SHUT-INS (A THREAD): US and Canada combined shut-ins appear to have been running higher than what listed companies have disclosed, perhaps peaking as high as ~4.0 million b/d (the figure quoted by Plains All American Pipeline - below from their 1Q conference call) | #OOTT 1/6

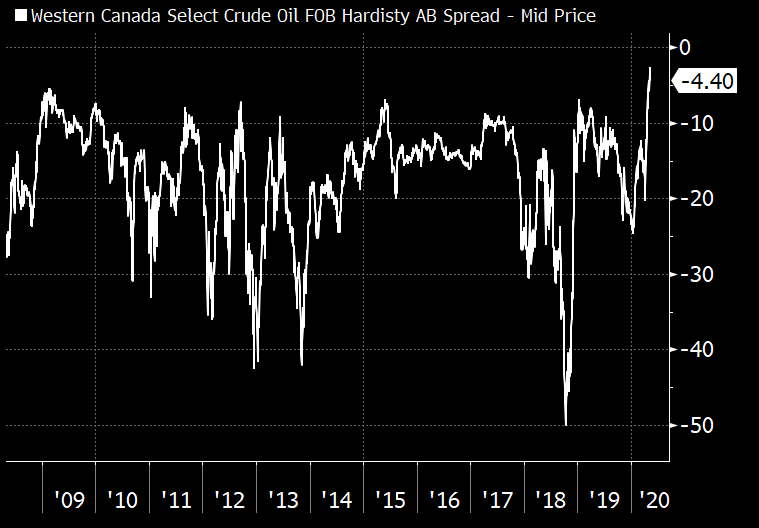

Canada likely saw at least 1m b/d in production shut-ins this month, and perhaps even a little more (multiple listed companies announced large cuts). That has triggered a rally in Western Canadian Select crude, with the WCS-WTI spread (chart) narrowing sharply | #OOTT 2/6

For the US, @EIAgov is pegging crude production at 11.6 m b/d (based largely on mathematical model), down ~1.5m b/d from peak. That& #39;s in-line with announced cuts, but probably not capturing all, considering the known shut-ins in Bakken and Alaska alone (~600k b/d) | #OOTT 3/6

The @EIAgov is relying on a large adjustment factor (-914k b/d last week) to hammer its supply, demand and stock data, suggesting it& #39;s either over-estimating output, or under-estimating stock and refinery input. Output probably the largest miss (red rectangle) | #OOTT 4/6

Yet, oil futures prices (and, crucially, US and Canadian physical crude differentials) have improved markedly in the last couple of weeks, and some oil companies are likely to return production back. Oil pipelines are already reporting larger week-on-week flows | #OOTT 5/6

What it means for the North American crude oil market? Probably we are moving into a just-in-time market: refinery pull releases crude from inventories and triggers the return (gradually) of some shut-in production, with the curve flattening | #OOTT 6/6

Read on Twitter

Read on Twitter