Onchain fees / Mempool update

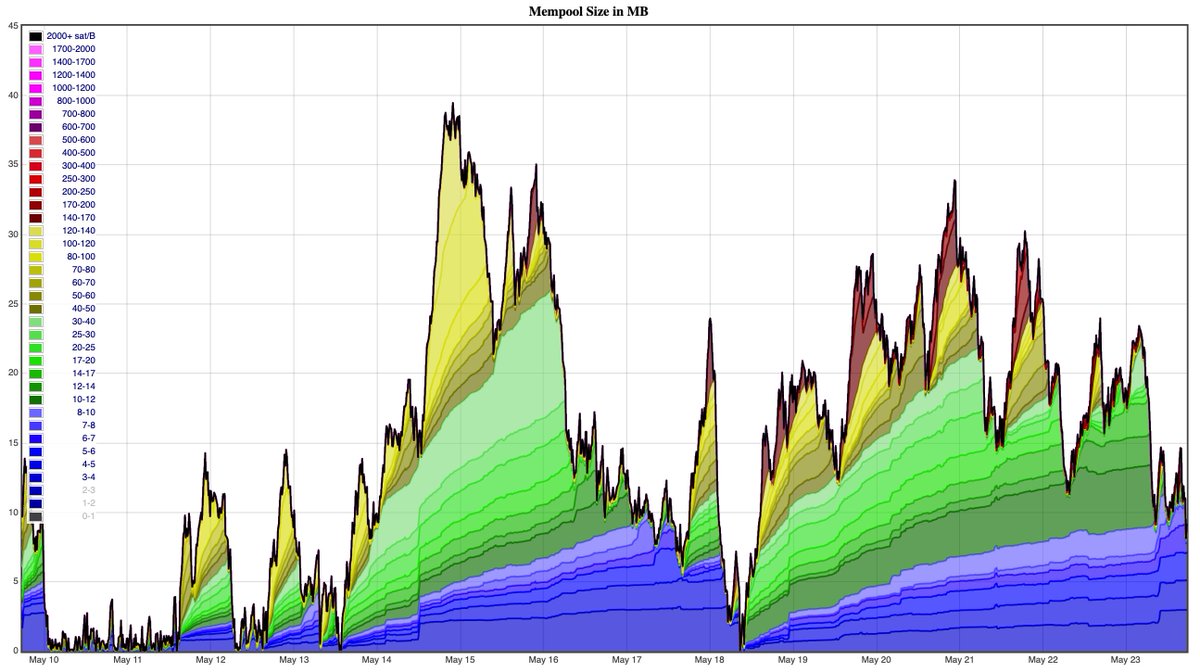

As we clear out the end of a 2w high-mempool period, time for some Saturday quarterback analysis and predictions for the mempool in a hypothetical bull market.

Snuggle in kids, it& #39;s mempool time!

As we clear out the end of a 2w high-mempool period, time for some Saturday quarterback analysis and predictions for the mempool in a hypothetical bull market.

Snuggle in kids, it& #39;s mempool time!

For context this is the equivalent thread from 1y ago, https://twitter.com/ziggamon/status/1134490575925927936">https://twitter.com/ziggamon/...

and another year from the original one which was seen by some as controversial at the time. https://twitter.com/ziggamon/status/975067727785349121">https://twitter.com/ziggamon/...

Causes: The past two weeks& #39; high fees had two main causes. First off is the halving which many of you celebrated, caused a decline in hashrate by some 20-30% or so. This has caused fewer blocks, and will continue until the next retargeting ca 14 days from now.

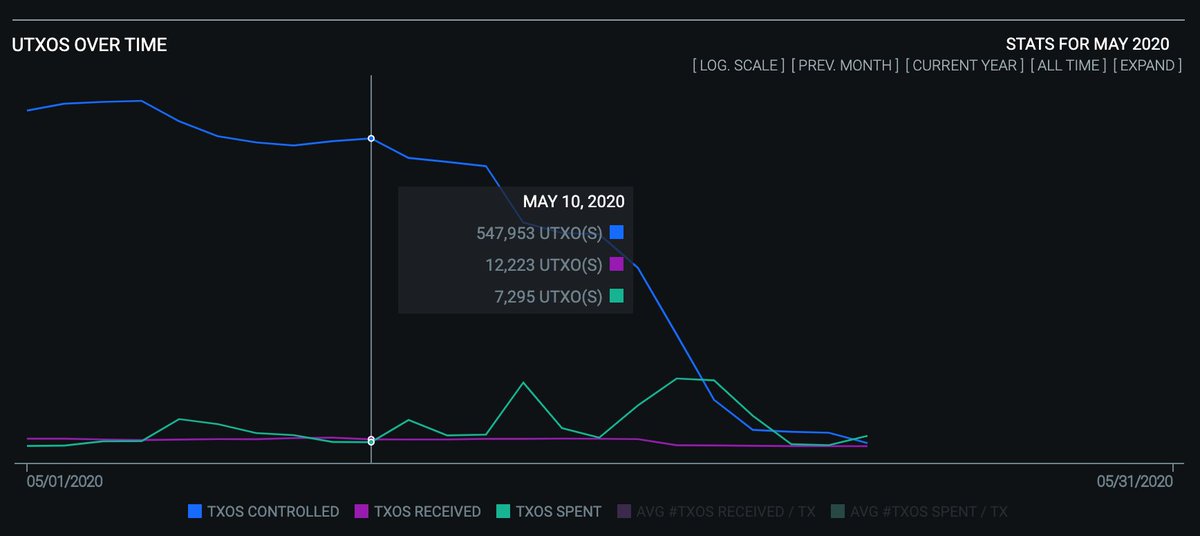

Secondly, is this mysterious entity which has been consolidating outputs at the highest fee rates, driving up fees for everyone. Over the past 14 days they have consolidated lower-bound of 720 thousand outputs, which lands at 5 MB per day, more than what Bitmex does.

The entity can be seen here https://oxt.me/entity/tiid/2561452717

H/T">https://oxt.me/entity/ti... @LaurentMT for custom indexing it. Speculation of who is behind it and why is ongoing and welcome, my money is on negligence, that usually is the cause. At avg 100 sat/B they lower-bound spent 72 BTC on this consolidation.

H/T">https://oxt.me/entity/ti... @LaurentMT for custom indexing it. Speculation of who is behind it and why is ongoing and welcome, my money is on negligence, that usually is the cause. At avg 100 sat/B they lower-bound spent 72 BTC on this consolidation.

And of course thirdly, the halvening caused large fluctuations in the bitcoin price, which as we know causes traders to be sending coins between exchanges, making this quite the perfect storm.

20-30% fewer blocks, large entity eating another 5%, and then some high demand on that

20-30% fewer blocks, large entity eating another 5%, and then some high demand on that

Which makes it a decent fire drill for what might happen if we see another bull market.

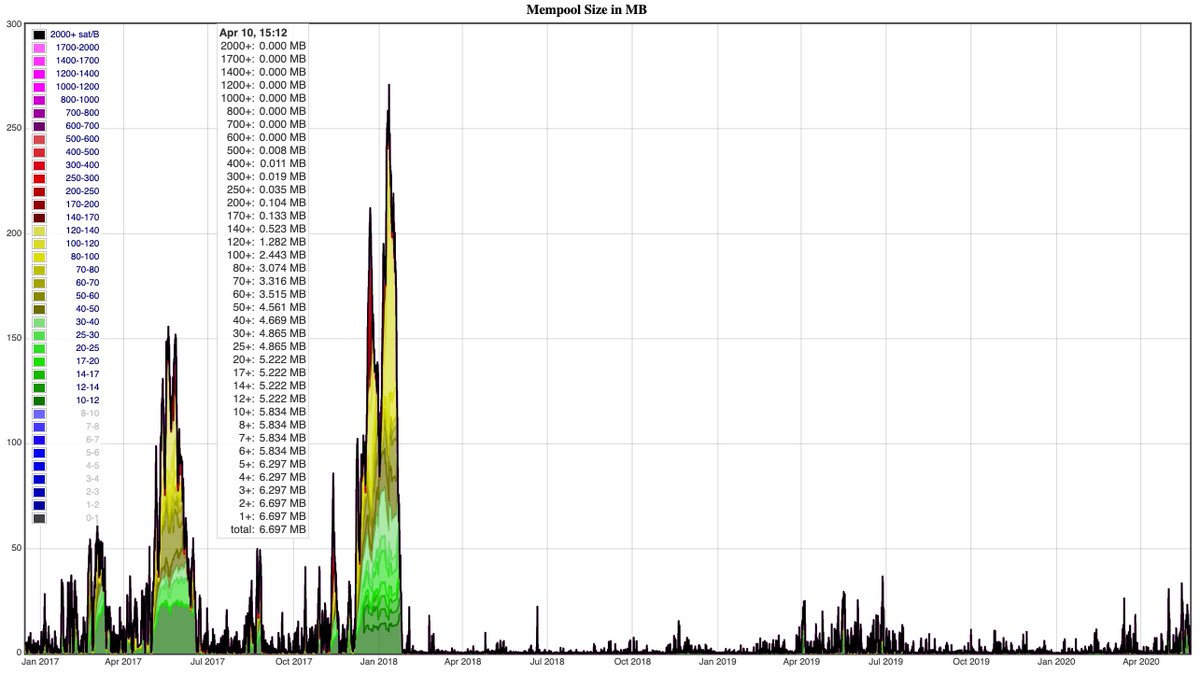

First of all a reminder, this is how this "crisis" stacks up to what happened in & #39;17

First of all a reminder, this is how this "crisis" stacks up to what happened in & #39;17

Some qualified guesses: I wouldn& #39;t now make the same call I did in & #39;18 that high fees can& #39;t happen. I think in a bull market we should expect a 5x growth in onchain transactions from what we saw, but we should then also see an increase in hash rate and less consolidation txs.

My hunch is that during the highest load during a bull run we will see pressure worse than what we saw the past two weeks, but very unlikely something worse than in & #39;17. Network has scaled significantly in so many ways since then, batching being just one of them.

It& #39;s possible that the mempool won& #39;t clean up for an entire month, but likely not two or more. By "clean up" I mean a point where transactions <10 sat/B confirm. The norm will still be that usually cleans up to that point every weekend.

It& #39;s impossible to predict if it& #39;d clean up all the way to 1 sat/B because there are still many entities that haven& #39;t cleaned out their wallets, and their behavior is hard to predict.

Interestingly, we may be seeing the emergence of a fee market for consolidations on weekends, as it& #39;s now imagineable that the mempool will not clean out all the way every weekend.

If it does, and one can no longer expect to concolidate utxos for 1.0 sat/B every weekend it will be bullish for the "never ending mempool" scenario that is needed for a healthy fee market.

My hunch is still that since tx demand comes unevenly, that means there will be spikes with intense pressure, causing some traffic to route through other paths, leading to the mempool always clearing out periodically. I hope I& #39;m wrong on this for the sake of the fee market.

As usual, advice to exchanges is to prepare for this, as it may be that the ability to deposit and withdraw becomes a competetive advantage. Bitrefill can help you get on Lightning, and I& #39;m sure Blockstream will gladly help you get on Liquid. If not, there& #39;s still LTC/BCH/DOGE

That& #39;s all for now, remember to sweep your coins, open your Lightning channels and keep staring at the mempool!

Read on Twitter

Read on Twitter