Capital gains are *very* concentrated. Ranking people by their taxable gains (2017-18), the top 5,000 people received over half (54%) of all gains. For comparison, top 5,000 ranked by income received 2% of all income. The top 1,000 all got over £7mil each... 2/

Aggregate gains tripled during the 2010s, mostly driven by & #39;super gainers& #39; who received over £1mil each. This resulted from Coalition government& #39;s 2011 decision to raise lifetime limit for & #39;Entrepreneurs Relief& #39; from £1mil to £10mil. Gains mostly went to business managers. 3/7

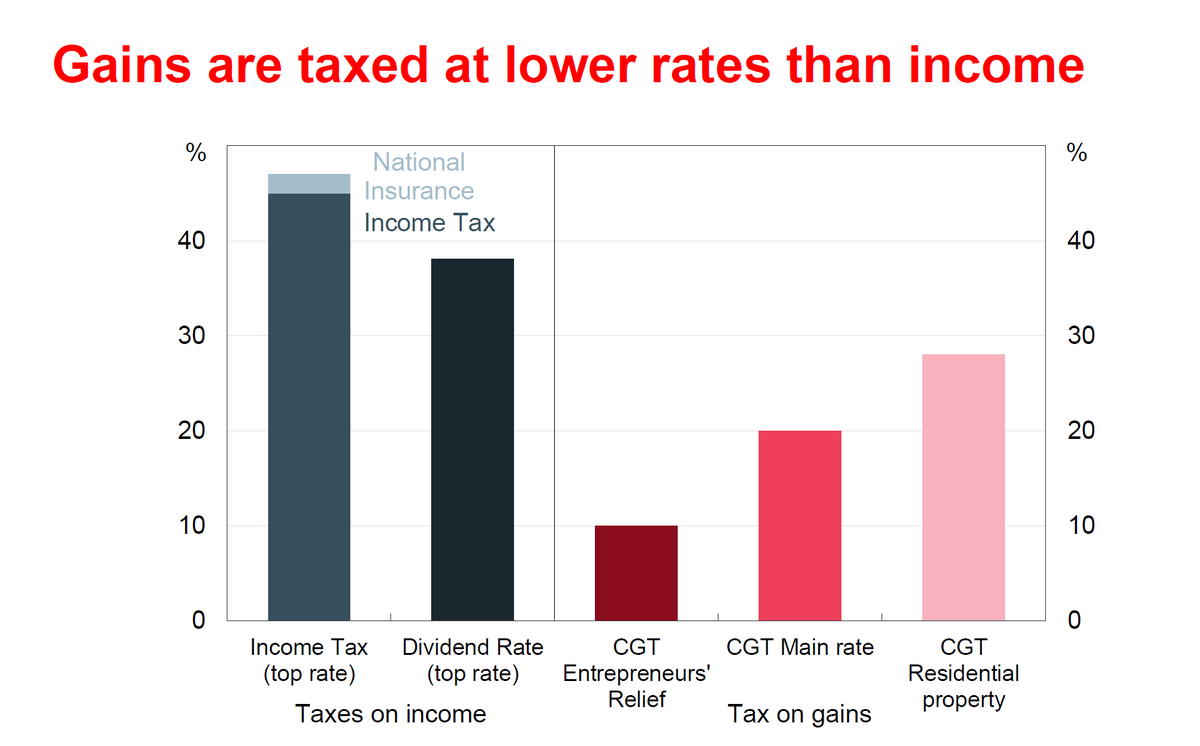

In many cases, gains are effectively just repackaged income. The legal line between them is blurred. But gains are taxed at much lower rates, so there& #39;s a strong incentive to swap income for gains, for anyone who can. Again, this is mostly business managers. 4/7

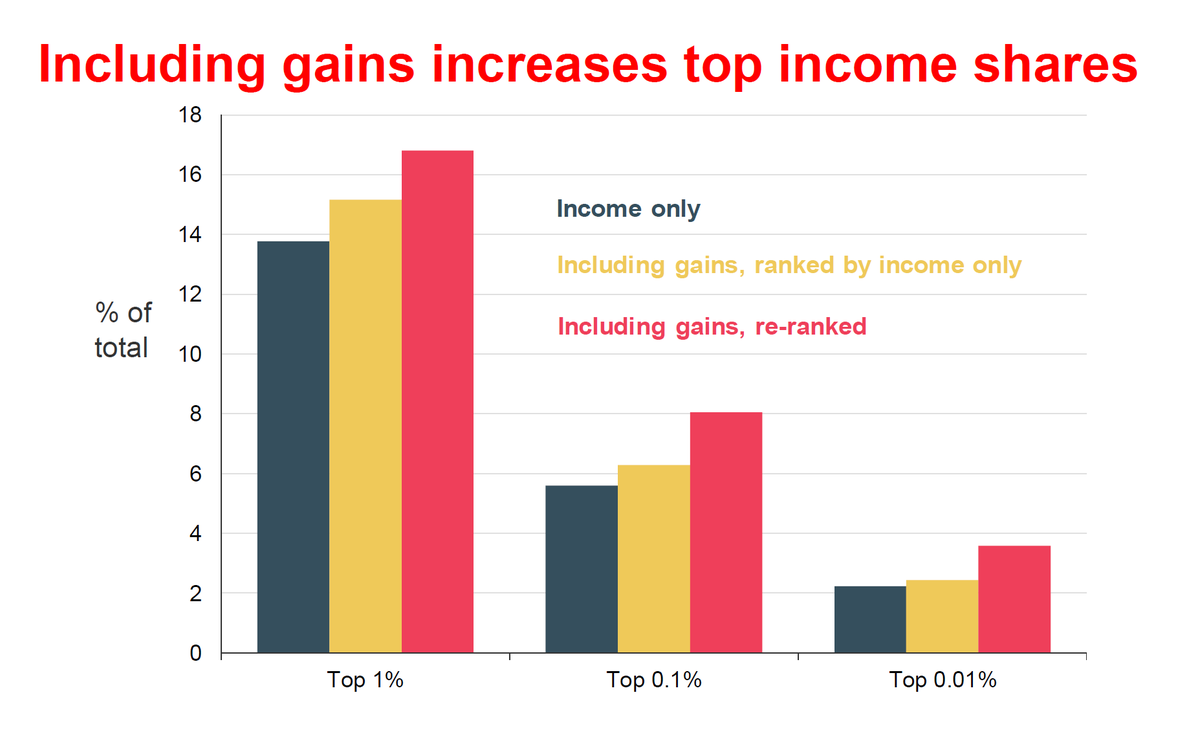

Gains mostly go to people who already have high incomes. 9 in 10 people who were in the top1% by total remuneration (income+gains) were already in top1% by income only. But the 1 in 10 who & #39;join& #39; the top1% have a lot of gains. So top shares are higher including gains. 5/7

This also changes picture of what happened to top-end inequality through 2010s. Looking at income only, it was mostly flat. But including gains, it went up (especially at very top). In other words, inequality didn& #39;t abate during austerity, just took a different form. 6/7

More results and discussion of the implications at the @resfoundation webinar, 11am today!

https://www.youtube.com/watch?v=GujKPL4HZKM&feature=youtu.be

Policy">https://www.youtube.com/watch... briefing: https://warwick.ac.uk/fac/soc/economics/research/centres/cage/manage/publications/bn19.2020.pdf

Resolution">https://warwick.ac.uk/fac/soc/e... Foundation report: https://www.resolutionfoundation.org/app/uploads/2020/05/Who-gains.pdf

Full">https://www.resolutionfoundation.org/app/uploa... working paper: https://warwick.ac.uk/fac/soc/economics/research/centres/cage/manage/publications/wp465.2020.pdf">https://warwick.ac.uk/fac/soc/e... https://www.youtube.com/watch...

https://www.youtube.com/watch?v=GujKPL4HZKM&feature=youtu.be

Policy">https://www.youtube.com/watch... briefing: https://warwick.ac.uk/fac/soc/economics/research/centres/cage/manage/publications/bn19.2020.pdf

Resolution">https://warwick.ac.uk/fac/soc/e... Foundation report: https://www.resolutionfoundation.org/app/uploads/2020/05/Who-gains.pdf

Full">https://www.resolutionfoundation.org/app/uploa... working paper: https://warwick.ac.uk/fac/soc/economics/research/centres/cage/manage/publications/wp465.2020.pdf">https://warwick.ac.uk/fac/soc/e... https://www.youtube.com/watch...

Read on Twitter

Read on Twitter