1/10 Here& #39;s the thing about many MINING TECHNICAL CONSULTANTS: Its not about the software, its about the assumptions used in the JORC or NI 43-101 docs. If you know how, you can make a bad project look quite good and a good project look bad. I call it

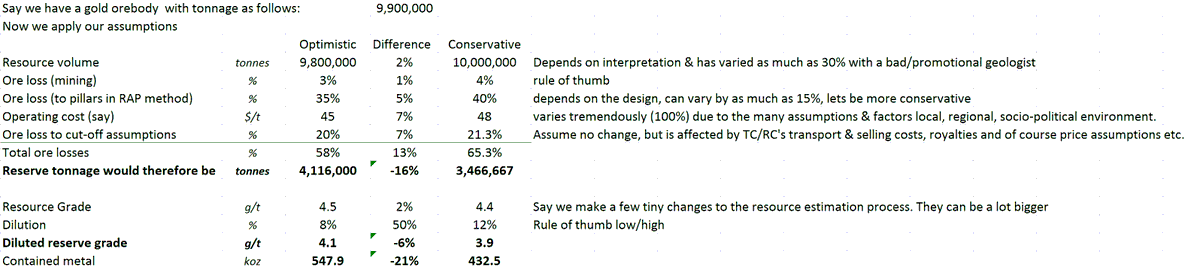

2/10 "Sum of the assumptions effect," with either a conservative or optimistic slant. There are literally hundreds of assumptions which can be manipulated to get to the desired objective. For example lets just look at how a resource & reserve changes with relatively small diffs

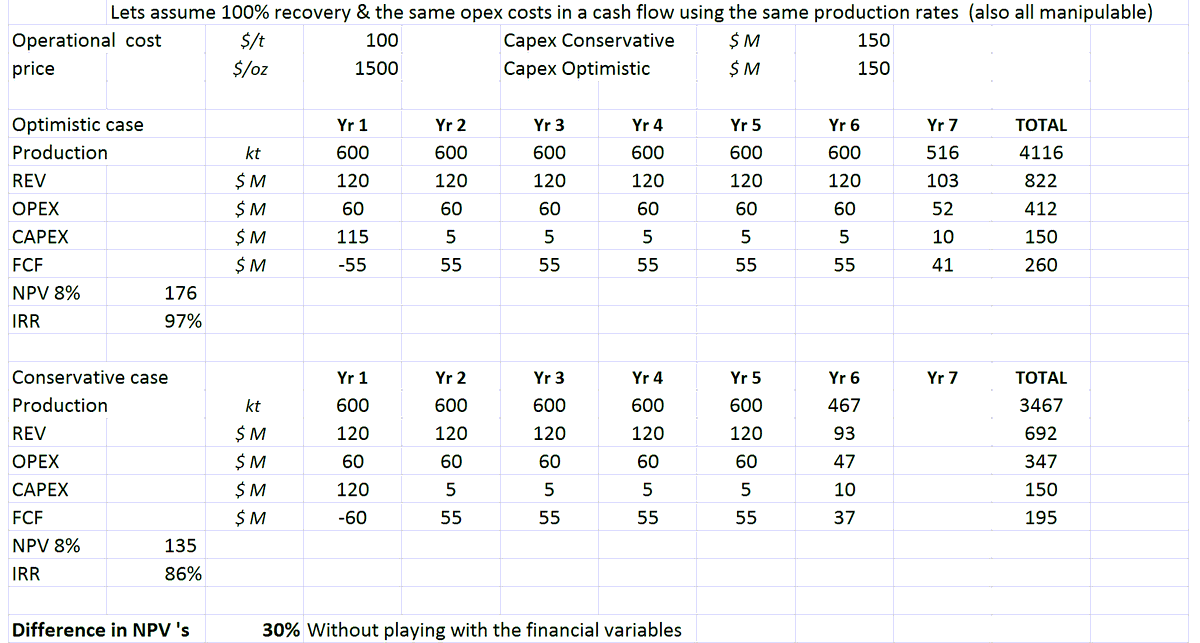

3/10 The impact is exacerbated when taking these assumptions into an mining, economic schedule and that& #39;s assuming we don& #39;t vary the financial assumptions much. It& #39;s an art & if you& #39;re good at it few will notice what is is being done.

4/10 Obviously everyone wants their project to look the best they can possibly be, so they hide the bad and highlight the good. Which is why you need good EXPERIENCED consultants and HONEST, operators who know what they& #39;re doing. Assumptions must be REASONABLE, rather than biased

5/10 There are 3 types of consultants: The ultra-conservatives who are too shit-scared to stick their necks out & do the right thing. Citing failed projects as the reason for their conservatism, their safety net renders many good projects uninspiring, which then become

6/10 buying opportunities for the smart. Then you get the useless-as majority of consultants who can& #39;t tell their asses from their elbows in any mine but think they know exactly what is going on b/c they have a PEng on their cards. They use leapfrog to do their modelling

because it is "implicit" and they have smart-looking spreadsheets which the stock promoters all love. The answers are all in the spreadsheet. Most have not held a proper mining job for more than a yr and never understood the importance of practical experience which takes time.

7/10 Consequently they miss things on the site visits b/c they do not understand what they are looking at. (There are also a bunch of analysts who are the same  https://abs.twimg.com/emoji/v2/... draggable="false" alt="😆" title="Smiling face with open mouth and tightly-closed eyes" aria-label="Emoji: Smiling face with open mouth and tightly-closed eyes">) It could be simple thing like a drill pattern or machine mismatch. Then they design a mine, but forget important

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😆" title="Smiling face with open mouth and tightly-closed eyes" aria-label="Emoji: Smiling face with open mouth and tightly-closed eyes">) It could be simple thing like a drill pattern or machine mismatch. Then they design a mine, but forget important

8/10 criteria is needed they had the practical experience. $GUY Guyana GF is a good example. No-one bothered to look at the long-term plan & see that you can& #39;t use a open pit ramp when you are mining waste above it. A simple, overlooked & easily solvable design error that

9/10 ultimately resulted in a major corporate catastrophe & gnashing of teeth for the SH& #39;s. In that case the operators also missed it, what were they thinking? Truth be told, they probably never saw it coming, and they never saw it coming because they were looking at

10/10 other things. Mining is relatively straight forward but with a helluva lot of variables. If you don& #39;t have the experience to make good assumptions & ID the key risks to every project, you can have the best looking plan & report in the world & it will fail. Who

11/11 remembers Rubicon Minerals? another good example. So when it comes to consultants, make sure you select good teams with track records and solid PRACTICAL experience. They are rare and consulting generally is going to get worse over the next decade as fewer and fewer good

12/12 guys are left. These consultants are diamonds, rare & brilliant. They ADD VALUE when they come to site b/c they spot things in time before they go wrong, & understand design criteria, requirements & constraints from their practical experience leading to solid studies.

@threadreaderapp unroll

Read on Twitter

Read on Twitter