Softbank& #39;s investments - Uber, Doordash, Wework, etc - are cons. They launder Saudi oil billions with "businesses" that lose titanic amount of money for many years, while also preying on real businesses and their own workforce.

1/

1/

Then, Softbank exits with an IPO that offloads the money-losing company on suckers who think its longevity means there must be a "path to profitability." Softbank cleans up, but workers& #39; lives and real businesses are destroyed, and the suckers get cleaned out.

2/

2/

A little microcosm of this is yesterday& #39;s viral tale of a pizzeria that found itself on the receiving end of a bungled short-con by Doordash and turned the tables on the company. It& #39;s a petty revenge, but so satisfying.

#schadenpizza">https://pluralistic.net/2020/05/18/code-is-speech/ #schadenpizza

3/">https://pluralistic.net/2020/05/1...

#schadenpizza">https://pluralistic.net/2020/05/18/code-is-speech/ #schadenpizza

3/">https://pluralistic.net/2020/05/1...

After all, when you& #39;re up against a bottomless well of Saudi oil-billions, there& #39;s precious few ways to score even a petty victory.

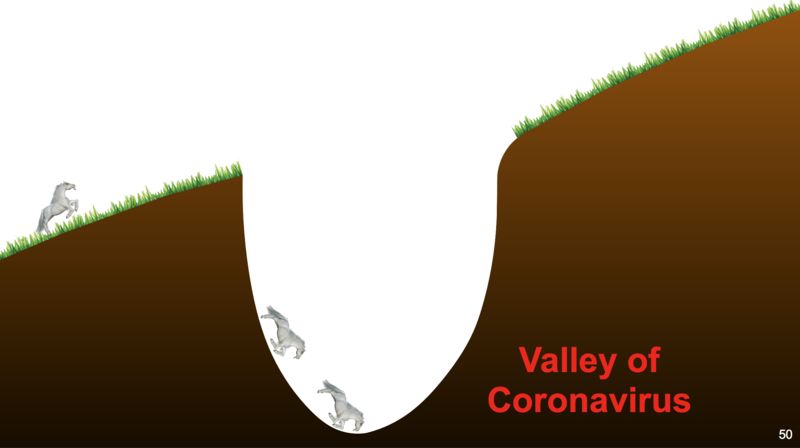

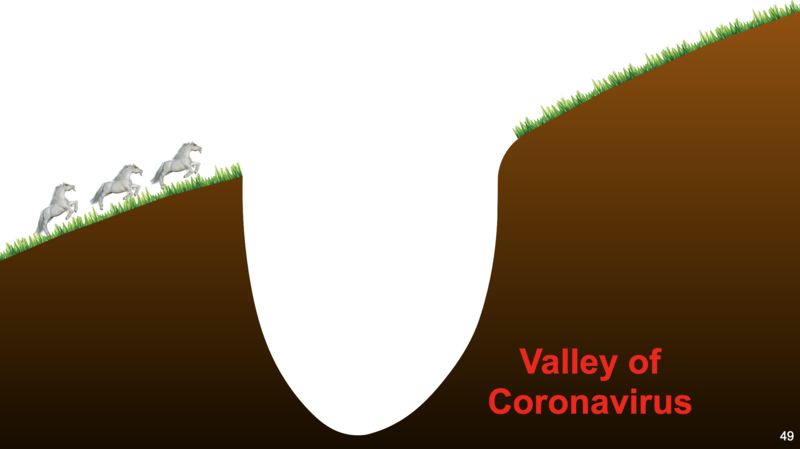

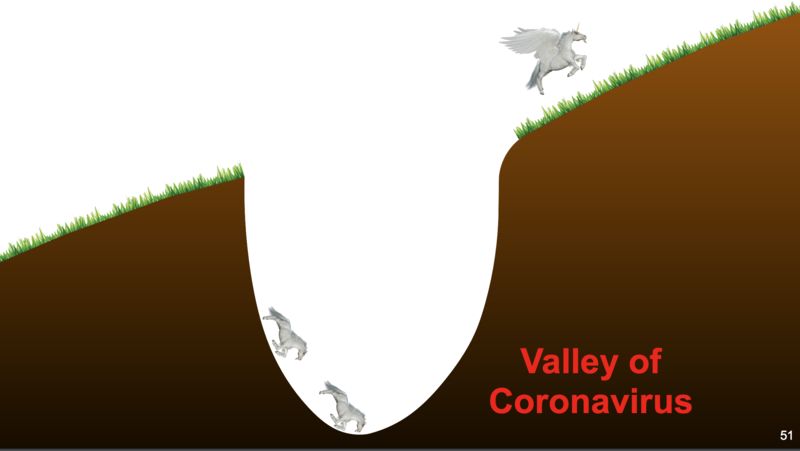

Enter coronavirus.

Softbank just posted a $17.7B loss on Wework and Uber.

https://www.bloomberg.com/news/articles/2020-05-18/softbank-vision-fund-books-17-7-billion-loss-on-wework-uber

https://www.bloomberg.com/news/arti... href="https://twtext.com//hashtag/Schadenfreude"> #Schadenfreude

4/

Enter coronavirus.

Softbank just posted a $17.7B loss on Wework and Uber.

https://www.bloomberg.com/news/articles/2020-05-18/softbank-vision-fund-books-17-7-billion-loss-on-wework-uber

4/

If there& #39;s one thing Trumpism has taught us about sociopathic con-artists, it& #39;s that their greatest boasts mask their deepest terrors. And Softbank is no exception.

Yesterday& #39;s Softbank earnings call was HILARIOUS.

https://www.bloomberg.com/opinion/articles/2020-05-18/the-unicorns-fell-into-a-ditch

5/">https://www.bloomberg.com/opinion/a...

Yesterday& #39;s Softbank earnings call was HILARIOUS.

https://www.bloomberg.com/opinion/articles/2020-05-18/the-unicorns-fell-into-a-ditch

5/">https://www.bloomberg.com/opinion/a...

Read on Twitter

Read on Twitter