OK, it’s time to dig into the nitty-gritty of Datadog $DDOG.

The following is what I have found from running the company through my “SaaS-o-Matic” investment framework.

Brace yourselves & grab a cup of coffee. Here we go! https://abs.twimg.com/emoji/v2/... draggable="false" alt="☕️" title="Hot beverage" aria-label="Emoji: Hot beverage">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="☕️" title="Hot beverage" aria-label="Emoji: Hot beverage">

*No position in $DDOG. https://twitter.com/7Innovator/status/1261317643103096839">https://twitter.com/7Innovato...

The following is what I have found from running the company through my “SaaS-o-Matic” investment framework.

Brace yourselves & grab a cup of coffee. Here we go!

*No position in $DDOG. https://twitter.com/7Innovator/status/1261317643103096839">https://twitter.com/7Innovato...

Datadog $DDOG is a cloud-based platform that provides monitoring & observability at all points of the software stack.

It helps IT folk track issues in software performance to avoid downtime & improve user experience.

Here& #39;s a link to my $DDOG framework: https://docs.google.com/spreadsheets/d/1j3rbalDuZqZ3lmqzn37NSRPfpUYz0On6NuGFBDJe5QE">https://docs.google.com/spreadshe...

It helps IT folk track issues in software performance to avoid downtime & improve user experience.

Here& #39;s a link to my $DDOG framework: https://docs.google.com/spreadsheets/d/1j3rbalDuZqZ3lmqzn37NSRPfpUYz0On6NuGFBDJe5QE">https://docs.google.com/spreadshe...

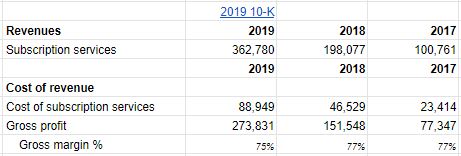

The company has grown very quickly.

In 10 years, it& #39;s already surpassed $360m in annual sales & attracted more than 10,000 customers.

That& #39;s incredible growth, supported by what Gartner believes is a $37B mkt oppty for IT Ops Mgmt.

In 10 years, it& #39;s already surpassed $360m in annual sales & attracted more than 10,000 customers.

That& #39;s incredible growth, supported by what Gartner believes is a $37B mkt oppty for IT Ops Mgmt.

And because it& #39;s cloud-native, $DDOG& #39;s gross margins are also very high. GM was 75% in 2019.

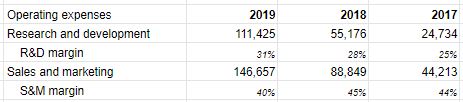

The company has plowed that into R&D and sales & marketing. R&D was 31% of sales last yr, and S&M was 40%.

Even better: R&D is increasing as a % of total sales, while S&M is decreasing.

The company has plowed that into R&D and sales & marketing. R&D was 31% of sales last yr, and S&M was 40%.

Even better: R&D is increasing as a % of total sales, while S&M is decreasing.

Let& #39;s look a bit closer at those costs.

Comparing Sales & Mkt spend to the customer count, $DDOG& #39;s spending ~$52k per new customer. This has increased in recent years.

[Note: not a perfect analysis, since a good portion of the sales budget is being used on existing customers.]

Comparing Sales & Mkt spend to the customer count, $DDOG& #39;s spending ~$52k per new customer. This has increased in recent years.

[Note: not a perfect analysis, since a good portion of the sales budget is being used on existing customers.]

$DDOG& #39;s R&D and overhead burden are ongoing & cost around $14k per customer each year.

That burden has doubled during the past two years.

That burden has doubled during the past two years.

But even with those increasing costs, $DDOG is also getting significantly more revenue per customer.

Subscription margin per customer has nearly doubled in two years, and is now $26k/customer.

When taking out the R&D and overhead, each customer is contributing around $12k/yr.

Subscription margin per customer has nearly doubled in two years, and is now $26k/customer.

When taking out the R&D and overhead, each customer is contributing around $12k/yr.

So now, we discount future contributions to the present.

Assuming an 10.5% discount rate ( $DDOG is a $21B company who& #39;s entirely equity-funded ) and a customer churn rate of 7% (as suggested by mgmt in their S-1)...

...we obtain a gross Customer LTV in 2019 of $87k.

Assuming an 10.5% discount rate ( $DDOG is a $21B company who& #39;s entirely equity-funded ) and a customer churn rate of 7% (as suggested by mgmt in their S-1)...

...we obtain a gross Customer LTV in 2019 of $87k.

And when pulling out the upfront new customer acquisition costs, $DDOG& #39;s *Net Customer LTV* was $35k last year.

This has increased in recent years, but not hugely. Net cLTV has grown from $28k in 2017 to $35k in 2018 to $35k in 2019.

This has increased in recent years, but not hugely. Net cLTV has grown from $28k in 2017 to $35k in 2018 to $35k in 2019.

So here are my conclusions.

1) First and foremost, $DDOG is an expensive stock!

At its $21B market cap, DDOG is selling at a rather generous 58X multiple of last yr& #39;s sales.

Even at its current run-rate, it& #39;s still at 40X full-year 2020 revenue.

That& #39;s a premium valuation.

1) First and foremost, $DDOG is an expensive stock!

At its $21B market cap, DDOG is selling at a rather generous 58X multiple of last yr& #39;s sales.

Even at its current run-rate, it& #39;s still at 40X full-year 2020 revenue.

That& #39;s a premium valuation.

2) Observability & monitoring is a lucrative $37B market. But $DDOG also competes with several others, including $NEWR, $SPLK, $DT, & $ESTC.

$DDOG is scaling, but not as quickly as I& #39;d like to see. Everyone in this space is growing. But can they do it profitably?

$DDOG is scaling, but not as quickly as I& #39;d like to see. Everyone in this space is growing. But can they do it profitably?

3) This is likely a large enough market to rise all boats.

$DDOG& #39;s 130% DBRR & large customer growth are encouraging.

As an investor, you should demand to see incredible results from this company for quite some time.

The shares are priced accordingly. https://docs.google.com/spreadsheets/d/1j3rbalDuZqZ3lmqzn37NSRPfpUYz0On6NuGFBDJe5QE">https://docs.google.com/spreadshe...

$DDOG& #39;s 130% DBRR & large customer growth are encouraging.

As an investor, you should demand to see incredible results from this company for quite some time.

The shares are priced accordingly. https://docs.google.com/spreadsheets/d/1j3rbalDuZqZ3lmqzn37NSRPfpUYz0On6NuGFBDJe5QE">https://docs.google.com/spreadshe...

Read on Twitter

Read on Twitter

![Let& #39;s look a bit closer at those costs. Comparing Sales & Mkt spend to the customer count, $DDOG& #39;s spending ~$52k per new customer. This has increased in recent years.[Note: not a perfect analysis, since a good portion of the sales budget is being used on existing customers.] Let& #39;s look a bit closer at those costs. Comparing Sales & Mkt spend to the customer count, $DDOG& #39;s spending ~$52k per new customer. This has increased in recent years.[Note: not a perfect analysis, since a good portion of the sales budget is being used on existing customers.]](https://pbs.twimg.com/media/EYZX0JDXsAA1McN.jpg)