1/ MEGA THREAD: Long $ISRG

ISRG has been an incredible compounder ever since its IPO back in 2000. It& #39;s a pure-play in robotic surgery.

Robotic surgery penetration is still just ~2.5% of worldwide surgery procedures. It& #39;s still Day 1 here!

Let& #39;s start with some history.

ISRG has been an incredible compounder ever since its IPO back in 2000. It& #39;s a pure-play in robotic surgery.

Robotic surgery penetration is still just ~2.5% of worldwide surgery procedures. It& #39;s still Day 1 here!

Let& #39;s start with some history.

2/ In early 90& #39;s, Stanford Research Institute (SRI) developed a surgical robot prototype. DARPA wanted to used it to remotely treat wounded soldiers.

Dr. Fred Moll was working at Guidant at that time. He proposed to commercialize the tech.

Guidant said it was too futuristic.

Dr. Fred Moll was working at Guidant at that time. He proposed to commercialize the tech.

Guidant said it was too futuristic.

3/ So as these things go, Moll left Guidant and teamed up with John Freund, a Venture Capitalist, to license the tech to commercialize robotic Minimally Invasive Surgery (MIS) for non-military medical purposes.

Intuitive Surgical was born in 1995.

Intuitive Surgical was born in 1995.

4/ Gary Guthart, the current CEO, was in academia at that time. He was looking for a postdoc opportunity, but a professor said, "...I don’t think you would make a good professor. You don’t like to write, and you spend a lot of time chatting with people."

5/ One day, Guthart went to play basketball when this guy from $ISRG asked him, "Do you know anything about this kind of non-linear math, I am struggling with this surgical robot I am trying to make..."

Guthart joined ISRG in 1996.

Guthart joined ISRG in 1996.

6/ In 1997, Freund left to found Skyline Ventures, a VC firm. In 2002, Dr. Moll left $ISRG to pursue other ventures within robotic surgery space.

Remember Dr. Moll. He& #39;ll reappear in this thread later.

Guthart became CEO of ISRG in 2010.

Remember Dr. Moll. He& #39;ll reappear in this thread later.

Guthart became CEO of ISRG in 2010.

7/ Okay, enough history. But what exactly is robotic MIS?

Think about the robots as extension of the surgeon& #39;s hands. Surgeon sits at the console near the patient and guides the robot to operate on the patient.

Think about the robots as extension of the surgeon& #39;s hands. Surgeon sits at the console near the patient and guides the robot to operate on the patient.

8/ If you want to get a better visualization of what these robots do, a better idea is to search "Da Vinci Intuitive" in YouTube.

This still sounds a bit futuristic, right?

"Any sufficiently advanced technology is indistinguishable from magic"

This still sounds a bit futuristic, right?

"Any sufficiently advanced technology is indistinguishable from magic"

9/ But why do we need robotic MIS? What& #39;s wrong with open surgeries?

"The public has no idea of the extent of difference between top surgeons and bad ones. Robots are good at going where they are supposed to, remembering where they are and stopping when required.”

"The public has no idea of the extent of difference between top surgeons and bad ones. Robots are good at going where they are supposed to, remembering where they are and stopping when required.”

10/ "The large incision required for open surgery create trauma to patients, typically resulting in longer hospitalization and recovery times, increased hospitalization costs, and additional pain and suffering relative to MIS”.

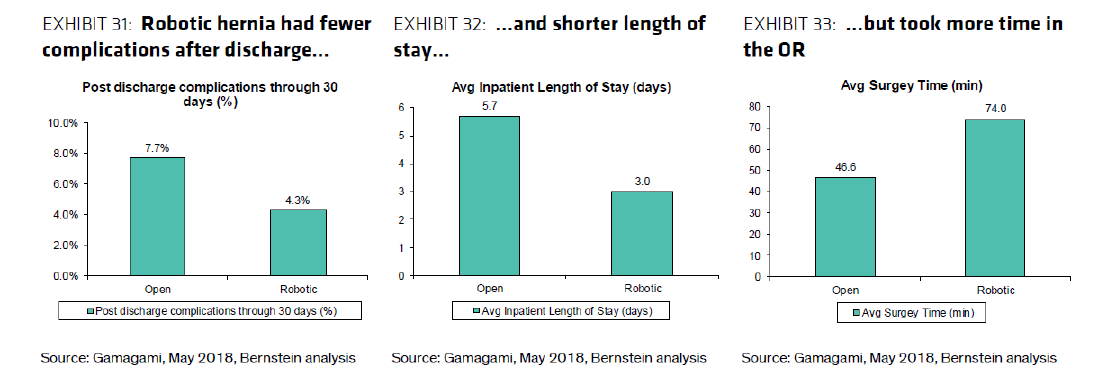

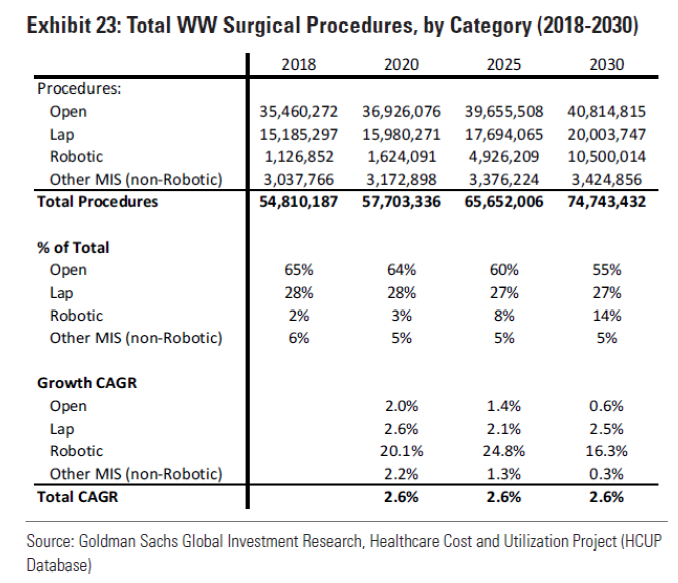

11/ Yet, ~65% of total surgeries are still open surgeries.

Why do robots take longer time in Operating Room (OR)?

There is fair bit of learning curve involved for surgeons to perform these surgeries. As utilization increases, OR time decreases.

Why do robots take longer time in Operating Room (OR)?

There is fair bit of learning curve involved for surgeons to perform these surgeries. As utilization increases, OR time decreases.

12/ There is also another MIS method: Laparoscopy. Here& #39;s how lap differs from robotic.

13/ Bernstein looked at 18 comparative studies between these two approaches. Robotic and lap were similar on most metrics (e.g., complications, recurrence, pain), though robotic was more often associated with shorter Length Of Stay (LOS) and longer OR time.

14/ Lap also costs less than robotic. Can lap stunt the growth of robotic?

As learning curve and the tech improves with more data and higher penetration, the value proposition will get clearer with time.

Robots don& #39;t have to take share from lap. It just needs to eat open& #39;s pie.

As learning curve and the tech improves with more data and higher penetration, the value proposition will get clearer with time.

Robots don& #39;t have to take share from lap. It just needs to eat open& #39;s pie.

15/ That leads us to the TAM question.

If open& #39;s procedure pie declines by 10% and it gets eaten by robots, you are looking at >15% CAGR for next 10 years.

$ISRG currently has ~90% market share.

If open& #39;s procedure pie declines by 10% and it gets eaten by robots, you are looking at >15% CAGR for next 10 years.

$ISRG currently has ~90% market share.

16/ Wait, how does $ISRG actually make money?

ISRG has 3 reporting segments

Systems

Instruments & Accessories (recurring)

Services (recurring)

~70% was recurring revenue in 2019. It was 48% in 2008.

Let& #39;s dive in further.

ISRG has 3 reporting segments

Systems

Instruments & Accessories (recurring)

Services (recurring)

~70% was recurring revenue in 2019. It was 48% in 2008.

Let& #39;s dive in further.

17/ Systems

Systems revenue comes from selling (primarily directly, but some are also sold through distributors) Da Vinci Systems to hospitals. Current global installment base ~5.6K. Shipment growing at >20% in last 3 yrs. ASP (in $ mn) is also generally increasing.

Systems revenue comes from selling (primarily directly, but some are also sold through distributors) Da Vinci Systems to hospitals. Current global installment base ~5.6K. Shipment growing at >20% in last 3 yrs. ASP (in $ mn) is also generally increasing.

18/ So two growth levers in Systems: Higher shipment units (volume), and higher ASP (price). Volume is more sustainable than price though.

~40% of the shipment is basically customers upgrading/trading existing Da Vincis.

Since Da Vinci systems are huge capex for hospitals...

~40% of the shipment is basically customers upgrading/trading existing Da Vincis.

Since Da Vinci systems are huge capex for hospitals...

19/ $ISRG introduced operating leases. A third of shipment is now operating leases. This option helped higher penetration.

There are ~6.2K hospitals in the US and ~3.5K Da Vincis. But hospitals with 5+ systems increased 4x in last 3 yrs, so penetration is lot lower than it seems

There are ~6.2K hospitals in the US and ~3.5K Da Vincis. But hospitals with 5+ systems increased 4x in last 3 yrs, so penetration is lot lower than it seems

20/ So as penetration becomes deeper, not only more hospitals will order Da Vinci systems, but many of them will order multiple of units.

21/ Instruments & Accessories

Three growth levers here in last few yrs.

I. Growing installment base (LDD)

II. Higher procedure utilization (MSD)

III. Revenue per procedure (LSD)

Once a hospital buys Da Vinci, its goal is to increase utilization. Recurring revenues.

Three growth levers here in last few yrs.

I. Growing installment base (LDD)

II. Higher procedure utilization (MSD)

III. Revenue per procedure (LSD)

Once a hospital buys Da Vinci, its goal is to increase utilization. Recurring revenues.

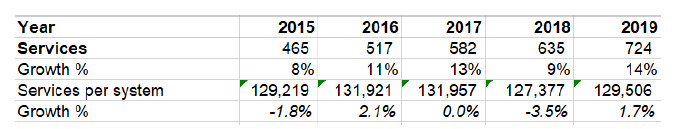

22/ For the Da Vinci systems ISRG sells, it also has service contracts with the hospitals. Each system on an avg. generates ~$130k recurring revenue stream/year.

Again, recurring source of revenue.

Again, recurring source of revenue.

23/ Once concern I had whether $ISRG is over-earning in the US. But over the last 12 yrs, US revenue mix went down from 80% to 70%, but margins remained remarkably stable.

Avg. FCF margin in last 12 yrs is 30%. Capex was 9.5% of sales last yr, highest in last 10 yrs. LT is ~6%.

Avg. FCF margin in last 12 yrs is 30%. Capex was 9.5% of sales last yr, highest in last 10 yrs. LT is ~6%.

24/ But margins never tell the whole story. What about ROIC.

Well, ROIC is off the charts.

No debt in balance sheet. $6 bn cash i.e. ~10% of mcap. Add ~30% FCF margin to this cash pile every year.

Well, ROIC is off the charts.

No debt in balance sheet. $6 bn cash i.e. ~10% of mcap. Add ~30% FCF margin to this cash pile every year.

25/ Boy oh boy, those ROICs are gonna attract some competition, right?

You bet they would. So how defensible is the moat?

I see 6 layers of defense. Let& #39;s peel one by one.

You bet they would. So how defensible is the moat?

I see 6 layers of defense. Let& #39;s peel one by one.

26/ I. ISRG has more than 20 years lead over competitors in robotic MIS. There are 21,000 peer reviewed journals that were published during last two decades that helped support the safety, efficacy, and benefits of Da Vinci systems. Da Vinci is de facto robotic MIS.

27/ II. Hospitals will incur a significant switching cost if they switch to a competing system. As I said earlier, massive learning curve is associated with robotic MIS. In fact, while upgrading $ISRG builds over earlier systems so that learning curve doesn& #39;t start from zero.

28/ More importantly, $ISRG enjoys the most powerful marketing: word of mouth. Surgeons themselves opened a Facebook group in which they actively discuss about Da Vinci robotic MIS.

29/ Besides, Da Vincis cost $1.5-2 mn/system. If you want to get the return on investment, you need to utilize it more. Not easy to just switch to competing products.

30/ III. ~7 million surgeries have been performed via Da Vinci’s system. Bernstein argued, “this long utilization history also means that ISRG has a deep clinical database with supporting clinical evidence and clear best practices for physicians"

Not easy to replicate this.

Not easy to replicate this.

31/ IV. $ISRG last year acquired Orpheus Medical, a platform designed to capture and share video and imaging to help physicians or care teams improve workflow and analysis of interventions. This will help ISRG to control the experience and help surgeons quicken learning curve

32/ V. The culture of the company also seems to be top-notch. According to Glassdoor, 97% of the employees approve of the CEO Gary Guthart. This makes him among the top 10 CEOs in 2019 (Glassdoor).

Avg tenure of Engineering team is >10 yrs. People seem to like it there.

Avg tenure of Engineering team is >10 yrs. People seem to like it there.

33/ VI. Although ISRG has the appearance of a tech company, at the end of the day it operates in the healthcare industry.

“Move fast and break things” can work in a tech pure-play, but healthcare is a highly regulated and slow-paced industry. Not easy to unseat incumbent.

“Move fast and break things” can work in a tech pure-play, but healthcare is a highly regulated and slow-paced industry. Not easy to unseat incumbent.

34/ Okay, now I need to seed some doubt in your mind. There& #39;s always a bear case.

Like I hinted, competition is coming, and it& #39;s coming from the behemoths $MDT and $JNJ who are 2.0x and 6.5x mcap respectively compared to $ISRG.

Like I hinted, competition is coming, and it& #39;s coming from the behemoths $MDT and $JNJ who are 2.0x and 6.5x mcap respectively compared to $ISRG.

35/ Both $MDT and $JNJ wanted to launch in 2020. Thanks to Covid-19, that& #39;s probably not gonna happen.

GS in its recent initiation said "MDT’s robots will be inferior in technology, but more cost effective compared to ISRG".

JNJ is more threatening in the long-run. Why?

GS in its recent initiation said "MDT’s robots will be inferior in technology, but more cost effective compared to ISRG".

JNJ is more threatening in the long-run. Why?

36/ Remember Fred Moll? Well, he& #39;s back big time.

He later launched another robotic MIS company named Auris Health which was acquired by $JNJ last year.

This makes me uncomfortable.

He later launched another robotic MIS company named Auris Health which was acquired by $JNJ last year.

This makes me uncomfortable.

37/ $JNJ is VERY serious. It also acquired Verb, which was previously a JV with $GOOG.

Verb’s plan is to build a digital surgery platform that combines robotic, advanced visualization, instrumentation, data analytics, and connectivity.

Verb’s plan is to build a digital surgery platform that combines robotic, advanced visualization, instrumentation, data analytics, and connectivity.

38/ I& #39;m still not losing my sleep though. Why?

I don& #39;t think this is winner-take-all market. It doesn& #39;t have to be. $ISRG had 20 year open field, and yet it penetrated only ~2% worldwide surgery market.

All three can co-exist.

I don& #39;t think this is winner-take-all market. It doesn& #39;t have to be. $ISRG had 20 year open field, and yet it penetrated only ~2% worldwide surgery market.

All three can co-exist.

39/ I expect market share of $ISRG to go down from 90% to 45% in 2030.

The market is too big for these behemoths to eat from each other.

But I might lose for something else...

The market is too big for these behemoths to eat from each other.

But I might lose for something else...

40/ Since I am assuming all three can co-exist, I& #39;m assuming current margins can sustain.

It, of course, may not which can certainly derail upside.

If $MDT and/or $JNJ competes with price, that& #39;s bad news for $ISRG longs.

It, of course, may not which can certainly derail upside.

If $MDT and/or $JNJ competes with price, that& #39;s bad news for $ISRG longs.

41/ Other issues: cultural/behavioral factors can make adoption slower than expected.

Recalls/negative reports or lawsuits can make things bumpy.

Duration of Covid-19 and stress on healthcare system can also be a factor in the near-term.

Recalls/negative reports or lawsuits can make things bumpy.

Duration of Covid-19 and stress on healthcare system can also be a factor in the near-term.

42/ With $6 Bn cash, ZERO debt and strong management, I expect $ISRG to weather the impending competition storm.

The stock isn& #39;t cheap. I don& #39;t think it& #39;s close to be fairly valued than undervalued.

But great companies usually surprise you.

The stock isn& #39;t cheap. I don& #39;t think it& #39;s close to be fairly valued than undervalued.

But great companies usually surprise you.

End/ I don& #39;t dawdle around for great companies to be severely undervalued. Mr. Market is generally smart.

As always, bears are welcome in DMs/comments. Bulls can also point out why I should be MORE bullish.

Phew! The tweet storm ends!

Happy weekend, everyone!

As always, bears are welcome in DMs/comments. Bulls can also point out why I should be MORE bullish.

Phew! The tweet storm ends!

Happy weekend, everyone!

Read on Twitter

Read on Twitter