1/ The ABL Plan is built on two academic studies that are repeatedly referenced in the Plan as "proof" that the Govt should not default on domestically-held debt because it& #39;d lead to a deeper economic recession. Neither of the studies say what ABL claims. They say the opposite

2/ These studies form the basis of ABL& #39;s view that the Govt should not haircut its debt. This is the whole purpose of the Defeasance Fund. But the studies don& #39;t really say what ABL claims. It& #39;s as though the studies were shoe-horned in to support the Defeasance Fund demand.

3/ Firstly, the ABL Plan says that an internal default would lead to 10-12% bigger economic contraction than assumed in the Govt Plan because an academic study shows that, on average, countries that experience internal default also experience deeper recessions.

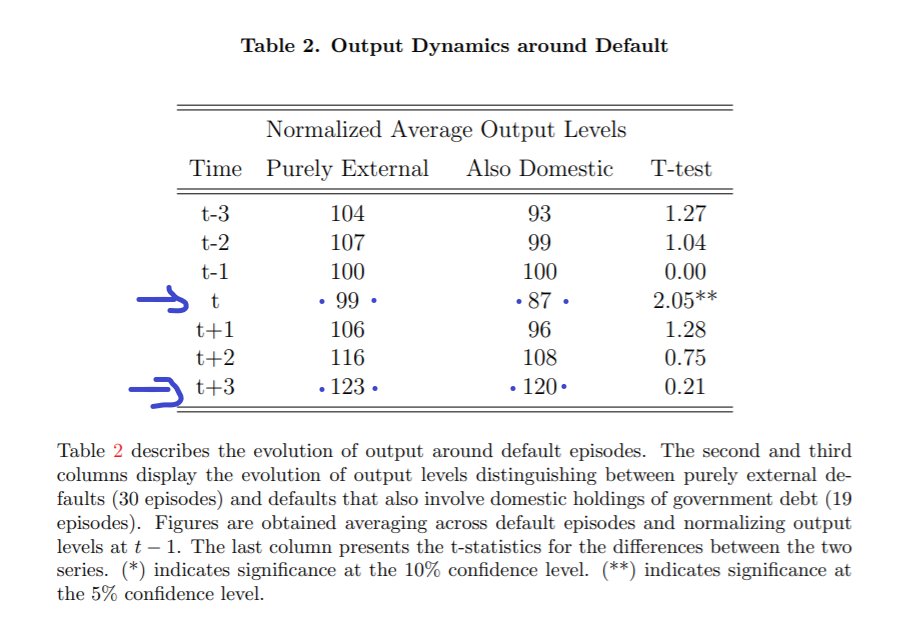

4/ Here& #39;s what the study actually says. It is not that domestic default CAUSES the economy to contract more, but that a larger economic contraction HAS ALREADY HAPPENED before the domestic default (default at time & #39;t& #39;). It& #39;s the exact opposite relationship.

5/ The countries in the studies experience default generally as follows: countries borrow a lot,lend to the private sector, the economy grows, then the economy stops growing and the country defaults b/c it borrowed too much. Private sector debt increases until the default

6/ Lebanon& #39;s default is fundamentally different. Banks stopped lending seriously to private sector three years ago. So we didn& #39;t have a private sector credit bubble. Banks lent their money to BDL (and indirectly the Govt). The default happened because new deposit inflows stopped

7/ The Lebanese economy has been in bad shape for years with flat output and shrinking lending to the private sector. The circumstances of the default for Lebanon is so fundamentally different from the normal case that these studies may not be representative of our case.

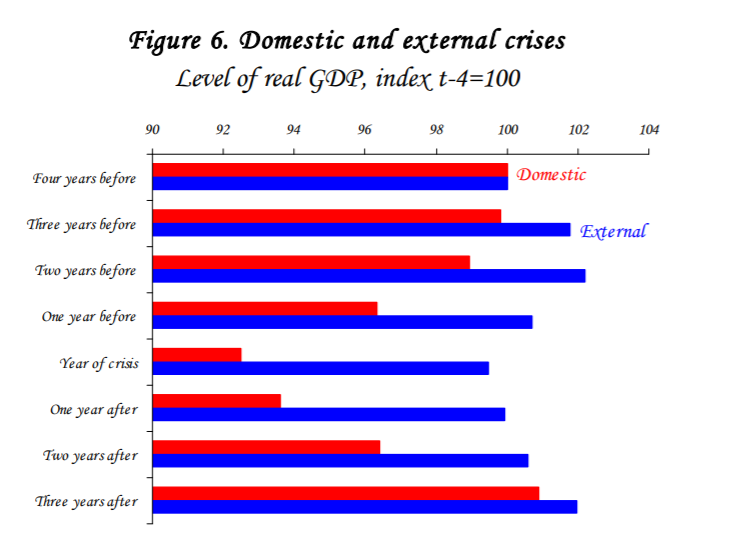

8/ Another chart from the study shows that GDP has already fallen to the low at the time of the default. Again, it& #39;s not the domestic default that causes the GDP contraction. The relationship is the opposite.

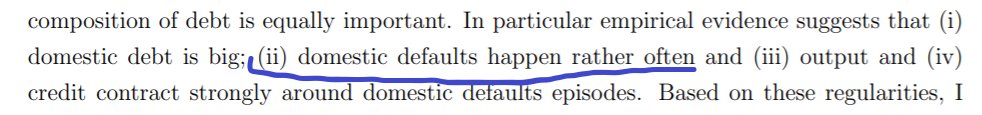

9/ The other study says the same. It& #39;s not that domestic default causes the economy to contract more, but that when output falls sharply enough, it leads to domestic default.

10/ ABL claims that internal defaults are rare (pic on left). The studies actually says they& #39;re not rare, literally the opposite (two pics on the right from the two studies).

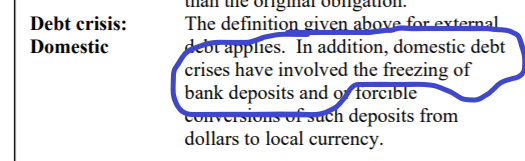

11/ ABL says that we need to avoid domestic default. The academic study says that domestic default INCLUDES freezing people& #39;s deposits. The ABL Plan includes harsher capital controls, so the ABL Plan itself assumes domestic default...

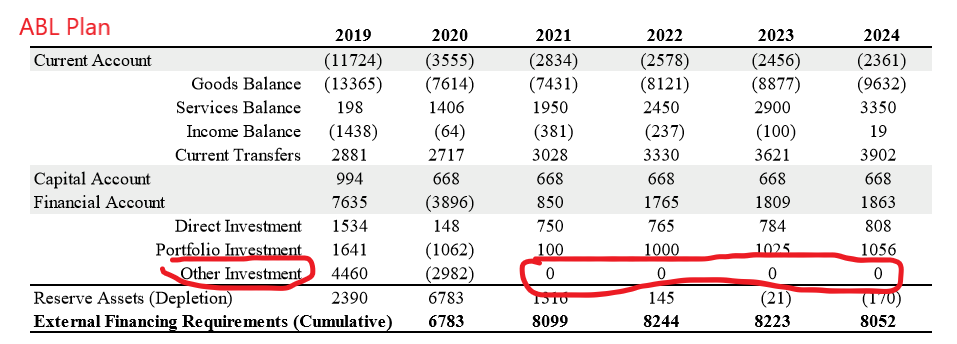

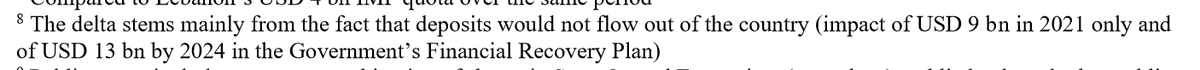

12/ The ABL Plan includes five years of harsh capital controls -- no transfers at all. So ABL itself is proposing a domestic default (see pics below from ABL Plan). The chart on the right shows zero transfers abroad and the footnote on the right explains.

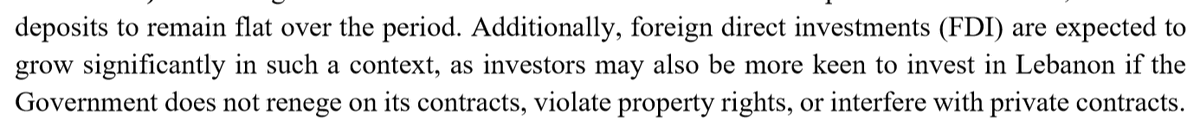

13/ But the ABL Plan assumes that foreign investment will thrive in Lebanon despite harsh capital controls in place. Capital controls are in place because the banks cannot meet their liabilities. Will investors do business in a country with non-functioning banks?

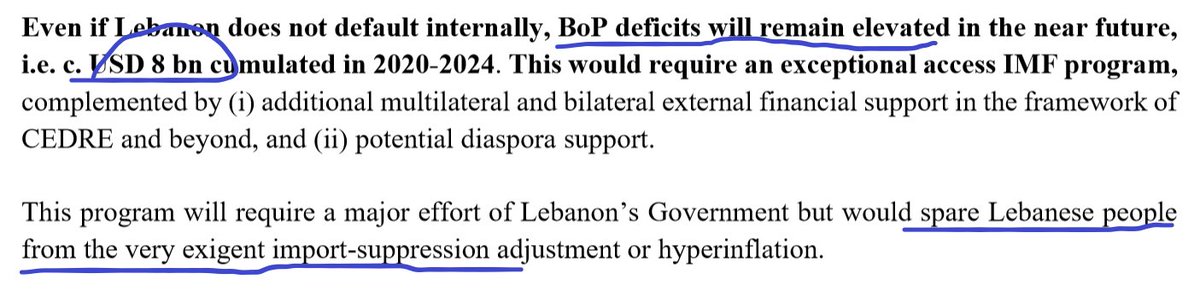

14/ The ABL Plan claims it spares Lebanese from the pain of excessive import suppression (ie from reducing imports too drastically). But the ABL Plan assumes the exact same import suppression as in the Govt Plan combined with harsher capital controls.

15/ ABL Plan says that one of the studies "empirically proves." These types of studies don& #39;t "prove". They "suggest" or "demonstrate" relationships, but proof is a math concept. This language is meant to convince you of an absolute truth. The study itself never says it "proves."

16/ In fact, one of the studies (though not the one they say "proves") says the opposite. The other study doesn& #39;t claim it proves anything, which is normal.

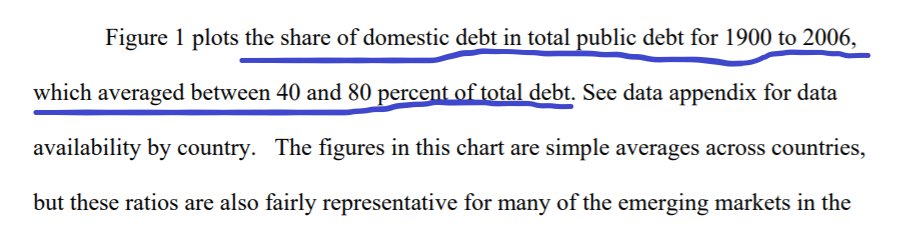

17/ The academic papers study a dataset of countries that experienced domestic default to understand the relationship between domestic default and economic growth. The countries in the study are countries in which domestic debt made up 40-80% of total public debt.

18/ For Lebanon, domestic debt makes up 95% of public debt (inc BDL)! Some countries may be able to avoid a domestic default because the domestic debt was a smaller portion of total debt, but how do you avoid it if your domestic debt is 95% of the total? Lebanon isn& #39;t comparable.

19/ The ABL Plan claims that Lebanon will more easily get exceptional access to an IMF loan if it does not default on domestically-held debt. What is the logic here? ABL doesn& #39;t say. The IMF lends to countries with sustainable debt...

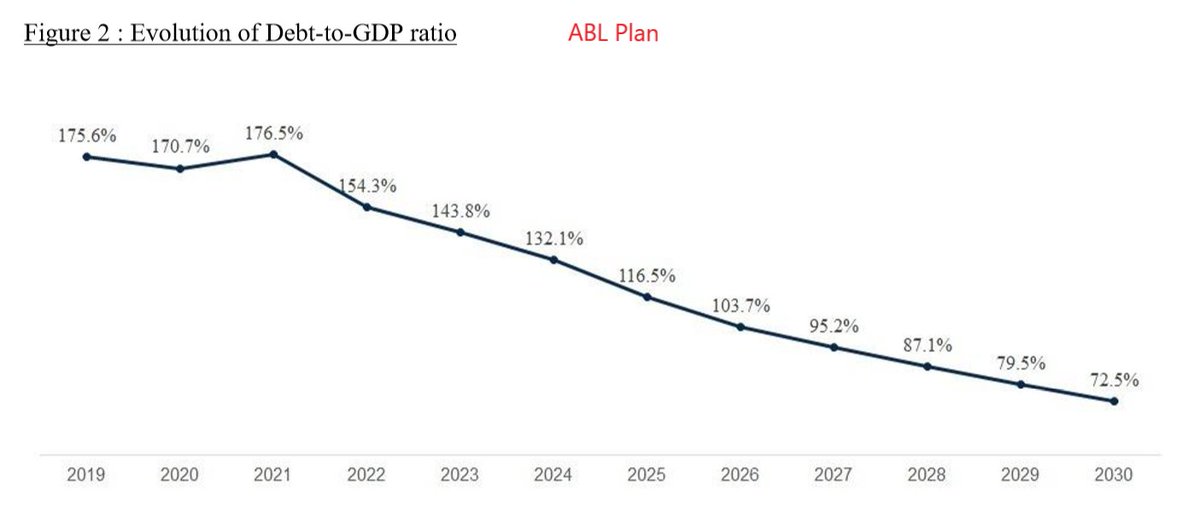

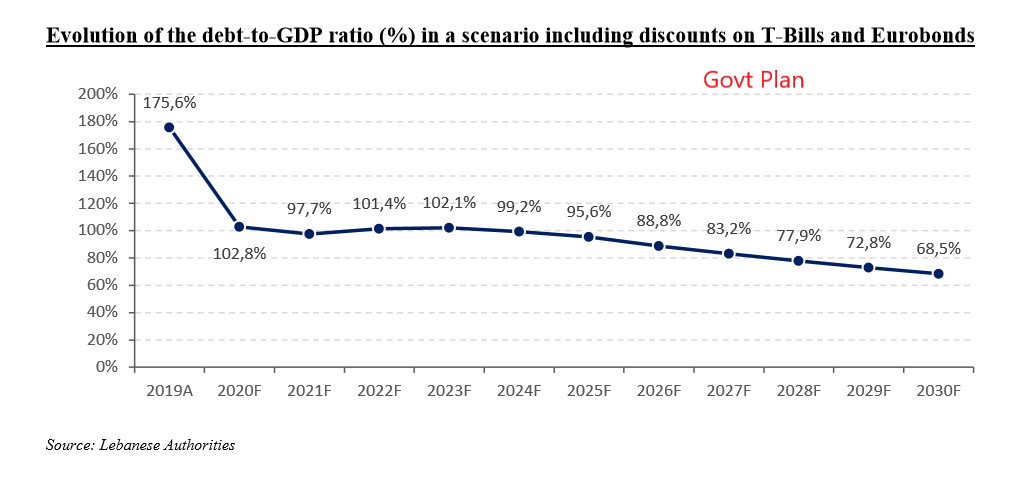

20/ If Lebanon doesn& #39;t haircut its existing debt and gives up to 30% of its revenue and all of its assets to the Defeasance Fund, how exactly does that improve debt sustainability? The Debt to GDP forecast in the ABL Plan is much higher than the Govt Plan.

21/ The impact of the Defeasance Fund on the fiscal deficit is also not shown in the ABL Plan, but it will make the deficit higher or require much more severe fiscal austerity. To avoid showing this, the ABL Plan leaves out the overall fiscal deficit, which Govt Plan does show.

23/ If the underlying justification of ABL Plan is so flawed (hard to see how it& #39;s not intentionally misleading), what are we to make of that? They expected nobody to read the studies? The person who included the studies didn& #39;t understand them? Or is it to mislead the reader?

24/ Read the studies yourself here:

https://www.federalreserve.gov/econresdata/ifdp/2015/files/ifdp1153.pdf

https://www.federalreserve.gov/econresda... href=" https://www.nber.org/papers/w13946.pdf">https://www.nber.org/papers/w1...

https://www.federalreserve.gov/econresdata/ifdp/2015/files/ifdp1153.pdf

Clarification: At best, the studies show that there is a relationship between domestic debt default and a bigger fall in output. The papers don’t say that domestic default causes the output to fall, as ABL claims. The relationship could be the opposite direction or something else

And if we even accept the premise that domestic default causes greater fall in output, should we not also look at studies to see the impact on output of a Govt liquidating all of its assets and slashing its spending another 30% in the middle of an economic recession?

I cleaned up some of the language in the blog post version. Twitter sucks. https://finance4lebanon.com/staggering-fact-the-abl-plan-is-built-on-two-academic-studies-that-say-exactly-the-opposite/">https://finance4lebanon.com/staggerin...

Read on Twitter

Read on Twitter