1. USDA language on how #CFAP payments will be calculated is confusing on the website but the actual rulemaking document makes it clear. This is text on USDA website: https://www.farmers.gov/cfap/non-specialty">https://www.farmers.gov/cfap/non-...

2. A reasonable reading of this text is that payment is applied to 50% of 2019 production or 100% of January 15, 2020 inventory. That is what I assumed earlier this afternoon. USDA needs to change this text to make it match what is in the rule.

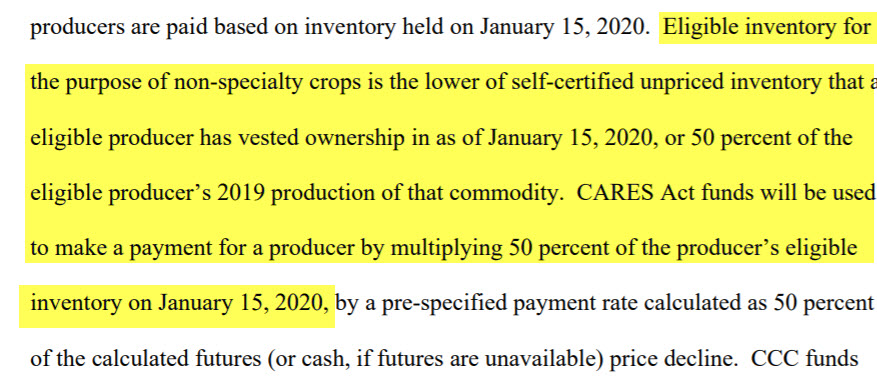

3. Here is the relevant text of the actual rule. This makes it clear that eligible bushels are 50% of 2019 production or 100% of Jan 15 inventory, whichever is smaller. Eligible bushels are then multiplied by 50% before applying the payment rate.

4. Correction of my earlier example for IL. Assume 200 bpa corn and 50 bpa soybeans in 2019. Corn: 200 X 0.5 X 0.5 X 0.67 = $33.5. Soybeans: 50 X 0.5 X X 0.5 X 0.95 = $11.88. Still will change cash flow statements, but not as dramatically as I first thought.

4. The full rulemaking document can be found here. Interesting reading. I& #39;m serious. https://www.farmers.gov/sites/default/files/documents/CFAP%20Final%20Rule.pdf">https://www.farmers.gov/sites/def...

Read on Twitter

Read on Twitter