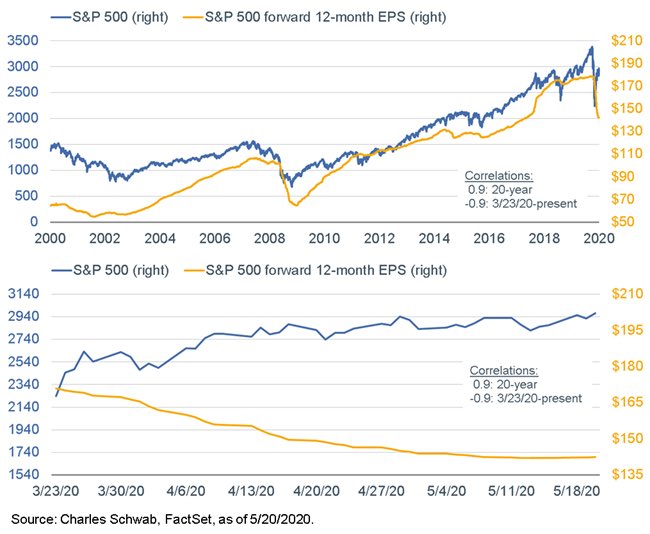

Intuitively, we can sense that stocks have disconnected from earnings estimates; but check out below, which shows that correlation betweeen S&P 500 & forward earnings estimates has been +.90 over past 20 years, but a mirror image -.90 since 3/23/20

Oops ... S&P 500 lines should be labeled “left” (if that wasn’t already obvious) ... sorry

Read on Twitter

Read on Twitter