Hertz (the car rental guys) filed for bankruptcy last night. Here& #39;s your 90 second catch-up [Thread] https://twitter.com/CNBCnow/status/1263945402514132994">https://twitter.com/CNBCnow/s...

You just got back from Vegas with a bad credit score and possibly Chlamydia. How do you get home?

If you answered "Uber". It& #39;s one reason these companies are being hammered. 2/3rds of car rental revenues come from airports.

Company is $19bn in debt, which also really.... Hertz

If you answered "Uber". It& #39;s one reason these companies are being hammered. 2/3rds of car rental revenues come from airports.

Company is $19bn in debt, which also really.... Hertz

US companies usually buy the cars & them sell them once they& #39;re done. In Europe, they buy the cars BUT with the right to sell them back to the manufacturer at a locked-in price in the future.

Which one seems like the less risky option?

Exactly - the European model

Which one seems like the less risky option?

Exactly - the European model

Now Hertz needs to sell its cars to pay off its debt. How many cars? Around half a million cars.

(I know you got anxiety reading this. It& #39;s a mess)

If they dump all 500k into the market at once, car prices will tank. So they will try and sell around 30k cars a month.

(I know you got anxiety reading this. It& #39;s a mess)

If they dump all 500k into the market at once, car prices will tank. So they will try and sell around 30k cars a month.

Hertz also owns Dollar & Thrifty car rental. They bought the business in 2012 for $2.3bn (terrible deal)

Hertz refused to increase their offer for Thrifty stock in 2008 ($2/ share)

Hertz ended up paying $72 four years later. Most people believe they could have scored it at $54

Hertz refused to increase their offer for Thrifty stock in 2008 ($2/ share)

Hertz ended up paying $72 four years later. Most people believe they could have scored it at $54

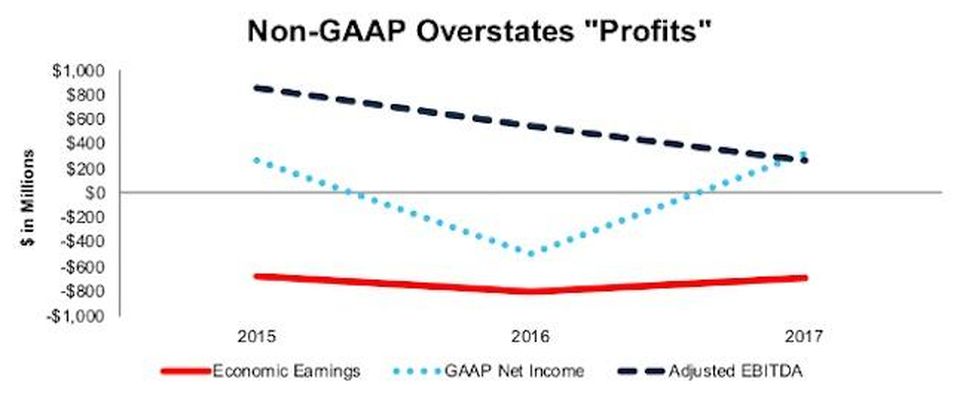

Besides completely overpaying for Dollar & Thrifty. Hertz also had a series of accounting issues. They paid SEC fines and had to restate 3 years of financial info.

The company turned around and sued 4 of its senior exec for $200m in damages.

The company turned around and sued 4 of its senior exec for $200m in damages.

Carl Icahn, who is valued at just under $17bn, owns roughly 40% of Hertz. Wait? Why doesn& #39;t he save the business?

Billionaires aren& #39;t fond of burning their own cash to save dying businesses.

Remember Richard Branson crying for help to save Virgin a few weeks ago?

Billionaires aren& #39;t fond of burning their own cash to save dying businesses.

Remember Richard Branson crying for help to save Virgin a few weeks ago?

"In chaos, lies opportunity"

Enter Apollo Global, a private equity firm known for betting on bankruptcies. They started buying up insurance contracts (credit default swaps) on Hertz debt a few months ago.

As bankruptcy risk increases, the value of the insurance goes up.

Enter Apollo Global, a private equity firm known for betting on bankruptcies. They started buying up insurance contracts (credit default swaps) on Hertz debt a few months ago.

As bankruptcy risk increases, the value of the insurance goes up.

Should government always intervene distressed companies? Short answer - No.

Usually debt holders and creditors get paid out first. Employees get settled (with protected benefits).

Bailouts are used to "rescue" already wealthy investors, hedge funds and large shareholders

[END]

Usually debt holders and creditors get paid out first. Employees get settled (with protected benefits).

Bailouts are used to "rescue" already wealthy investors, hedge funds and large shareholders

[END]

@chamath nailed it on CNBC a few weeks ago https://twitter.com/CNBC/status/1248669571441209346?s=20">https://twitter.com/CNBC/stat...

Read on Twitter

Read on Twitter