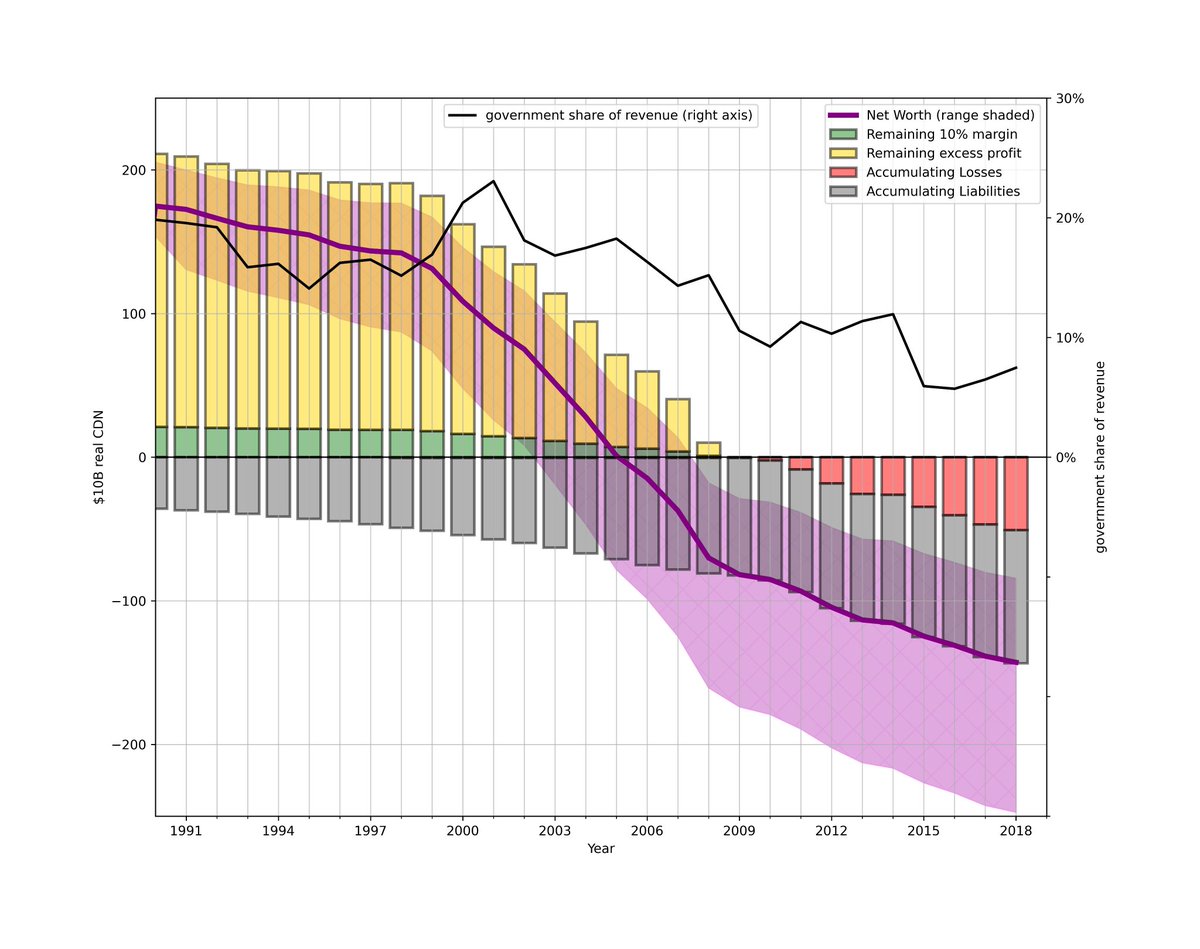

Let me explain the two datasets on #abpoli& #39;s crude #oilandgas industries: profits/royalties and cleanup costs.

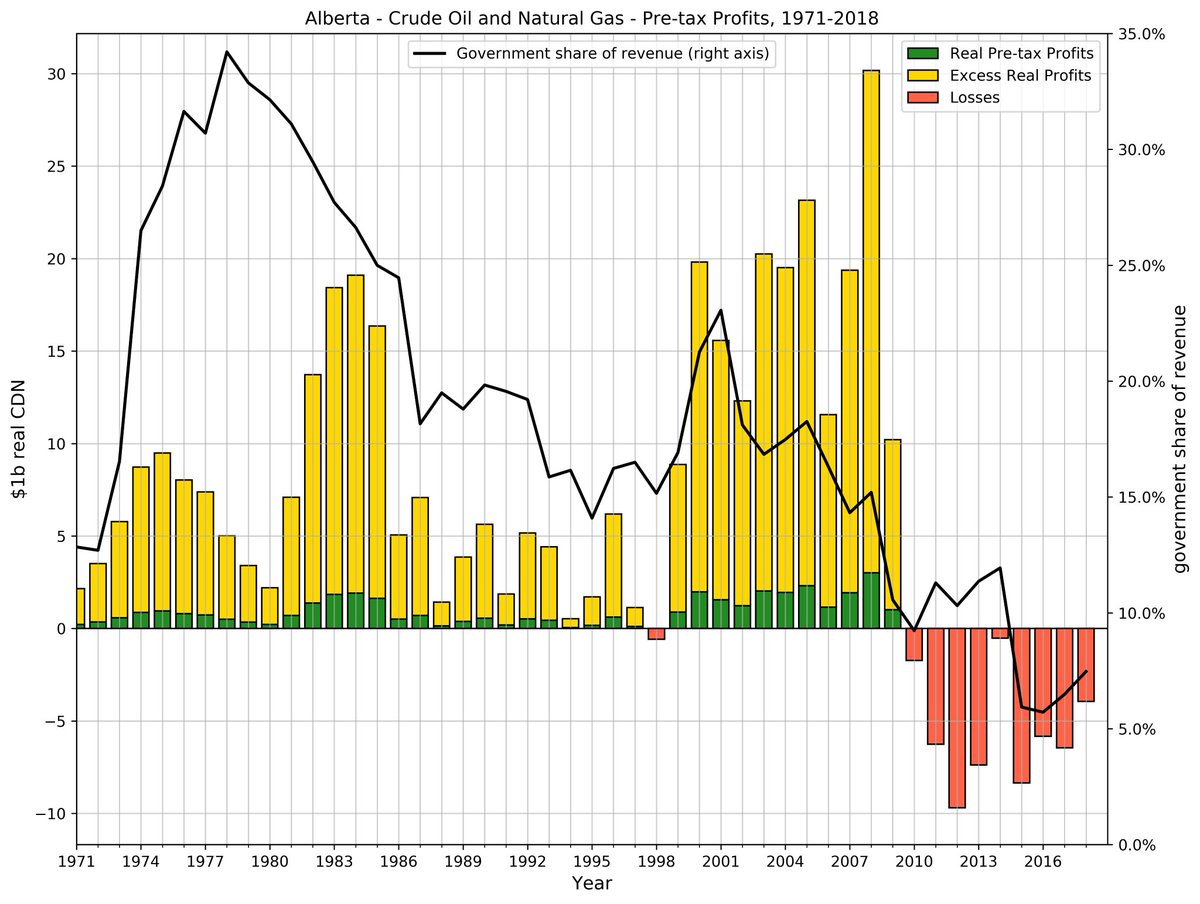

Here is profits (& #39;normal& #39;=10% return on investment; & #39;excess& #39;=>10%)& #ableg& #39;s share of the money generated from our collective natural wealth...

#cdnpoli #RedWater #AROs

Here is profits (& #39;normal& #39;=10% return on investment; & #39;excess& #39;=>10%)& #ableg& #39;s share of the money generated from our collective natural wealth...

#cdnpoli #RedWater #AROs

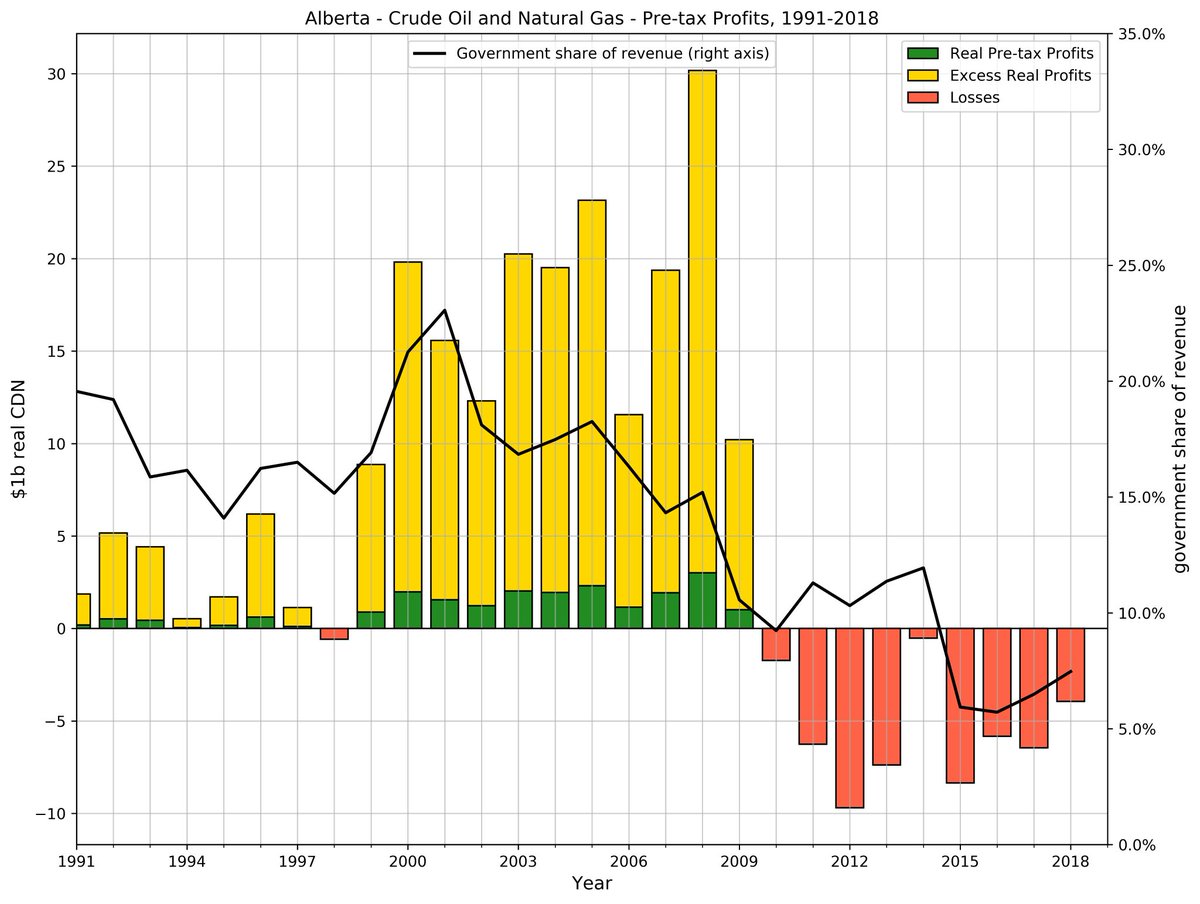

Here is the same @OilGasCanada data as above, focusing on the last 30 years #abpoli #oilandgas has been in systemic crisis from weight of environmental debt #ableg & @AER_news have allowed to accumulate...

#ableg #cdnpoli #RedWater

#ableg #cdnpoli #RedWater

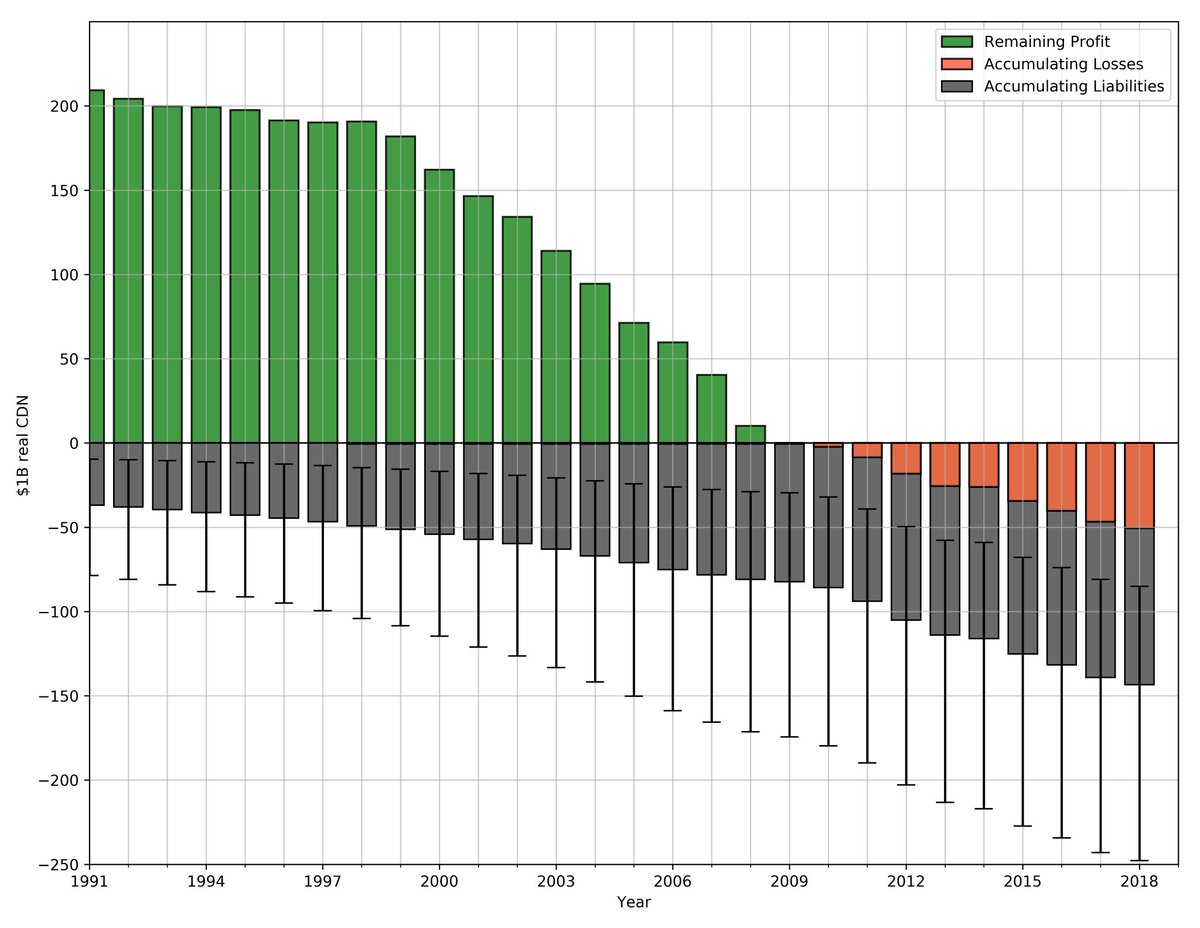

Here is the above data re-organized from an annual flow of profits/losses to a stock of remaining profits/losses, with average cleanup costs for wells+pipelines+facilities from @ALDPCoalition re-organized by date of first production...

#ableg #abpoli #cdnpoli #oilandgas #RedWater

#ableg #abpoli #cdnpoli #oilandgas #RedWater

I suggest remaining profit minus accumulatedbliabilities/losses is a rather credible measure of #solvency.

Annual Net Worth = Remaining Profit minus Accumulated Liability/Losses

#ableg #abpoli #cdnpoli #oilandgas #RedWater #AROs

Annual Net Worth = Remaining Profit minus Accumulated Liability/Losses

#ableg #abpoli #cdnpoli #oilandgas #RedWater #AROs

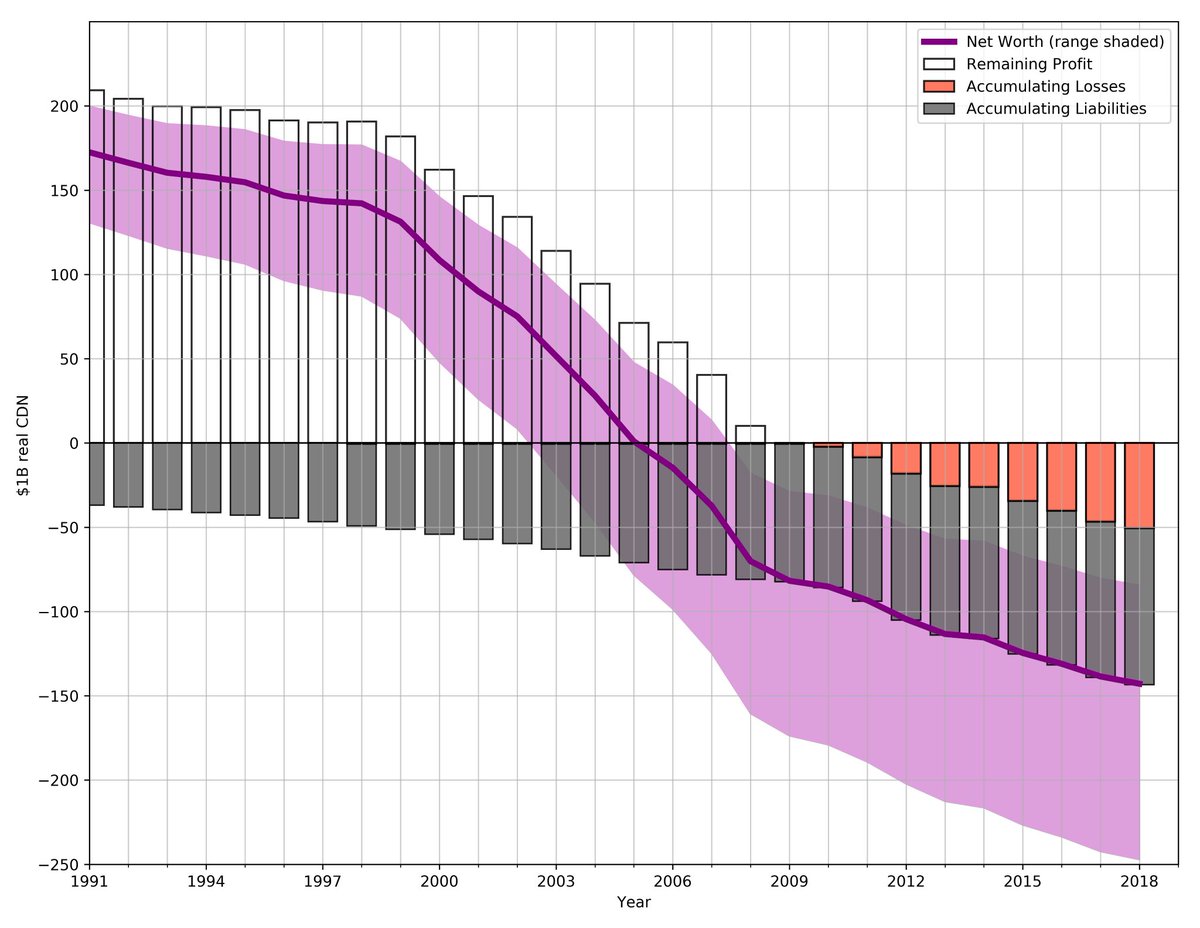

Here, it& #39;s all put together to illustrate how #ableg & @AER_news have allowed @OilGasCanada to pocket hundreds of billions in real & fictional profits while driving #abpoli #oilandgas insolvent by at least $150 billion (not including financial debt).

#cdnpoli #RedWater #AROs

#cdnpoli #RedWater #AROs

Read on Twitter

Read on Twitter