A fintech product& #39;s ultimate Product Market Fit comes from unlocking Arbitrage Market Fit.

So it& #39;s not only important to Know Your Customers but also to Know Your Arb. Here are some examples of PMF achieved via AMF https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

Feel free to share some more.

So it& #39;s not only important to Know Your Customers but also to Know Your Arb. Here are some examples of PMF achieved via AMF

Feel free to share some more.

1/ Robinhood -> Fee Arb

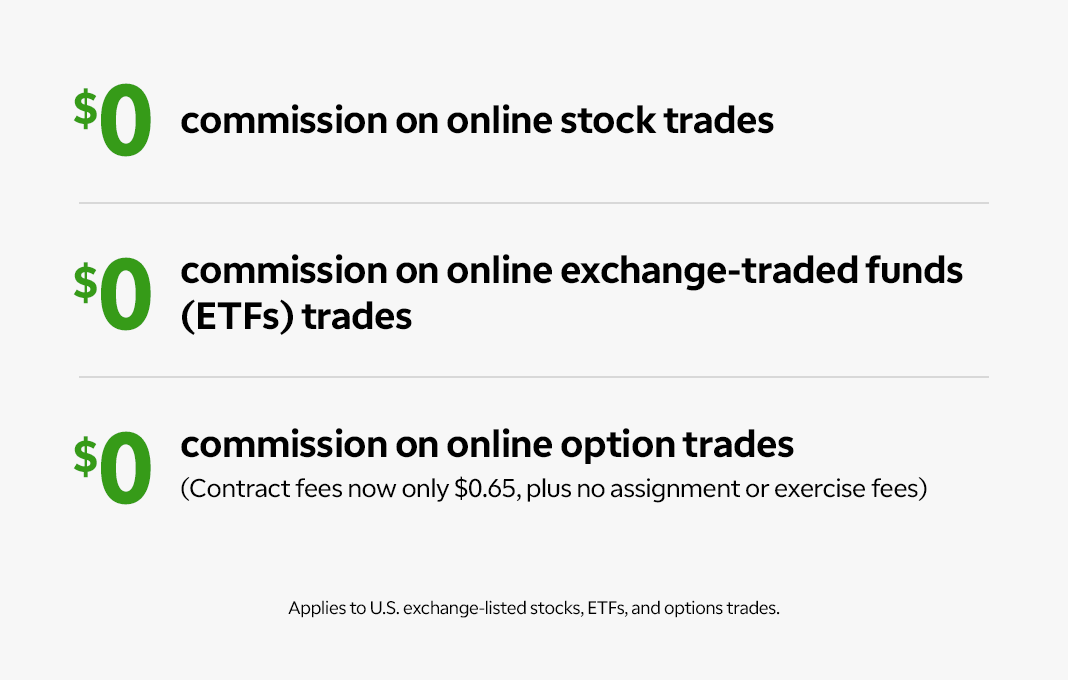

Robinhood launched in 2013 with zero fee broking. Customers were paying ~1% on their invested assets to brokers. Today, the entire broking industry has moved to zero-fee broking & the brokerage war is now over.

This is how TD Ameritrade advertises today.

Robinhood launched in 2013 with zero fee broking. Customers were paying ~1% on their invested assets to brokers. Today, the entire broking industry has moved to zero-fee broking & the brokerage war is now over.

This is how TD Ameritrade advertises today.

2/ Chime -> ACH Arb

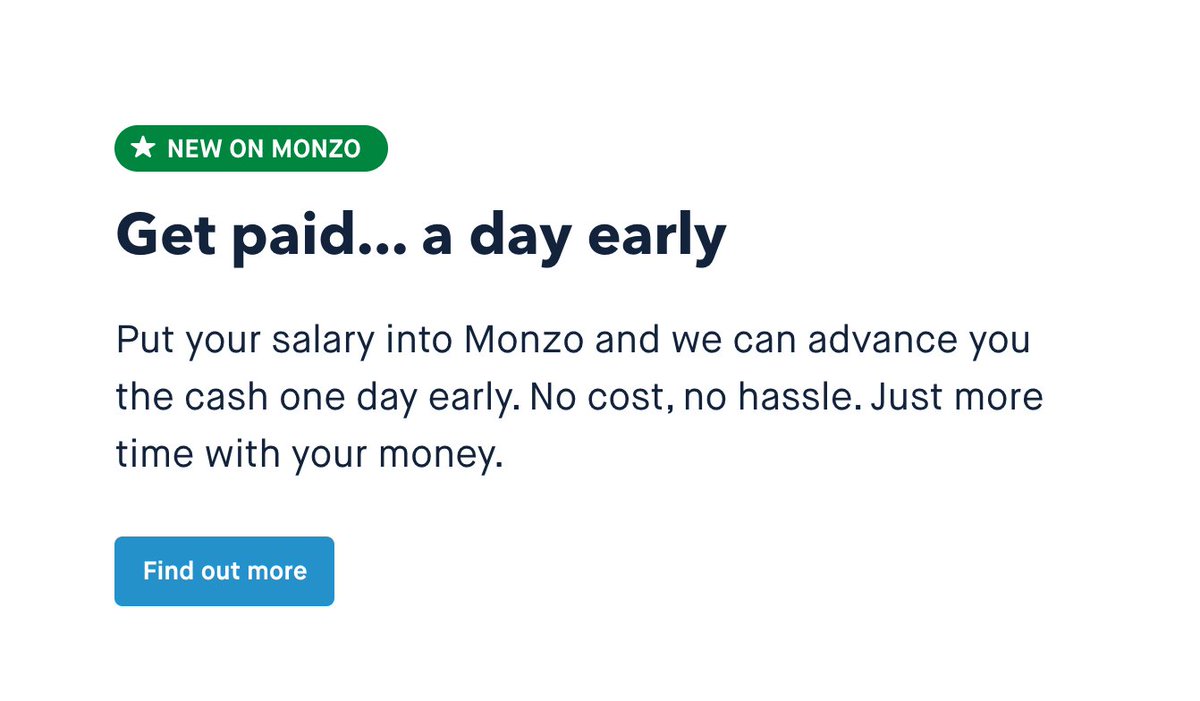

Direct Deposit ACH takes 2 days to settle but risks associated with ACH failing are ~0 unless the employer is going bankrupt.

Chime used this arb for their 2-day early salary to blue-collar workers & is now the #1 neo bank.

Monzo & Varo are playing catchup

Direct Deposit ACH takes 2 days to settle but risks associated with ACH failing are ~0 unless the employer is going bankrupt.

Chime used this arb for their 2-day early salary to blue-collar workers & is now the #1 neo bank.

Monzo & Varo are playing catchup

3/ Coinbase -> Legal Arb

There was no secure & & #39;legal& #39; way to buy Bitcoin in the US. It just seemed shady. Coinbase gave legitimacy to Bitcoin.

Coinbase is now one of the largest & most highly regulated exchanges in the world & has onboarded 30M users. https://www.coinbase.com/legal/licenses ">https://www.coinbase.com/legal/lic...

There was no secure & & #39;legal& #39; way to buy Bitcoin in the US. It just seemed shady. Coinbase gave legitimacy to Bitcoin.

Coinbase is now one of the largest & most highly regulated exchanges in the world & has onboarded 30M users. https://www.coinbase.com/legal/licenses ">https://www.coinbase.com/legal/lic...

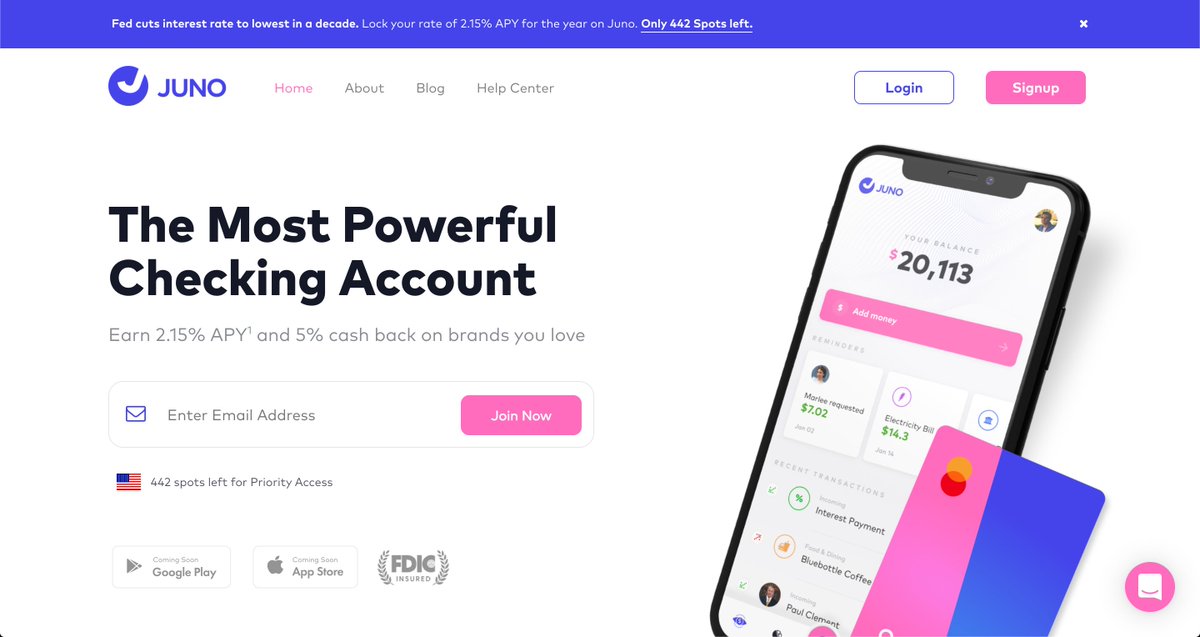

4/ Marcus -> Interest Arb

Marcus by Goldman Sachs now has ~$60B in AUM by providing a high-interest savings account.

Banks in US are currently sitting on 4% net interest rate margin (NIM) & give 0% on checking & ~0.5% on savings.

We are using this arb for high yield checking

Marcus by Goldman Sachs now has ~$60B in AUM by providing a high-interest savings account.

Banks in US are currently sitting on 4% net interest rate margin (NIM) & give 0% on checking & ~0.5% on savings.

We are using this arb for high yield checking

5/ Paytm -> Legal Arb

Paytm was once a mobile recharge company in India. RBI added 2FA on all payments including cards & net banking and introduced wallets without 2FA.

By Jan 2014, Indian Railways & Uber added Paytm Wallet & the rest is history. https://www.techcircle.in/2015/04/29/paytms-big-day-railway-ticketing-platform-irctc-adds-paytm-wallet-as-a-payment-option/">https://www.techcircle.in/2015/04/2...

Paytm was once a mobile recharge company in India. RBI added 2FA on all payments including cards & net banking and introduced wallets without 2FA.

By Jan 2014, Indian Railways & Uber added Paytm Wallet & the rest is history. https://www.techcircle.in/2015/04/29/paytms-big-day-railway-ticketing-platform-irctc-adds-paytm-wallet-as-a-payment-option/">https://www.techcircle.in/2015/04/2...

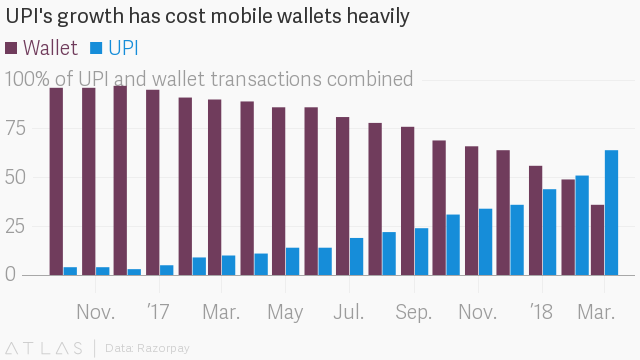

6/ PhonePe -> UX Arb

PhonePe was acquired by Flipkart when it was pre-launch. UPI was all the rage then. Turns out it was an interoperable money transfer system with mobile auth builtin.

Transferring money from banks to wallets was no longer needed. Move over wallets, hello UPI

PhonePe was acquired by Flipkart when it was pre-launch. UPI was all the rage then. Turns out it was an interoperable money transfer system with mobile auth builtin.

Transferring money from banks to wallets was no longer needed. Move over wallets, hello UPI

7/ Revolut -> Exchange Arb

Revolut acquired banking license in Europe. It had no loan book or deposits. There was an arb. Europe has many local currencies & no borders.

Waived off tx fees with borderless, feeless travel card. They still say - Exchange money with no hidden fees

Revolut acquired banking license in Europe. It had no loan book or deposits. There was an arb. Europe has many local currencies & no borders.

Waived off tx fees with borderless, feeless travel card. They still say - Exchange money with no hidden fees

In conclusion, if a fintech identifies & weaponizes an arb & given a free run will wipe out margins left in that business. This is a broader move towards giving back to consumers the Bezos way, now in fintech

The only way to fight this is to reduce margins & work with fintechs.

The only way to fight this is to reduce margins & work with fintechs.

8/ Brex -> Pricing Arb https://twitter.com/AaryamanVir/status/1263591303608066062?s=19">https://twitter.com/AaryamanV...

Read on Twitter

Read on Twitter