Read

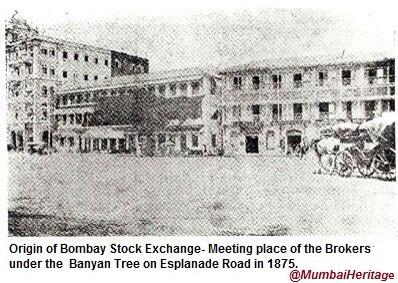

In the 1840s few folks started trading in bullion, exchange, & shares under the Banyan tree. As the volume goes up, there were now 25 in the count and all of them contributed Re. 1, to form an association, and called it as & #39;The Native Share and Stock Brokers’ Association& #39;

But they needed space, so hired a trading hall in present Dalal Street. With no funds of its own to pay the trading hall’s monthly rental of Rs. 100 they got Dinshaw Maneckji Petit, to fund them. Another Parsi contribution in Bombay Story. Read more https://twitter.com/sidart_misra/status/1251487059040022528">https://twitter.com/sidart_mi...

Let& #39;s Jump to 1970s (Read another of my thread). Congress Gone and by 1977 George Fernandes was the Industries Minister. Now, this hard-core socialist will do something that would lay the foundation of the equity cult in India<while NO one credits him>. https://twitter.com/sidart_misra/status/1246417511245111297">https://twitter.com/sidart_mi...

The Foreign Exchange Regulation was enacted and all foreign companies were asked to either list their shares on the Indian bourses or quit India. Some companies like Hindustan Lever (HLL), Nestle, Colgate obliged, but others like Coca Cola quit. #AatmaNirbharBharatPackage

These listing gave Indian investors an opportunity to share the wealth created by some of the best international companies. Thus new era in equity investing in India got started and in these time, enter Dhirajlal Hirachand Ambani to ride this Equity Wave.

He came out with the Reliance Industries’ IPO in 1977 and issued 2.8 million equity shares of Rs. 10 each. Dhirubhai managed to convince a large number of first-time retail investors to invest in Reliance. The rest, as they say, will become history. Why keep on reading...

In the first year of listing, 1978, the price reached Rs. 50, in 1980, it was Rs. 104 and by 1982 it was going smooth when two main events happened, 1st Pranab Mukherjee’s (then FM) allowed NRIs to invest directly into Indian equities. <some day a https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">on Attack of Swaraj Paul>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">on Attack of Swaraj Paul>

2nd event-Some old boy Marwadi club of Kolkata thought to take PANGA. These bear operators started driving down his stocks. By 18th March selling pressure was so intense that BSE was to be closed for an hour or so. Bears sold 350000 shares, brought share price at 121 from 131.

The Maverick Dhirubhai with his own internal network got the news of the play. And, he decided to play a Poker Game. Officially he or Reliance can’t buy its own shares. He used his Gujrati network and got his brokers to start buying any Reliance shares on offer.

Bears had sold short-in i.e, they had sold shares they did not own in the expectation that the price would fall and let them pick up enough shares later at a lower price. itself could not legally. And, NRI investors based in West Asia had picked most of the physical stock

In 3-4 weeks total 1.1M shares were sold & 80% of that was with Dhirubhai. On BSE, alternate Fridays=settlement days, when all transactions of the last 2 weeks are cleared. Sellers deliver shares to buyers, buyers accept delivery, or either party asks for ..

...the transaction to be postponed to the next clearance day after paying badla/compensation for the delay.

April 30, 1982, was one of those Friday. A day of total chaos in BSE history. A day when Ambani will deliver the coup de grace by demanding delivery as HIS BADLA.

April 30, 1982, was one of those Friday. A day of total chaos in BSE history. A day when Ambani will deliver the coup de grace by demanding delivery as HIS BADLA.

Ambani knew that these sellers couldn& #39;t possibly have the shares they had sold. The panic-stricken bears& #39; bid for every Reliance share they can, in order to fulfil their commitments. But there was NO Seller. Ambani& #39;s brokers also refused any postponement of the deal.

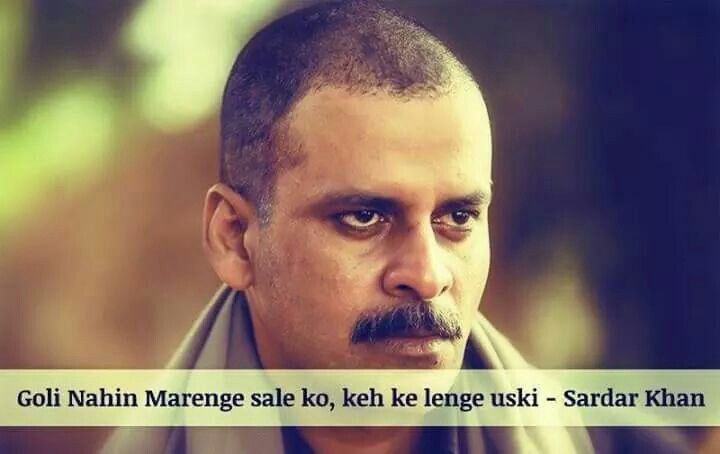

BSE had to be shut down for three days while the exchange authorities tried to bring about a compromise between the unyielding bull (Ambani) and the flustered bears. Ambani was,“Teri keh ke lunga". Later his broker sold the share at a very peak to let the BSE operate again.

Read on Twitter

Read on Twitter