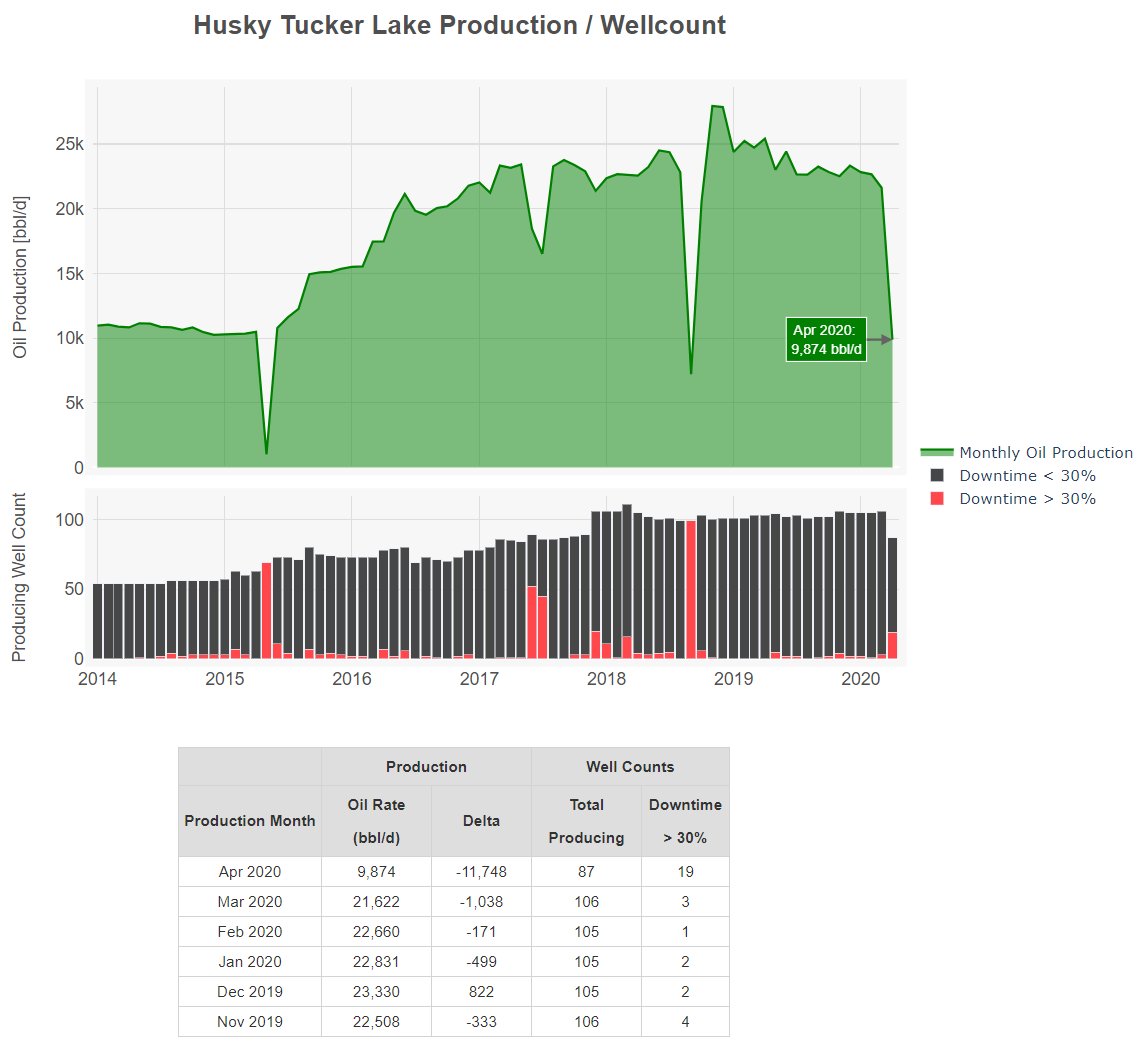

For comparison, $HSE Sunrise project showing reduced production with limited number of wells >30% downtime, implying wells are being slowed rather than shut-in. Tucker Lake reducing rates with shut-ins and slowdowns.

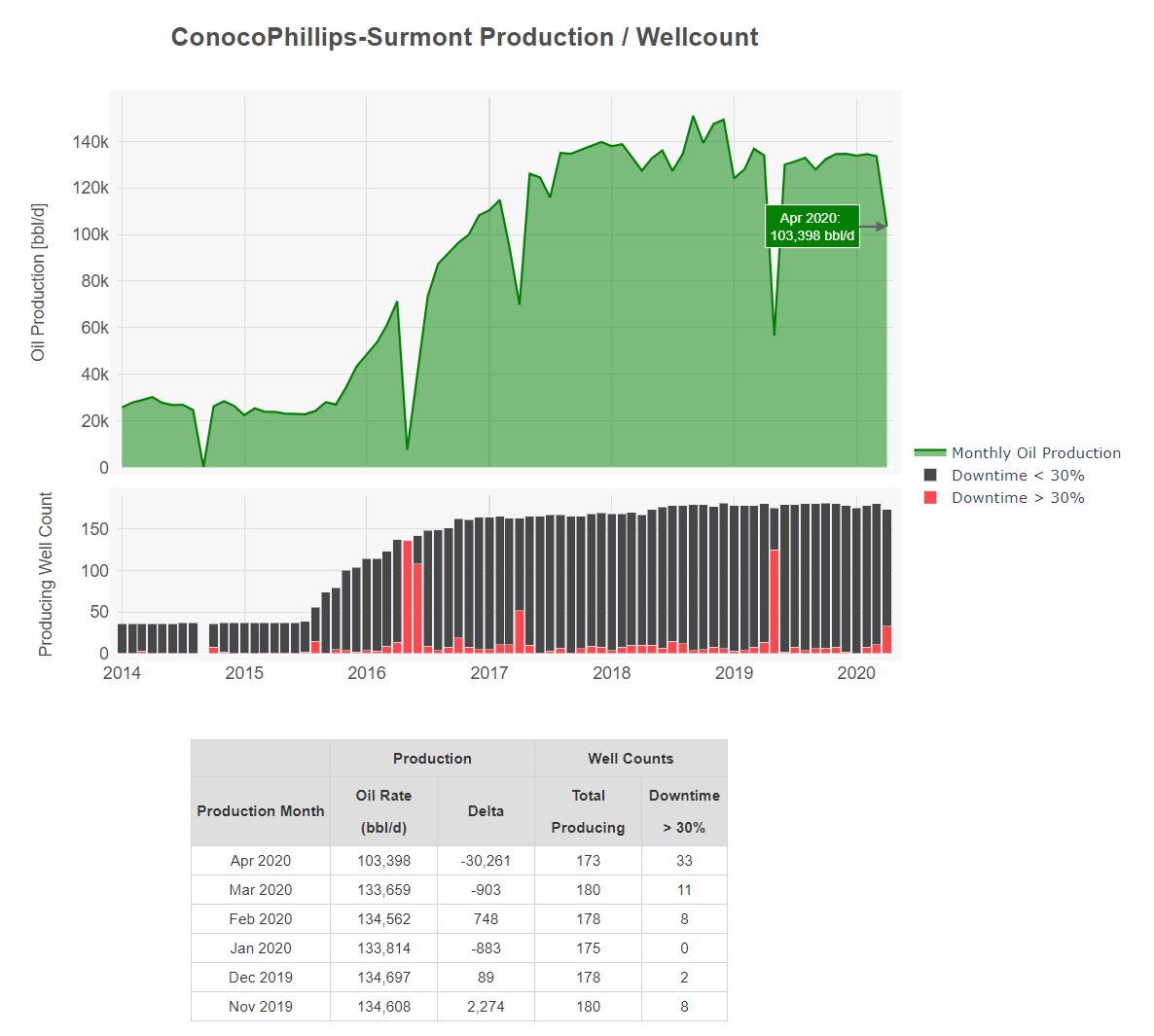

$COP Surmont on its way down towards the 35K bbl/d range as previously announced. Appears there are some some shut-ins, but mostly well ramp-backs to this point. Will be interesting to see if they actually get that low.

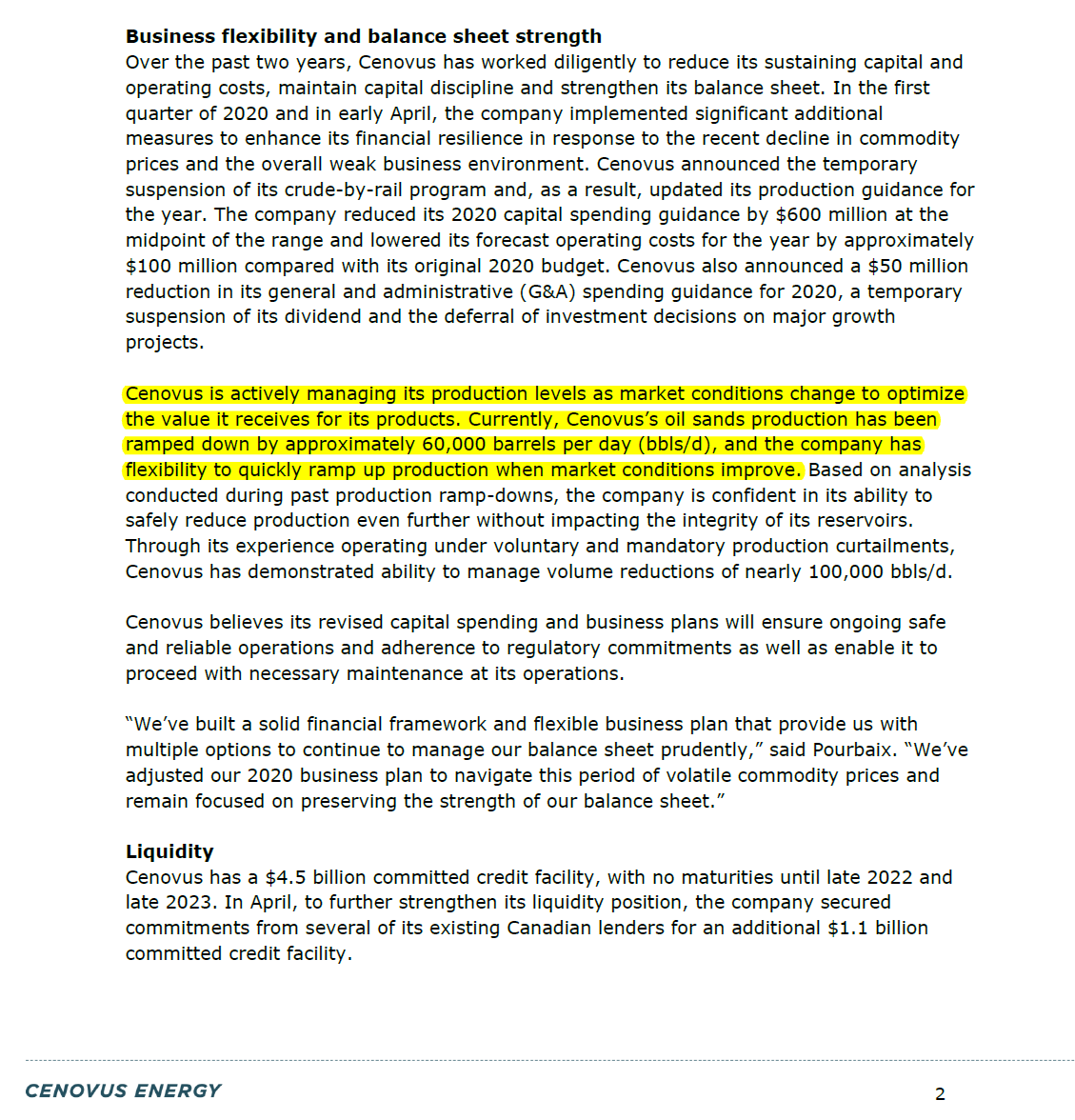

$CVE Christina Lake ramping back from the end of 2019 highs with the previously announced production cuts and temporary suspension of its crude-by-rail program.

$CVE Foster Creek holding steady

$CNQ Kirby South ramping back wells likely trying to protect newer/younger wells at Kirby North

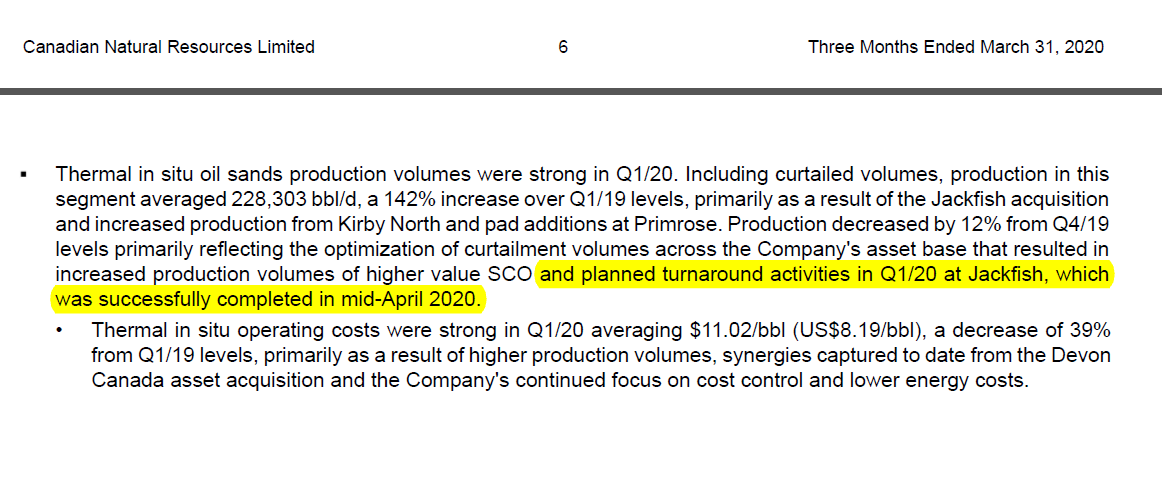

$CNQ Jackfish reductions largely due to a maintenance turnaround in March at the Jackfish 3 plant. Unclear what rates it will return to in May.

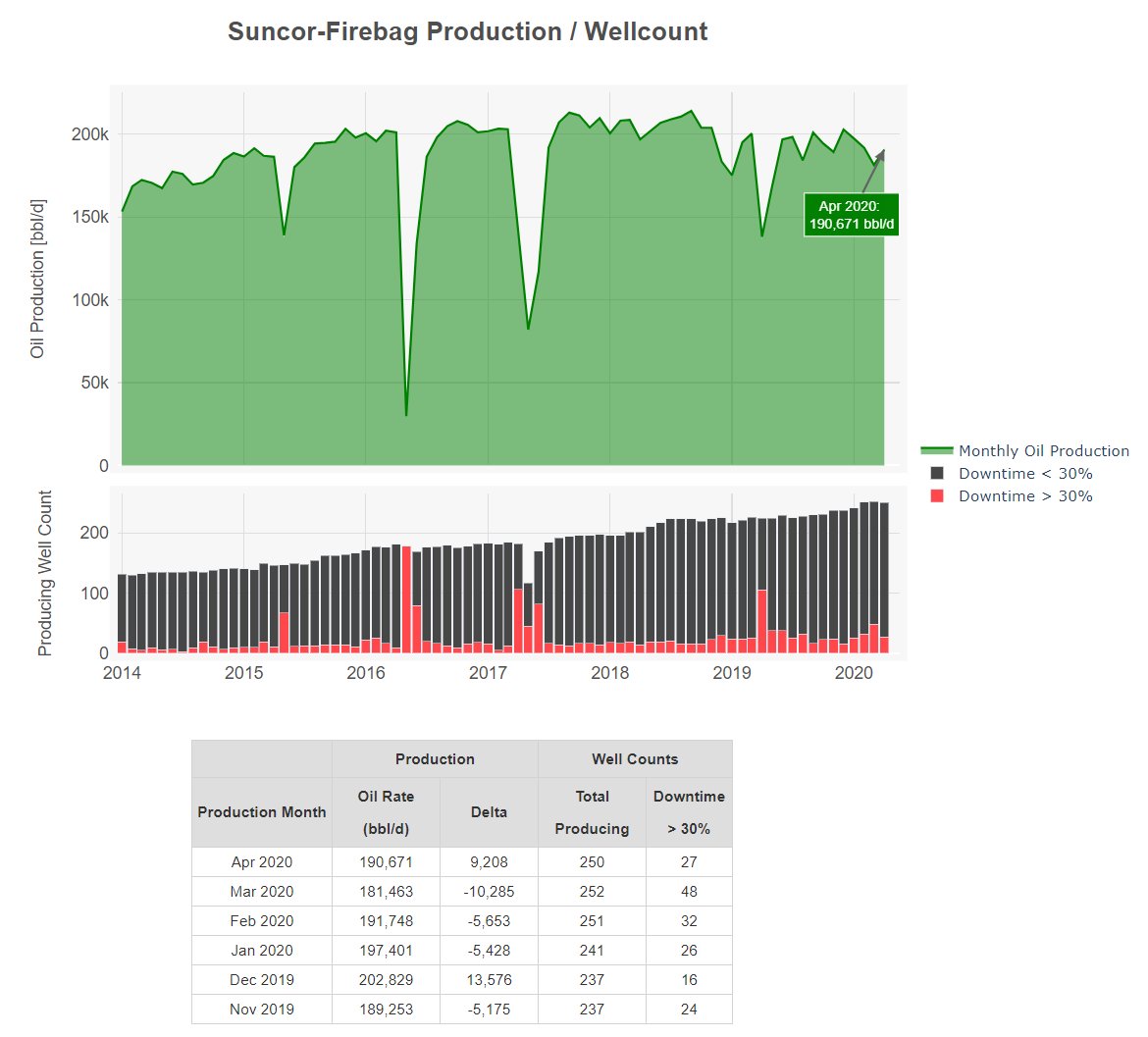

$SU Firebag production steady. Mackay River still offline.

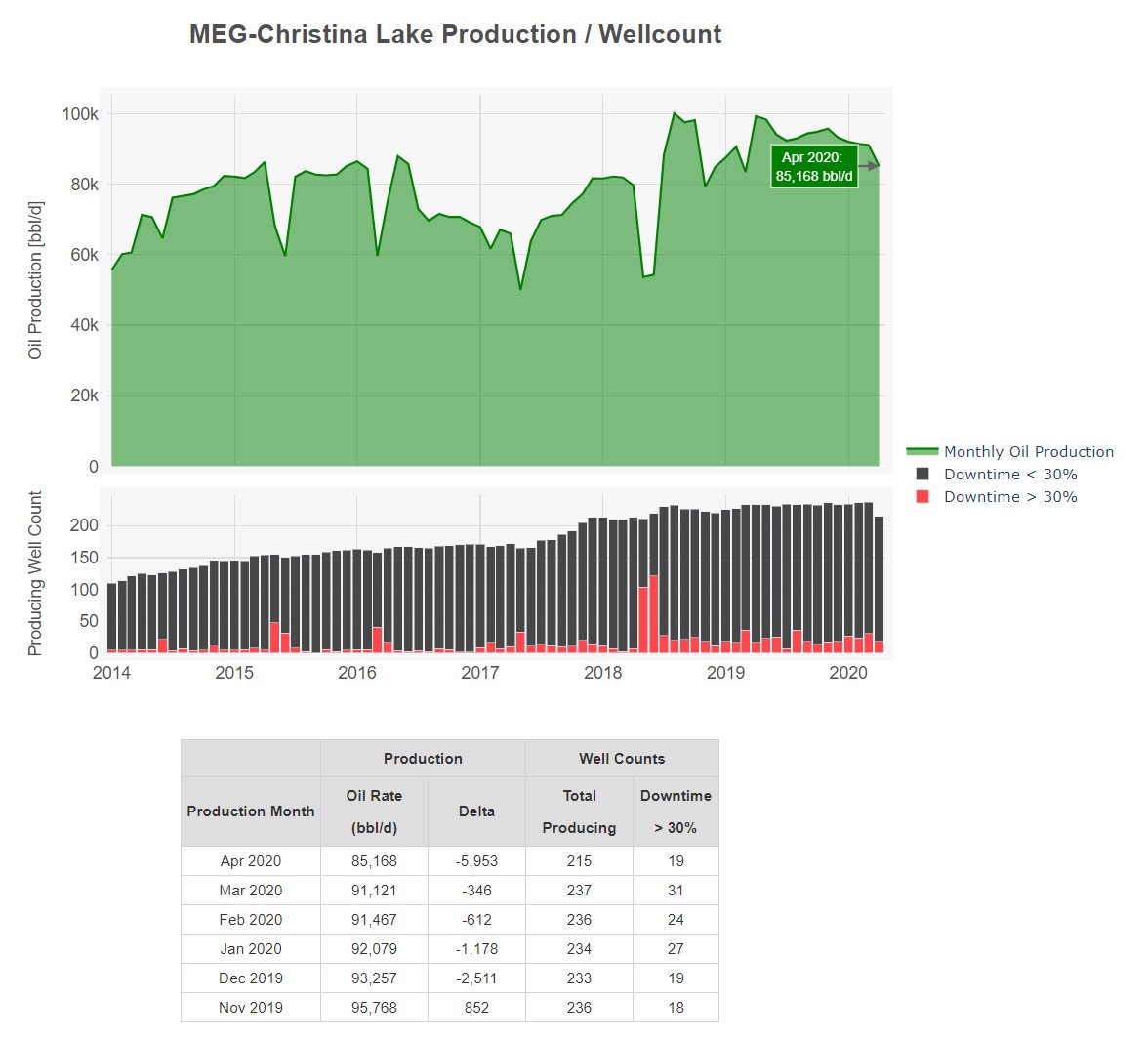

$MEG Christina Lake, small reduction in rates.

Greenfire Hanginstone project appears to be on its way to a full shut in. Producing well count dropping and those that did produce in April, over half were offline for more than 30% of the month.

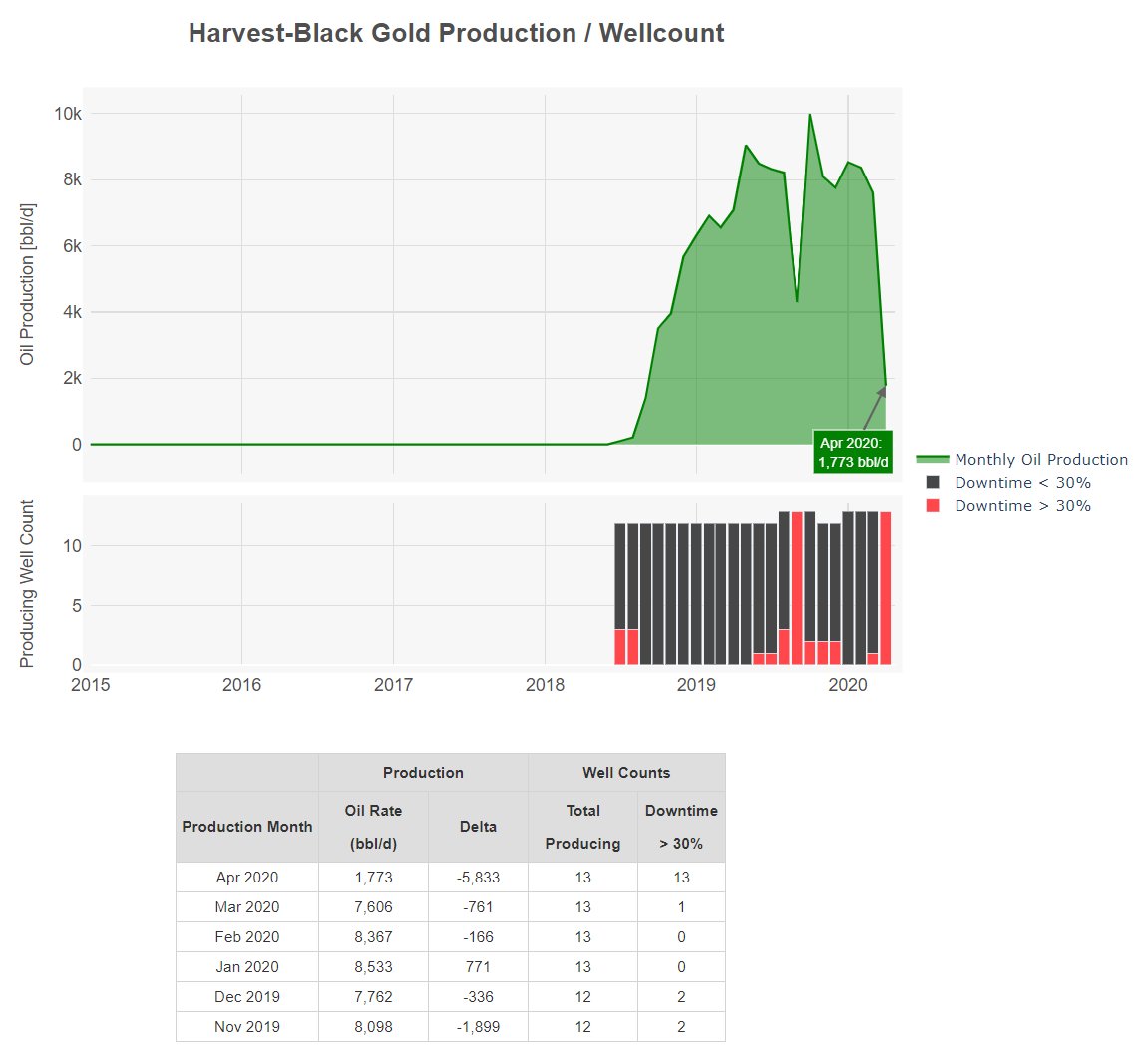

Harvest Blackgold project also appears to be headed for full shut in. All wells that had production volumes for April were offline > 30% of the time. Likely shut-in mid month.

Sunshine West Ells looks as if it was headed for a shut-in prior to market collapse, but made it official with zero production in April.

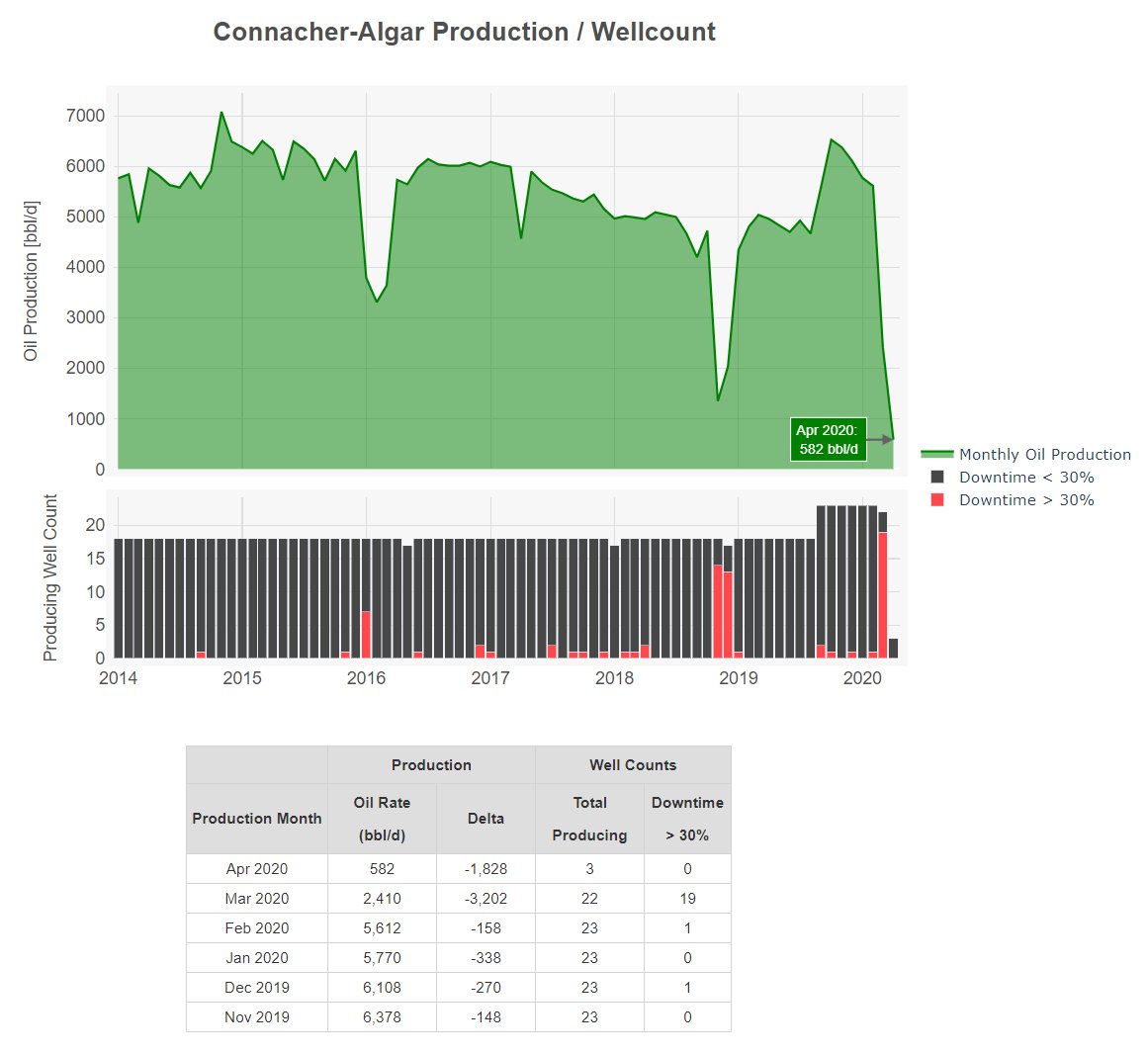

Connacher Oil and Gas Great Divide SAGD Facilities (Algar & Pod One) both look like they shutting in or operating at extremely low rates.

With June WCS pricing currently sitting in the US$28.50/bbl range (vs US$2.70 /bbl in April), it is likely to see some of the larger producers bring a few of these ramped back / shut-in barrels back to the market. END

@SadBillAckman @TSXcapital @WillRayValentin @rbl1973

@SadBillAckman @TSXcapital @WillRayValentin @rbl1973

Read on Twitter

Read on Twitter