A very interesting @WSJ article over the weekend regarding how #European governments that have railed against U.S. big #tech companies over privacy concerns are now embracing these same companies’ #coronavirus contact tracing #technologies.

This gets to a longtime argument we’ve made about @ecb policy and the role of #innovation in spurring greater #growth in the region: https://www.blackrockblog.com/2019/07/25/bolder-european-policy-action/">https://www.blackrockblog.com/2019/07/2...

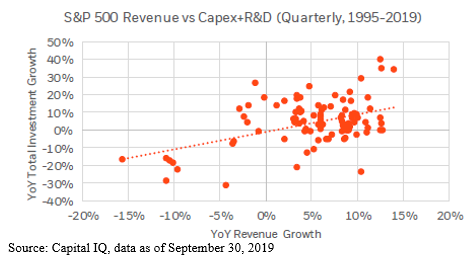

Essentially, it has long been our view that negative interest rates ( #NIRP) are counterproductive and what’s needed is #equity investment in innovation, #technology, and 21st century #infrastructure.

Negative #rates do not create demand for #credit, but can hinder #investment due to the pressures it places on #banks, insurance companies, #pension funds, etc.

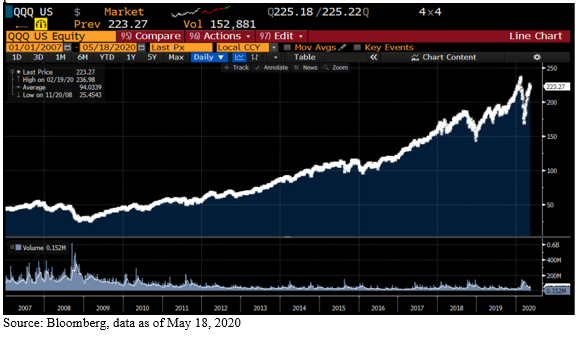

By contrast, #markets have weighed in on the prospects of large-capitalization U.S. #technology firms, and it’s decidedly more positive.

Leaving the question of current #market valuations aside for the moment, the primary reason for that #tech success, in our estimation, is quite simply strong research and development (R&D) programs that produce #innovations that make #consumers’ lives better.

Read on Twitter

Read on Twitter