Speaking of she-cessions and care-work in strange times:

The 1942 mass income tax met fierce resistance from married women war workers who had children. Like care workers today, they were under pressure!

Thread. 1/17

The 1942 mass income tax met fierce resistance from married women war workers who had children. Like care workers today, they were under pressure!

Thread. 1/17

Three weeks after the budget speech, Finance made a concession. Wives were too important in the wartime labour force to be ignored.

2/17

2/17

A married man would keep the larger “married” exemption; his wage-earning wife would be taxed as single. The result: something to help pay a “girl” to do housework and child care.

3/17

3/17

What happened in the postwar New Normal? In 1947’s budget, Finance Minister Doug Abbott made many cuts in personal income taxes. Cartoonist Bob Chambers sketched his “Little Man’s” fear, hope, and pleasure in 2 cartoons, before and after the budget speech: 04/28 and 05/01.

4/17

4/17

But the special wartime incentive (or removal of disincentive) for two-income married couples was gone. Abbott argued that the other cuts were enough, and that “special groups” shouldn’t get “special income tax exemptions” to “persuade them to work.”

5/17

5/17

Since Pierson’s _They’re Still Women After All_, historians have described the cancelling of this tax measure as aimed (w/ family allowance, closing day nurseries, marriage bar reintro’d in civil service) at shunting women, esp. wives, out of the labour force.

Yes. But.

6/17

Yes. But.

6/17

Who objected? Certainly, married women facing renewed constraints on their choice to work. Especially distressed were those whose husbands, as veterans, were struggling to get on their feet. But there were other voices, ones whose cry resonates with re-opening talk today.

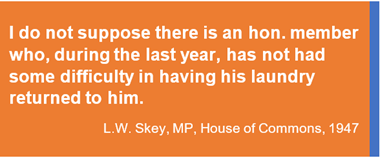

In the House of Commons, 2 Toronto Progressive Conservative MPs (Skey of Trinity & Ross of St. Paul’s) raised the need for tax incentives to keep married women “in essential employment.”

What were those jobs? Laundry workers. Waitresses. Textile Workers. Schoolteachers. Nurses.

What were those jobs? Laundry workers. Waitresses. Textile Workers. Schoolteachers. Nurses.

Those women’s jobs were “essential” (as Skey said) because of the care and feeding they provided, ever so cheaply, both to bachelors and to families.

10/17

10/17

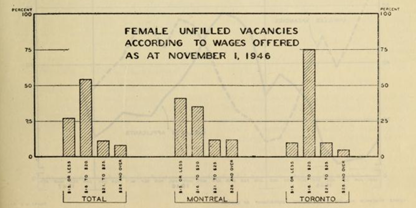

But not so essential as to command a living wage. The Labour Gazette showed 75% of “female vacancies” going unfilled in Toronto in November 1946 in the $16-$20 dollars a week wage cohort. (Mar.1947)

(In this world, classified ads specified Female Vacancies or Male Vacancies.)

(In this world, classified ads specified Female Vacancies or Male Vacancies.)

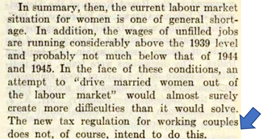

The Labour Gazette (Mar.1947, p297) said that critics were right about the shortages, but wrong about both the real impact on family incomes AND about the intention of the federal government:

11/17

11/17

Labour shortages in women’s jobs continued. The winter of 1949 saw a spike in men’s unemployment, but a Financial Post headline said “Jobs Go Begging – Not Enough Girls to Go Around.” (3/12/1949). Why? Not the lack of a wee tax break. Women needed good pay, safety, dignity!

12/17

12/17

Today, there are still jobs that are mainly done by women, even though not only women do them. Wives’ incomes still matter in their households, though rarely as a mere supplement.

13/17

13/17

And someone still has to pay to take care of the kids (& the elders & the ill), whether individually, with income foregone or by buying a service, or together by many small contributions in the tax-transfer system.

14/17

14/17

The recovery and our future economic well-being depend on handling these realities well.

Handling them together, using the fiscal sinews of solidarity, seems right to me.

15/17

Handling them together, using the fiscal sinews of solidarity, seems right to me.

15/17

This thread inspired by @ArmineYalnizyan’s recent comments on @TheAgenda. No she-covery, no recovery. No she-covery without child care.

https://tvo.org/video/are-we-in-a-covid-19-she-cession

16/17">https://tvo.org/video/are...

https://tvo.org/video/are-we-in-a-covid-19-she-cession

16/17">https://tvo.org/video/are...

Sources for this tiny tax twitter-thread: my 1991 article “Human Rights Law as Prism: Women’s Organizations, Unions, and Ontario’s Female Employees Fair Remuneration Act, 1951” and these, with big thanks to http://archive.org"> http://archive.org for the Labour Gazette!

Read on Twitter

Read on Twitter