A quick update on @LinkedIn hiring data through the first 8 days of May 1/n https://www.linkedin.com/posts/guyberger_the-us-labor-market-was-in-rough-shape-during-activity-6668670936646070273-pEu4">https://www.linkedin.com/posts/guy...

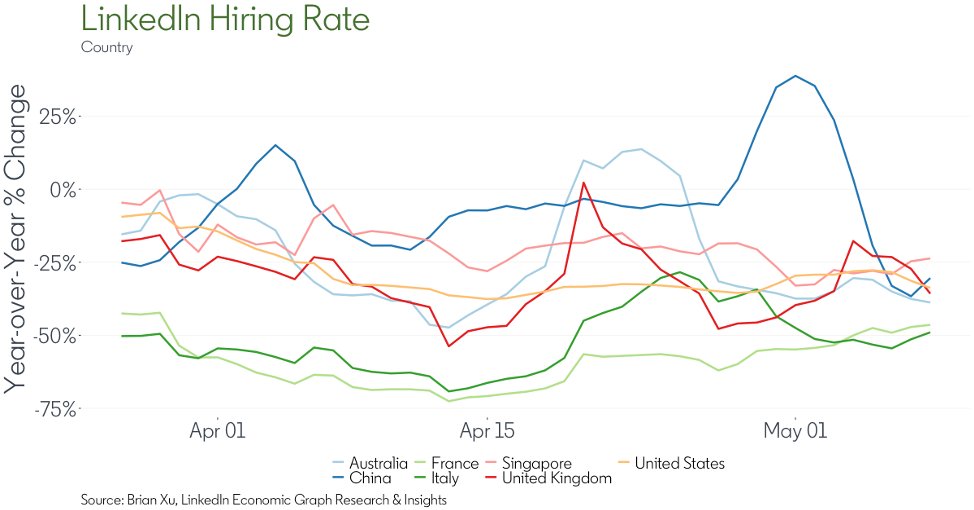

We& #39;ve seen hiring *stabilize* at roughly 35% below year-ago levels in the US, since mid/late April. Unlike other high frequency data, we don& #39;t see a meaningful pickup. If one is happening, it& #39;s very small so far. 2/n

We do see some industries where hiring, while still depressed relative to pre-COVID, has definitely picked up in the past few weeks: education, wellness/fitness, public administration, public safety, and agriculture. 3/n

Education and wellness/fitness are pretty intriguing. We haven& #39;t examined them in depth yet, but I wonder if these were previously-brick& #39;n& #39;mortar sectors that were able to "retool" for virtual/online operations relatively quickly. 4/n

Most other sectors are basically depressed and stable in our data, just like the overall hiring rate. One exception that& #39;s still deteriorating is oil & energy, which might be still be reeling from the energy price collapse.

Read on Twitter

Read on Twitter